There’s a weird conspiracy theory going around that the Trump Administration will re-value the gold in Fort Knox and restructure the dollar. DKI thinks this is unlikely, but we do see the value in going through the idea as a thought experiment. Dell nears a massive final contract with xAI giving us another data point that DeepSeek didn’t eliminate the need for AI-related hardware. Democrats in the press accuse Elon Musk of benefitting from his close relationship with President Trump…only to find out the proposed purchase came from the prior Administration and doesn’t mention Tesla by name. DKI reminds you that most of the “independent” press has been on the government payroll. DKI also emphasizes we have no problem with the prior White House wanting to buy armored EVs made by Tesla or another manufacturer. We’re criticizing a partisan press, not Democratic politicians who bear no responsibility for this “misunderstanding”. Last month, DKI suggested President Trump was threatening tariffs on EU exports as a way to pressure those countries to contribute more to their national defense and NATO capabilities. Europe got the message and stocks of their defense contractors rose. In our educational segment, we take on some of the misperceptions about stock buybacks and outline how we like to see management allocate capital.

This week, we’ll address the following topics:

- The Dollar Restructuring Conspiracy

- Dell Nears a Final Contract with xAI

- The Armored Tesla Controversy is Not Joe Biden’s Fault

- European Defense Stocks Up Big

- The Benefits and Misperceptions of Stock Buybacks:

While I was traveling from Da Nang, Vietnam to Seoul, Korea this week, DKI Intern, Josh Reaves, continued delivering the largest portion of the intellectual horsepower behind this week’s 5 Things. His work, thought process, and work ethic are exemplary. New DKI Intern, Finley Roland told me her dream was to start a podcast. Everyone here loved the idea so, in the next few weeks, we’ll be introducing you to DKI Foundations, a video and audio podcast where Finley and I explore basic finance, career advice on getting that first big job out of school, and the value of radical honesty. We will be tying much of this to real-world career and travel stories. The incredible team at Flying V is already working on branding and a logo. I think Finley is going to be an excellent Executive Producer and Host. Soon, you’ll have the opportunity to judge for yourself.

Ready for a week of military and armored vehicle news? Let’s dive in:

1. The U.S. Dollar Restructuring Conspiracy:

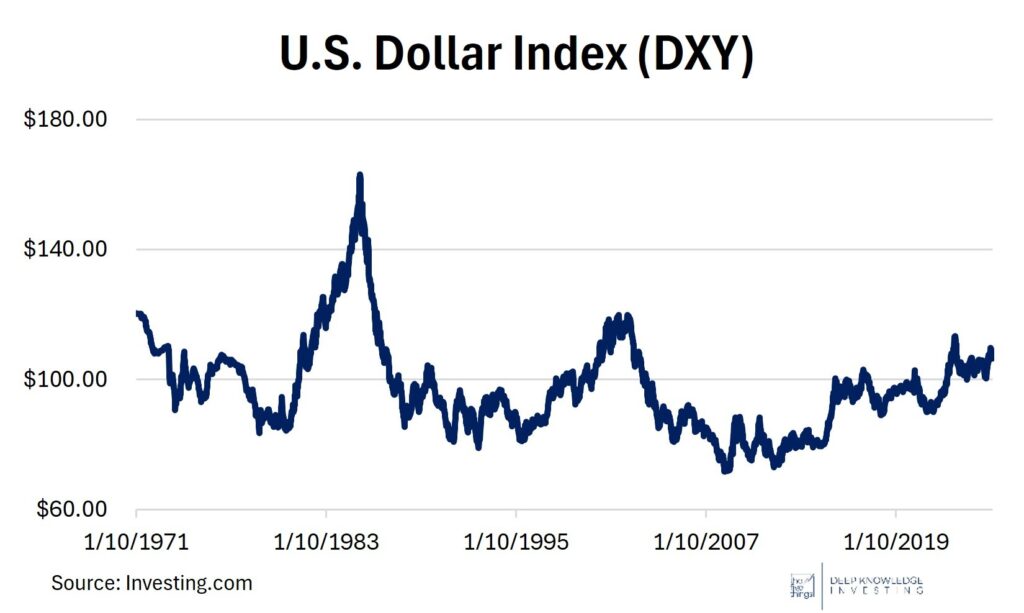

There has been a theory discussed in recent weeks about a potential restructuring of the U.S. dollar, sparked by a paper written by President Trump’s economic advisor, Stephen Miran. It outlines a plan to conduct a gold audit, revalue the gold to its current fair market value, and increasing the assets of the United States by approximately $800 billion. This action would likely come concurrent with an audit of the gold reserves in Fort Knox, something that hasn’t been done in half a century (for some reason).

If the Administration simply added another $800MM of currency to the economy, it would cause an increase in inflation, something that’s reviled by the population. There has also been talk that the incremental $800MM in assets could be used to reduce the national debt, something that would lower borrowing rates. That would be of great help to the new Treasury Secretary looking for a way to refinance Janet Yellen’s shortening of the duration of country’s bond liabilities.

Adding $800B of currency would weaken the dollar. Reducing $800B of debt would strengthen it.

DKI Takeaway: While this potential action might make the government’s borrowing spiral easier to manage, it is only a short-term solution to a long-term issue. The best way to handle this overreliance on borrowing is to address overspending—something the Trump Administration, Elon Musk, and DOGE are working on with great intensity. At this point, I think revaluing the gold reserves is unlikely to happen. However, should they proceed, one interesting potential move would be to use the additional $800MM to buy Bitcoin. This would leave total assets and liabilities unchanged, properly value the gold reserves, and diversify our national strategic financial assets.

2. Dell Contract With xAI Near Completion:

Dell Technologies ($DELL) is nearing completion of one of its largest contracts with Elon Musk’s xAI. The $5 billion deal will supply Dell’s advanced AI servers for xAI’s expanding programs, including Grok.

AI-specific server demand is at an all-time high, with 1.5 million shipments projected by 2026. At the forefront of this market, Dell will begin delivering servers equipped with Nvidia’s ($NVDA) powerful GB200 chips this year. The contract aims to enhance xAI’s Memphis-based Colossus supercomputer, which currently operates over 100,000 GPUs.

DeepSeek did not crash the model.

DKI Takeaway: This agreement underscores the skyrocketing demand for AI infrastructure and critical hardware like GPUs and servers. Dell has established itself as a top market player, well-positioned for substantial gains as tech companies scale their AI capabilities. The AI and infrastructure sectors of Dell’s business have seen massive growth, with over $10 billion in server shipments last year and projections exceeding $14 billion by 2026. Dell continues to strengthen its position as a leader in AI-specific servers, setting the stage for significant growth as demand for these servers accelerates.

3. The Armored Tesla Controversy:

Elon Musk has recently faced criticism regarding the potential procurement of armored Teslas by the U.S. Department of State. Rachel Maddow mocked the idea, suggesting it resulted from Musk’s support for President Trump’s campaign and calling it hypocritical given his leadership of the cost-cutting initiative known as DOGE (Department of Government Efficiency). If Madow had gotten the story right, we’d agree with her. She didn’t.

Many commentators failed to disclose that this proposed purchase actually originated under the Biden administration. In 2024, the Department of State was directed by the executive office to explore adding armored electric vehicles to its fleet. The department included a $400 million planned procurement of these armored EVs in its forecast, published in December 2024, a month before President Trump took office.

The order, from the prior Administration, had nothing to do with President Trump’s relationship with Musk. The AI image of the armored Cybertruck looks cool though.

DKI Takeaway: Not only was this procurement incorrectly attributed to President Trump, but the term “planned procurement” also indicates that no government contract has been awarded to any company. Elon Musk addressed the allegations, stating, “I’m pretty sure Tesla isn’t getting $400M. No one mentioned it to me, at least.” These accusations are transparently false. After all, why would a president who rolled back many pro-electric vehicle policies award nearly half a billion dollars to an electric vehicle manufacturer? Presidential advisors and donors should not receive preferential treatment for contracts. The media should do actual work before reporting. And people losing corrupt funding as a result of the efforts of DOGE should understand the American people want an end to wasteful spending. (In the interest of remaining non-partisan, DKI notes that none of this is the fault of the prior Administration.)

4. European Defense Stocks Up Big:

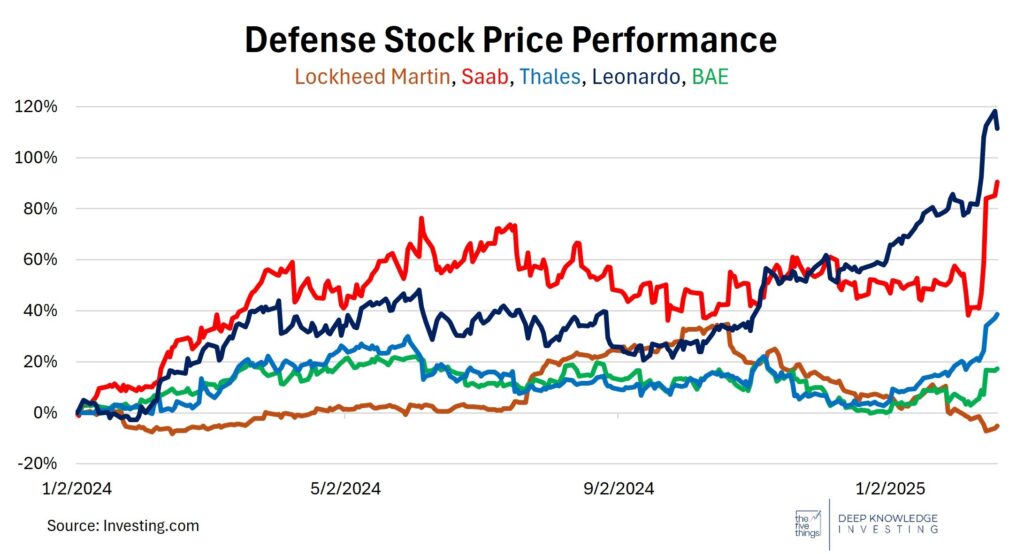

Following statements by Vice President Vance, Secretary Hegseth, and President Trump criticizing the defense spending of fellow North Atlantic Treaty Organization (NATO) members and the war in Ukraine, European governments are starting to take seriously the need to contribute more to their own defense. After committing less military spending than promised for years, European governments are ready to take on more responsibility, and defense stocks have seen significant growth.

The U.S. and Russia are currently engaged in peace negotiations in Saudi Arabia regarding the war in Ukraine. The United States’ role in NATO has come under scrutiny, with growing calls for an independent European army.

Amid potential increases in European defense spending, defense manufacturers have posted strong gains. Companies like BAE Systems ($BAE), Thales ($HO), Saab ($SAAB B), and Leonardo ($LDO) are up an average of 12% this week and 27% since the U.S. presidential election.

Europe is getting ready to take on a bigger role in its military defense preparation.

DKI Takeaway: Meanwhile, shares of American defense manufacturers like Lockheed Martin ($LMT) have dropped nearly 22% since the election, reflecting President Trump’s more isolationist stance. The new Administration is talking about making substantial cuts to military spending here in the US.

President Trump’s position on NATO and the war in Ukraine has been clear from day one: The U.S. believes it pays too much to protect European nations and wants them to foot more of their defense bill. DKI has said from the beginning that tariff threats on European goods were always a negotiating tool to increase the military funding of NATO partners.

5. The Benefits and Misperceptions of Stock Buybacks:

In recent years, it’s been popular for some financially illiterate politicians to claim that stock buybacks only enrich the company executives and for some people who work in finance to claim they provide only a one-time benefit to shareholders. Neither is true.

A stock buyback is when a company acquires its own shares (typically in the stock market) and retires them. They enrich all shareholders in proportion to the percentage of the shares outstanding they own. Because the shares are retired permanently, buybacks are not a one-time benefit; but rather, reduce the share count in perpetuity. They are also more tax efficient than dividends because they allow shareholders to determine the timing of recognizing gains allowing them to pair gains with offsetting potential losses.

Low interest rates have contributed to some of the increase.

Here’s what DKI prefers in order of best to worst:

- Management sees incredible growth opportunities and invests in growing company operations.

- Management thinks the stock is hugely undervalued relative to future growth and they use cash on hand to buy back stock.

- Management thinks the stock is hugely undervalued relative to future growth and they take on debt to buy back stock. (Note that under the right circumstances, this can provide incredible benefits, but comes with a lot more risk.)

- Management makes an error in judgment and buys back the stock ahead of declining or negative growth. This destroys value.

- Management makes an error in judgment and takes on debt to buy the stock ahead of negative growth. This can lead to bankruptcy.

Stock buybacks are typically a vote of confidence by management in the company. While much of the criticism of buybacks is inaccurate, DKI always recommends making a careful evaluation on a case-by-case basis. Above all else, if you bought and own the stock, then why would you object to management buying back the stock leaving you with a larger percentage ownership in an asset you already like?

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.