This post originally appeared on April 24, 2023.

Introduction:

DKI has been writing about the danger to the dollar as the world’s reserve currency for over a year and on more than a dozen occasions. From a piece we published earlier this month:

Most notably, I gave an hour-long lecture at the Institute for World Politics explaining how the anti-Russian sanctions were not hurting the Russians; but rather, destroying the value of the dollar as the world’s reserve currency.

We’ve commented on the growing relationship between Saudi Arabia and China.

We’ve expressed concern about the inconsistent and counterproductive US energy policy.

Of greatest importance, DKI has partnered with Alex Macris to cover the topic in detail. Alex wrote Running on Empty which is the best work I’ve ever seen explaining the creation and inevitable decline of the petrodollar. DKI hosted Part I of Running on Empty and Alex was kind enough to invite me to write a final chapter explaining how to protect your portfolio from the coming carnage.

If you’re a DKI subscriber, and want a free copy of Running on Empty, just email me at IR@DeepKnowledgeInvesting.com and we’ll send you a link for a complimentary download.

The offer of a free copy of Running on Empty for DKI subscribers is still good.

The Anti-Russian Sanctions:

A key point in the intensifying public debate has become the unreliability of the US as a partner. It was a mistake to impound the dollar reserves held by Russia in 2022. From a piece written just over a year ago:

In February, the United States froze the dollar reserves of the Russian Central Bank. At first glance, this action seems to make sense. If the Russians are going to invade another country, reducing their capacity to pay for expensive military actions would be an effective way to discourage that behavior. The problem isn’t so much that the United States impounded Russian money. The real issue is that the United States sent a message to the rest of the world that the dollar doesn’t represent “hard” (reliable) currency; but rather, is only available for use as long as a country is on friendly terms with the United States and acts in accordance with U.S. policy.

Again, we’re not pro-Russia. However, there is a mistaken idea in Western mass media that the world is against Russia and its war against Ukraine. There are approximately 150 countries representing most of the world’s population that don’t care about this issue and are still doing business with Russia. The US changes leadership every 2-6 years and some of those 150 countries just noticed that their dollars can be impounded if new US leadership is unfriendly to their country, or if changes in US policies aren’t a priority for them. If the US wants people to hold dollars, those people need to perceive the dollar as reliable. This point is about practicality, not politics.

The Long-Term Decline of the Dollar and Potential Competitors:

Many people are writing about how the dollar won’t lose its reserve currency status. Excellent reasons given tend to be the size and liquidity of US markets, historical momentum, and the unreliability of potential competitors China and Russia. Others note that the dollar is backed by the US military. Furthermore, much of the globe is not thrilled with our willingness to use that same military in various regime changes and other missions around the world. The US military is effective, but some countries don’t view it as protecting THEM.

I’ve also written many times that I see a potential BRICS (Brazil, Russia, India, China, Saudi Arabia) competitor to the dollar as something to watch and an idea that could work. Smart people have pushed back on the idea, but usually without detail. They tend to say it won’t happen. The best argument I’ve seen is that this currency doesn’t exist as of now. That’s true, but if it’s created and backed by commodities, it could take share from the dollar.

China has succeeded in getting Saudi Arabia to price oil in yuan (the petroyuan) and are backing those payments with gold. If you do a web search, you’ll see a re-making of trade arrangements all over the globe as countries de-dollarize their economies. This has led to an avalanche of doomsayers claiming that it’s all over for the dollar followed by a counter-avalanche of analysts saying the dollar isn’t even close to over.

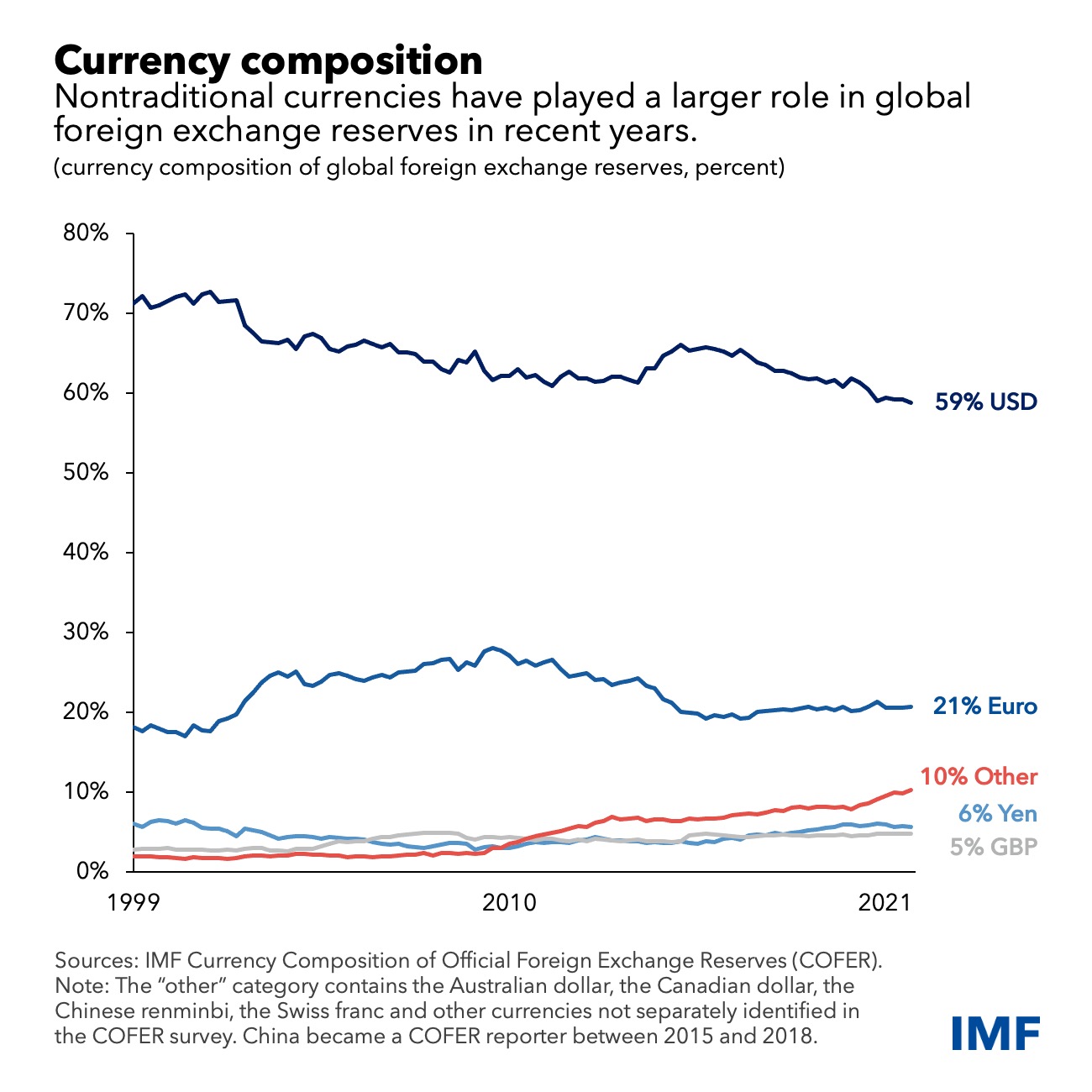

The issue we have with this lens is it tends to treat reserve currency status as binary. It’s like being behind on the mortgage and one day the bank successfully forecloses. You go from living in your house to out on the street. That’s NOT what will happen here. In fact, the dollar has been losing share for a long time. This chart is from the IMF:

That’s a loss of about 12% share in the last two plus decades. But look at the slope of the line and notice it’s getting a bit steeper in recent years.

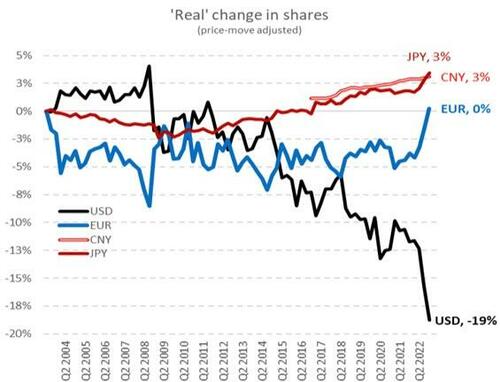

However, the situation is actually worse than the chart above indicates. Over the weekend, ZeroHedge published a graph by Stephen Jen showing that adjusting for the strong dollar vs other currencies over the past year, the dollar actually lost considerable share.

Our conclusion is that losing reserve currency status doesn’t happen like flipping a light switch where the US goes dark while some other competitor turns on instantly. These things take years (or decades) to play out. However, we’re seeing a long-term trend towards de-dollarization that’s increasing in speed.

There Are Actions You Can Take:

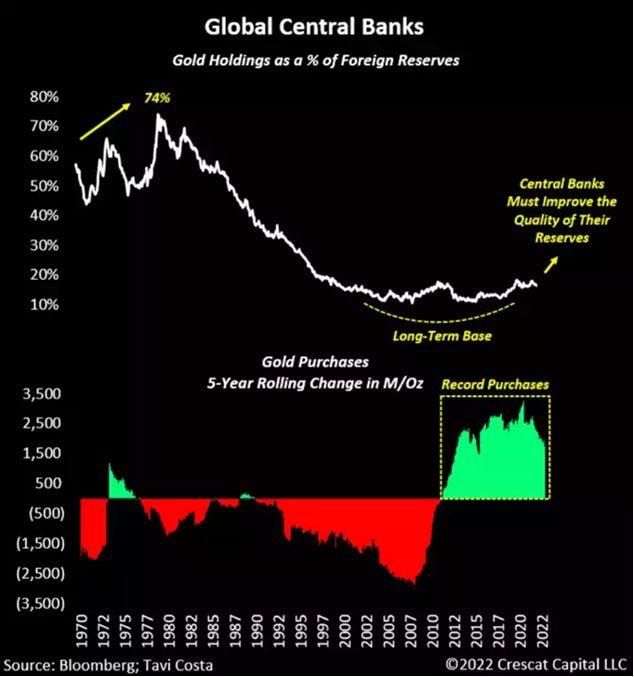

Enough political and economic theory. Let’s look at what’s going to happen and what to do about it. As for where the money fleeing dollars is going, central banks have been making record purchases of gold:

Graph from Hellas Posts

As of today, the dollar is still the best house on a bad block. As someone who travels frequently, I can tell you that the desire of people in South/Central America and Asia to hold dollars is still strong. That won’t last forever, and there are things you can do to protect yourself. We own large positions in uncorrelated assets like gold and Bitcoin and positions in energy companies that would benefit from a declining dollar.

As an American, I’m concerned about this change. As the Founder of Deep Knowledge Investing, I’ll continue to find ways to ensure our subscribers can benefit from these (unfortunate) changes. The Current Recommendations page with specific tickers and analysis is available to subscribers here.

This is a complicated topic and if you have questions, I promise that others have the same question. I’m reachable at IR@DeepKnowledgeInvesting.com.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.