Many Americans are horrified at how our government is spending money. Candidate Trump ran for President promising to go through the budget line by line. Most Americans expected to find waste, but the amount of theft and fraud is staggering. We also found out that the “independent” press is being funded by massive “foreign aid” budgets. When I said DOGE wouldn’t be able to make meaningful cuts to spending, I was underestimating the amount of bad behavior by our government. CMS and the IRS are next on the audit list. President Trump eliminates minting new pennies. Some claim this is a burden on the poor. DKI counters that it’s the intentional currency debasement leading to inflation that’s the real burden on the poor. The January CPI report is both higher than last month and above expectations. It’s risen consistently since the Fed cut rates (against DKI’s advice). Will we be mature enough to avoid saying “I told you so”? Probably not, but read on to find out. The Consumer Financial Protection Board (CFPB) is being gutted. Democrats claim this will harm the poor. Republicans claim the CFPB was a money-laundering and price-fixing operation. DKI claims the issue is much more complicated that the partisans talking points. We try to provide some sense and balance in explaining the situation. DKI is also putting in place plans to help more beginning investors start to understand finance and the stock market. In this week’s 5 Things, we offer a list of tips for beginners to consider as they start their journey to financial independence.

This week, we’ll address the following topics:

- DOGE proves skeptics wrong. Including me. I was one of the skeptics.

- No more new pennies. 99 Cent discounters wept.

- January CPI Report continues to rise. Will DKI be mature enough to avoid saying “I told you so?” Don’t bet on it.

- CFPB shakeup by Trump. This is more complicated than pundits pretend.

- Tips for beginning investors.

Intern, Josh Reaves, continues to do the heavy lifting for the 5 Things. He’s a star! New Intern, Finley Roland, is impressing the internal social media team with her research and ideas. Look for great things from her starting in a few weeks. Nazim (the dream) Abbas is re-making the video version of the 5 Things. And as always, Flying V CEO, Robb Fahrion, continues to host the 5 Things video with me even when I’m 15 time-zones away. Robb has been a friend and partner and continually devotes his personal time and resources to supporting DKI. If you’re looking for a marketing firm that cares about their clients in this way, let me know and I’ll put you in touch. I’m nearing the end of two months in Asia (currently in Da Nang, Vietnam) and the team has kept everything moving. Great job all and thank you very much!

Ready for a week of humility from me? Let’s dive in:

1. “I was Wrong”, DOGE lives up to promises:

I was skeptical about the Department of Government Efficiency (DOGE) when they first announced their plan to cut $2 trillion from government spending. Politicians of both parties have risen and fallen, promising to streamline processes, cut waste, and reduce corruption, and reinvent government—yet they rarely accomplish anything meaningful.

I believed DOGE was a great idea headed by exceptionally capable people. However, I thought the ability of an advisory agency to cut trillions of dollars of approved spending would be unlikely to succeed. Earlier this week, Peter Thiel said no one should underestimate Elon Musk. Thiel was right and I was wrong. Here’s a small list of cost-saving initiatives within the first weeks of President Trump’s term:

- DOGE terminated 104 government DEI contracts across 30 federal agencies, saving over $1 billion and reinforcing Martin Luther King’s message that we should judge each other by our character and capabilities.

- DOGE shut down the U.S. Agency for International Development (USAID), which funneled over $32.5 billion to foreign nations in 2024 alone—some of it for outrageous programs like DEI musicals in countries that didn’t want them. It also funded “independent media” all over the world with written instructions for “large scale social deception”. There is also evidence that USAID funds were likely used to try to overthrow democratically elected government in other countries.

- DOGE advised President Trump to offer buyouts to 2 million federal employees to reduce government bloat.

- DOGE is playing a key role in modernizing the FAA’s aircraft safety notification system, which has failed multiple times in recent years.

- While no action has been taken yet, DOGE now has access to Treasury digital payments, overseeing everything from Social Security to tax refunds. In doing so, they have discovered people getting paid who have no Social Security number and people getting paid multiple times on duplicate SS numbers. DKI recommends DOGE call authID $AUID as they have a biometric security system that can eliminate this kind of fraud.

Can we at least agree on cutting duplicate SS payments thus depleting funds for seniors?

DKI Takeaway: Everyone knew there would be fraud and waste at an organization as large as the US government. However, the scale of the fraud and societal gaslighting from funding thousands of bought news media masquerading as “independent” was beyond the wildest fears of the most ardent Libertarians. DOGE has proven itself to be a swift and effective agency, reportedly generating over $1 billion in savings per day in just three weeks so far. This represents a major step toward more responsible taxpayer spending. Next targets may include CMS (the agency that disburses Medicare and Medicaid funding) and the IRS.

2. Trump orders minting of new pennies halted:

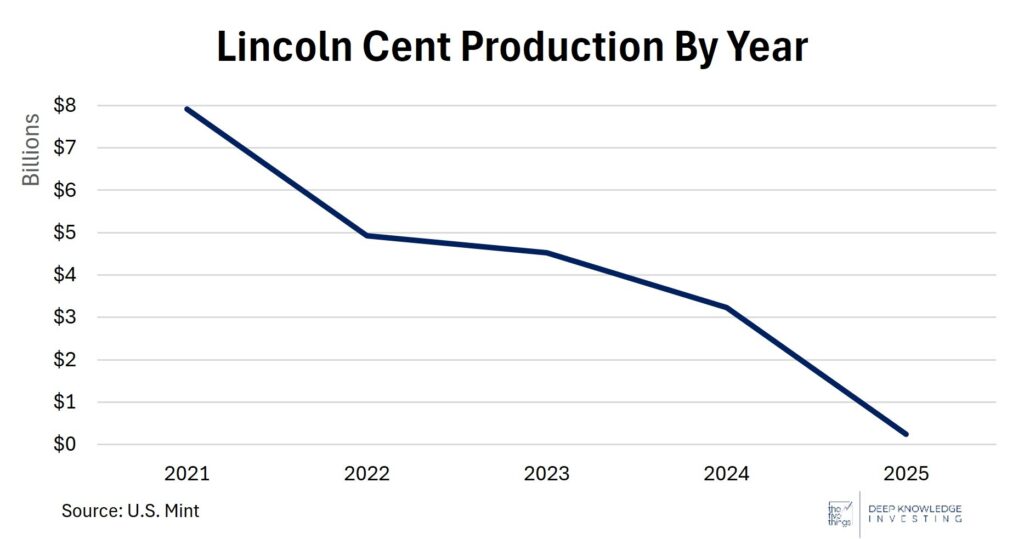

On February 9th, President Trump ordered the U.S. Treasury to halt the minting of pennies. He cited the rising cost of production, with each penny costing approximately 3.7 cents to produce.

In 2024, the U.S. Mint produced 3.2 billion pennies, reporting an $85.3 million loss on this production. While this is a common-sense move to cut wasteful spending of taxpayer dollars, it creates a minor issue for consumers. A 1989 bill mandates rounding transaction amounts to the nearest five cents if the penny is removed. While this change is unlikely to affect credit and debit card users, it could slightly disadvantage low-income consumers who rely more on cash transactions.

Low-denomination coins have been successfully phased out in other countries, such as Canada in 2012. Canada reported cost savings and smoother transactions due to rounding. Many economists believe the impact on U.S. consumers would be minimal, similar to Canada’s experience. Diminished purchasing power and a reduced reliance on cash transactions have made coins nearly obsolete.

It might be time to let go.

DKI Takeaway: Even if eliminating the penny slightly disadvantages low-income consumers in cash transactions, the decision is justified. Reducing costs while simplifying transactions, especially as cash usage declines, is a clear and practical choice. DKI emphasizes that removing the penny from circulation is merely the symptom. The cause is constant debt-fueled overspending leading to growth in the money supply resulting in inflation. Inflation can be a benefit for wealthy people who can afford to use constantly debased debt to buy hard assets. It destroys the financial security of the less affluent. This is why we are cheering for DOGE to slash government spending. More than any government benefit program, stabilizing the currency will be the thing that makes life easier for low-income and fixed-income Americans.

3. January 2025 CPI report comes in hot!:

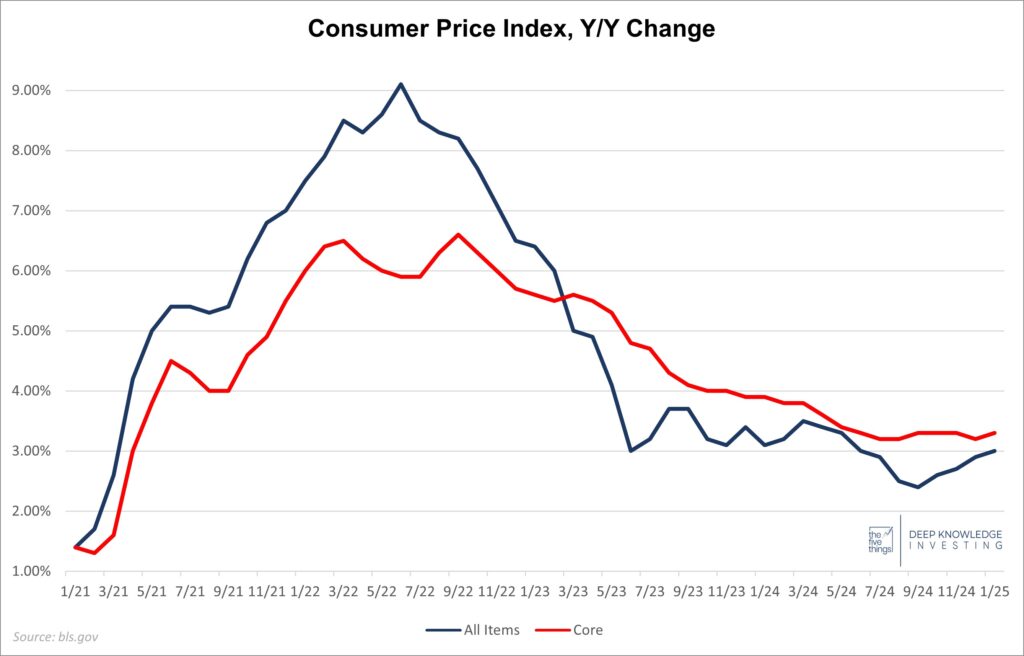

The January Consumer Price Index (CPI) rose again last month to 3.0%. This was above last month’s 2.9% and also above expectations. More alarming, the monthly increase was 0.5% which annualizes to 6.2%. The Core CPI which excludes food and energy was up 3.3% vs last year and 0.4% for the month. Both of these were above expectations. Food inflation was up with eggs gaining constant media attention. Energy and vehicle prices had been tailwinds for the CPI, but have reversed course in recent months. Services pricing remains sticky and has been a constant problem for the Fed. Finally, shelter (a fancy word for housing) was up 4.4% with recent Fed rate cuts not reducing the cost of home ownership or increasing the supply of homes on the market.

The blue line started climbing immediately after the Fed rate cuts started.

DKI Takeaway: DOGE is working hard at cutting wasteful government spending and is doing so at a rate even beyond what I hoped. The thing to be potentially concerned about right now is cuts to government spending could throw the country into a temporary recession. Washington has been creating the GDP numbers out of thin air with wasteful spending that adds no economic value, but does add to GDP. This is what DKI has referred to as a Potemkin economy. It looks good, but isn’t real. With the CPI continuing to rise, stagflation for a couple of quarters is a possibility. DKI warned that the Fed cutting rates starting last September was an error. Since then, inflation has done nothing but rise, long-term rates are HIGHER, and market strategists are reducing expectations for future rate cuts. Is your portfolio prepared for higher inflation? Reach out if you want help with that.

4. Big Changes coming for the CFPB:

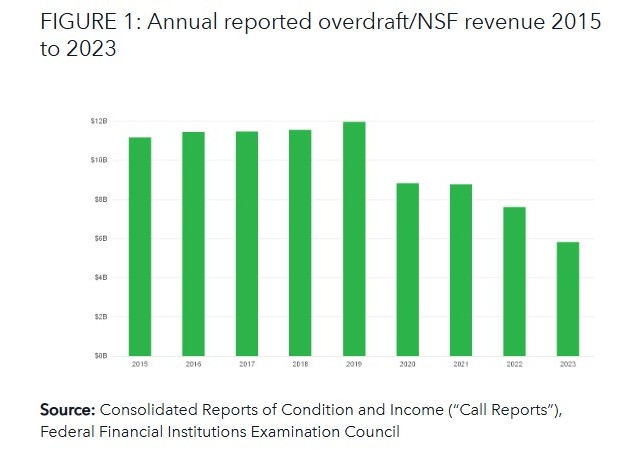

Recently, President Trump has taken significant steps to reduce the influence of the Consumer Financial Protection Bureau (CFPB). On February 1st, he dismissed CFPB Director Rohit Chopra and placed the agency under Treasury Secretary Scott Bessent. After taking command, Bessent immediately halted all CFPB activities while Russell Vought assumed the role of acting director.

These actions have paused all CFPB oversight of financial institutions, including investigations and enforcement actions, effectively eliminating an entire category of government intervention in private financial transactions.

While the CFPB had good stated intentions, many of its regulations increase costs for banks, which are ultimately passed on to consumers. For example, Rohit Chopra aimed to reduce credit card late fees and limit overdraft fees. While these policies seem consumer-friendly, they also harm responsible borrowers by raising interest rates, encouraging late payments, and reducing credit access for low-income individuals. Even worse, by engaging in a form of price fixing, these regulations reduce the incentives for banks to provide these services to low-income or high-risk households.

However, some of Chopra’s initiatives had potential benefits, such as bolstering data privacy, eliminating junk fees, regulating buy-now-pay-later services, and improving credit reporting accuracy. When Democrats point to these examples, they are standing on solid ground.

Lower overdraft fees are a positive – as long as you still have access to credit.

DKI Takeaway: The CFPB occasionally creates meaningful financial regulations, but it needs an overhaul to ensure its policies don’t hinder economic growth or impose unnecessary burdens on financial institutions and consumers. DKI acknowledges the complexity in the issue. We discourage price fixing or limiting fees because they result in removing financial service options for low-income people. We also acknowledge that there are some valuable protections pursued by the agency. Some Republicans have alleged that CFPB funding was used to pursue questionable partisan goals. While DKI is not prepared to comment on that at this time because don’t know the truth yet, given all the financial abuse DOGE has found in just three weeks, we think these allegations deserve investigation. We also remind readers that more than one thing can be true. The agency could both pursue good policy goals and also divert funds for partisan goals.

5. Tips for Beginning Investors:

Learning to invest can be intimidating for a newcomer. Other disciplines allow you to start as a beginner. Little leaguers start by hitting the pitches of 10-year-olds. As they advance, they face high-schoolers, college pitchers, minor leaguers, and then when ready, a few get to face the very best. It’s not like that in the stock market. Our schools don’t teach basic finance, and in the stock market, you’re facing off against Citadel, Millenium, Blackrock, Fidelity, and DKI (of course) on day 1. Here are a few key points to help newcomers get started:

It can feel like a lot at the beginning, but there are resources to help you.

- Meme stocks, non-Bitcoin crypto, and zero-day-to-expiration options are all fun, exciting, and offer the chance to make a lot of money quickly. They are also likely to result in massive losses over time if you’re not an experienced and nimble trader. Going to a casino may be better than these options for beginners.

- The press is not your friend. By the time it’s being discussed in the Wall Street Journal or on CNBC, professional investors have already responded to the information.

- Look for businesses you understand, or read about them until you do understand them. Don’t just look at the company itself. Look at their end markets. You probably know what Nvidia $NVDA does, but then look at the spending plans of their customers like Meta $META, Alphabet $GOOG, and Microsoft $MSFT.

- Understand the basic financials and look for high growth in revenue, improving operating margins, and rising earnings. Know if the cash flow is positive and growing, or negative. You can find this information in the quarterly 10-Q reports and annual 10-K reports filed at SEC.gov. This information is free and publicly available.

- Find useful sources to read that speak to you at YOUR level. Peter Lynch’s book “One Up on Wall Street” is still relevant and can be understood by new investors. Lyn Alden @LynAldenContact is great on macro, Unicus @UnicusResearch does excellent research on short selling which can teach you what NOT to do. If you’re interested in energy, check out Mark Rossano @markfny, Big Orrin @Big_Orrin, and Tracy Shuchart @chigrl. And of course, I recommend Deep Knowledge Investing. Many of these services offers a free and a paid option and following them on X is both free and a good way to learn.

- Finally, take your time. It’s ok to start with index funds and to invest a little at a time. There’s no need to figure it all out immediately or to commit capital before you’re ready.

- Not all financial advisors are great, but DKI works with some of the best. Reach out if you want professional help from someone registered to do that. I’ll connect you with someone I respect.

The video version is here: https://www.youtube.com/watch?v=BisVuqTxLYo

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.