Overview:

Two months ago, we did a webinar with DKI Board Member, Howard Freedland, and his business partner, Sophie Schneeberger of Echo Fine Properties. We warned that higher interest rates would lead to higher mortgage rates, and that would lead to a softening of the real estate market. We suggested that people who were going to sell their home do so quickly before these changes took place. Reaction was mixed with some saying our analysis helped them understand the coming changes in the housing market and others accusing us of being scare-mongers with a political agenda. It’s not clear how mortgage payment math is either scary or political, but it was interesting to see the intensity of the reaction.

A few days later, we published an article explaining in writing what we had discussed on the webinar. We were confident in our conclusions and asked Howard to let us know when he saw the inflection point in the red-hot south Florida market. What we’ve found out in the past day both confirmed our concerns and also surprised us.

Here’s the Part We Got Right:

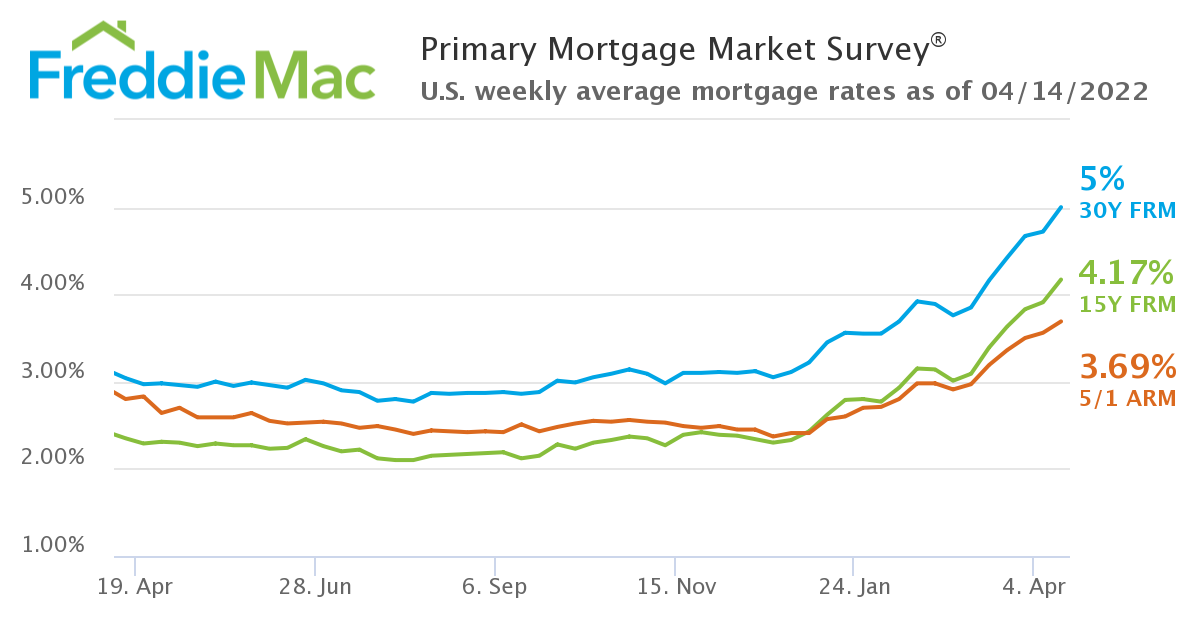

We predicted that rising mortgage rates would lead to a softening of the real estate market. Here’s what happened to rates:

We can see that in a matter of months, the 30-year mortgage rate went from 2.8% to over 5.0%. While 5% mortgage rates aren’t exceptionally high on a historical basis, we’ve seen an 80% increase in mortgage rates in a short amount of time. That’s going to impact the market.

Howard reports that while the south Florida real estate market is still strong, he’s seeing signs of an inflection point. Inventory in one desirable community has gone from 8 homes to 29 in a few weeks. Previously, homes that were receiving multiple all-cash offers above asking price in one day are now getting 60-70 showings in a month with no offers. While these are anecdotal reports, a quick web search will reveal increasing inventory and decreasing transaction activity in many markets.

Here’s the Part We Didn’t Predict:

This week we also spoke with a mortgage broker who explained to us how competing mortgage companies were qualifying clients for mortgages with higher payments. As mortgage rates rise (which increases monthly payments), home buyers either need to bid less for the home they want, or buy smaller less-desirable homes. Instead, they’re being encouraged to say they’re buying the house as an investment property and intend to rent it. Even though the prospective homeowner doesn’t have the income or credit score to support the new mortgage payment, the bank will ignore that and approve the mortgage based on projected rental rates. The problem is the buyer actually intends to live in the house despite an inability to make the higher mortgage payments that come with rising interest rates.

This is all very similar to the no-documentation “liar loans” done around 15 years ago when mortgages were offered to people who didn’t provide information on income or asset levels. In this case, buyers aren’t required to qualify based on income, asset, and credit score because they state a “false” intention to rent the property rather than occupy it.

It’s possible the people involved don’t remember as far back as 2008, but we see another possibility as more likely. When we asked who owned these future non-performing loans, our contact replied that they were primarily being sold to private equity and other private firms. So, the people making these bad loans are ensuring they won’t own them when they go bad. As of now, we don’t have a clean way to short this irresponsible activity, but we’ll be keeping an eye out for that. Anyone with a view on that topic is invited to contact us at IR@DeepKnowledgeInvesting.com.

Conclusion:

Increasing housing inventory combined with looser credit standards are signs that the real estate market is starting to see the signs of slowing we predicted two months ago. Astute readers may assert that lower prices for housing could reduce the level of inflation we’ve been concerned about for months. Our response to that hypothetical question is “maybe”. In general, that’s a correct assertion, but we note that recent housing inflation recorded in the CPI has been in the 4% – 6% range while actual housing price increases have been in the 18% – 20% range. There’s a lot of room for real inflation to fall before hitting the level indicated by the official numbers reported by the Bureau of Labor Statistics. When the discrepancy is this wide, it’s difficult for us to predict what kind of change in the real world will look like a month later in the misleading official statistics.

We’ll continue to monitor the situation and will report back periodically as we learn more.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI , affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.