Overview:

We’ve had some fun lately at the expense of Federal Reserve Chairman, Jerome Powell, who kept interest rates at zero for far too long and insisted that inflation would be “transitory” well past the point when Deep Knowledge Investing was warning it represented a real and persistent problem. Then, we took note of “Hurricane” Jamie Dimon who recently determined that the United States might be in for an economic downturn at some future point and of some indeterminate intensity.

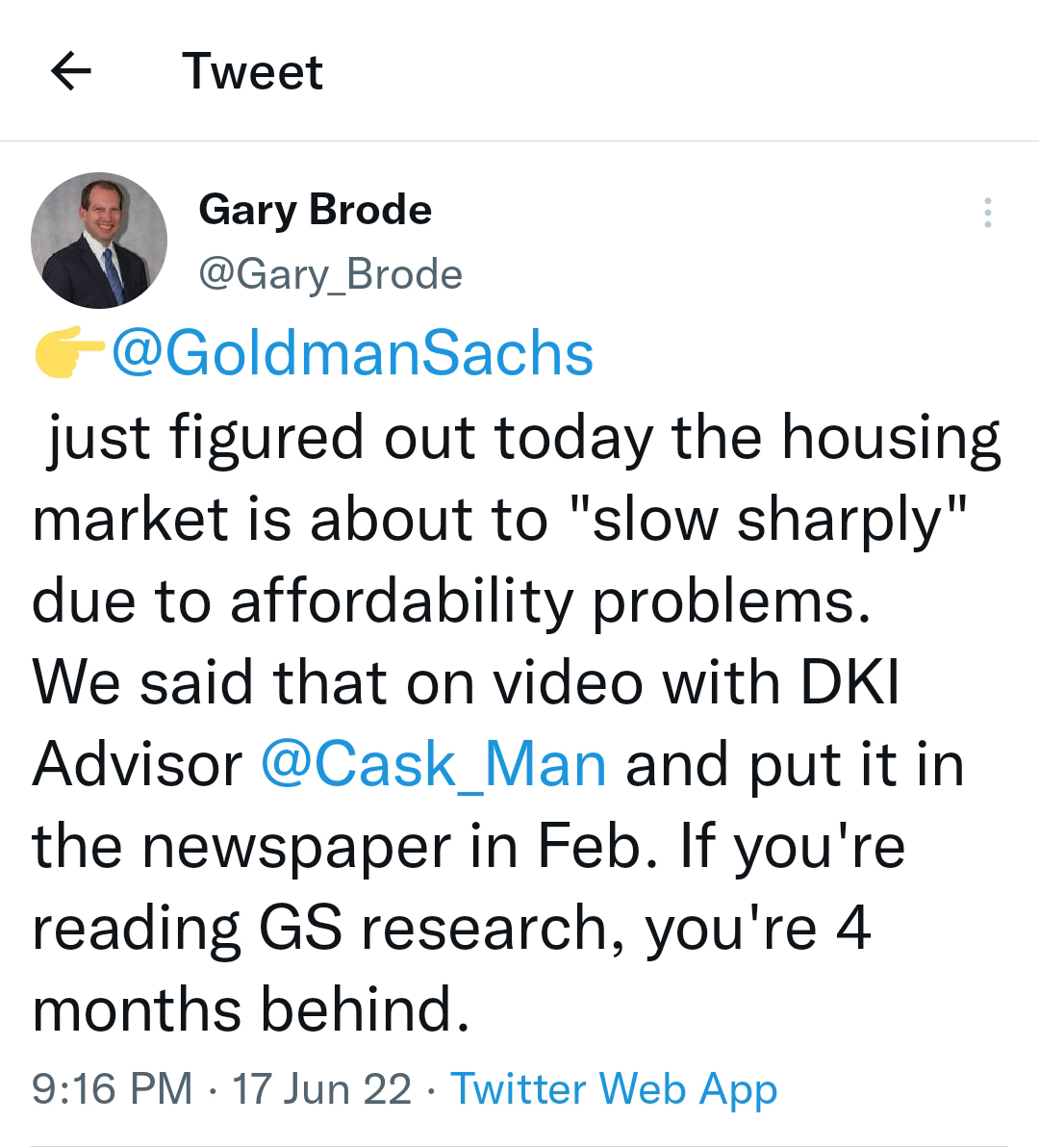

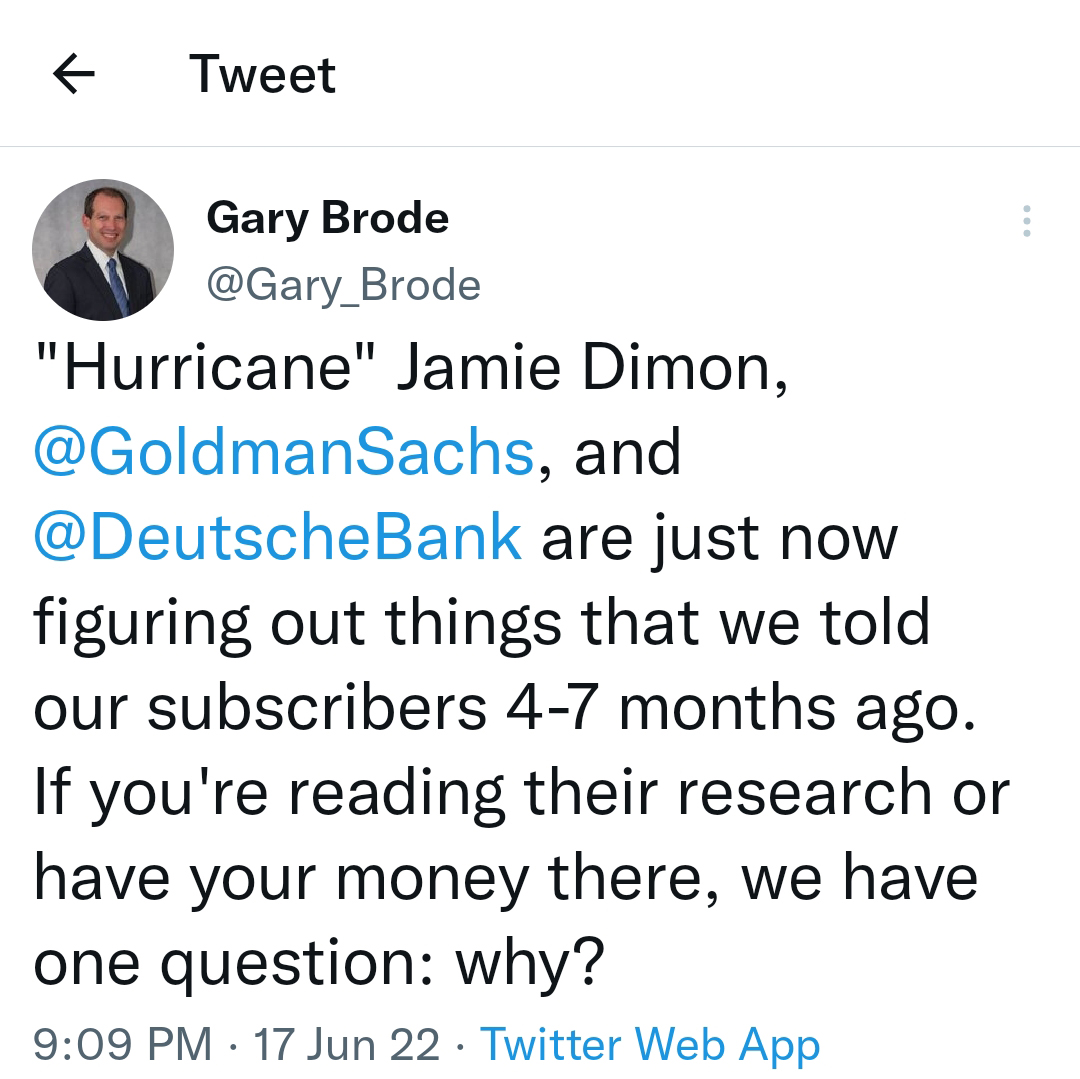

Last week, the floodgates for unhelpful and very late predictions opened wide as Goldman Sachs apparently just figured out the housing market is about to “slow sharply” due to affordability problems, an issue Deep Knowledge Investing highlighted back in February here and here. Then, Deutsche Bank chimed in by moving their expectations for a recession from 2023 to “earlier”. We told you four months ago (here and here) that GDP had turned negative and that, combined with high inflation, meant we had already entered stagflation.

Because it’s 2022, it’s all captured 240 characters at a time:

So, what’s going on here? This might sound like a rant, but there are a lot of people who have significant capital being invested based on nonsense. These firms have an unlimited research budget and access to all possible data sources. It wouldn’t surprise us if their annual research budget totaled tens of millions of dollars (probably way too low) to hundreds of millions of dollars (more likely). Why are these three big firms with hundreds of economists, analysts, and market strategists half a year behind actual events?

Three Reasons the Sell-Side is Hopelessly Behind:

-

They Don’t Want to Tell Clients the Truth

Earlier this year, we spoke to a wealth management firm interested in Deep Knowledge Investing research. We pointed out similar examples to the above ones where our work had been both predictive and months ahead of the work done at the big establishment firms. We got an interesting reaction. This firm didn’t want us to tell their clients that there were problems in the market, the money supply, with inflation, and coming interest rate hikes. They didn’t want their clients to know that we had large (and profitable) short positions. Their concern was that nervous clients would pull money out of the market impairing firm profitability.

The truth is those clients would have likely been grateful for the helpful guidance and appreciated the opportunity to reduce exposure into a rapidly declining market. The first half of 2022 has been one of the worst starts to a year in market history. This firm wasn’t thinking about how to protect their clients’ portfolios by profitably reducing exposure; but rather, was thinking about gathering more assets to collect more fees even if it meant poor or negative returns for their clients.

We can assure you this kind of thinking is common and is the reason the conflict-free research that DKI provides is so important. We’re not afraid to tell you that we see troubling signs and that we have large short positions. Our subscribers benefit financially from our willingness to tell them the truth even and especially when the truth is unpleasant.

-

Groupthink:

There are two kinds of groupthink that infect the research process at the big firms; internal and external. The internal version is one anyone who’s ever worked at a large firm will find familiar. One person with a non-consensus view can’t just put that view out in public. There are committee meetings, reviews, and concerns about how it will all look. The gravity in the room is towards conventional thinking that keeps everyone comfortable. Most insidiously, with so many people all agreeing on the consensus view, they tend to take comfort in knowing that so many other smart people agree with them. That could simply mean they’ve all made the decision to be comfortably wrong together.

The external kind of groupthink involves triangulating where your position is relative to your peer group and competitors. In this situation, a non-consensus view is expressed by being just a little bit off of the group consensus, but not so much that you’d look like a maverick. We see this a lot with equity analysts who know a company they follow is going to miss earnings estimates by a lot. If the consensus estimate is $1.00, the “brave” analyst will lower their rating from “strong buy” down to “buy” or “neutral” and show an estimate of $.98 or $.99. When the company then reports a quarter with $.75 of earnings, the analyst with the low estimate on the Street will claim victory. If the company beats the quarter and announced a positive surprise, our negative analyst will only be off the consensus by a penny or two and won’t be too embarrassed.

The point of all of this is rather than figure out what they think is going to happen, groupthink takes over and estimates and expectations become based on what everyone else thinks is going to happen. The most accurate and funny description of this phenomenon is contained in an article titled “The Rules to Being a Sellside Economist” by Dario Perkins which we recommend highly.

-

Government Contacts:

Senior executives at these establishment firms have close contacts at the highest levels of government including with the President. These firms are huge political donors and lobby government agencies constantly. There’s also a revolving door between regulatory agencies and these big firms, and Goldman Sachs has had a constant direct line to the position of Secretary of the Treasury. These relationships are symbiotic and banking executives are understandably cautious about upsetting the politicians in power.

We’ve written in the past about how government statistics like the Consumer Price Index (CPI) don’t represent objective reality; but rather, are numbers made up by the government and adjusted to reflect a politically expedient point of view. These sell-side analysts, economists, and executives have an interest in not contradicting the preferred narrative of the politicians in power. So, they wait until a problem like inflation or recession is undeniably present to “predict” the negative event.

Conclusion:

We want to conclude with two points. First, these firms do not have client interests anywhere on their list of priorities. DKI and other independent research firms provide conflict-free guidance. We tell you what we really think and how we’re investing OUR OWN capital regardless of whether it’s positive, negative, or upsetting to a third party. Our only obligation is to our clients. So, we’re left with the question we asked in the above tweet: If you’re using the research of these establishment sell-side firms or have your money there we’d like to know why.

Our second point relates to what we see as the real value of the sell-side research we’ve been writing about today. It provides us a regular source of investment opportunities. These firms are consistently wrong in predictable ways which we’ve outlined above. When markets move due to a false impression of reality, it gives us an opportunity to take a position and wait for reality to impose itself. One reason DKI subscribers made as much money as they have by being short the markets this year is because when the establishment called inflation transitory and refused to see a recession that’s currently being experienced by millions of Americans, it gave us the chance to take short positions at higher prices and make greater profits. If you know they’ll be wrong and how they’ll be wrong there are profits to be made.

If you’d like to be 4-7 months ahead of JP Morgan, Goldman Sachs, and Deutsche Bank, just click here.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI , affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.