Nvidia $NVDA has a great quarter, but the stock was priced for perfection. Still, Jensen Huang had some interesting comments on DeepSeek. There are rumors that Microsoft $MSFT is cancelling data center leases…but the big tech firms all just confirmed higher AI spending for 2025. The January PCE falls, but it won’t be enough to move the Fed. GDP growth is present and fake. Finally, in our educational section, we help new investors understand the difference between ETFs, mutual funds, and equity indexes.

This week, we’ll address the following topics:

- Huge NVIDIA earnings don’t keep the stock safe. DeepSeek resource usage is above what many thought just weeks ago.

- Microsoft data center rumor. Are they cancelling leases and should others do the same?

- The January PCE is down, but don’t expect the Fed to cut rates yet.

- GDP growth due to government spending again. The private economy is in recession.

- ETF vs. mutual fund vs. equity index. We explain the difference for new investors.

Ready for a week of technology and macro news? Let’s dive in:

1) NVIDIA Q4 Earnings Report:

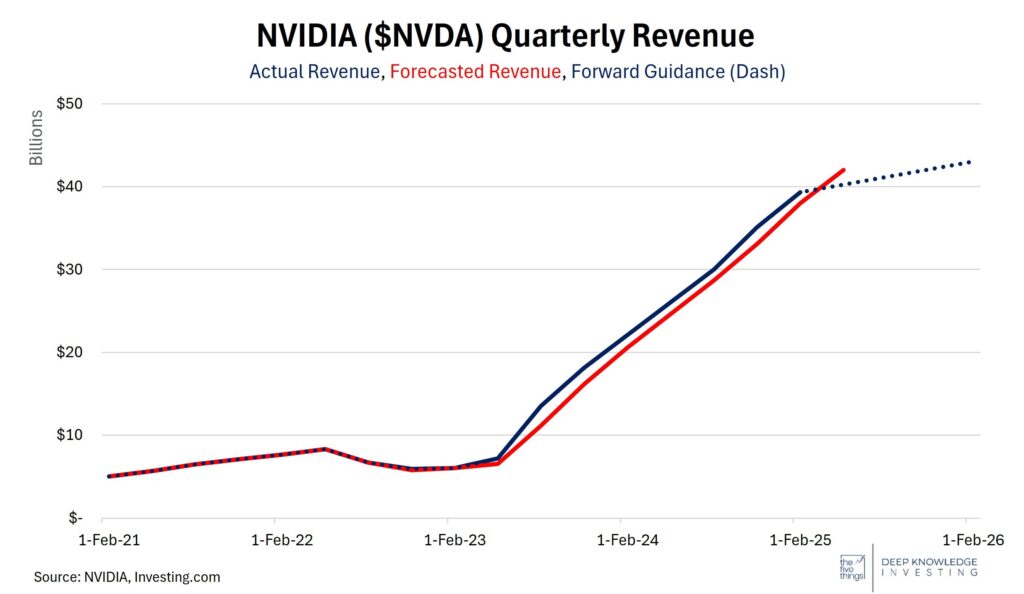

Nvidia ($NVDA) has been the largest contributor to the performance of the S&P 500 and NASDAQ 100 indexes for the past couple of years. Its earnings reports have become market-shaking events that even non-technology analysts follow. The company didn’t disappoint in the recently announced 4th quarter (sort of). The new Blackwell AI chips sold well and total sales were up 78% with net income up 80%, both beating expectations. Projections for 1Q sales of $43B was slightly above analyst estimates. The beat plus optimistic projections put on hold for now the speculation that DeepSeek would alleviate the need for AI datacenters powered by Nvidia’s best and most expensive GPUs.

Huge growth and still above expectations.

DKI Takeaway: Despite the excellent results, $NVDA stock fell from around $135 to $124 by the end of the week. The stock has been priced for perfection and with annual sales of over $200B expected this year, Nvidia’s growth rate has to slow. It’s “falling” from over 100% to the mid-50s this year. DKI has commented previously that there are no shortcuts in AI and that DeepSeek’s model requires less up-front resources and training at the expense of higher back-end computing and energy usage. $NVDA CEO, Jensen Huang, said that reasoning models like DeepSeek use 100x more computing resources. Future demand remains huge, but the stock is reacting to expectations that exceeded even these great results.

2) Microsoft Data Center Rumor:

There have been recent rumors indicating that Microsoft ($MSFT) has canceled multiple leases with data centers in the U.S. These leases have a combined 700 megawatts of center capacity. Many investors are taking this as a sign that the data center market is oversupplied as tech centers continue to sweep up data capacity to expand their AI programs. They are also calling into question how much data processing and storage is actually needed for AI and cloud services.

The company claims it’s not cancelling leases, and has planned over $80 billion in infrastructure investments.

Lease cancellation could mean a pivot toward building and owning more of its own data centers rather than leasing space or there has been a reassessment of their capacity needs. The company has already filed to build two new data centers in San Antonio, supporting the claim that the current level of data center capacity is needed, but Microsoft is being strategic with how they are obtaining this capacity.

Is Microsoft cancelling leases & reducing investment, or building their own capacity?

DKI Takeaway: While Microsoft has denied the rumor, some have speculated that the company is reducing exposure to expensive data center leases and are trying to exit before competitors do the same cutting the price. Microsoft’s own 4Q conference call discussed increasing investment in AI spending. While it’s possible the company has rethought its plans in just a couple of weeks, it’s not clear what the truth is yet. One thing DKI thinks is that many of the companies spending tens of billions of dollars on AI don’t yet have a business plan to earn a return on this investment. As of now, most people have decided that the premium version of Copilot isn’t worth the monthly charge. As more companies offer AI models, the pricing of whatever emerges is likely to fall as well.

3) Fresh PCE Numbers:

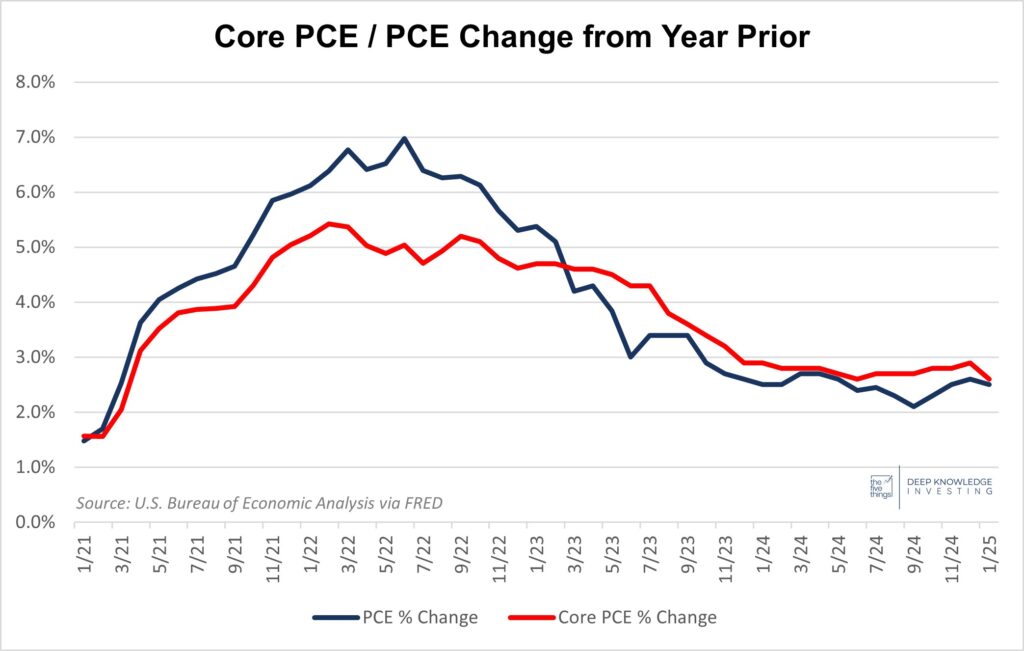

The Personal Consumption Expenditures (PCE) price index is an inflation gauge that tracks the prices of goods and services bought by a typical household. Because it reflects consumer experience, it is the preferred inflation metric of the Federal Reserve. The index showed a year-over-year increase of 2.5% in January, down slightly from 2.6% in December, aligning with expectations. The Core PCE which excludes food and energy eased to 2.6% year-over-year from December’s 2.9% also in line with expectations.

Not much progress in the past year.

DKI Takeaway: In January, consumers cut spending and increased savings. As usual, we saw decreases in spending on durable goods and increased spending on services including housing. While the January PCE was below the December reading, the chart above indicates there’s been no meaningful progress towards the 2% target in the past year. In addition, the monthly change was 0.3% which annualizes to 3.7%. With no new significant data to come in the next few weeks, we expect that the Federal Reserve will continue to “pause” and leave the fed funds rate unchanged at the March meeting. This is consistent with market expectations.

4) GDP Growth is Misleading:

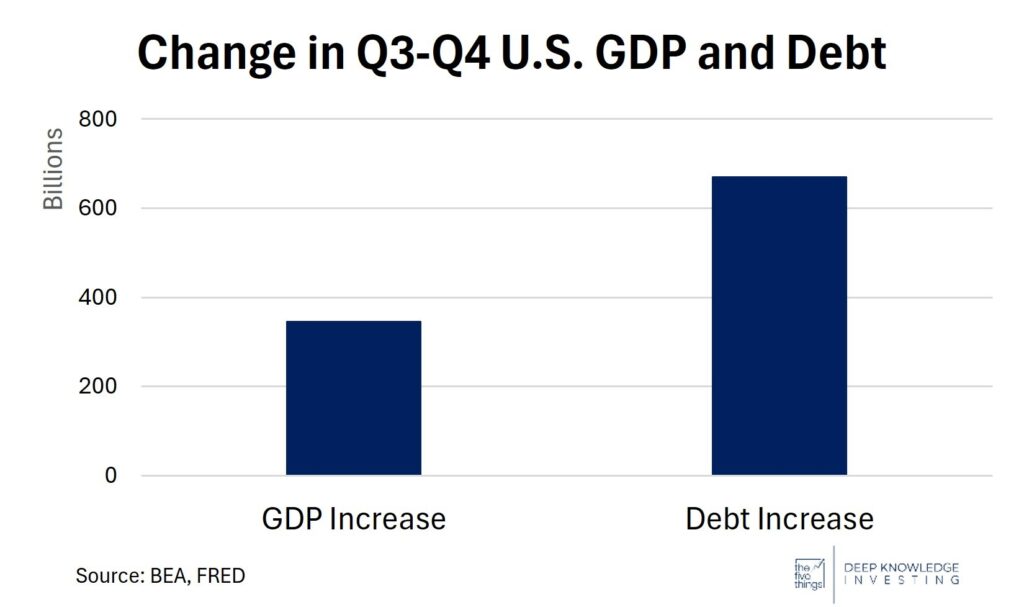

Last week, we got the 4Q GDP announcement showing growth of 2.3%. This was down from the prior quarter’s 3.1% and in line with expectations. The 2.3% isn’t a big enough change to cause the Fed to alter its current policy. Declines in consumer spending and investment were offset by higher government spending. That highlights a concern DKI has been discussing for two years.

All of the growth in the economy is just higher government spending.

DKI Takeaway: More than 100% of the increase in GDP came from debt-fueled government spending. There was also substantial growth in healthcare expenses which is largely funded by government. As the Department of Government Efficiency (DOGE) uncovers staggering levels of government fraud, economists are facing a crazy situation. Clearly, it’s in the best interests of the country to eliminate as much fraud, theft, waste, and money-laundering as possible in the US government. However, as we cut that spending and wasteful employment, the US is likely to enter a technical recession. More importantly, the productive private sector continues to shrink. President Trump is trying to increase US-based manufacturing through tariffs. Whether that will be effective or not is the biggest debate in finance right now.

5) Equity Indexes v. Mutual Funds v. ETFs:

We often hear the terms ETFs (Exchange-Traded Funds), mutual funds, and equity indexes in investing, but while their names sound similar, they serve distinct purposes.

Mutual Funds pool investors’ money to invest in everything from stocks and bonds to real estate and foreign assets. These funds are managed by professionals who have a mandate to invest in specific kinds of stocks or financial instruments. Mutual funds usually charge a management fee and can be actively or passively managed.

ETFs also offer the diversified exposure of mutual funds but trade like individual stocks on an exchange. Investors can buy and sell shares throughout the trading day, often with lower fees. These funds can focus on specific markets, such as commodities, bonds, or investment themes like lithium mining and batteries. This provides a more flexible investing option with broad market reach.

Equity indexes, like the Dow Jones Industrial Average or S&P 500, are not investment products. Instead, they act as benchmarks that track the performance of groups of companies. Indexes are often used to gauge how well the market is performing on a given day and to compare other funds against overall market performance.

Here’s the video version: https://www.youtube.com/watch?v=6UoOb4_iYsA

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.