Overview:

We’ve been getting a lot of important questions recently from amateur investors regarding some of the more advanced topics we discuss at Deep Knowledge Investing. Many people have been taught about things like diversification and dollar cost averaging, but don’t really understand things like hedging, offsetting different kinds of risk, or shorting stocks. That’s not a problem because no one is born knowing these things, and these topics are rarely discussed in detail on popular finance shows. Let’s go over some of the basics for how we think about hedging, and along the way, we’re going to show you some of the specific ways we address risk in our portfolio.

Again, this can be a complicated topic, so if you want more detail or have follow-up questions, just reach out to us at IR@DeepKnowledgeInvesting.com. We’ve found that if one reader has a question, others will as well, and reader questions lead to some of our best blog posts. It’s ok to not know the answer, and admirable to want to know more. There’s also a lot of information on the DKI blog here.

What is Hedging:

Hedging is taking a position to reduce a specific risk in your portfolio, or buying insurance against risk. For example, homeowners carry insurance in case of fire, or some other disaster that destroys their home, or causes substantial damage. In flood zones, homeowners buy separate flood insurance to protect against that particular loss.

Professional investors do the same thing. We look at our portfolio, the stock market, the economy, and other related factors, and try to figure out what issues can come up that would cause us losses. Then, we design “hedges” (or insurance) to protect us from those potential problems. Let’s go over some examples.

Market Hedges:

Deep Knowledge Investing has been clear since early January that we expected inflation to lead to higher interest rates and in turn, to lower stock prices. There are multiple ways we could have managed this risk:

- We could have sold our existing stock positions. Exiting the market can be a fine solution when you expect negative returns.

- We could short market indexes like the S&P 500 (ticker: SPY) or the NASDAQ 100 (ticker: QQQ). We did this and it’s been our largest profit producer all year. (More on shorting stocks below).

- We could buy puts on market indexes like the S&P 500. We did this and it’s provided a huge return on capital. (More on buying puts below).

Is Shorting Stocks Risky/Dangerous/Hard/Wrong:

Many market participants act like shorting stocks is some sort of forbidden, ultra-risky, arcane activity that’s not appropriate for regular investors (and sometimes, for anyone). Shorting stocks is simply buying a stock in reverse. Everyone is used to the idea of buying a stock, hoping it will go up, and selling it for a profit. When you short a stock, you borrow it and sell it, hope it goes down, and then buy it back at a profit (and return the borrowed shares). Same steps – just in a different order.

Some have argued that this is wrong or un-American. We’d like to know why? When you sell a stock, it’s not because you think it will keep going up. Why is buying then selling ok, but selling followed by buying isn’t?

Others argue that this is risky because losses on a short position can be unlimited. This is technically true, but perhaps misleading. For example, if we own a basket of stocks that we like as long-term investments, and think that the market will decline (as it has since January), we can continue to own those long-term investments, and short market indexes that will go down as the Federal Reserve raises interest rates. (That’s example #2 above). The bet we’re taking is that our individual stock picks will outperform the market which is EXACTLY why we bought them in the first place.

Some people will tell you that we’re taking on unlimited risk and we could lose everything by being short the market. Again, technically true but misleading. By only owning long stock positions, we are risking everything we own in the portfolio. Shorting market indexes against our long positions will reduce our risk (under most circumstances). The most likely scenario is that both our long positions and the market short will rise and fall together (one producing profits and the other losses) reducing the amount of risk we have at a given time.

This is not a hypothetical academic exercise. In recent days, while the market has gone down sharply due to a rising Consumer Price Index (CPI), our short positions and put options (#2 and #3 above) have produced huge profits offsetting losses from other long positions. When done right, the short positions reduce risk instead of increase it. Deep Knowledge Investing exists to help you understand and make these decisions that protect your portfolio.

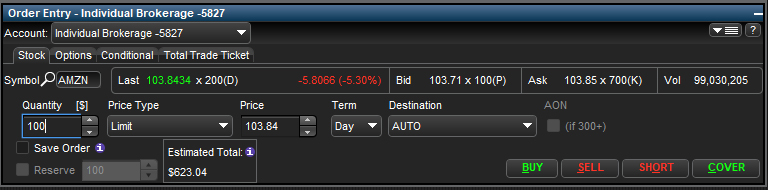

For those of you who haven’t done this before, and find it confusing; no problem – we can explain. Please take a look at the order entry box pictured below. You can see that it’s set up to execute an order for 100 shares of Amazon (ticker: AMZN) at $103.84. The “normal” process would involve clicking the “buy” button in the bottom right, and when you want to exit the position, using the “sell” button.

Remember above when we said that shorting is simply buying in reverse? So, if you wanted to short 100 shares of AMZN, you’d use the “short” button, and when you were ready to exit the position, you’d click the “cover” button. It really is that simple.[1]

Let’s go through an example. Say you buy the 100 shares of AMZN at $103.84. You’d have 10,384 invested. As a tech stock, AMZN will be most correlated with the NASDAQ. With the QQQ trading at $366.55, you could short 28 shares of that, and bring your equity exposure back to close to $0.

What About Buying Put Options and What’s a Put Option:

Options can be complicated. There’s a lot of math that goes into valuing an option, and on my screen alone, the option order entry box includes designations for basic options, covered, spreads, butterflies, iron butterflies, condors, and iron condors. Believe it or not, these are common options trading strategies and not the menu at a shiatsu massage parlor. For the purposes of this discussion, we’re going to eliminate all of that complexity and help you understand one basic thing you can do to hedge your portfolio.

To hedge your portfolio, you can buy put options on an index like the SPY. Put options give you the right (but not the obligation) to sell a stock or an index at a specified price before a specified date. We bought July 15, $350 strike put options on the SPY[2]. This sounds complicated, but simply means that we have the right to sell the SPY for $350 on or before the close on July 15th. As the S&P 500 has declined in price during recent volatility, the value of those options has increased and they now trade well above the price at which we recommended them to subscribers.

The advantage of owning these options is we can’t lose more than what we paid to buy them. In addition, if we’re correct about the direction of the market, the options will go up many times in value as opposed to the 10% we’d see in a correction or the 20% that would mark an official “bear market”.

The downside of using options is if the market goes down, but not by enough, you lose 100% of your investment. The other downside is you have a deadline; in this case, the July 15 expiration date. For this reason, we tend to make initial option positions small and accept the possibility of total loss of capital.

This is just like buying insurance for your home. You pay something for the insurance (like the cost of the put option), typically for one year (like the expiration date on the put option), and have a deductible (like buying a put option at a strike price below the current price). But if there’s a disaster, the insurance company will pay you many times over what you paid for that insurance. It’s the same thing with the options.

Here’s an example: We already told you we own July 15 $350 strike put options. I’m writing this piece on June 13th, 2022. Today, the S&P 500 fell by 3.88% and the VIX (a measure of volatility used to price options[3] rose by 23%. The SPY options rose in value by 133%. So, the market went down by almost 4% and the options more than doubled in value. As noted earlier, it’s not a large position for us, but you can see how a small amount of capital used properly can provide a lot of protection on a big down day like today.

Hedging for Inflation:

We’ve written on this topic at length, and our best guide on it is available here. The key point is that as we predicted last November, inflation is much higher than most people expected, and is understated by the Consumer Price Index. Anyone who’s tried to buy a house, a car, fuel, or food in the last year understands this. Another way of describing inflation is by noting that a dollar today doesn’t buy as much as it used to buy. Given that much of our assets are denominated in dollars, we wanted to help people hedge for inflation. That just means we were looking for ways to benefit from a dollar that has less purchasing power. We recommended the following things:

- Property: We told people to refinance their mortgages in late 2021/early 2022 before interest rates rose. If you own your home, you’ll be able to pay back that mortgage years later in dollars that have less value. At the time (and still now), mortgage rates were below the inflation rate meaning the bank is booking profits, but losing value on the deal. (Who doesn’t love beating the bank at their own game?)

- Gold: This has been the standard for money for thousands of years and it’s very difficult to increase the supply of gold. Our linked guide gives several options for how to buy and own gold, but the easiest is to own the exchange-traded fund (ETF) that tracks the price of gold (ticker: GLD).

- Silver: The secondary standard for money and one with greater industrial use. As with gold, we offer multiple options and the easiest one is the ETF with the ticker: SLV.

- Bitcoin: While Bitcoin has declined with the market, long-term, we see it as a deflationary asset during inflationary times. That’s a fancy way of saying that while more dollars are being printed which reduces the value of the dollar, fewer Bitcoin are being mined which will protect its value in the future. The safest way to own Bitcoin is with your own storage and private key. If that’s overwhelming for you, you can buy the Grayscale Bitcoin Trust (ticker: GBTC).

- Oil: This is our second largest position (after the market short discussed above). We like owning well-run major oil companies with already-permitted wells. If you want to know which ones we’re buying and why, we go through it in detail in this video. We don’t like paying insane prices at the gas station any more than you do. You might as well own some oil production and gain a benefit from higher prices instead of just paying more and complaining.

Conclusion:

Hedging sounds like a fancy complicated word, but it’s just a way of figuring out what’s going to hurt your finances and finding a way to buy some protection for that coming event. At Deep Knowledge Investing, we forecast the things that are going to affect your portfolio, explain our thinking clearly, and design effective ways to make money from coming chaos and problems. We’re comfortable operating in a challenging environment. Our webinars are designed to explain complicated concepts to non-professional investors. And for those of you who are busy, overwhelmed, or just focused on your real job and families, we maintain a current recommendations page that lets you know what we’re doing.

We deal with an enormous amount of complexity so that this doesn’t become hard for you.

[1] For those of you who are market professionals, we acknowledge that there are complications related to borrow availability, short rebate, short dividends, and percentage of the float already sold short. This is intended to be a piece for beginners and those complications aren’t big considerations for people shorting the S&P 500 against their long exposure.

[2] The SPY trades at about 1/10th the value of the S&P 500. So, if the S&P 500 were trading at $3,700, the SPY trades around $370.

[3] We can cover option math in a later more advanced piece. For now, just accept that volatility is used to price options.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI , affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.