30+ YEARS OF ACTIONABLE INSIGHTS IN THE SECURITIES INDUSTRY

Deep Knowledge Investing

DKI empowers hedge fund managers, portfolio managers, family offices, and high net worth individuals to earn higher returns in the equity portion of their portfolios. We provide conflict-free, well-researched stock ideas, and timely market commentary. Deep Knowledge without hidden agendas.

DKI empowers hedge fund managers, portfolio managers, family offices, and high net worth individuals to earn higher returns in the equity portion of their portfolios. We provide conflict-free, well-researched stock ideas, and timely market commentary. Deep Knowledge without hidden agendas.

The Five Things to Know in Investing is a weekly show and newsletter that helps you earn higher returns in the equity portion of your portfolio. Subscribe for free below.

30+ YEARS OF ACTIONABLE INSIGHTS IN THE SECURITIES INDUSTRY

DKI empowers hedge fund managers, portfolio managers, family offices, and high net worth individuals to earn higher returns in the equity portion of their portfolios. We provide conflict-free, well-researched stock ideas, and timely market commentary. Deep Knowledge without hidden agendas.

Ask Gary an Investment Question

What investment related question do you have for Gary? Ask away and your question may be featured on an episode of The Five Things!

Deep Knowledge Investing's goal is to make you money regardless of the economic environment. We keep the pulse on the market and interesting positions so that you don't have to do the research on your own.

Subscribe to receive all correspondence from DKI including The Five Things, investment research, new stock picks, and more!

As Seen In

As Seen or Published In...

The One Thing We Never

Hedge is Our Opinion

DKI focuses on identifying and analyzing aspects of the selected investments the market is missing. Our only goal is to help our subscribers earn better equity returns and we've done that consistently.

Barron's

RealVision

DKI Founder Gary Brode was interviewed by Maggie Lake on Oil and the reappointment of Fed Chair, Powell.

SumZero

Barron's

RealVision

DKI Founder Gary Brode was interviewed by Maggie Lake on Oil and the reappointment of Fed Chair, Powell

United States Military Academy At West Point

Deep Knowledge Company Research

Complete reports explaining an actionable investment thesis. One example is Royal Caribbean Cruises Ltd. which Barron’s published in full: here. There will be a consistent focus on identifying and analyzing those aspects of selected investments the market is missing.

- Barron's

- Complete Reports

- RealVision Daily Briefing

- CNBC'S Squawk Box

- Tv Is Next

- Institutional Investor

Gary Brode

Learn More About Our Founder

DKI is managed by a 30-year hedge fund veteran

In Gary’s three decades of experience, we have come to understand that traditional sell-side research is not designed to make the investor money. It is designed to market investment banking services to the companies they cover. We do the opposite.

What is Deep Knowledge Investing?

What They Are Saying

"I’ve known Gary for 17 years. He’s always been a source of great investment ideas and reliable high-quality research. When I decided to start Concentric Capital Strategies, he was the first service that I subscribed to and I’m glad I did."

Seth Turkeltaub

Founder of Concentric Capital Strategies, formerly Portfolio Manager at Millennium

SWAYworkplace

Check Out Our Recent Blog Posts

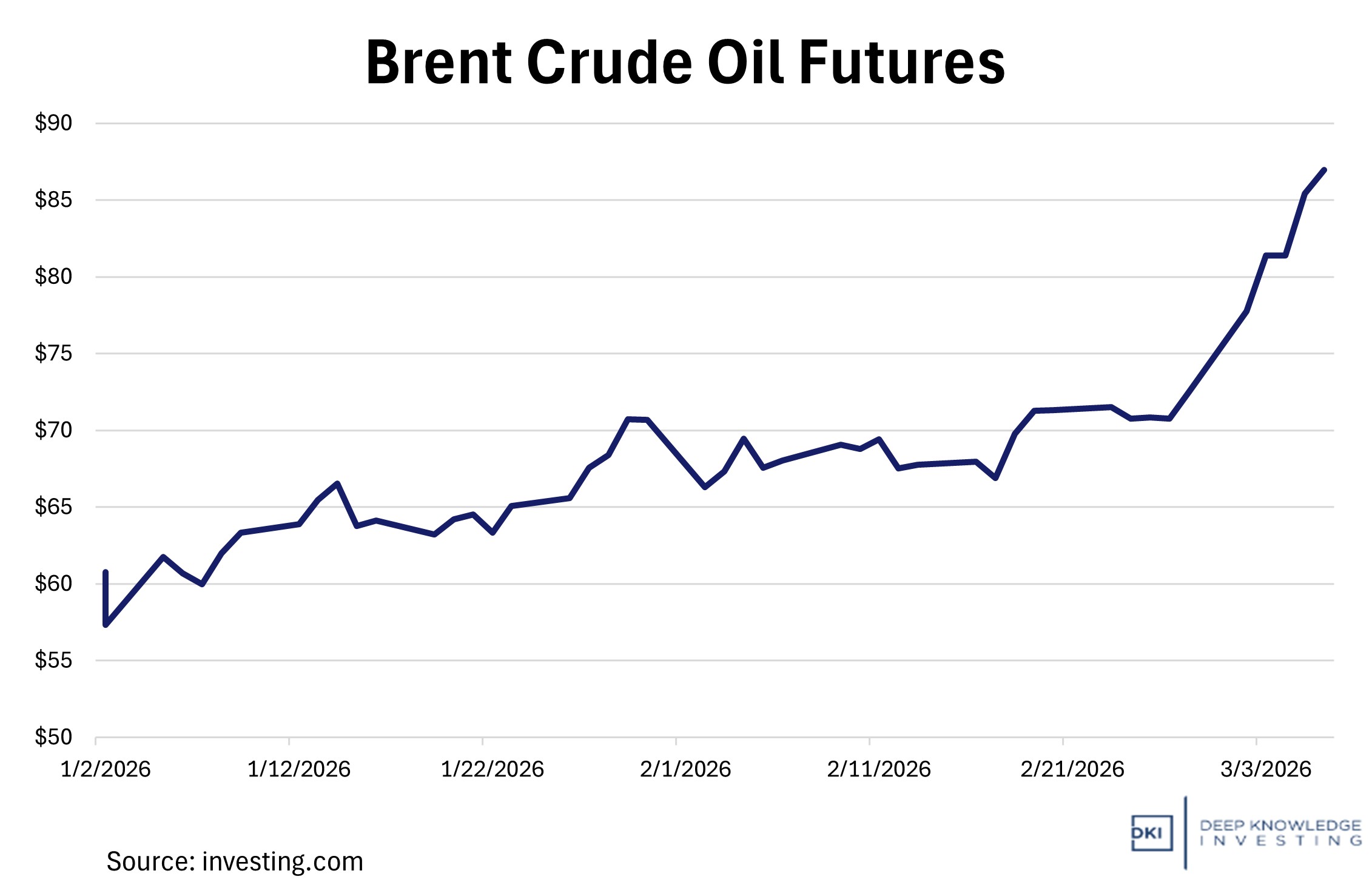

5 Things to Know in Investing This Week – The Many Ayatollahs Issue

Join Now

Post Hoc Analysis

As before, anything I write regarding the situation in Iran is based on what I believe to be true right now. None of us know how accurate any individual report is. Every

Iran and the Portfolio

Join Now

5 Things to Know in Investing This Week – The Parking Issue

Join Now

Categories

5 Things to Know in Investing This Week – The Many Ayatollahs Issue

Join Now

Post Hoc Analysis

As before, anything I write regarding the situation in Iran is based on what I believe to be true right now. None of us know how

Iran and the Portfolio

Join Now

Investment Performance

Investment Performance

Other

Bitcoin: Recommended on 11/9/20 at $15,479.57.

Recommended shorting the S&P 500 on 2/24/20 ahead of a 33% drop in the index.

Equity

Houghton Mifflin Harcourt (HMHC) Opened on 1/29/21 at $4.93. Closed on 2/22/22 at $20.90.

Other

Shorted S&P 500 on 2/24/20 at $3,337. Covered 3/23/20 at 2,237. Return of 49% in 28 days.

Bought Bitcoin 11/9/20 at $15,479. Still own.

Current Price:

Recommended $GBTC at the same time for people who couldn’t buy Bitcoin.

Recommended shorting the S&P 500 on 2/24/20 ahead of a 33% drop in the index.

Re-recommended $GBTC due to the discount to NAV on 6/14/22 at $14.53 and 6/30/23 at $18.84.

Equity

Bought $LVS on 4/27/20 at $43.78. Sold at $53.66 on 6/10/20. Return of 23% in 44 days.

Bought $HCA on 8/18/20 at $133.67. Sold at $250.00 on 7/20/21. Return of 88% including dividends in 336 days.

Bought $HCA on 9/24/20 at $115.79. Sold at $250.00 on 7/20/21. Return of 117% including dividends in 299 days.

Bought $HMHC on 1/30/21 at $4.93. Sold on 2/22/22 at $20.90. Return of 324% in 388 days.

Bought $HMHC on 3/25/21 at $5.61. Sold on 2/22/22 at $20.90. Return of 273% in 334 days.

Bought $ENVA on 4/26/21 at $32.85. Sold on 10/24/23 at $43.21. Return of 32% in 911 days.

Bought $ENVA June 16, ’23 $40 strike call options on 3/24/23 at $5.30. Sold on 5/30/23 at $7.30. Return of 38% in 67 days.

Bought $LVS December 15, ’23 $45 strike call options at $3.30 between 9/25/23 and 10/6/23. Sold for $3.55 on 12/13/23. Return of 8% in 79 days.

Bought $SRUUF on 11/21/22 at $11.26. Still own this.

Bought $TPL on 2/04/22 at $1,095. Sold 75% of it on 11/16/22 at $2,655. Return of 142% in 285 days.

Bought more $TPL on 6/30/23 at $1,325.59. Still own this.

Investment Performance

Equity

Other

Stop Missing Out

We never close trades on the website, so this will be the only way you will know

how we’re trading an idea and when we exit a position.