I write these macro updates infrequently. I try to do so when I have something significant to say that’s different from the dominant narrative. Conventional wisdom in the markets is correct more often than not. But when I find myself annoyed at the obvious falsehoods in the financial reporting and on Fin-X on a daily basis, it’s time to write another piece. I’m going to touch on some sensitive topics. If you only want to read things that fully support the goals of team red or team blue, then this is your trigger warning. Still here? Let’s dive in:

Everywhere is a Mess:

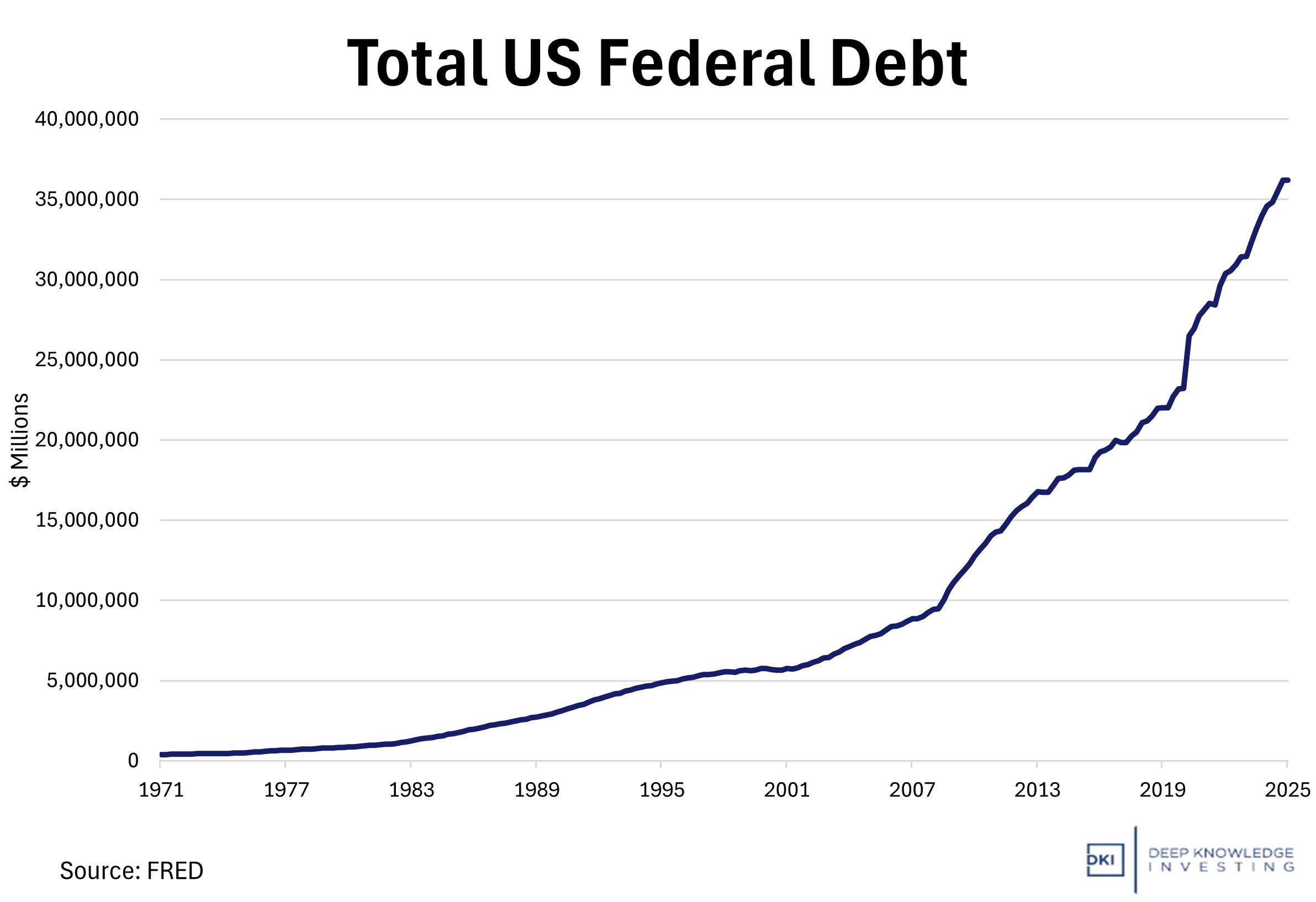

US: I’ve written extensively about the fact that the US is bankrupt and just hasn’t had its credit cards cut yet. People focus on the $37T of on-balance sheet debt. That would be manageable if we weren’t adding another $3T – $4T to that every year. Making things unsustainable are the off-balance-sheet liabilities like Social Security, Medicare, Medicaid, Obamacare, and pensions. Those are around $200T. The actual liabilities of the US government are about a quarter of a quadrillion dollars. What can’t be paid won’t be paid.

This is a disaster and it’s just the on-balance sheet total.

The plan, to the extent that there is one, is to keep printing in order to pay for this excessive and wasteful spending through inflation. Politicians in DC are either financially illiterate and don’t understand that you can’t print currency to create prosperity, or are just hoping they can steal enough while in office and get out before everything collapses. If you were pitching this as a movie script, you’d say its Nero fiddling meets the children’s game, hot potato. We’re going to have a stealth default where we pay our debts in fiat dollars that have little value. This is a problem, except the rest of the world is in worse shape.

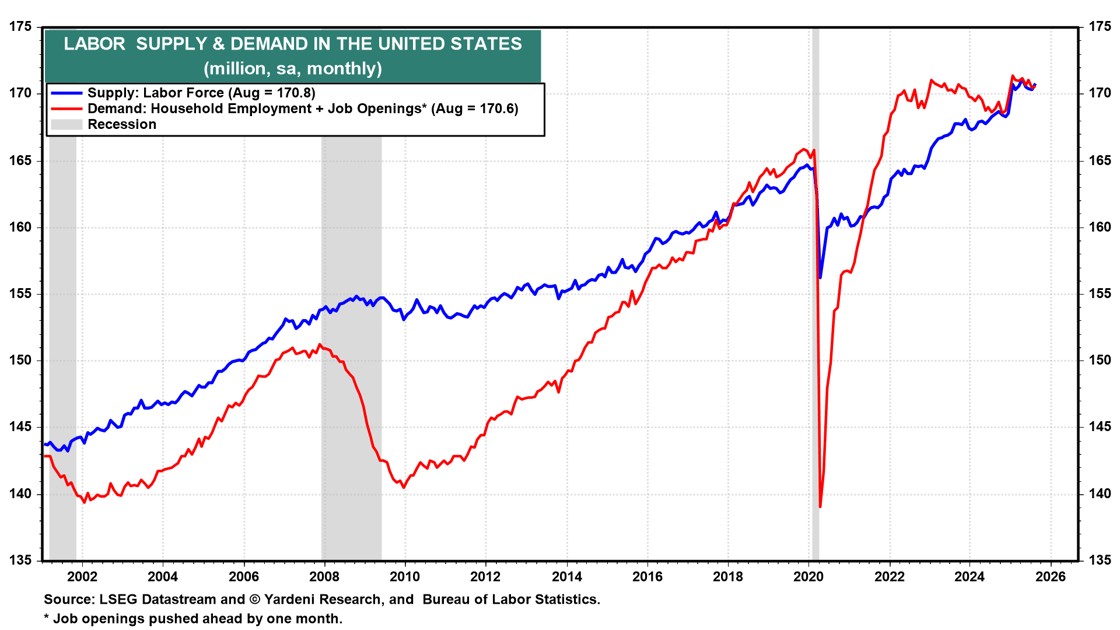

One non-disaster is related to repatriations. We were warned by the media that sending people home who are in the US illegally would mean a labor market disaster and that certain industries, farming in particular, wouldn’t have enough workers. That hasn’t happened. The August CPI report had food at home inflation at 2.7%. That’s both a bit high and probably understated, but not close to the threatened disaster of crops rotting in the fields.

The most recent labor market data indicates that unemployment is rising and that for the first time in years, available jobs are now below the number of people seeking work. While the labor market is softening, wages continue to rise. The unemployment numbers have gotten marginally worse as more workers enter the workforce; likely due to higher wages. The more people who want to move from public assistance or unemployment insurance back into the labor force, the better for all of us.

Graph from Yardeni Research showing labor supply rising to meet demand.

Any lack of clarity here is largely due to the inaccuracy of the data. Many reporters and economists threatened that President Trump firing the head of the Bureau of Labor Statistics (BLS), Erika McEntarfer, meant he was politicizing the BLS and that there would be a crisis of confidence in the “data” coming out of that agency. Let’s look at the record. In 2023, there was an 823k downward revision in the number of jobs. In 2024, there was an 818k downward revision. In the summer of 2025, there was a 258k downward revision.

In fairness, McEntarfer wasn’t in office when the bad data was collected for the first of those revisions. Others have noted that voluntary participation in data collection by private companies has declined. Fair enough, but as the data got worse and as the revisions got huge, did McEntarfer do anything to materially improve the situation? I think the real “crisis of confidence” should be related to the BLS reporting inaccurate data; not the President firing the person in charge when her agency reported the bad data. McEntarfer’s replacement has talked about making changes to the methodology that’s resulting in these massive revisions. That’s the right approach.

I also want to revise my conclusion on the motives behind prior data. The big revisions started during the prior Administration and constantly featured positive jobs data on the announcement day when there was lots of attention followed by later downward revisions when fewer were paying attention. At the time, I speculated that the BLS had political motives and was attempting to help the Democratic party which was in power at the time and would get credit for job growth. The reporting pattern is the same under President Trump. While the President claims this is due to political bias, I disagree with him and with my former opinion. We’re still seeing better initial announcements followed by later downward revisions. If that pattern was helpful to a Biden Administration, then wouldn’t it be equally helpful to a Trump White House? I’ve revised my prior opinion and now think the BLS simply operates with low-quality and outdated data. I still stand by my criticism of McEntarfer because to the best of my knowledge, she didn’t take steps to improve data collection and reporting.

Update: As I was writing this piece, it was announced that the US added 911k fewer jobs than previously reported from March 2024 to March 2025. Firing the person in charge doesn’t threaten the integrity of inaccurate data.

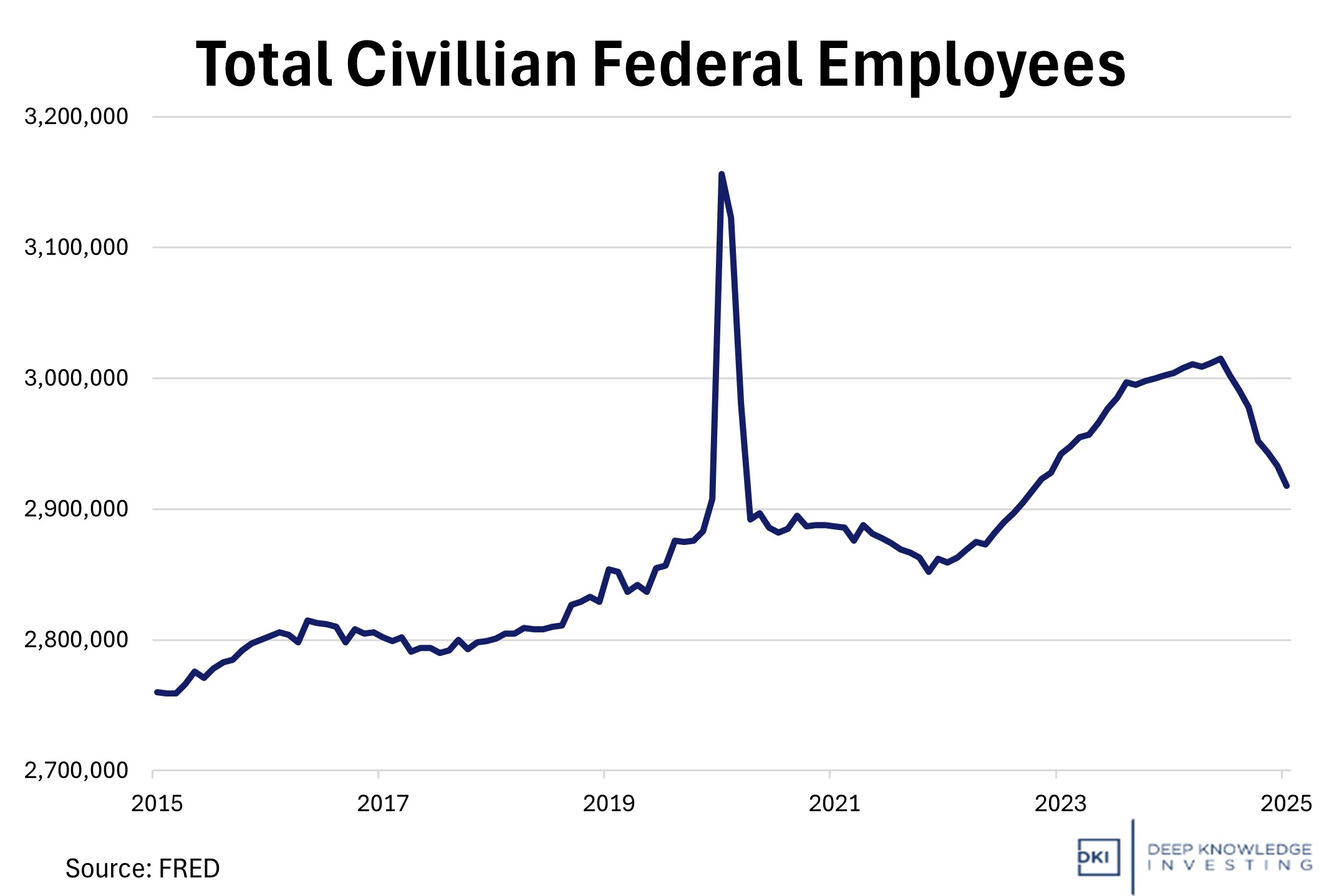

Many economists are saying the recent weak job numbers are a sign that the economy is heading for recession. That may be true, but I’m not sure that’s what the data is saying. The job growth numbers are weak, but we’ve also had a reduction in the federal workforce. I regularly pointed out that the prior White House used debt-fueled federal funding to increase employment and GDP making the economy appear stronger than it was. Over the past few years, GDP growth was due to increased government spending which causes GDP to rise even if it creates no value. Cutting some of this bloat makes the employment numbers look weak, but doesn’t indicate a loss of productivity. If we end up with fewer Federal employees and regulators and more manufacturing jobs over the next few years, I’d consider that a win.

Both part of the reason employment is “weak” and not a bad thing.

Japan: I’ve been speaking and writing about the issues Japan is facing since October of 2022. The government has taken on massive debt and kept interest rates somewhere between negative and insanely low. Now, they’re trapped. The BoJ needs to raise rates to keep the yen from falling. But higher rates lead to higher interest expense. That leads to higher government expenses which in turn, leads to more money printing leading to….more inflation.

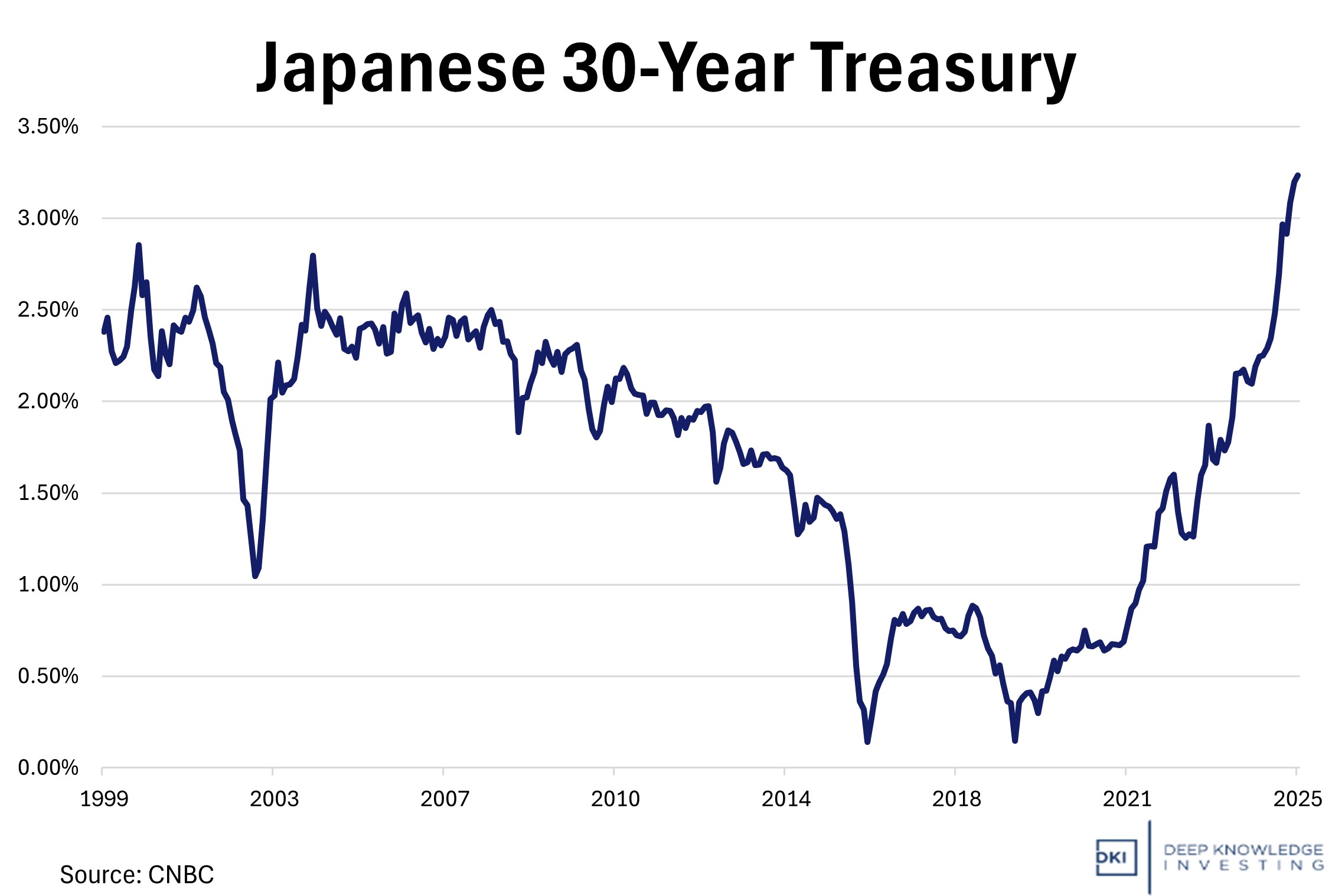

Japanese 30-year yields have already hit all-time highs. The chart has gone nearly-vertical. That alone would be enough to cause problems, but Japan is currently in the middle of a constitutional crisis. The government is busy figuring out the details on how to vote to decide if they want to vote to replace the government.

Japan is going to need to print to cover the interest.

Japan is also facing a demographic problem. Too many of their women don’t want to date and have children and too many of their men have given up on dating and family entirely. It’s an often-repeated point that Japan now sells more adult diapers than baby ones. As always, too much debt instead of economic growth kills an economy and leads to a lack of affordability and family formation; a problem we’re staring down here in the US as well. To sum up, Japan has a debt problem, a currency problem, an inflation problem, a demographic problem, and a constitutional crisis.

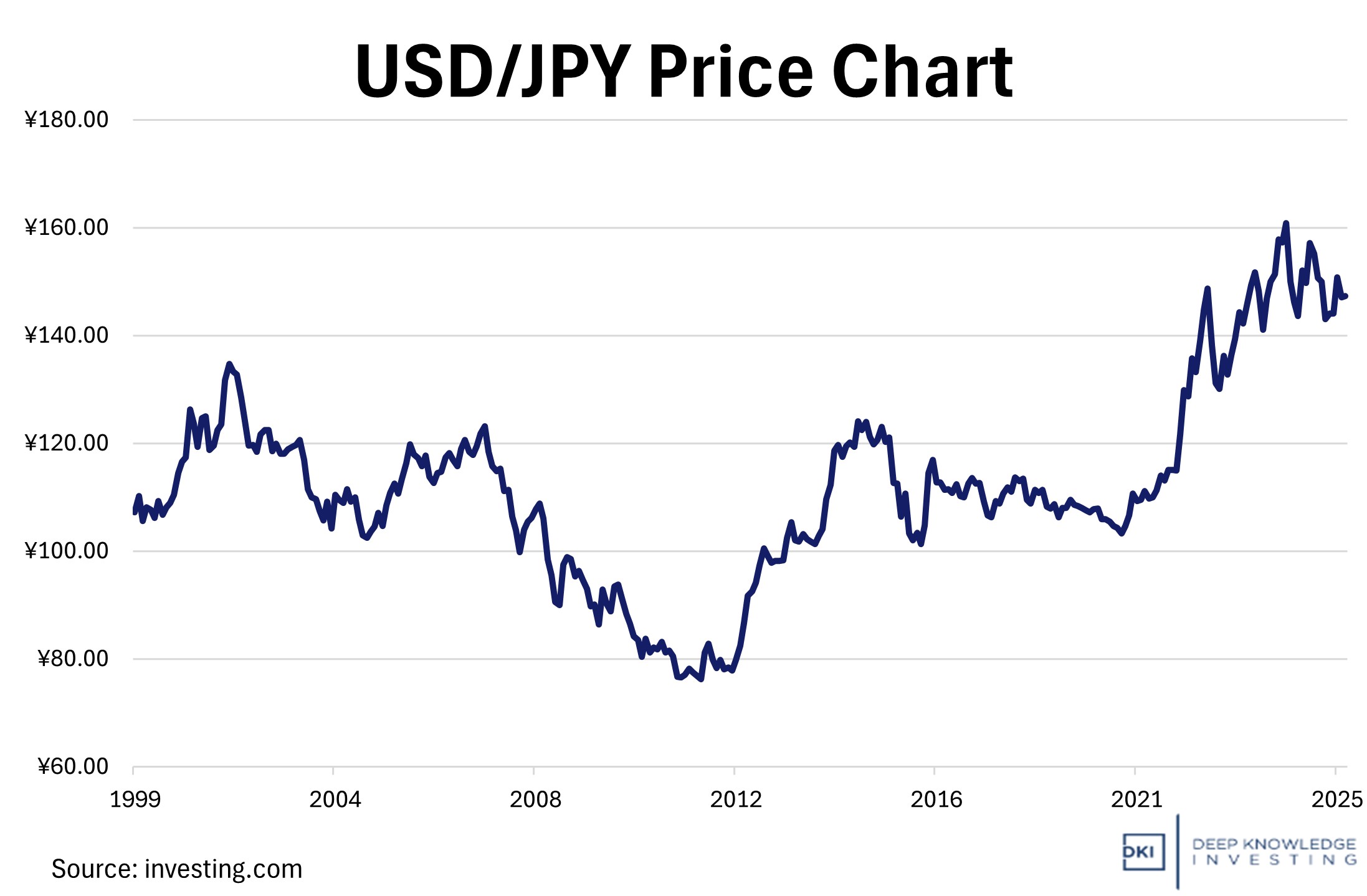

Recent political instability hasn’t caused the yen to weaken materially.

Update: As I was writing this piece, Prime Minister Ishiba resigned. It’s not clear yet who will take over and what Japan’s monetary policy will be. The yen didn’t move much against the dollar on the news.

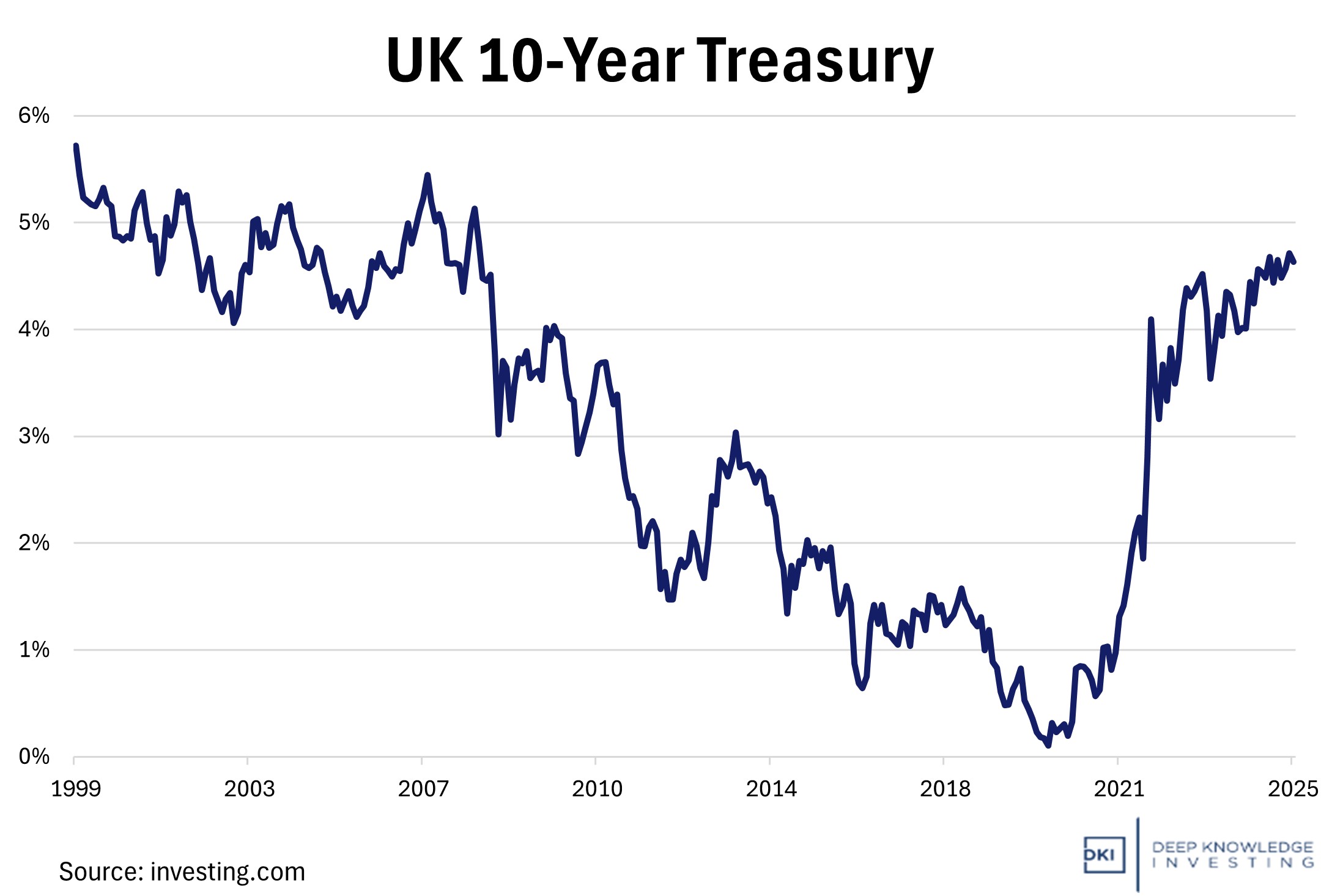

Europe: I’ve spent the past few months enjoying life in Europe and the European lifestyle. Unfortunately, parts of the continent and the UK are a mess. The UK has financial problems and is seeing rising bond yields. Too much of the population is on public assistance. In England and Wales, one in ten people aged 16 to 64 claim benefits for disability or incapacity. Across the UK, 19% of working age people receive means-tested government benefits.

Like the US and Japan, this leads to unsustainable rising interest costs.

The country is starting to see public demonstrations against crime committed by illegal immigrants. The police have looked past terrible abuse of its children and instead, jailed the people who complained about the abuse. Those in power have given up prosecuting violent crime and have been arresting people for social media memes. The country is spending billions of pounds providing comfort for many who came illegally while the native population struggles and faces police action for displaying their country’s flag. The financial problems combined with suppressed rage is a bad combination. The UK is the world’s sixth largest economy and one of the ten largest trading partners of the US. That’s large enough that domestic unrest and another change in government would affect economic conditions in many countries.

Once the economic engine of Europe, Germany has cut its own throat on the altar of environmentalism. They’ve shut down nuclear plants and are now burning coal to “save” the environment. They’ve rejected Russian oil and gas in favor of expensive “green” energy and have made electricity so expensive that it’s uneconomic to manufacture cars in the home of Porsche, BMW, and Audi.

Like the UK, Germany has decided that free speech isn’t an option for people who disagree with the government. Recently, all political parties except the controversial AFD have decided that no one will be able to say anything critical of non-Germans who have taken over parts of the country. Unconstrained immigration has led to schools where no one but the teachers speak German meaning the children in those schools won’t learn the language and integrate. The teachers can’t communicate with their students. Noticing increases in violent crime is also punishable by the authorities. Seven AFD candidates have died in the run-up to the coming elections. Authorities claim that there’s nothing unusual about this and that there is nothing suspicious about the causes of death. Others claim these deaths are the result of targeted assassinations and serve as a warning to others. I don’t have any way to verify the truth, and merely point out that trying to disqualify a political party instead of beating them at the ballot box will inevitably lead to this kind of speculation and these kinds of accusations.

Some of you reading this will be upset that I mention these issues. Others will be upset that I’m not stating the case more forcefully. That’s fine. You’re welcome to your own opinion. Mine is that suppressing speech and not allowing people to notice violent social problems leads to worse problems. President Kennedy once said “Those who make peaceful revolution impossible will make violent revolution inevitable.” We can talk about these issues calmly. Alternatively, suppressing them will lead to worse violence. The UK is facing this exact problem and the US is struggling with eradicating cancel culture as well.

France also has a terrible debt problem that may bring down the current government. The country has a massive social benefits welfare package and a culture that prioritizes leisure time. That was always unsustainable, but higher energy costs combined with large payments for non-working immigrants are pushing that timeline for collapse forward. French politicians are stuck. Keeping spending at current levels is unsustainable and will lead to disaster. However, making the necessary spending cuts will upset a population accustomed to working 35 hours a week with many weeks of annual vacation and early retirement. The response to any austerity no matter how minor is typically demonstrations and riots that lead to a breakdown of social order and replacement of the government.

Update: While I was writing this piece, the French government collapsed in a no confidence vote. The Prime Minister lost the vote due to his support for eliminating two national holidays, freezing some benefit levels, and slightly reducing the annual deficit. (That means continued overspending, not actual austerity.) As noted above, not cutting spending leads to disaster while slightly reducing spending increases leads to loss of office. That’s France and Japan with new governments on the way this week alone and massive demonstrations in the UK over the weekend.

The message is clear: Cut spending and the voters will replace you with someone who won’t cut. The French want a gold-plated benefits package without paying for it and it’s not going to happen. For those of you who want to point out that the US has the exact same problem, I’m with you. I’ve said for years that we can’t vote our way out of our financial issues as both team red and team blue always vote for more spending. There’s no sense in being upset about it. The only thing you can do is have a portfolio designed to profit from higher future inflation. At DKI, we’ve done that.

I used to think that Japan would crack first, then the EU, then the UK, and then the US. I’m no longer sure of that. The EU might fall before Japan does and with the social upheaval that will accompany it. (Given the multiple failed governments, I want to clarify that by “fall”, I mean a catastrophic economic outcome and social unrest, and not a government peacefully changing leadership.) The US isn’t in great shape, but where else are you going to go to invest? At least we have public companies that are profitable and the best tech companies on the planet. I’m staying invested in the US with a heavily hedged portfolio and lots of dollar-alternatives. The term “best house on a bad block” comes to mind.

The Federal Reserve Was Never Independent:

Politicians and fiat economists have been busy bemoaning the loss of Federal Reserve independence under President Trump. They claim he’s politicizing the Fed and that his actions are outside the norm. Let’s deal with the obvious first. President Trump’s frequent castigating of Chairman Powell in public is unseemly and counterproductive. He’s created a situation where if Powell does what the President wants and lowers rates, it appears as if he’s bending to the political wishes of the White House.

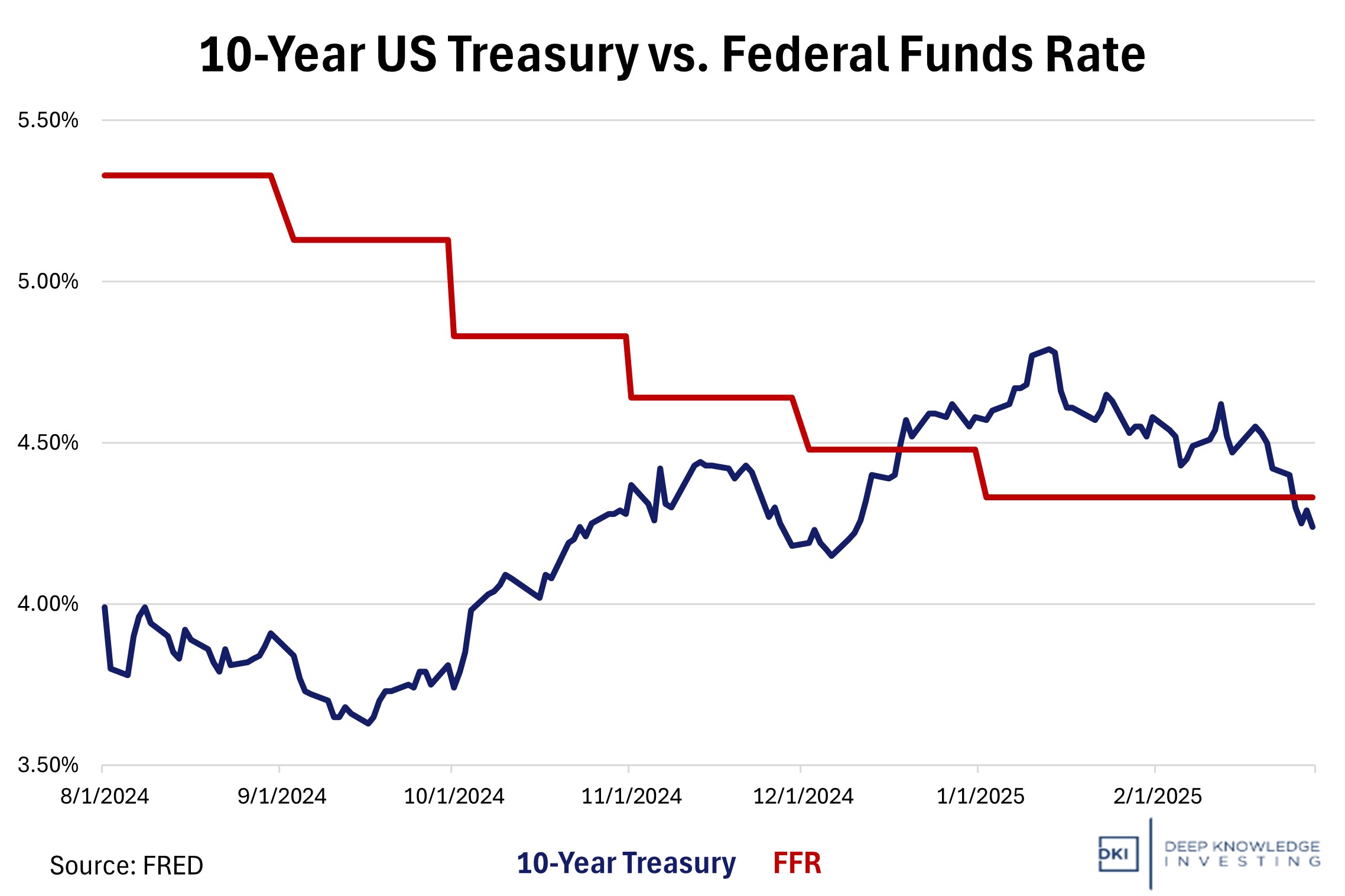

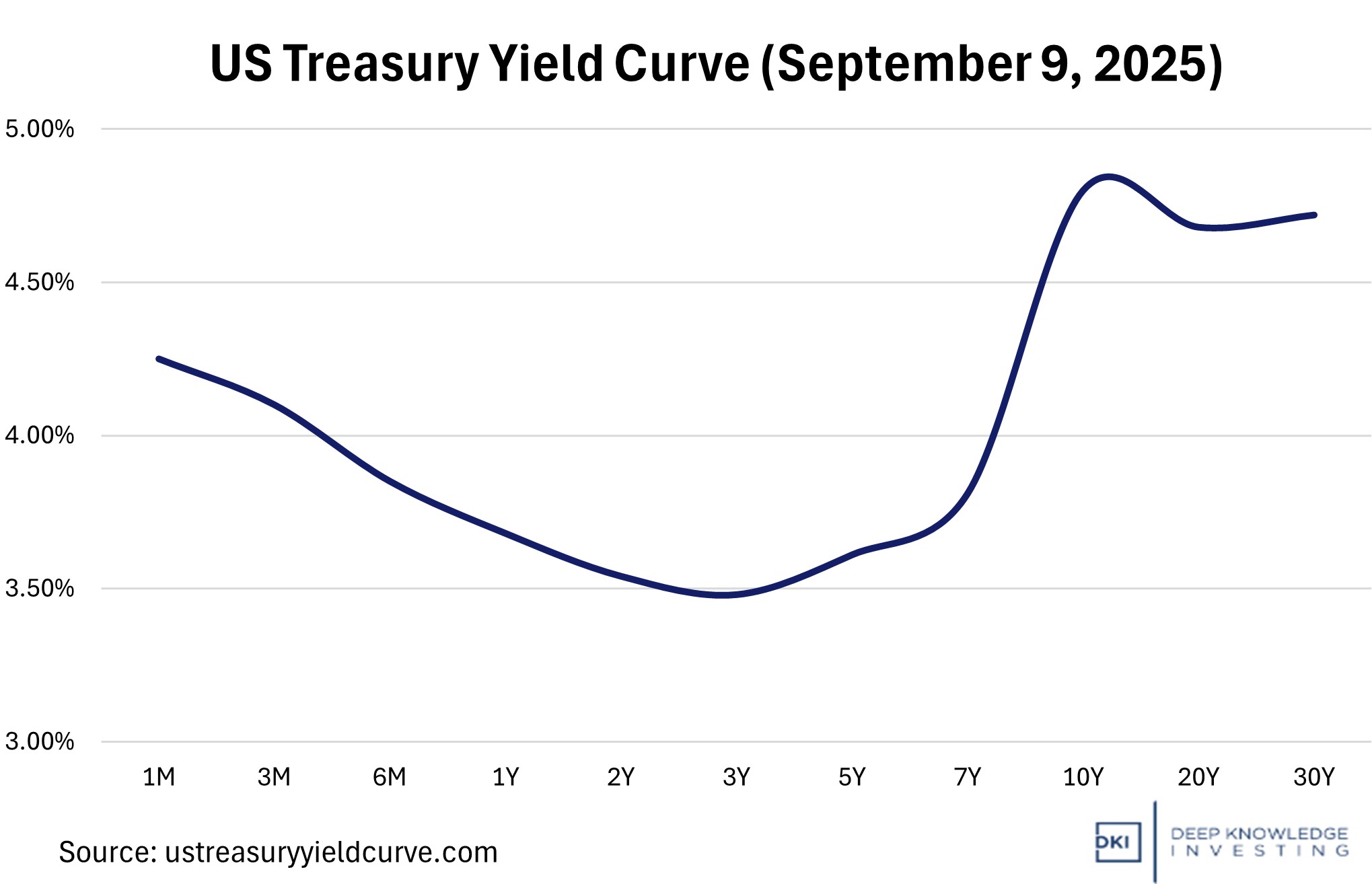

While I understand why every president wants low interest rates and a “hot” economy with plenty of nominal GDP growth, I don’t think President Trump’s preferred fiscal policy will lead to his desired outcome. The Fed doesn’t control the whole yield curve; only the overnight rate. The bond market sets the rate for everything else from one week to 30 years. In September of 2024, the Fed began a process of lowering the fed funds rate by 100bp (1%). Instead of seeing lower borrowing and mortgage rates, the yield on the 10-year Treasury rose by 100bp. The curve got steeper in exactly the way the White House and the Fed didn’t want to see. The reason for this was bond investors correctly expected higher future inflation as a result of a more dovish Federal Reserve. When Chairman Powell and the Fed Governors[1] do reduce the overnight rate, it may not lead to lower corporate borrowing and mortgage rates. That’s not what President Trump wants.

The 10-year yield rose by approximately 1% as the Fed cut the fed funds rate by 1%.

However, President Trump’s conduct is outside the norm only in that he makes his wishes known in public. The Fed has NEVER been an independent institution and US presidents have OFTEN interfered in its workings. I covered this previously in an article titled “President Trump, The Fed, and What Really Matters”:

I consider all the pearl clutching to be performative. People are outraged that the Fed is being politicized – Where have they been for the past century? The reason the Fed exists is to allow the government to debase fiat and steal from us slowly. Think about inflation as a reduction in purchasing power. Where did that purchasing power go? It was stolen by the government and used to spend on their own priorities. The inflation we experience is directly related to Congressional overspending. They used to have to tax us to fund their preferred spending which forced Americans to decide whether government largesse was worth the tax bill. Now, with the Federal Reserve in existence and the link to hard money (gold) severed, we have $37 trillion in debt, a multi-trillion-dollar deficit every year, and another $200 trillion (or so) in unfunded off-balance sheet liabilities. The Fed is one key reason for the massive growth of government. I can’t imagine a more political role in any country that that.

Let’s look at some history as well. FDR had his New Deal which represented a huge increase in government size and scope. Much of our unpayable off-balance sheet liabilities like Social Security are due to FDR’s policies. The Fed made that possible.

Later, President Johnson had his Great Society which caused another big increase in government size and spending. That required the Fed to manage all the additional fiat. In addition, President Johnson famously slammed Fed Chairman, Arthur Burns, into a wall; literally strongarming him into lowering rates prematurely.

President Nixon disastrously took us off the gold standard in 1971. It caused a huge increase in inflation, an exponential increase in government debt, and a constant reduction in living standards. It also wasn’t his fault. Foreign countries had figured out that the US had issued more dollars than it had gold in its vaults. They started turning in their dollars for gold. Had Nixon done nothing, the US would have run out of gold and merely had paper dollars in circulation backed by nothing (similar to what we have today). All Nixon could do was recognize the reality that our government had spent more than it had and the Fed had cooperated in accommodating that excess spending.

Before Powell took over, Janet Yellen was the Fed Chair. She famously said that her biggest regret was not creating more inflation. Would any of you be happier had she succeeded? Inflation encourages consumption. Stable currency encourages saving and investment. The latter is effective in building long-term national wealth. The former is unsustainable.

The Fed has always been political. Politicians have always wanted accommodating policy. Congress has always wanted to spend more than it should. Today’s hysteria exists because President Trump is great at getting reactions out of people. Sometimes, that’s useful. In this matter, it’s not. I think Powell hasn’t been a success at his job, and will likely turn out to be better than whoever replaces him. There’s no sense in getting upset about a new Fed Governor or a more dovish future Fed Chair. Either way, Congress is going to overspend. As Lyn Alden @LynAldenContact says, “Nothing stops this train” which means that the dollar is going to be debased into oblivion regardless of what the Fed does.

For the first 23 years of the existence of the Federal Reserve, the Chairman of the Fed was also the President’s Treasury Secretary. Since then, William Miller (Carter) and Janet Yellen (Obama/Biden) have served in both roles. The Fed has always been a political institution and the same people claiming it’s being politicized are doing plenty of that themselves. From the same article:

I just criticized a Republican President and a Republican Fed Chairman. I’ve regularly criticized Republicans for running for office claiming they’d be fiscally responsible only to see them take huge Democratic budgets as a baseline and increase spending from there. Right now, the Democrats are enjoying the Republican firing squad between the White House and the Federal Reserve, but they’re not blameless here.

Judy Shelton – Hard Money Advocate:

The Democrats are playing up the “politicizing the Fed” line in public, but let’s look at their track record. In general, the party has favored more spending, more dollar debasement, and ultra-loose Fed policy. During the first Trump Administration, he nominated Judy Shelton @judyshel to the Federal Reserve. Shelton drew criticism and concern because she’s a hard money (gold) enthusiast who has advocated for a 0% inflation target and has questioned whether we need a Federal Reserve at all. Is anyone surprised I thought this was a fantastic nomination? At DKI, we’re on team #EndTheFed. Every single Democratic Senator voted against Shelton, and with a couple of Republican “no” votes and a couple more not present due to Covid quarantine, her nomination failed. This means the Democrats voted against a hard money advocate and are now saying yet another easy money advocate would politicize the Fed. It’s hard to escape the conclusion that the party doesn’t have a view on monetary policy, and just likes to criticize anything President Trump does.

A recent kerfuffle relates to President Trump trying to remove current Fed Governor Lisa Cook for mortgage fraud. Democrats claim that he’s doing this to remove Cook and replace her with a more friendly Fed Governor. This accusation is plausible. However, there appears to be evidence that Cook has claimed multiple primary residences in order to receive lower mortgage rates. Second residences default at higher rates than primary ones and typically carry higher mortgage rates. Claiming a second home as a primary residence means other homeowners and taxpayers take on the expense of that extra risk. Governor Cook was not denying the charge; but rather, saying this conduct doesn’t affect her duties at the Fed. Depending on the circumstances, her conduct is potentially chargeable as felony mortgage fraud and punishable with substantial fines and jail time.

While I think the Democrats are correct in their assessment of President Trump’s motives, I’d like us to have a Federal Reserve staffed by people who haven’t committed mortgage fraud either before or during their tenure at the central bank. There have been accusations that other high-ranking officials favored by President Trump have committed similar mortgage fraud. If true, my proposed solution is to start replacing lots of government officials; not to leave everyone in their current positions.

Update: While this piece was in edit, there was a report that Cook identified one of her homes as a second home on some but not all documents. Based on what I’ve seen to date, it appears likely that she identified the home as a primary home on some documents and as a second home on others.

The Fed is going to cut in September. The outcome is likely to be a steeper yield curve featuring lower short-term rates and higher long-term rates.

In the short-term the left side will fall. In the long-term, the right side will rise.

Tariffs:

I’ve been writing about the non-disaster that tariffs have been since “Liberation Day”. History shows that tariffs often don’t lead to horrible inflation due to an increase in domestic supply and some consumer switching. The original Trump tariffs were so much of a non-disaster that most people forgot they existed and the subsequent White House kept them in place. No one noticed or cared. The Federal Reserve is warning that tariffs could lead to “transitory” inflation; a one-time increase in the price index. That’s possible and elevated PCE (Personal Consumption Expenditures) index results and PPI (Producer Price Index) results from a couple of months ago suggest the Fed might be correct, although at a level far below what most fiat economists threatened. The reason this could be correct is many suppliers and retailers bought massive inventory ahead of tariff implementation and it also takes a while for higher prices to work their way through the supply chain. At this point, it seems reasonable to conclude that any inflation from the tariffs is likely to be temporary and not economy-destroying.

What do we get on the other end? Many people are focused on the “revenue” the government is collecting from the tariffs. I don’t think that’s the real benefit. As a result of having the world’s reserve currency and a high-wage population, the US has been outsourcing its manufacturing capacity to low-cost countries for more than 40 years. Decades of this have hollowed out our manufacturing base and we can no longer produce many important things. We don’t make our own pharmaceuticals, most of our semiconductors, our own personal protective equipment, the components that go in most of our cars, our own ships, and many other crucial items for daily life and national security. We depend on other countries, including unfriendly ones, for these and many other things, and print dollars to import them. Those printed dollars are the true cause of inflation meaning the same people who lost their jobs due to outsourcing are the ones paying the bill. I’m not normally a big fan of “income equality” as a metric for economic success, but I can understand why more people are dissatisfied with the current status quo.

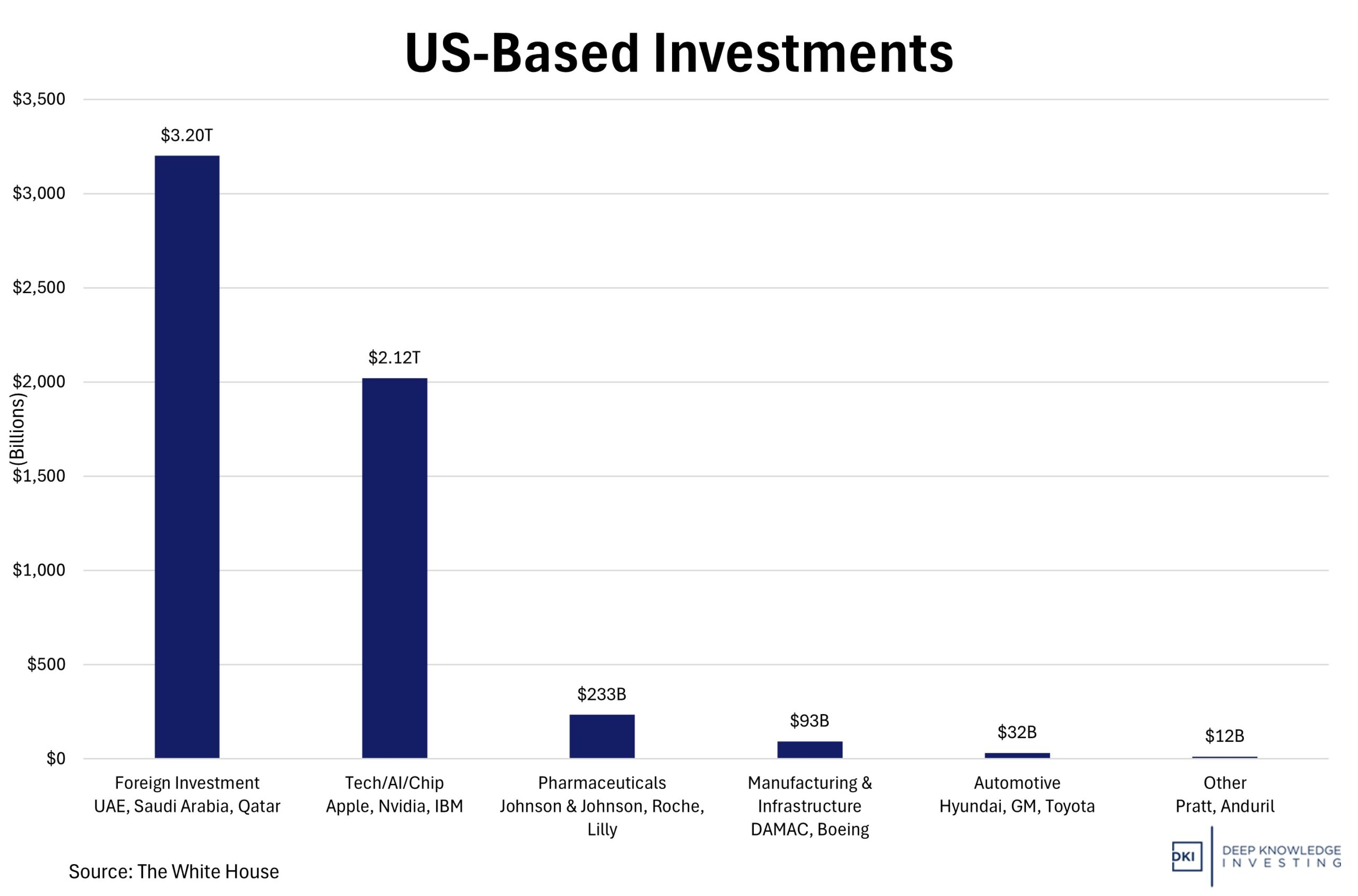

Want to reverse decades of outsourcing? This is a good start.

While the fiat economists, who constantly justify endless stimulus spending and money printing, constantly castigate President Trump, I see something different. There have been trillions of dollars of commitments for domestic manufacturing in just the past 5 months. Companies are planning on building new capacity here in the US which will shore up domestic capability and provide hundreds of thousands of new jobs. In my opinion, this is a huge win for everyone. Critics say that these companies are only making promises to stay on President Trump’s good side and that they’ll drag out costly implementation until a more friendly Administration is in the White House. We should all be watching these companies for signs that they’re putting shovels in the ground and not delaying. We should watch and see if government agencies expedite necessary approvals or sabotage these pro-growth efforts with endless red tape. Those who claim to want to help the “little guy” should be leading the charge here. If they’re not, they (and their motives) should be viewed with suspicion as well. We all benefit from more jobs and more manufacturing capacity so should watch who moves things forward and who creates delays.

A lack of consistency here is also an impediment to a successful outcome. In order to build a multi-billion-dollar plant, a company needs regulatory certainty. Companies making the decision to build based on a cost change due to tariffs won’t proceed if the next Democratic President eliminates the tariffs and costs revert to favor other countries and more outsourcing. In this matter, everyone is to blame. Democrats keep going to partisan Judges to try to get the tariffs declared illegal. These partisan Judges keep reversing White House policies only to be overruled constantly for overstepping their authority by the Supreme Court. An Obama-appointed Judge just over-turned all the tariffs necessitating an emergency Supreme Court ruling. I don’t know how that’s going to turn out, but how can we expect companies to build new plants with this level of uncertainty?

The Trump Administration isn’t helping themselves either. They’re constantly changing messaging and tariff levels in public. They’ve issued exemptions for some companies and not others. Recently, Trade Advisor, Peter Navarro, said that the tariffs might not be permanent. That’s not good messaging. If the tariffs will be eliminated, then who’s going to build a factory here? We need a coherent plan. That’s not just the fault of the Trump Administration. Constant changes in leadership and policies is how our government works. In this matter, our business leaders need consistency; not sabotage by the Democrats, and inconsistent messaging by the President and his Republican team.

I’m also not concerned about the histrionics from other countries. Some of them have bemoaned US tariffs, but conveniently ignored the massive trade barriers they have against US goods to protect their own industries. At a meeting of central bankers in Sintra, Portugal earlier this summer, Federal Reserve Chairman, Jerome Powell, got a hearty round of applause when he said that US tariffs could lead to future inflation. These central bankers loved Powell’s concern that tariffs could lead to an economy-harming slowdown in growth. I’d take their comments and applause more seriously if they weren’t coming from countries that have tariffs, subsidies, and other trade barriers to protect their own domestic manufacturing. Either they believe that only US tariffs hurt growth and their own are fine, or they’re talking their own book. The smart money is on option two.

One area where I give President Trump a lot of credit is his ability to reset a status quo that doesn’t work for the US. For those who don’t like that thought, that’s what he was elected to do and the elected leaders of other countries represent the interests of THEIR own citizens. For decades, most European countries underspent on defense while outsourcing their protection to a high-spending American military. They then spent those funds on social welfare. President Trump reset that one-sided status quo by pressing the EU to live up to their NATO commitments. For decades, the US has had low tariffs while other countries sold into the largest consumer market in the world and protected their own national producers. These countries don’t like to see the previously advantageous trade relationships reset, but why shouldn’t President Trump monetize access to the US market and try to restart US manufacturing? India and Japan are unhappy with his efforts, but they can get a better deal by lowering their trade barriers. Whether it’s international relations or personal relationships, it’s easy to get attached to a status quo that benefits you. Just don’t be surprised when the other party wants a more reciprocal relationship even if change is uncomfortable.

The full story on tariffs isn’t written yet, but as of now, there’s no sign of massive inflation, destroyed demand, or economic upheaval. There may be some inflation, and as much as I hate inflation, I think it’s worthwhile to pay some price to try to reverse four decades of selling off our manufacturing capacity. More domestic supply will bring down prices as well. Finally, I’ve been writing this since April, but many countries offered President Trump a deal to lower their tariffs against US goods to zero if he set US tariffs on theirs to zero. This whole adventure could result in lower tariffs with many countries. Those offers are a perfect example of my point above: It took the President resetting the economic and relationship status quo to get the US a better deal. Reciprocity is healthy in a relationship; even if it comes as a result of tariff threats.

Five months in and as DKI predicted, new tariffs haven’t led to economy-crushing inflation yet.

Inflation – A Prediction:

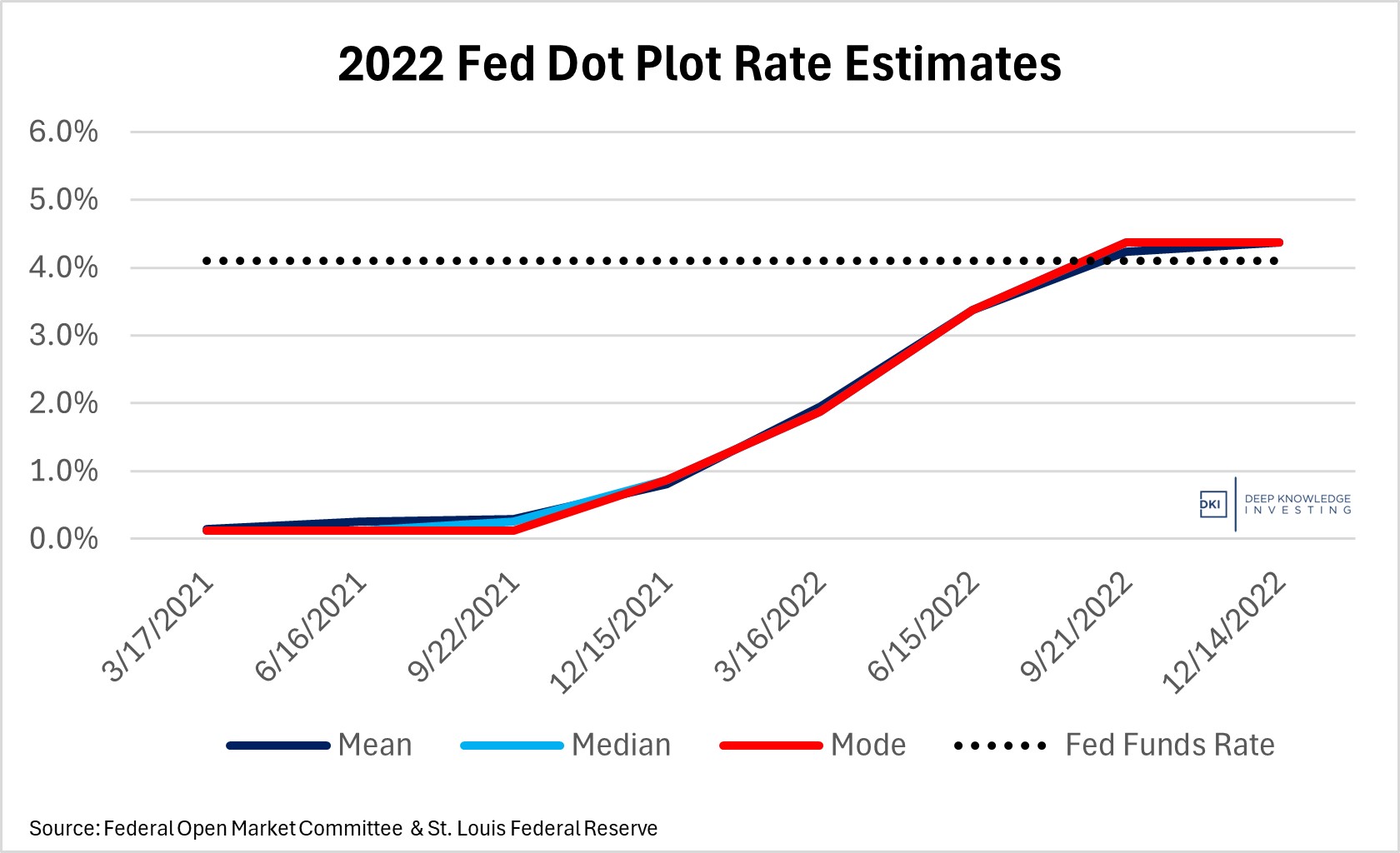

A couple of years ago, I worked with one of the DKI interns to track Federal Reserve projections for the fed funds rate at the end of the year. Despite the fact that the Fed theoretically has the best data possible, a massive budget, hundreds of PhD-level economists, and CONTROL of the fed funds rate, they were unable to predict their own actions even 6 months in the future. Projections for inflation are similarly unreliable. The whole exercise reminds me of the high-level military official who asked a meteorologist for weather predictions on D-Day months in advance. When the meteorologist replied that he couldn’t be accurate so far in the future, the military man replied that was ok; they just needed to put something in the chart.

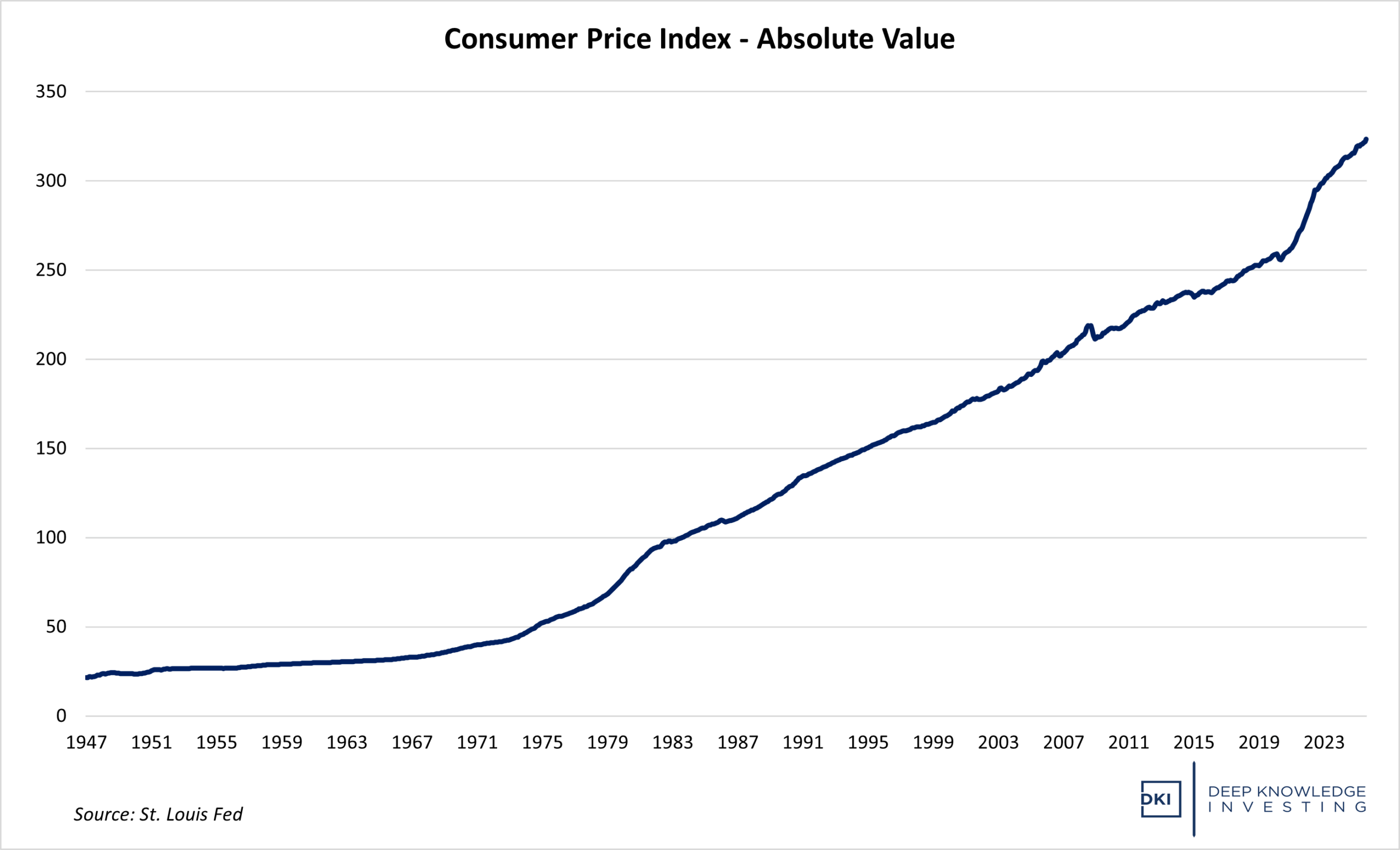

I’m going to avoid the hubris of telling you I can predict the CPI (Consumer Price Index). However, I do have some directional thoughts over the short and long term.

- I think tariffs may lead to some “transitory” one-time increases in prices for select items but nothing like the economic Armageddon predicted by fiat economists.

- As of now, there’s little evidence of significant increases in the price of goods despite an American consumer that keeps spending at record rates.

- Signs of increased credit stress are starting to show. This will eventually lead to reduced spending and lower inflation.

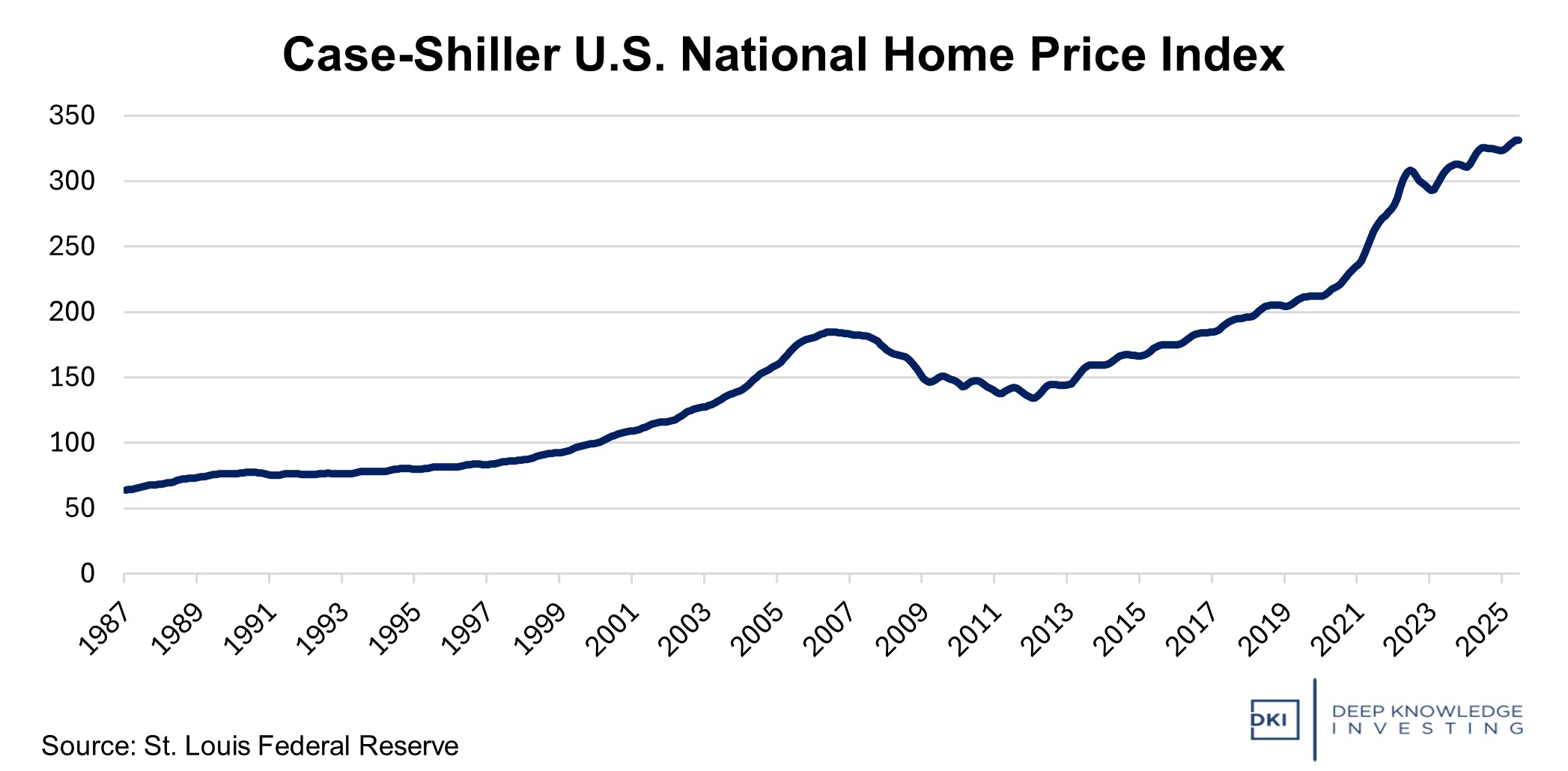

- There are signs of lower housing prices in many markets and the OER (Owners Equivalent Rent) statistic is reported months late. Shelter (a fancy word for housing) is the primary reason for the elevated increases in the CPI during the past several months. Once the OER calculation catches up with reality, we’re likely to see a lower CPI.

This is the reason for the higher CPI. It’s turning in some markets faster than is reflected in the BLS data.

All of that means I think we’re unlikely to see a big spike in the CPI in the near future and we might see it decline some. All bets are off if the Fed does something crazy, and markets are now thinking we may see a jumbo 50bp (.5%) rate cut later this month with more cuts this year.

The Fed is terrible at forecasting. The following graph shows that at the end of 2021, Fed Governors expected the fed funds rate to be below 1% the following year. This is despite the fact that growing inflation was an obvious problem and I wrote an inflation primer in November of 2021 discussing it. The actual fed funds rate at the end of the year was above 4%, a miss of more than 300bp.

The Fed was late to respond.

My long-term prediction is we’re going to see continued inflation. The original and proper definition of inflation is an increase in the money supply. Given massive Congressional overspending (both parties) and their preference to pay for this unsustainable spending through debt and money printing, more inflation is unavoidable. No one is going to cut spending and most of Congress is financially illiterate. The Democrats have gone full-on Communist. The Republicans pretend to be the part of fiscal sanity, but when in power, always increase spending from unsustainable levels. There’s no sense in getting upset about it. The answer is to own high-growth stocks, energy, hard assets, gold, and Bitcoin. Having asset-backed debt, like a mortgage, means you’ll own hard assets while owing in constantly-debased fiat. This turns the pain of inflation back on the source of it. The DKI portfolio is well-prepared for this outcome. If you find this piece helpful and want some assistance investing for the coming environment, we invite you to subscribe.

This is the long-term outlook. Prepare now.

The Market Reaction:

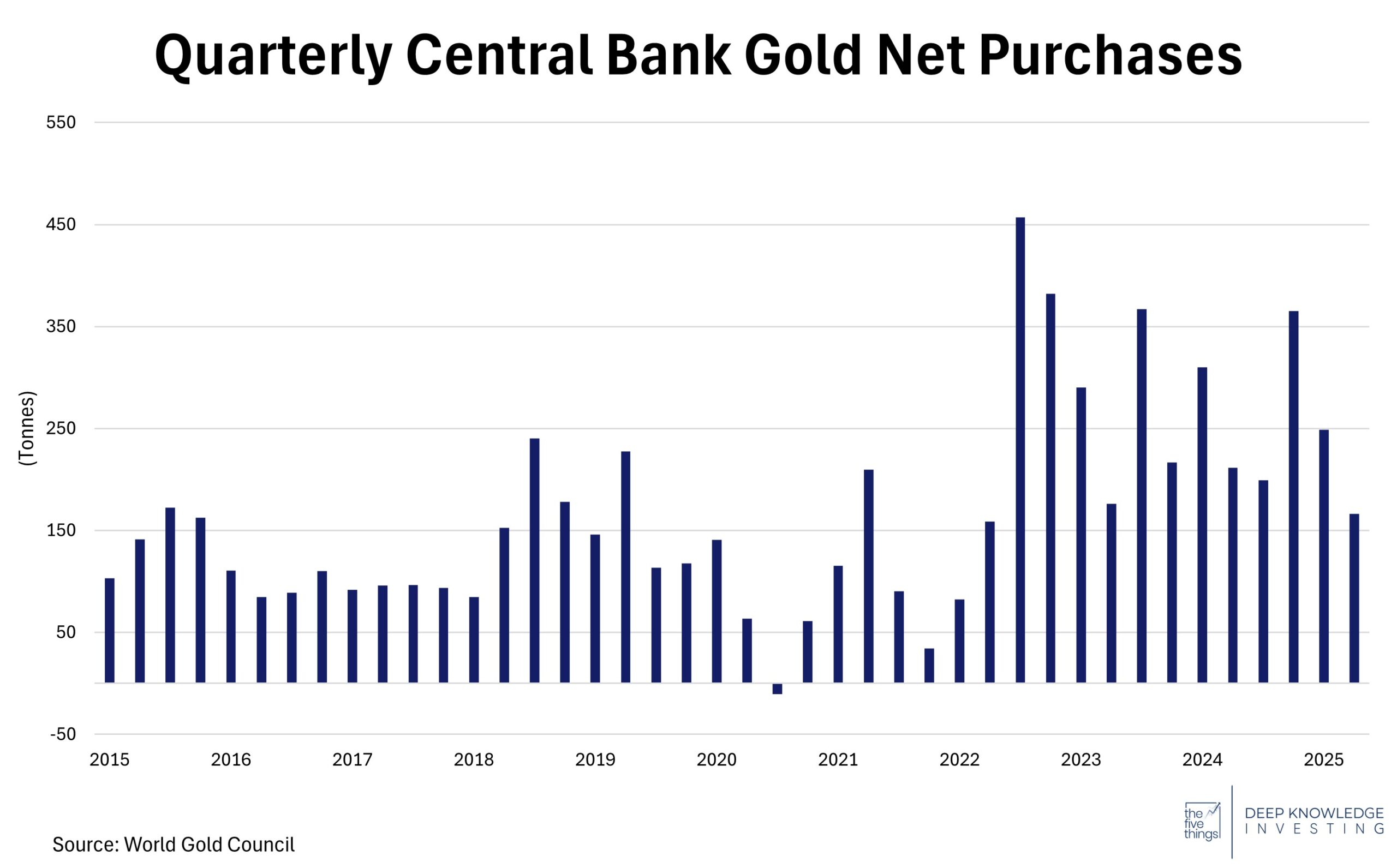

Gold: Gold investors have correctly understood that every western government is debasing their currency. Ever-increasing spending is leading to higher debt levels and more currency printing. Gold is considered by many to be the one true “hard” money and the most reliable store of value. DKI subscribers started to buy gold in 2020 and the price has more than doubled since then, rising 37% year-to-date. Many talk about how the price of gold has risen in that time-frame. I like to reframe that by saying that gold has maintained its purchasing power for thousands of years. It’s the purchasing power of fiat that’s declining.

Gold is also benefitting from becoming an increasing share of central bank reserves. Some governments are concerned about excess spending in the US devaluing the purchasing power of the dollar. Others are concerned that the US took Russian dollar-reserves as punishment for the war in Ukraine. Regardless of the reason, it communicated that dollars could be confiscated if the government holding them wasn’t in the good graces of Washington DC. While many doubt the ability of the BRICS countries to form their own reserve currency, it should concern Americans that more than half the population of the world is actively trying to reduce reliance on the dollar. Buying gold is their current expression for that opinion.

Central banks are shifting slowly out of the dollar and into gold.

Bitcoin: I’m constantly surprised by the friction between gold enthusiasts and Bitcoiners. The thesis for both is the same. Government abuse of their national currencies is driving investors towards both the yellow metal and the orange coin. As of the 2024 halving, Bitcoin is now harder than gold with a slower issuance schedule than additions to the gold supply from mining. Bitcoin is also benefitting from greater institutional adoption. That’s partly due to ETFs that allow investors and RIAs to hold Bitcoin equivalents in standard brokerage accounts and partly due to fear of being left behind by Bitcoin’s incredible returns. It’s up 22% this year alone. DKI subscribers started buying Bitcoin in 2020 at around $15k. I haven’t sold any yet.

Energy: Energy has been a tailwind this year for the CPI as tariff-related fears have reduced expectations for global growth. Production has offset any concerns related to geopolitical uncertainty. Despite US efforts, Russian oil embargos have been ineffective with even ally, India, taking advantage of reduced-price Russian energy and absorbing supply not going to Europe.

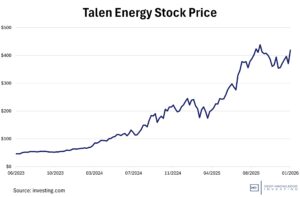

My primary focus in this area is uranium. The US and the rest of the world need more electric supply to maintain and improve their material standard of living which is almost 100% correlated with energy usage. In addition, new AI datacenters are going to need massive amounts of power. Individual datacenters use as much electricity as entire cities. Given the political and regulatory difficulties associated with building more carbon-based generation and the intermittent nature of wind and solar, the answer to this problem is going to be nuclear. New small modular reactors (SMRs) have a smaller footprint than earlier plants and don’t have the risk of dangerous meltdowns.

Growth Stocks: In general, equities hold their value in an inflationary environment. They’ve done well this year and I expect to always hold a limited number of high-growth stocks with the potential to more than double in price.

Conclusion:

While I’ve disagreed with most market commenters on inflation, the Fed, the fed funds rate, the “politicization” of the Bureau of Labor Statistics, and tariffs, I do agree that the Fed is about to start easing again. From DKI’s August CPI piece:

Given the recent downward revisions to the employment numbers, I agree with consensus that the Fed will lower the fed funds rate when they meet this month. I think the Fed fears a recession more than they fear inflation. Some are betting on a “jumbo” 50bp (0.5%) decrease. I think that’s unlikely. Inflation remains elevated. The real rate is below 2% which is not “restrictive”. President Trump has publicly pressured Chairman Powell making it difficult for him to reduce rates without looking like he’s caving to the White House. And the emergency policy bias is towards caution. That’s because in the event of an economic downturn, the Fed has a history of immediately using quantitative easing to flood the system with liquidity. On the other hand, a resurgence of inflation is difficult to control and Fed policies to deal with that tend to either be very expensive or to take a long time.

I think we’re looking at a 25bp cut and are locked in for long-term inflation. Regarding the equity markets, we’re likely to be looking at two contradictory effects. Congress is going to keep supplying the market with liquidity. As described above, I think the Federal Reserve’s current interest rate policy is accommodating (low) and not restrictive (high). That liquidity, plus strong earnings from mega-cap tech stocks with monopolies, is driving equity indexes higher. These things work until they don’t. As described above, this level of spending and stimulus is unsustainable. The system can’t work like this indefinitely, but it can keep prices rising for a while.

The crack is likely to be the work of the bond vigilantes. That’s just an exciting term for when the bond market rejects the next trillion-dollars (or so) of bond offerings from the US Treasury. When that happens, bond yields will rise. As we’ve described with Japan, that leads to skyrocketing interest expense which gets financed with newly printed dollars which leads to more inflation and higher interest rates. These things happen slowly at first and then all of a sudden. What looked like a stable equilibrium with rising equity prices and low bond yields one year can become an avalanche of change the next. Said more simply, buy the dip works until it doesn’t. The best analogy I’ve seen for this is dropping grains of sand onto the top of a pile. There will be small “avalanches” and then one large one. The small ones are the “buy the dip” opportunities. It’s impossible to figure out which grain of sand will trigger the big one. The Fed cutting will lead to higher inflation, higher long-term bond yields, higher short-term equity prices, and a big future problem. When that problem arrives, expect Congress to respond with more stimulus spending and the Fed to respond with lower rates and more quantitative easing.

Invest accordingly, and feel free to reach out if you’d like some help.

Acknowledgments:

Howard Freedland is a member of the DKI Board of Advisors with expertise in commercial real estate, and wine and spirits. He also contributed an incredible amount of time to edit this piece. He’s the one who ensures these are readable and well-sourced.

Cashen Crowe is a DKI Intern from the University of Tennessee. He prepared the graphs for this piece and his strong work-ethic, intellect, and engaging personality are assets to the firm. He’s a consistent contributor.

Robb Fahrion is the Founder and CEO of Flying V, DKI’s digital marketing partner. He and his firm have helped shape DKI’s content including long think-pieces like this one.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.

[1] Chairman Powell and the Fed Governors would be a great name for a band.