Overview:

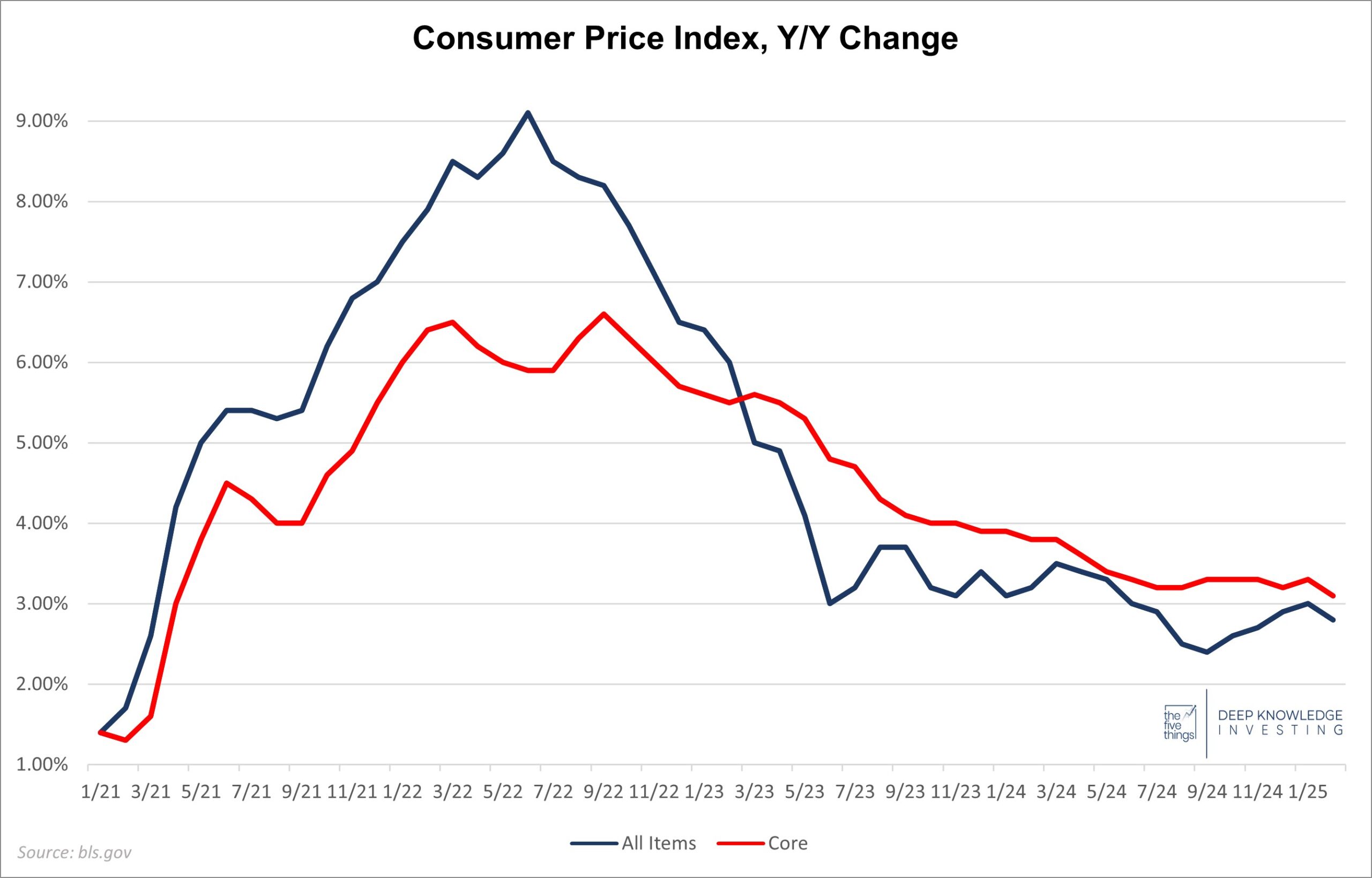

Today, we got the February Consumer Price Index (CPI) report which showed an overall increase of 2.8% for the last year and 0.2% for the month (annualizes to 2.4%). That’s below last month’s 3.0% and above the prior month’s 2.9%. Both the annual number and the monthly were 0.1% below expectations. The monthly was a large decline from 0.5% from the prior month. The Core CPI which excludes food and energy was up 3.1% vs last year and up 0.2% from last month. both Core numbers were 0.1% below expectations and 0.2% below last month’s report. Let’s go through the details:

Down this month, but still above where we were a few months ago.

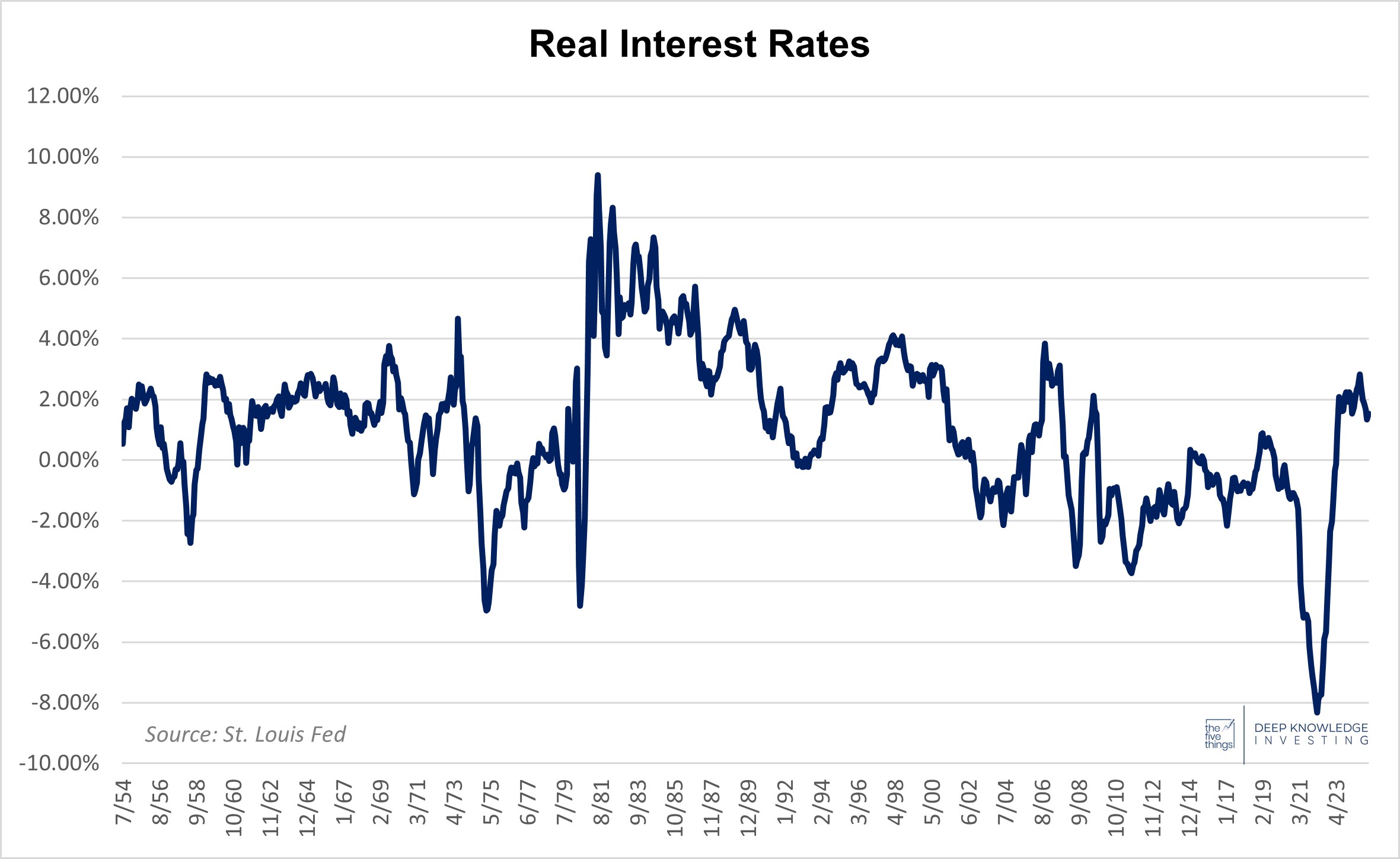

Still well below 2%. That’s not restrictive.

Food:

Food inflation came in at 2.6%, slightly higher than last month. Food at home was up 1.9% which was consistent with last month and still understated. Food away from home is now up 3.7%, an increase from the last few months. I write this every month, but I continue to be skeptical of this part of the CPI, and have been for the past two years. It seems understated to me and I’ve yet to find someone who will tell me their grocery bill is up only 2% in the past year.

Repeated from last month because it’s still accurate: On the food front, I’m noticing two trends in the news. One is consumers have gotten tired of the constantly increasing tipping requests (demands?) and are starting to eat out less often. Frustrated waitstaff are posting on social media that if you’re not going to tip at least 20%, then you don’t deserve to eat out. They may get their wish, but be unhappy with the resulting fewer customers tipping anything.

Egg prices are in the news again as our government unwisely forced farmers to kill entire flocks if even one bird tested positive. Articles I’ve read from farmers suggest the wiser approach is to let the disease run its course and keep the chickens that have demonstrated disease resistance. In an incredible show of chutzpah, Democrats started blaming President Trump for the rising price of eggs just one week into his term. I think it takes longer than that to grow a chicken which is the only way egg prices are going to come under control. (Written last month and modified below.)

Since then, there has been talk about securing supply for more imported eggs and I suspect those won’t be subject to a tariff. In addition, I read an interesting article that made the case that the real culprit in the rise of egg prices are the few large corporations that control most of the egg supply. Normally, I’m not a fan of the “corporate greed” claim as the reason for higher prices. That’s because these claims tend to be politically motivated and light on facts. However, this argument that we’ve over-concentrated our food producers in general and egg supply in particular was compelling. If that’s the case, it would be wrong to blame Biden for the increase in prices under his watch and Trump for current prices. The remedy would be more active anti-trust, something we saw under that last Administration that appears to be continuing under the current one, a rare area of bipartisan agreement these days.

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families.

The reason I keep reprinting the same language about understated food inflation is because the BLS keeps printing the same nonsense.

Energy:

Energy has been an overall tailwind for the CPI following the huge increases in 2022. Energy prices were down -0.2% vs last year and down 0.2% vs last month. This reverses three months of increases. Gasoline was down 3.1% y/y, and down 1.0% in January. Fuel oil was again the big mover showing a 5.1% decrease for the year, but a 0.8% increase from January. President Trump is trying to bring down energy prices, and he’s going to need to succeed to help reduce the CPI. Some discussed tariff plans may have the opposite effect so this one is a little harder to predict. We also note widespread predictions of a recession which tend to reduce near-term demand by a small amount. That reduction tends to be enough to bring down pricing at the margin. This scenario, lower CPI due to recession-reduced energy demand would not be positive for equities.

Vehicles:

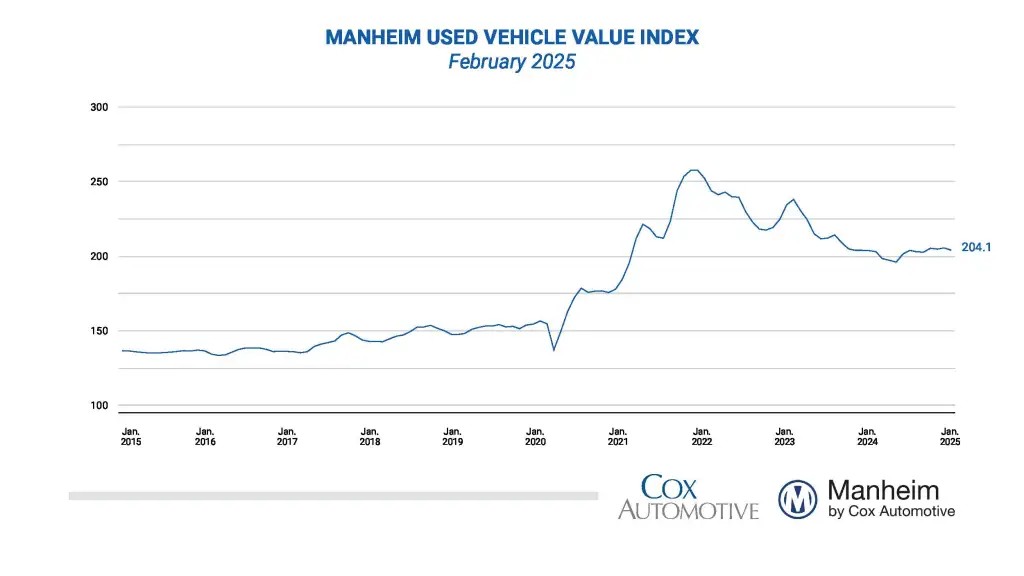

New vehicle pricing was down 0.3% continuing the downward trend. The monthly change had been flat or up six months in a row, but was down 0.1% this month. Used vehicle pricing was up 0.8%, and up 0.9% vs last month marking six straight months of increases. We’d also note that the decrease in used car pricing is off of a huge increase. Still, if you look at the chart below, you can see that after the enormous Covid-related run-up in used car prices, recent decreases have retraced more than half of the Covid-related price increases. Pricing is returning towards the “normal” trend and the more recent trend is towards a return to higher prices. There’s also a substitution effect. As new cars become unaffordable, that increases demand and pricing for used cars. The difference in pricing change between used and new has been substantial over the past six months.

Meandering after a multi-month increase.

Services:

Services prices were up 4.1%, slightly below last month and a continuing multi-year problem for the Fed. That is partly because much of the increase is caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, we’re about to start seeing the effect of a reduction in government employment. More importantly, too many Americans are suffering real wage reductions where their raises aren’t keeping up with the inflation they’re experiencing. In addition, all job growth has been in government jobs or jobs heavily funded by the government. DOGE is likely to put this trend in reverse, although without much loss in national production.

All of the new jobs are part-time and almost all job growth is coming from government and health care which is largely funded by government. That’s telling you the public market is throwing money into the economy while private businesses aren’t doing as well. I’ve written at length for years about positive employment data that is later quietly revised downwards. The “data” is so unreliable that it’s no longer useful.

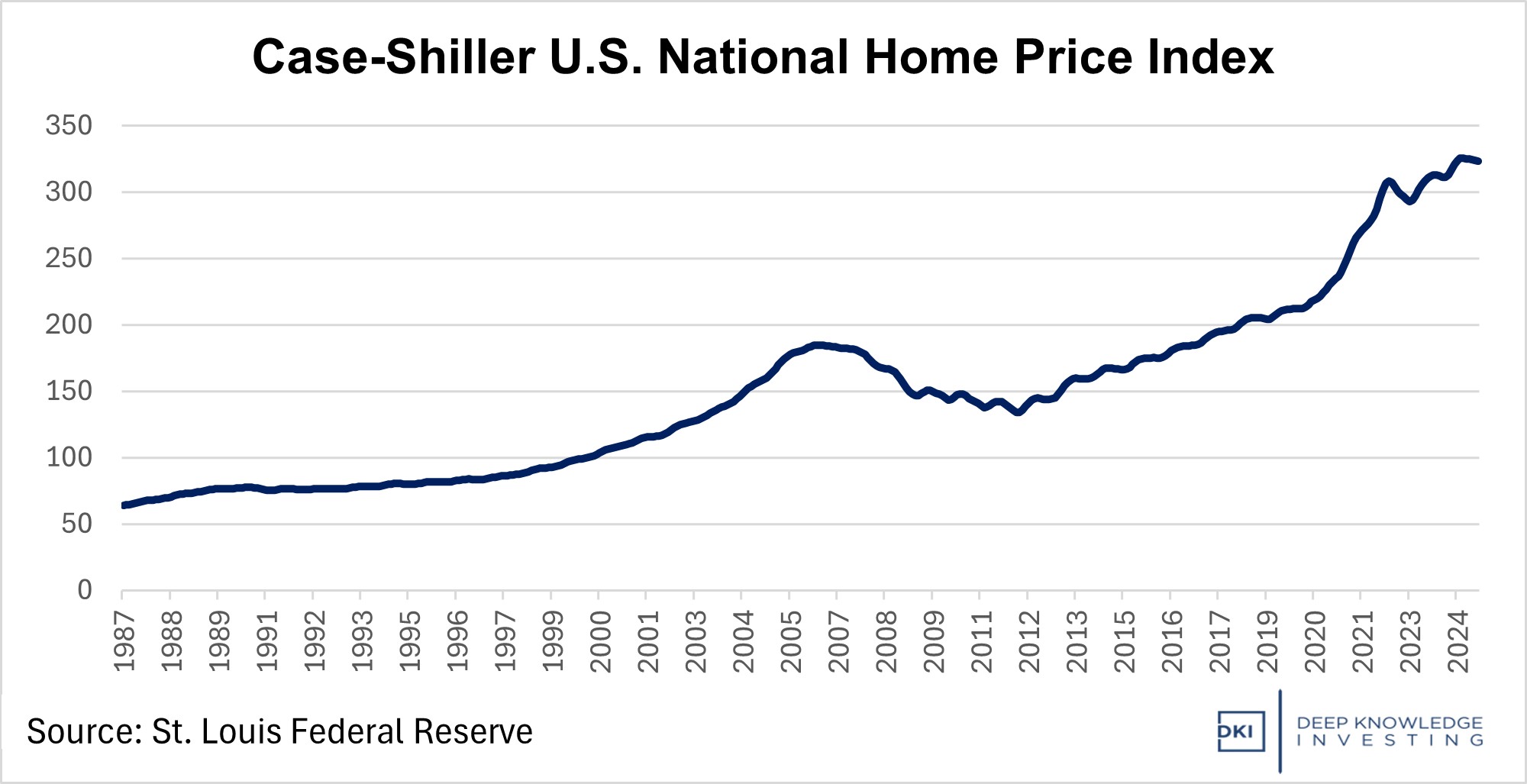

Shelter (a fancy word for housing) costs were up 4.2% which was below last month, but still painful for hopeful homeowners and renters. This category was responsible for about half of the CPI increase for the month.

The Trump Administration is trying to reduce the yield on the 10-year Treasury because due to some unwise political gamesmanship by former Secretary Yellen, they have to refinance another $7 trillion in the next 12 months. As the 10-year yield has come down in the past couple of months, mortgage rates are also falling. Typically, as financing costs decline, we see increases in pricing. That may not be the case this time as people who felt locked-in to their homes because they didn’t want to give up low-cost mortgages may put additional supply on the market. If lower rates lead to more supply, it would lead to improvement in housing affordability, something that’s been particularly painful for young people right now.

We were told Fed hikes would lower home prices. They didn’t. We were told lower rates would improve affordability. They might soon.

Analysis:

Inflation has been a problem since 2021. I’ve said all along the Federal Reserve reduced rates too early. Today’s lower-than-expected CPI is encouraging the market to think inflation is under control and the Fed can start reducing rates soon. The difficulty is the path to that outcome is likely to involve a reduction in demand due to a technical recession.

DOGE is working on cutting huge amounts of government spending. For a long time, increases in government debt have outpaced increases in GDP. That means we’ve been in a private market recession for a while and the government is still using stimulus spending to create the illusion of economic growth. While I come across a lot of people worried about a recession, I’m not so concerned if the reason for a “recession” is a reduction in wasteful government spending and theft.

I also think there’s a lot of optimism about a CPI that was 0.2% below last month and 0.1% below expectations. The market was worried just four weeks ago by a higher-than-expected 3.0% CPI with a 0.5% monthly increase (which annualizes to 6.2%). It’s hard to come up with one inflation number for an economy as large as the United States, and definitely not something you can do to 0.1% accuracy. At this point, the market has been reacting to very small changes in general statistics.

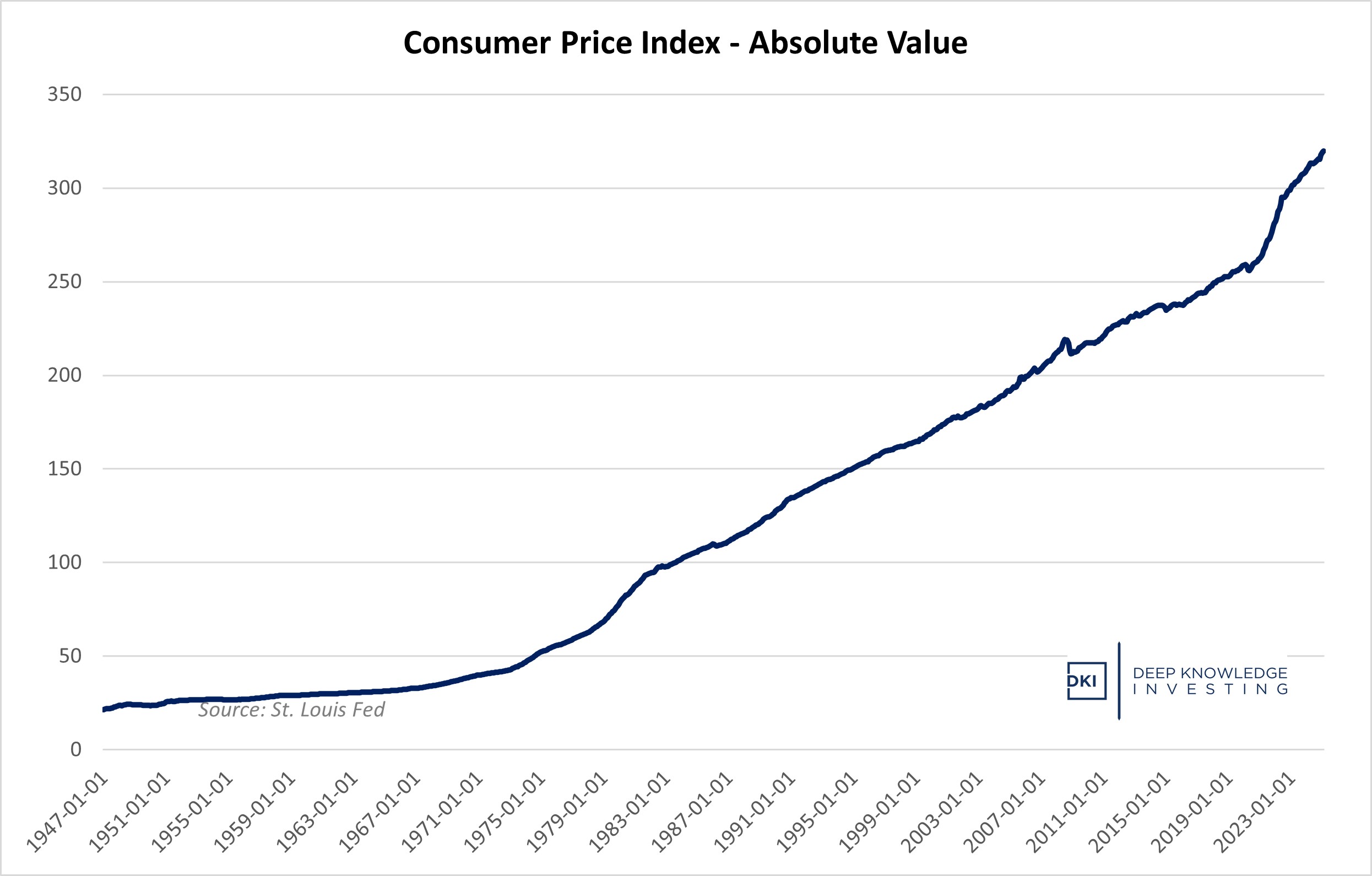

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

Conclusion:

DOGE remains the big story. The waste and fraud are horrendous. When Elon Musk said he could cut $2 trillion, I was skeptical. Peter Thiel warned not to underestimate Elon Musk. As they go through the budget line by line, there is a lot that can be cut. I was too pessimistic about the opportunity for DOGE.

The thing to be potentially concerned about right now is cuts to government spending will throw the country into a temporary recession. Washington has been creating the GDP numbers out of thin air with wasteful spending that adds no economic value, but does add to GDP. This is what DKI has referred to as a Potemkin economy. It looks good, but isn’t real. With the CPI continuing to rise, stagflation for a couple of quarters is a possibility. We could end up with lower inflation if reduced wasteful government stimulus reduces demand. Higher unemployment in government, the fastest growing sector for employment, is going to start showing up in the employment reports soon.

Treasury Secretary, Bessent, is trying to get the yield on the 10-year down because prior Treasury Secretary, Yellen, unwisely reduced the duration on government bond sales. Bessent has to refinance $7 trillion and has succeeded in getting rates down some at the expense of the stock market. The Administration will take a temporary hit to the equity markets to get that outcome, and have said as much in public.

IR@DeepKnowledgeInvesting.com if you have any questions.

DKI Intern, Josh Reaves, contributed to this report.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.