Overview:

Nassim Nicholas Taleb is one of our intellectual heroes. His books, which include The Black Swan and Fooled by Randomness, constitute some of the best thinking and writing on risk in general, and financial risk in particular. He’s been publicly negative on Bitcoin, and while that is a respectable point of view, we disagree with his recent tweet on the topic. While we admire Mr. Taleb and believe him to be someone who researches his topics carefully, we believe the tweet in question (captured below) is demonstrably false.

In an article titled “Bitcoin” which was published on Medium four years ago, Taleb was positive on the cryptocurrency. In addition to questioning the wisdom of having important institutions run by our expert class who bear no penalty for being wrong, he wrote the following:

“Bitcoin” may fail; but then it will be easily reinvented as we now know how it works. In its present state, it may not be convenient for transactions, not good enough to buy your decaffeinated expresso macchiato at your local virtue-signaling coffee chain. It may be too volatile to be a currency, for now. But it is the first organic currency.

But its mere existence is an insurance policy that will remind governments that the last object establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.

This year, in an article titled “Bitcoin, Currencies, and Fragility”, Taleb changed his position, and argued that Bitcoin was worth $0. We go beyond his recent tweet and examine arguments made in this paper. Should Mr. Taleb read this and believe we have misstated any of his points, we invite him to contact us. We’ll be happy to discuss the matter and clarify if necessary.

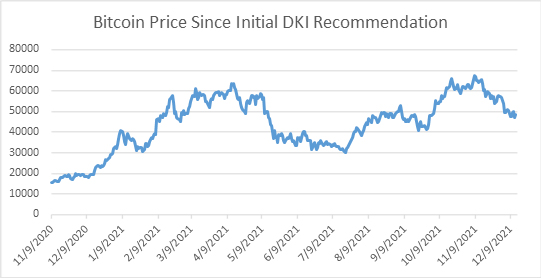

We first wrote about Bitcoin in November, 2020 in a piece titled “Why We’re Buying Bitcoin”, and then updated our positive recommendation in January, 2021. We’ve also done webinars on both Bitcoin and other cryptocurrencies. Bitcoin was around $15k at the time of our first recommendation. We continue to own a position.

Point 1 – Bitcoin is no hedge for adversity:

Mr. Taleb implies in both his paper and in the tweet (with the linked article) that Bitcoin doesn’t act as a hedge; but rather, as a risk asset correlated to temporary liquidity conditions. He correctly notes that during the early stages of the Covid lockdowns Bitcoin fell further than the US stock market and recovered more once the Federal Reserve began injecting huge amounts of liquidity into the financial system.

His assertions are correct if we’re looking at the past and at US Dollars. Given Taleb’s propensity for writing about and hedging for long-tail events, we’d counter that just because recent Bitcoin volatility was correlated with equity values and liquidity doesn’t mean that will always be the case. The Covid-related adversity Taleb cites was caused by self-imposed lock-downs and “fixed” by the extreme actions of the Federal Reserve. If the next disaster isn’t self-imposed, or fixable by government action, Bitcoin could be an ideal and uncorrelated hedge. The fact that this particular swan was white (correlated) doesn’t mean the next one can’t be black (uncorrelated).

Taleb seems to be saying that Bitcoin hasn’t served as disaster protection in the US so it’s not a hedge for adversity. We’d note that the US financial system hasn’t fallen (yet), or experienced a system-ending disaster, so it’s premature to draw this conclusion. However, we do have examples of systems that have fallen where desperate citizens have turned to Bitcoin.

On this point, we would direct Mr. Taleb to the situation in Venezuela. The communist government there has nationalized industries, ruined the economy, and caused hyper-inflation. As a result, Venezuela has taken over 3rd place on the global crypto adoption index. Some argue that impoverished Venezuelans are using crypto currencies to protect the value of the little money they have and adopting it as a unit of exchange. Others suggest Venezuela’s use of cryptocurrencies is related to government officials trying to launder funds. While we find one explanation encouraging and resourceful, and the other reprehensible, either way, Bitcoin is serving as a solution to adversity much more significant than a temporary decline in equity indexes.

Taleb also notes that the success of Bitcoin depends on the interest and participation of Bitcoin miners who provide the computational power to keep the system operating. Every fiat currency, payment system, and the entire global financial system (equities, fixed income, and other assets) require an operational electric grid, the internet, willing participants, and the continued stability and involvement of world governments. Every financial instrument except physical access to precious metals relies on these characteristics. The most likely scenario is that all of these assets fail at some point in the future and having some exposure (even 1%) to Bitcoin protects against problems in these other assets.

Regarding gold and silver, we agree that their long-term history as a store of value does provide some disaster protection. However, metals are subject to theft and government confiscation[1]. In addition, metals may be difficult to carry across borders while in the process of fleeing a disaster situation while Bitcoin can be moved anywhere at any time. Further, if Mr. Taleb (as someone with a history of hedging for improbable and uncommon events) is contemplating some kind of Mad Max scenario where the electric grid fails, and the internet is turned off, we’d submit that the best hedges against this kind of adversity is food, water filtration equipment, ammunition, medical supplies, and farming equipment.

Point 2 – Bitcoin is no hedge for inflation:

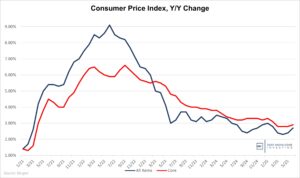

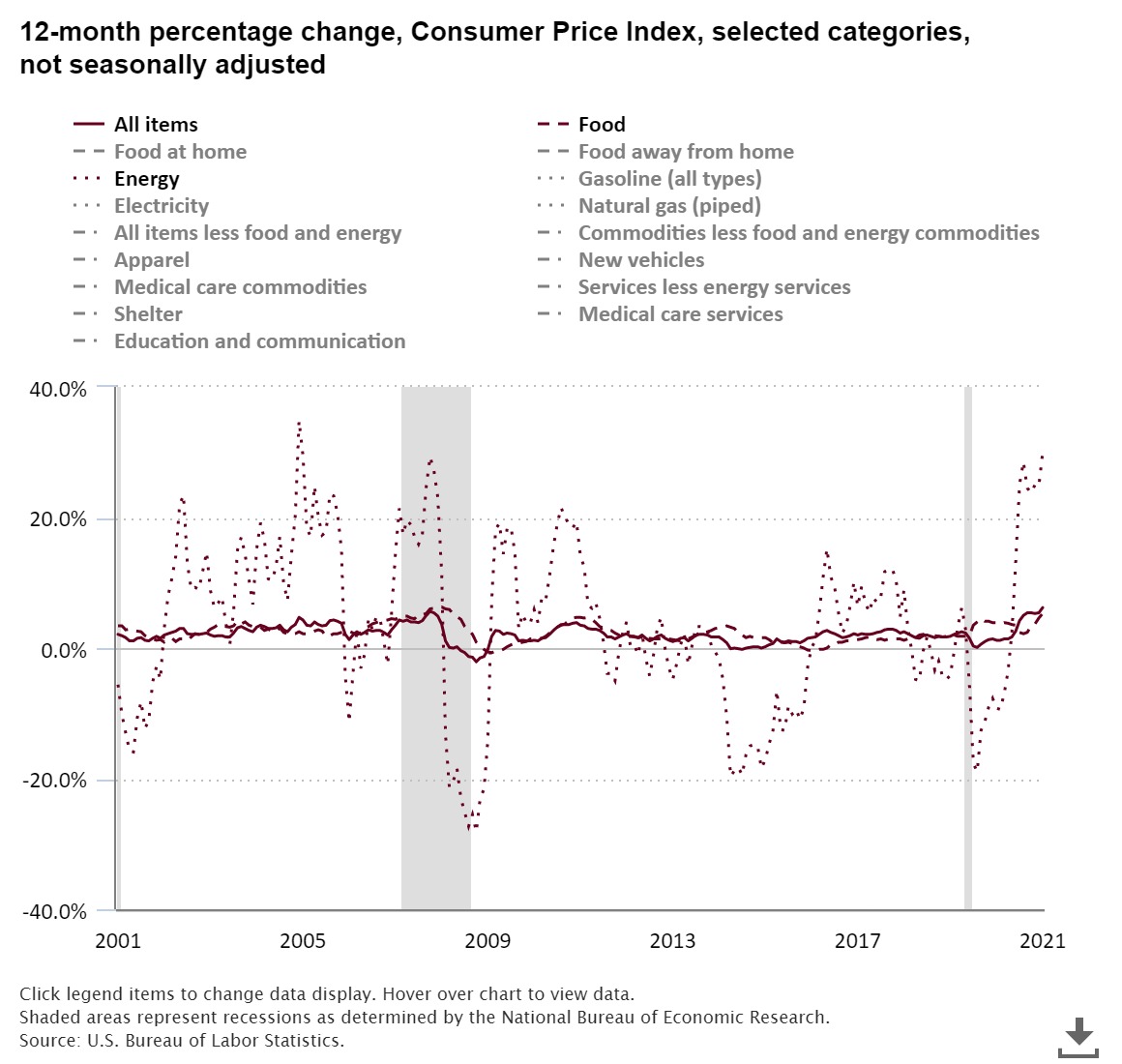

While we believe the US Consumer Price Index (CPI) understates the true impact of inflation on the life of the average citizen, a chart is helpful here. The below chart from the U.S. Bureau of Labor Statistics shows that the CPI has increased 6.2% in the last year (raised to 6.8% during this writing), and that inflation started to increase about a year ago. In the same period (October 31, 2020 to October 31 2021), Bitcoin rose from $13,458 to $60,074, an increase of 446%.

Mr. Taleb might argue that Bitcoin has been rising for reasons unrelated to inflation fears, and that’s at least partially true. A year ago, we addressed the reasons for our expectation that Bitcoin would increase in price here and here, and inflation was only part of the case. Still, the short-term evidence seems to support our point of view.

We think Taleb’s point here is more related to correlation with other risk assets and volatility which we address above. Given that the US hasn’t experienced significant inflation during the lifetime of Bitcoin, it’s too early to make a determination either way. However, we stand by our point that historical volatility and correlation does not mean that Bitcoin can’t or won’t hold its value in the event of US Dollar hyperinflation.

In addition, while people are focused on nominal US debt approaching $30 trillion, unfunded future liabilities are a multiple of that number. This estimate is for another $130 trillion, but we’ve seen estimates double that number. Either the US government defaults on its promises, or it prints hundreds of trillions of dollars of currency to cover those promises. Either way, when people refer to Bitcoin as a hedge against inflation, they’re typically referring to the more extreme scenario, and not one that depends on whether the CPI is 2% or 7%.

Mr. Taleb also makes a great point about Bitcoin being subject to government monitoring, hacking, and interference. He’s right, and government monitoring of citizens is a huge civil liberties issue. Again, we note that the US Dollar is being manipulated openly by the Federal Reserve on a daily basis. Our bank accounts and purchases are being monitored by numerous entities including multiple national security agencies, the Internal Revenue Service, the banks themselves, and the credit card companies. None of this is proof that Bitcoin is worth $0. To us, it’s a clear demonstration that we should have some assets in alternatives to US Dollars including gold, silver, and Bitcoin.

Point 3 – Bitcoin is no hedge for deflation:

We agree with this one. Bitcoin is a deflationary asset itself, and not designed to act as a hedge against deflation. We find this assertion curious because we haven’t seen a serious argument being made that people are buying Bitcoin to hedge against expected deflation, or even many expectations of deflation[2]. If Mr. Taleb thinks we’re missing something regarding this point, we invite him to contact us.

Right now, 90% of all Bitcoin that will ever be created are already in existence. Of the 19MM Bitcoin that currently exist, it’s estimated that about 2MM are irrevocably lost. The remaining 2MM Bitcoin will be mined over the next 119 years. As Bitcoin usage grows, the marginal increase in supply shrinks. Compare this with all major fiat currencies including and especially the Dollar where huge recent currency creation is accompanied by both enormous budget deficits and even larger off-balance sheet liabilities necessitating more future currency creation. This comes after two years where approximately 80% of all Dollars in existence have been created.

Point 4 – Bitcoin is no currency:

While Bitcoin is not a fiat currency, backed by the “full faith and credit” of a recognized government, if it can be used to purchase goods and services, then for all intents and purposes, it is a currency. In addition to the Venezuela example above, we note that El Salvador has just made Bitcoin legal tender, and all merchants must accept it. Granted, the process hasn’t gone smoothly from the beginning, but Bitcoin is being used as currency.

Thousands of stores in Japan accept Bitcoin and while Japanese citizens need to pay taxes on capital gains in Bitcoin, when it is used to make purchases, these transactions are not subject to consumption taxes. Bitcoin can be used to pay taxes in Japan and Ohio, and can be used to pay salaries in New Zealand. Here’s a list of major US companies accepting Bitcoin including Microsoft, AT&T, and Burger King. The number of companies accepting Bitcoin for goods and services, and the number of governments accepting it for tax payments is constantly growing.

Mr. Taleb can claim that these goods and services aren’t priced in Bitcoin; but rather, are priced in Dollars, Yen, or other fiat currency and then converted. We agree, and that’s the case for every currency. We’re writing this from Tamarindo, Costa Rica where you can use Dollars or Costa Rican Colones almost everywhere. Every establishment uses a different exchange rate, but you can pay in either currency. The price of an item in Dollars is tied to the price of that item in Colones, and both are currencies used for commerce. This is also the case with Bitcoin.

While Bitcoin is less useful in some purchasing circumstances than cash, the below photo from @MoneykingGG makes the point that Bitcoin is absolutely a currency.

Taleb writes about “the total failure of Bitcoin to become a currency” and then in the next paragraph criticizes it for more expensive transaction costs, slow transaction times, and the inconvenience trying to do large numbers of small transactions. We find it disingenuous to exclaim the “total failure” of Bitcoin as a currency and then write about the ways it’s used as a currency.

A big part of Mr. Taleb’s assertion that Bitcoin isn’t a currency is related to the fact that as of this writing, very few prices are listed in Bitcoin; but rather, as we noted above, are priced in fiat currency and the merchant will take Bitcoin at an exchange rate. That’s a fair point, but Bitcoin has some great advantages. It’s possible to transfer large dollar amounts of Bitcoin anywhere in the world almost instantly. It can be converted easily into fiat currency and used to make purchases. New systems are solving for transaction time enabling more purchases directly with Bitcoin. There is no one currency or unit of exchange that is perfect in all places, in all situations, and for all purposes. Bitcoin isn’t a perfect solution. Like all currencies and all units of exchange, it’s great in specific circumstances.

If Taleb wants to limit the definition of a currency to fiat, we’d point out that over time, 100% of fiat currencies go to $0. This article cites a study of 775 fiat currencies that all became worthless. The average life expectancy for a fiat currency is 27 years and the oldest two currencies standing right now are the British Pound at 327 years (which has lost over 99% of its value) and the US Dollar at 229 years (which has lost 96% of its value since 1800). The first retail transaction for bitcoin was 11 years ago and Bitcoin itself is 13 years old, about halfway to the average life of a fiat currency. According to Mr. Taleb’s Lindy Effect, it’s likely that Bitcoin survives to at least the average age of a fiat currency.

Taleb asserts that as a non-dividend paying asset with no earnings stream, when Bitcoin miners abandon the cryptocurrency, then it will be worth $0. Further, if we expect that the future price of Bitcoin is $0, and can’t receive dividends, then it’s worth $0 now. What we’d like to know is if all fiat currencies go to $0, and the longest standing ones have lost almost all of their value as well, why does Taleb ascribe $0 value to Bitcoin, but not express similar skepticism on the value of fiat currency? This leaves us with only gold and silver having proved their long-term value, but they’re useless for basic commerce. At a minimum, precious metals fail Taleb’s “buy a coffee” with it test. Again, instead of valuing everything in dollars which are also trending towards $0 on a long-term basis, why not have a 1% position in Bitcoin?

He does delineate non-dividend-paying assets like art or other collectibles as different because the owner receives aesthetic value for owning them. That’s a fair point, but with the advent of Non-Fungible Tokens (NFTs), we’re seeing huge interest in digital assets. People are spending significant sums on virtual assets both in online meeting places and in video games. We know all fiat currencies in history have gone to $0. The future of digital assets and cryptocurrencies hasn’t been written yet. We think it’s premature to declare there’s any “proof” that Bitcoin (or other non-dividend-paying digital asset) is worth $0.

Point 5 – Bitcoin is nothing:

As of this writing, Bitcoin’s market cap is just under $1 trillion. It is accepted by multiple governments as valid currency. Thousands of businesses including large flagship enterprises accept it as payment. Desperate people in places where the fiat currency has effectively no value use it. Large asset managers and pension funds are starting to take positions with client assets (and their own as well). An entire industry of decentralized finance is starting to develop, and Bitcoin is the largest asset in this growing part of the financial world. And it’s possible that Bitcoin or other cryptocurrencies enable banking services for the poor and un-banked, and free the rest of us from the decisions of the large money-center banks. This isn’t “nothing”.

Conclusion:

Perhaps, like every fiat currency ever, Bitcoin will end up worthless. Perhaps, another cryptocurrency will take the lead, or perhaps, they’ll all fail. We respect Mr. Taleb and admire his intellect, but think he has the wrong end of this particular discussion.

[1] An argument Taleb employs against Bitcoin.

[2] During edit, it was pointed out to us that Kathie Wood is the exception to this point. Hat tip to the DKI interns who read widely, cover a lot of ground, and appear to rarely sleep.

Acknowledgements:

We’d like to acknowledge the contributions of Deep Knowledge Investing analysts, Jordan Canik and Danny Pfeiffer to this paper. Their intellectual curiosity, admirable work ethic, and integrity are assets to DKI.

We’d also like to acknowledge the contributions of multiple members of the Deep Knowledge Investing Board of Advisors. Their knowledge of finance and cryptocurrencies improved this report in meaningful ways.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.