This week, we got news on the new national crypto strategic reserve that first spiked the dollar price of some coins, then crashed them. The details now indicate the Bitcoin can only be bought if it doesn’t cost the taxpayer anything. It’s not clear what those circumstances might be. As DKI wrote in January, it’s now obvious that China is importing Nvidia’s best GPUs for AI training. That was always going to be the likely outcome. The Trump tariffs lead to multiple companies announcing hundreds of billions of dollars in US-based manufacturing. DKI tries to give you a more complete view of the situation instead of just partisan talking points. I discuss this topic in depth with @MartyBent on this week’s TFTC Podcast. Mortgage rates are plummeting. DKI just wrote on the intention to “crash stocks to save bonds” and explain why. (Article paywalled). Finally new DKI Intern, Cashen Crowe, makes an immediate contribution with an explanation of dollar cost averaging. Outstanding work, Cashen, and welcome!

This week, we’ll address the following topics:

- Crypto Strategic Reserve: The government will hodl, but not purchase.

- China has Nvidia’s best processors. DKI is shocked that highly valuable, small, untraceable GPUs were sent illegally. OK – we said this in January.

- Apple and TSMC invest in U.S. manufacturing: This needs to be included in discussions about tariffs.

- Mortgage rates plummet. They’ll crash stocks to save bonds.

- Educational thing: dollar cost averaging.

Ready for a week of lower interest rate news? Let’s dive in:

1) Crypto Strategic Reserve Set at Hodl not Buy:

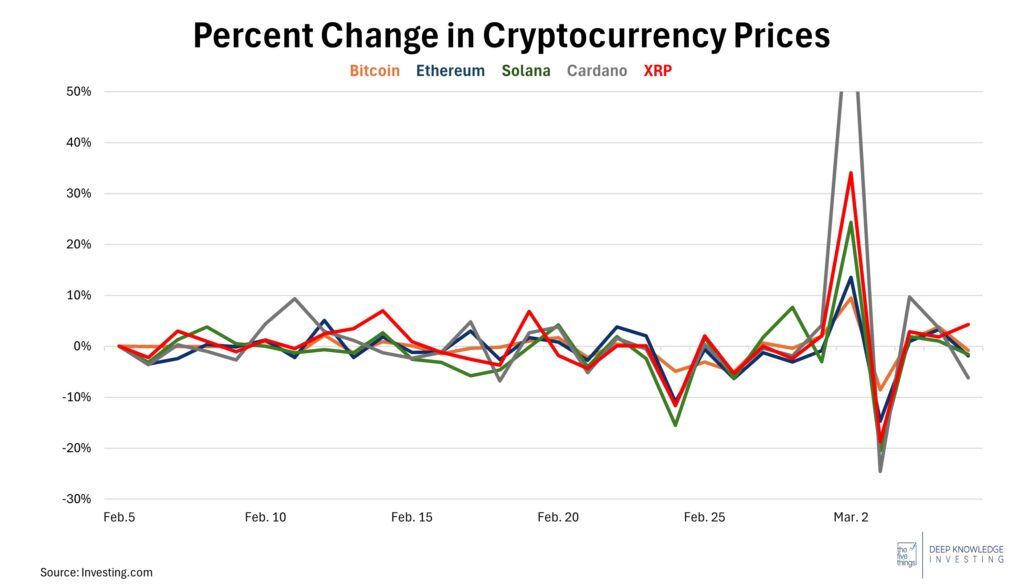

Last week, President Trump announced plans to create a “Crypto Strategic Reserve”, aiming to make the US the “Crypto Capital of the World”. He also announced the reserve will consist of Bitcoin (BTC), Ethereum (ETH), and alt coins like Solana (SOL), Cardano (ADA), and Ripple (XRP).

The market reacted by boosting the prices of the included currencies across the board. Bitcoin (BTC) initially surged to over $94k, fell to $82k, and recovered to $90k in a volatile week. The alt coins saw gains of 13% for XRP, 34% for Cardano, and 3% for Solana.

Easy to see where we got announcement volatility. Don’t worry – the interns will be severely punished for using “pumpkin” instead of orange for Bitcoin!

DKI Takeaway: Details became available at the end of the week. The Crypto Strategic Reserve allows for new purchases of Bitcoin only, and only then if it can be done at no cost to the taxpayer. At this point, it’s not clear how the government could purchase more at no cost unless they’re considering doing things like selling assets and using the proceeds to buy Bitcoin. Bitcoin initially traded down when the market realized no new purchase were contemplated and the plan was just to permanently hold Bitcoin seized as part of other operations. The price quickly recovered. DKI generally approves of this development, but would prefer this strategic reserve to only hold Bitcoin. We also think it would make sense to issue some unlimited fiat to buy supply-limited Bitcoin; an opinion heavily represented in my own portfolio and that of many in the DKI investing community.

2) China Has Nvidia’s Best Processors – Something We Said in January:

It’s been an open secret that China has had access to Nvidia’s $NVDA best GPUs in violation of US export restrictions. This is something DKI has been saying since January. A recent WSJ article provided additional details. Servers using $NVDA’s last generation Hopper GPUs (still subject to export restrictions) are selling for $250k in China. The newest Blackwell-powered servers are selling for $600k. Grey-market dealers are reporting that they can deliver dozens of servers now and hundreds within months. Each server contains multiple GPUs.

China has been sourcing these GPUs for years.

DKI Takeaway: In hindsight, it’s obvious these export restrictions would have limited effectiveness. If you want a $600k server, the cost of shipping from a third country isn’t meaningful. Beyond the physical logistics of shipping a relatively small and expensive item, high-end GPUs are accessible through the internet on an hourly basis. Finally, the Nvidia $NVDA GPUs that were approved for export to China met the technical specifications provided by the government, but still delivered similar performance to the restricted best Hopper chips.

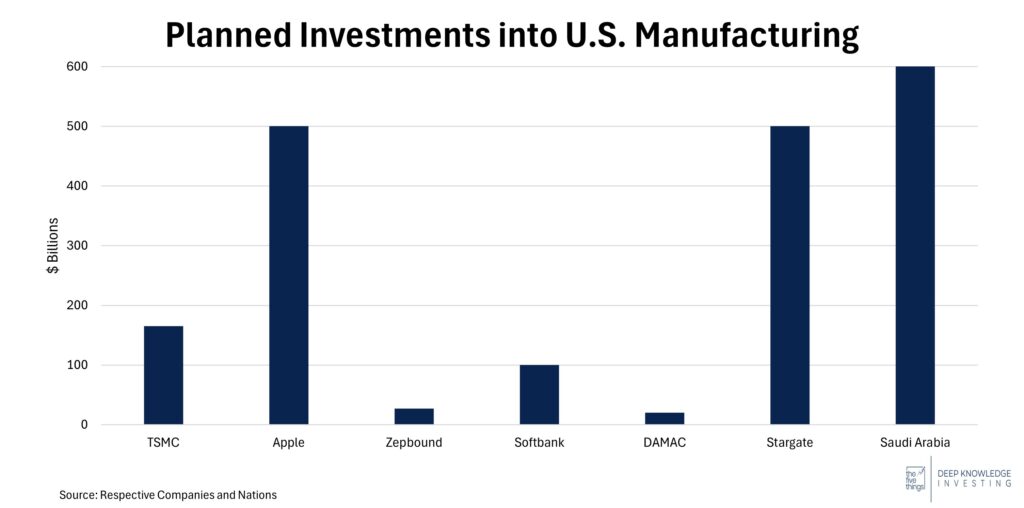

3) Apple and TSMC Investments: A game changer for U.S. Manufacturing:

Recent investment commitments from major tech companies are strengthening the US position in domestic semiconductor and AI chip manufacturing. This is driven by a mix of efforts to make supply chains more resilient, hedge geopolitical risk, and start to reshore American manufacturing. Apple plans to invest $500 billion in research and AI chip production over the next five years, creating tens of thousands of new jobs within the manufacturing and engineering sectors. TSMC also plans to invest an additional $100 billion ($165 billion total) into US manufacturing to capitalize on already remarkable production efficiency within the US. This includes 3 new fabrication plants, 2 advanced packaging facilities, and a major R&D center, supporting over 40,000 new construction jobs

Investment in the US to this degree will continue to lower reliance on foreign semiconductor and chip production while protecting against geopolitical tensions in Asia. These new jobs will give the US workforce a chance to increase the precision and efficiency needed to compete with operations abroad.

Reversing 4 decades of outsourcing won’t be fast, but this is a good start.

DKI Takeaway: President Trump’s early efforts to advance the US position in the semiconductor field using tariffs may outperform the effectiveness of the CHIPs act introduced in 2022. There is understandable concern about the efficacy of tariffs to improve the economy without increasing inflation. DKI thinks any conversation on the subject should include the prospective benefits in addition to the pitfalls. Tariffs are encouraging domestic investment in a field critical to our economy and national security. The hope is that we’ll see continued investment in domestic manufacturing adding to the growth from the subsidies created in the CHIPs act. DKI is looking forward to the years-long coming debate about the effectiveness of subsidies vs tariffs.

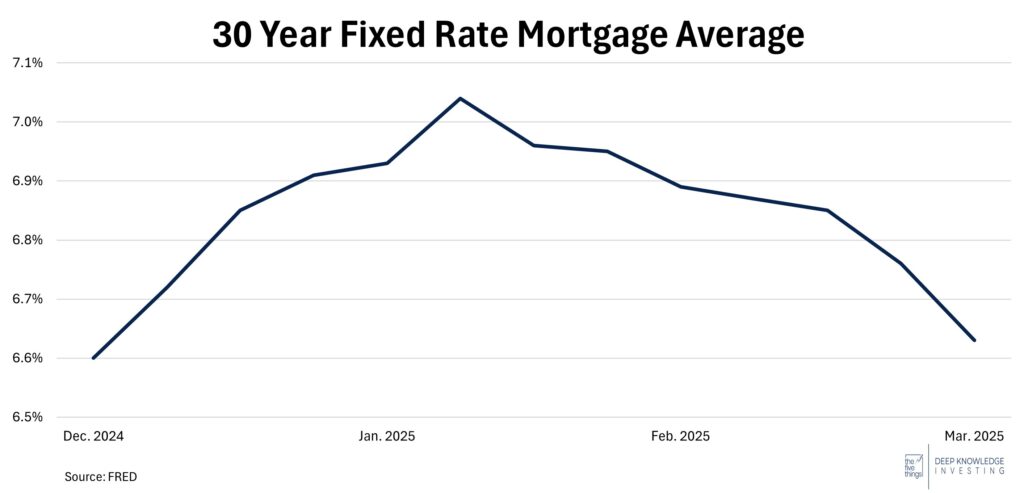

4) Mortgage Rates Plummet – Killing Stocks to Save Bonds:

Last year, Treasury Secretary, Janet Yellen, reduced the duration on the US bond portfolio. By reducing the supply of 5-10 year Treasuries, she hoped to reduce the yield on those securities. This would, in turn, reduce borrowing costs for corporations and mortgages; something you’d like if your party were running for re-election. This didn’t work, and current Treasury Secretary, Scott Bessent, now has to refinance $7 trillion in the next year. In order to keep interest expense from continuing to skyrocket, the current White House is trying to reduce interest rates even at the expense of the stock market. When you hear the expression “crash stocks to save bonds”, this is what that means.

40bp decrease in two months is meaningful. Might take more to get sellers back in the market.

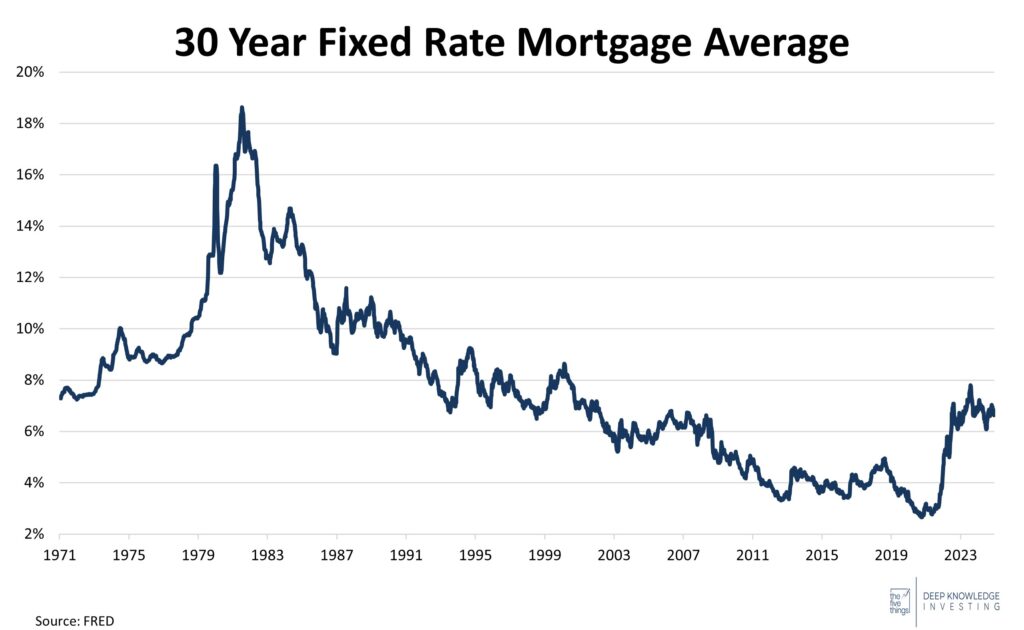

Unpopular opinion, but 6.6% mortgages aren’t horrible.

DKI Takeaway: The Trump Administration is succeeding in reducing interest rates. As tariff-related inconsistent messaging spooks the stock market, money is flowing towards the perceived safe haven of the Treasury market. This has reduced the yield on the 10-year Treasury from 4.8% to under 4.3% in a short time. Mortgage rates are also falling. Typically, lower mortgage rates result in lower financing costs and higher purchase prices, but we’re likely to see something different this time. Recently, higher mortgage rates have incentivized people to stay in their homes as the higher rates on a new mortgage meant living in a smaller home to have the same monthly payments. Lower rates should start to move some sellers off the sidelines and increase available supply. I discuss this topic along with tariffs with Marty Bent on the TFTC podcast.

5) Dollar Cost Averaging:

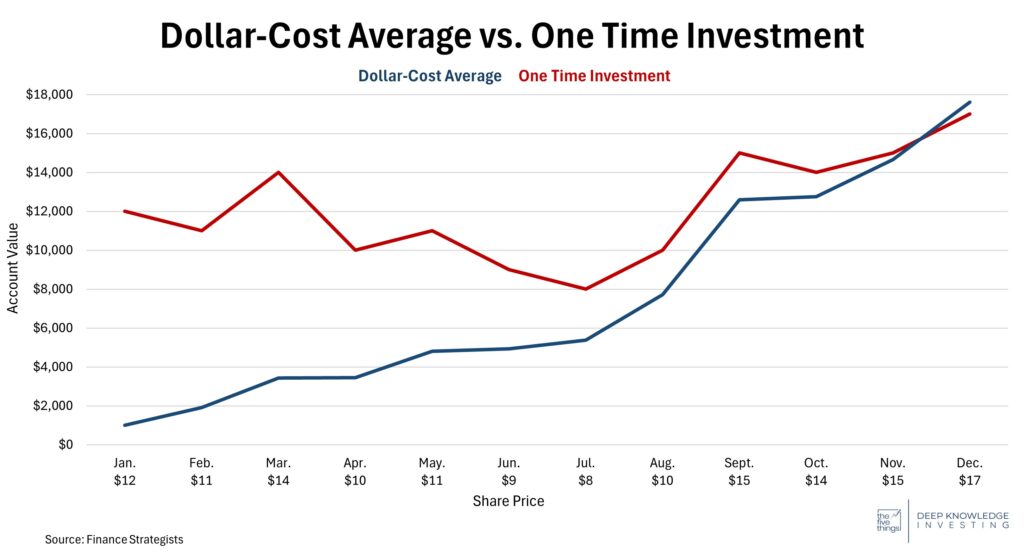

Timing the market is challenging, but dollar-cost averaging has made it easier for many retail investors to deal with potential negative stock performance from bad timing. Dollar-cost averaging is an investment strategy where someone will invest equal amounts of money on a scheduled basis, regardless of share price. Because they would buy more shares at lower prices and fewer shares at higher prices, the investor ends up with a lower average cost.

Dollar-cost averaging also provides investors with peace of mind, removing the pressure of market volatility. In the event of a sharp decline in stock price, continued investment will lower the average price paid. However, this practice leaves investors subject to higher transaction fees and the potential to see limited returns if the stock rarely declines in price.

In this hypothetical example, $1k/month gets you better results than $12k on day one.

DKI Takeaway: If an investor had wanted to buy the S&P 500 ETF in early February of this year, they would have significantly benefitted from dollar-cost averaging. With investments being spread over time, the investor wouldn’t see negative returns on a lump-sum, but rather smaller amounts invested at each scheduled point. As the S&P continued to decline through the month, each new investment would be made at a lower price, reducing the average cost per share. When the market eventually begins to recover, the investor will have a greater chance of seeing better returns. Worth noting, this works the opposite way in a sharply rising market where the investor would be best off investing the full amount on day one. Still, for most investors, cash flow limitations mean they’ll be allocating capital over a long period of time.

Here’s the video version: https://www.youtube.com/watch?v=_vWQtsCBTsY

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.