We have an extra-long version of the 5 Things this news-heavy week. The CPI rose and was above expectations. The Fed is still going to cut. There’s still no evidence of massive tariff-based inflation yet. The BLS crushes its former record for downward job revisions. They need new methodology and President Trump was right to change leadership. Oracle gets a $300 billion dollar order from OpenAI. Congratulations to Larry Ellison as he enjoys his moment as the world’s richest man. OpenAI is considering converting part of its business to a Public Benefit Corporation and is facing regulatory and investor concerns. DKI notes again that AI companies are going to need a business model that earns a return on the hundreds of billions they’ve spent on training the LLMs. We also wonder where they’ll get the gigawatts of power necessary to run those new datacenters. Klarna has a volatile IPO, but the financers got the pricing right. We’re hoping Klarna got the risk control right as many buy-now-pay-later users are surprised to receive bills for their purchases. The CBOE launches long-term futures contracts for Bitcoin and Ether. Investors will have the option to hedge in more regulated markets. Phil Muscatello contributes a guest “Thing” explaining the risks of private credit investments.

This week, we’ll address the following topics:

- The Consumer Price Index rose from 2.7% to 2.9% and was above expectations. The Fed is still going to cut. We explain.

- The Bureau of Labor Statistics sets a new record for job revisions at a loss of 911k for the year ending March 2025. President Trump was right to replace its leadership.

- Oracle $ORCL receives a $300B order from OpenAI sending the stock and market indexes to new records. Larry Ellison becomes the world’s richest man. Can OpenAI pay that bill?

- OpenAI looks at converting part of the company to a Public Benefit Corporation and is facing potential regulatory issues and investor discontent. The whole AI space needs a business model. As a user, don’t expect it will be free.

- Klarna $KLAR stock rises following the IPO then falls back to something close to the initial offer price. We think the long-term default rate will matter more than short-term volatility.

- The Chicago Board Options Exchange is launching long-term futures contracts for Bitcoin and Ether making hedging in regulated markets feasible.

- Phil Muscatello of the Stocks and Shares for Beginners podcast contributes this week’s educational topic. He explains the opportunity and risks of private credit investments.

Let’s credit the DKI interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem. This week’s 5 Things went to 7 “Things” and they’re all back in their university classes. Despite early exams, they continue to produce outstanding research and work. It was great having Robb Fahrion back in the hosting chair of the video edition last week as we dealt with technical problems related to my internet connection here in Marrakesh. This week, Phil Muscatello steps in as an experienced guest host. Check out his educational podcast linked below. As always, the team at Flying V continues to improve the written and video versions of The 5 Things.

1) The CPI Rose and Was Above Expectations – The Fed is Still Going to Cut:

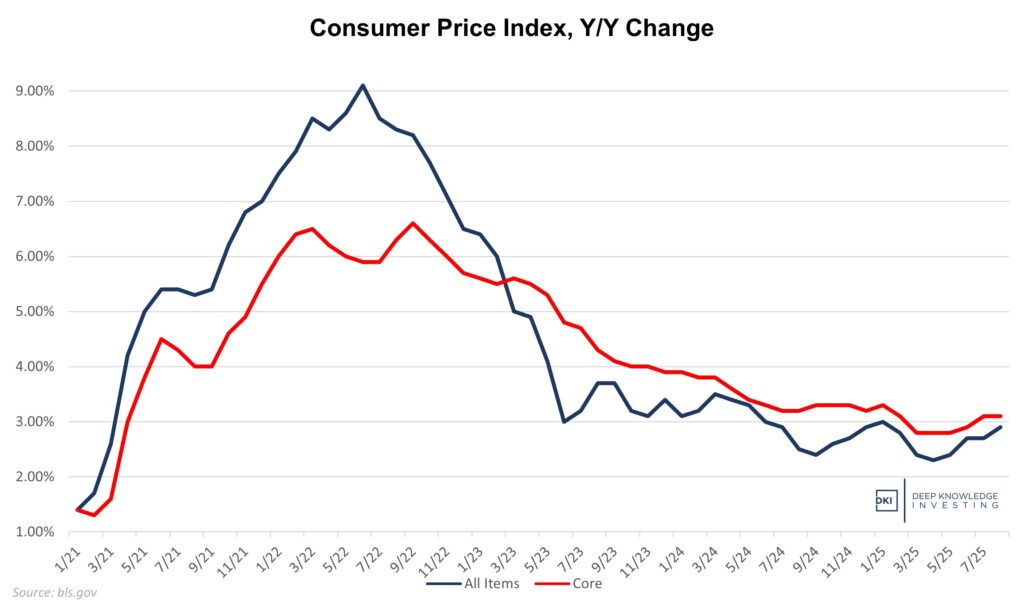

Last Thursday, we got the August Consumer Price Index (CPI) report which showed an overall increase of 2.9% for the last year and was up 0.4% for the month (annualizes to 4.9%). The annual number is up 0.2% from July and 0.1% above expectations. The monthly is up 0.2% and 0.1% above expectations. The Core CPI, which excludes food and energy, was up 3.1% vs last year and up 0.3% for the month. These were both consistent with last month and in-line with expectations. Yet again, the primary reason for the increase was shelter (that’s the fancy word the Bureau of Labor Statistics uses for housing). There is still no evidence of the tariff-related inflation disaster threatened by fiat economists. The Producer Price Index was also reported this week and the index for final demand goods was up only 0.1%.

Rising for a few months. The Fed is still going to cut.

DKI Takeaway: I’ve spent the past few years telling you how the CPI is understated. Right now, with shelter being the primary reason for CPI increases, and the Owners’ Equivalent Rent calculation being a lagging factor, I think the CPI is going to decrease in the short-term. Given the recent downward revisions to the employment numbers, I agree with consensus that the Fed will lower the fed funds rate when they meet this month. I think the Fed fears a recession more than they fear inflation. Some are betting on a “jumbo” 50bp (0.5%) decrease. I think that’s unlikely. Inflation remains elevated. The real rate is below 2% which is not “restrictive”. President Trump has publicly pressured Chairman Powell making it difficult for him to reduce rates without looking like he’s caving to the White House. And the emergency policy bias is towards caution. That’s because in the event of an economic downturn, the Fed has a history of immediately using quantitative easing to flood the system with liquidity. On the other hand, a resurgence of inflation is difficult to control and Fed policies to deal with that tend to either be very expensive or to take a long time.

2) Massive Jobs Revision Reveals Labor Softer-than-Expected Labor Market:

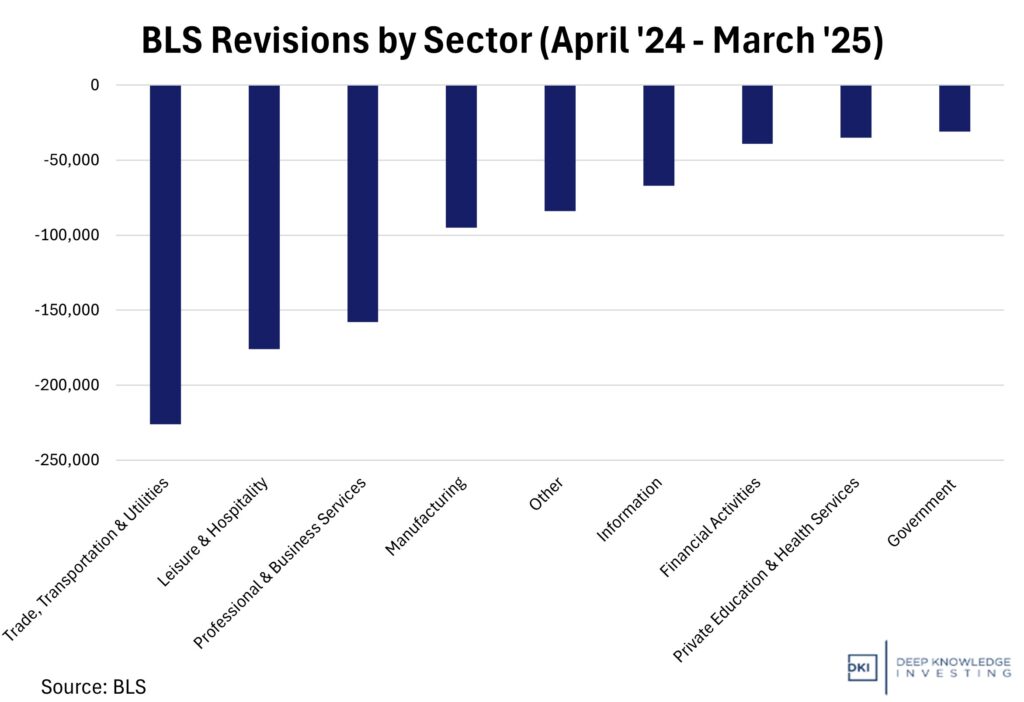

This week, we got the Bureau of Labor Statistics’ annual benchmark revision. It cut U.S. nonfarm payroll figures by 911,000 jobs for the 12-month period ending March 2025, reducing average monthly job growth from about 147,000 to roughly 70,000. The largest reductions came in leisure & hospitality, professional/business services, and retail. The revision implies that some of the labor market resilience claimed by the prior White House was overstated and that softening was underway before there were any tariff pressures. August’s headline jobs figure was just ~22,000, supporting signs that hiring has decelerated. JPMorgan CEO, Jamie Dimon, reacted sharply saying the revision confirms that the economy is “weakening,” though he stopped short of declaring a recession, highlighting data that paints a softer picture compared to the business profits that have shown resilience.

The BLS keeps setting records for revisions and data inaccuracy.

DKI Takeaway: This deeper job cut shifts the baseline for how strong recent economic data really is, and it heightens the risk that policymakers from the previous presidential term were overestimating labor strength. For the Fed, this means greater latitude to ease, but with a thin margin for error if inflation doesn’t cooperate. While the jobs growth is currently weak, that’s being offset by repatriations. Wage growth has continued leading more Americans to come off the sidelines and rejoin the labor market. This has increased the unemployment rate slightly, but in the best possible way; people getting off public assistance in order to work. For the first time in years, there are more people looking for jobs than there are jobs available. I’ve written about this previously, but when the BLS data is this inaccurate, President Trump is right to replace its leadership. Fiat economists and political operatives can scream that his action is politicizing the BLS, but most of us just want accurate data, not near-million-person job revisions.

3) Oracle Sees Record Surge Driven by Earnings and Cloud Deals:

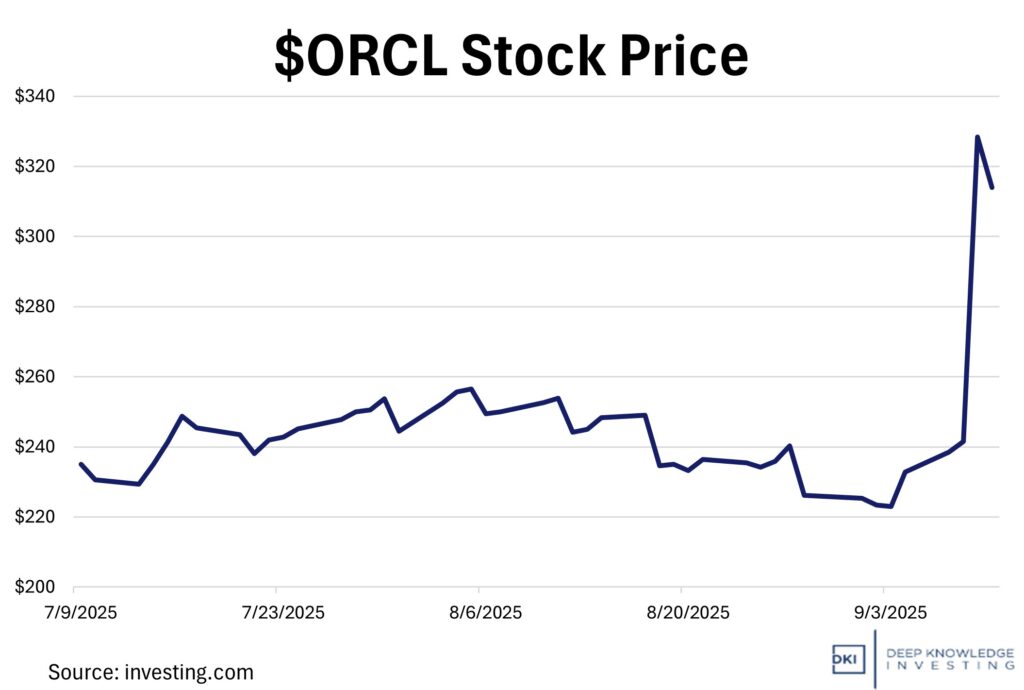

Oracle’s stock jumped nearly 40% last Wednesday, reaching all-time highs and bringing the company near a $1 trillion market cap. This came after strong financial results and raised forecasts on Oracle’s cloud and AI business. With total revenue up 12%, cloud revenue jumping 28% YoY, and four multi-billion-dollar cloud contracts landed in the quarter, Oracle showed extreme growth, justifying the surge. The big headline was a commitment from OpenAI to buy $300 billion from Oracle over the next five years. Co-founder Larry Ellison owns roughly 41% of Oracle, resulting in an estimated $117 billion gain in net worth in one day. This briefly made Ellison the world’s richest person. The stock now trades around 45x forward earnings, meaning the market has priced in very optimistic growth. Any negative changes in the AI field could cause serious problems for Oracle’s stock.

A $300B deal can move even the mega-cap tech stocks.

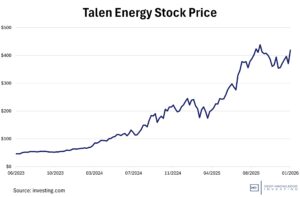

DKI Takeaway: Oracle’s growth reflects a powerful combination of strong earnings, cloud growth, and landmark contracts. The company will need to deliver on its promises to justify the increase in price. A $300 billion dollar order from OpenAI is incredible; however, OpenAI is still years away from being profitable (more on that below). The contract also requires 4.5 gigawatts of power which equals the generation capacity of two Hover Dams. All of this AI infrastructure is going to need comparable increases in power generation. That’s going to mean nuclear power. Do you own enough uranium?

4) OpenAI’s Bid to Shift Its Hybrid Structure Faces Regulatory Issues:

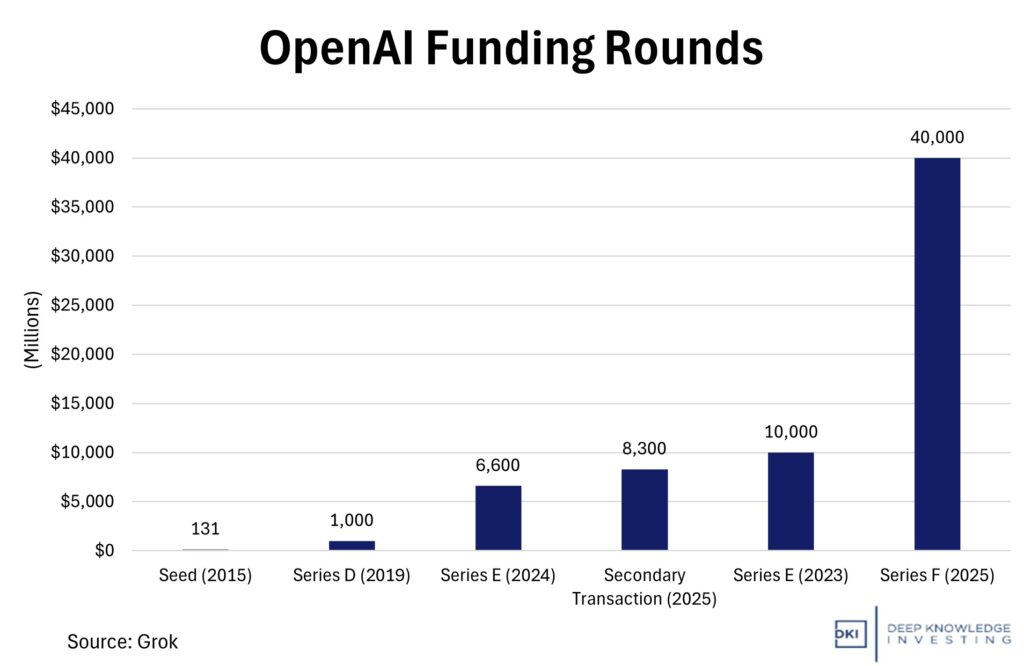

OpenAI was founded as a nonprofit in 2015 with the mission of ensuring artificial general intelligence benefits all of humanity. Over time, it created a for-profit subsidiary (OpenAI LP) under a “capped profit” model to attract investments, pay for computing power, and compete in the fast-moving AI landscape. In late 2024 and into 2025, OpenAI proposed converting its for-profit arm into a Public Benefit Corporation (PBC), which would balance the profit motive with statutory mission obligations, and contemplated reducing nonprofit board control. However, those plans have faced friction: the California and Delaware attorneys general are investigating whether OpenAI’s restructuring violates charitable trust law and whether charitable assets are being repurposed without proper oversight. The restructuring is tied to nearly $19 billion in investor funding. If it fails, many backers are may be poised to withdraw. OpenAI has also considered whether it might relocate out of California if regulatory resistance blocks the conversion.

Credit to OpenAI for building something that attracts interest from users and investors.

DKI Takeaway: OpenAI’s attempt to convert into a more “normal” investment vehicle highlights how capital requirements for high-stakes AI development force trade-offs between mission and monetization. The current “nonprofit + capped-profit LP” structure looks increasingly like a bottleneck; restrictive for investors, odd in governance, and vulnerable to regulatory pushback. The public benefit corporation (PBC) route may loosen constraints while preserving some mission oversight, but major risks remain, including diluted control by the nonprofit, ongoing legal challenges, and the possibility of losing investor confidence if the structure looks too compromised. For those watching, the key questions are: will the PBC model satisfy investor demands without sacrificing mission? Can regulators ensure public benefit and safety obligations are enforceable? The outcome could become the precedent that reshapes how all leading AI firms balance profit, governance, and social responsibility. DKI has often commented on the expense of AI training combined with the lack of a profitable business model right now. The one area where we have absolute confidence is in the need for more power generation.

5) Buy Now, Pay Later Goes Public:

Klarna’s ($KLAR) IPO opened on Wednesday, the 10th, raising $1.4 billion. Klarna is a Swedish fintech company providing online financial services, such as payment processing for the e-commerce industry, managing store claims, and handling customer payments. Earlier this summer, we covered the concern over growing defaults on Buy Now, Pay Later payment plans with Klarna leading the competition for poor credit decisions. The pre-market price of Klarna shares was $40 per share, which increased by around 30% to $52 per share after the market opening on Wednesday.

These gains were short-lived, as the stock fell back down to $46 per share, decreasing the day’s movement from 30% to a still respectable 15% increase. Based on this closing price, Klarna’s market value at the end of the day was over $17 billion.

The IPO was fairly priced. Trading was volatile.

DKI Takeaway: Klarna’s opening day 15% gain is an outlier when compared to other recent IPOs that have taken the market by storm. Figma and Circle both rose over 200% in their initial public offerings. Klarna was more accurately priced and retail investors are starting to become more aware of the danger of volatile IPOs. At DKI, we’re long-term investors so our view is that price volatility for a couple of days matters less than the future of account defaults.

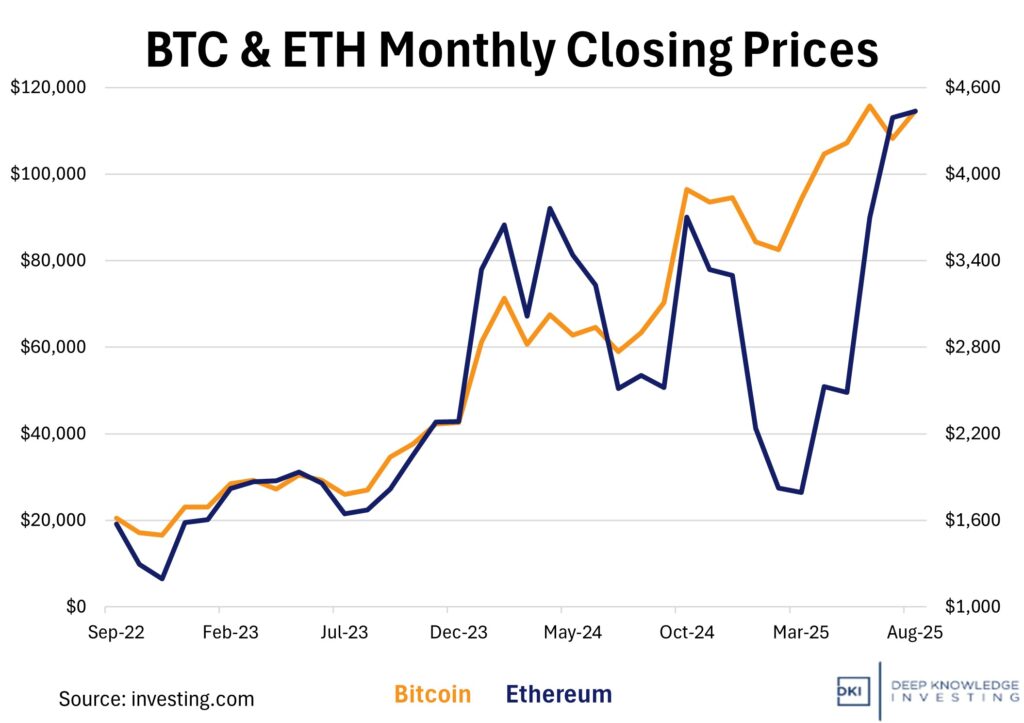

6) CBOE Plans to Unlock Crypto Hedging for the Long Haul:

The Chicago Board Options Exchange (CBOE) recently announced plans to launch long-term futures contracts, or “continuous futures,” for Bitcoin and Ethereum. The contracts will last up to 10 years and are designed to mimic popular perpetual futures (a derivative contract with exposure to an asset without an expiration date) offered by offshore crypto exchanges. The CBOE’s product prices daily through cash adjustments to provide continuous market exposure within a regulated market.

The plans target a longstanding gap in the US crypto markets. Traders have had to choose between continuously rolling over short-dated contracts or resorting to offshore exchanges. By bringing a longer-dated futures product to the US, The CBOE has the potential to meet market demand and take a larger place in the world of crypto derivatives. Much of today’s trading volume has been sacrificed to unregulated markets, creating security concerns for many investors.

My largest position is Bitcoin. DKI subscribers have made almost 8x their money here.

DKI Takeaway: For retail and institutional investors alike, long-term BTC and ETH futures are tools for hedging. These futures allow investors to lock in prices or hedge against volatility over long periods of time. Though the plans are pending approval, this would mark a milestone in the US markets. As the crypto and stablecoin market continues to grow, objectives like these become more feasible. This perpetual-style trading should also draw in more institutional involvement within regulated markets, creating needed liquidity.

7) Is Private Credit an Appropriate Investment for Amateur Investors:

We welcome Phil Muscatello of The Stocks and Shares for Beginners Podcast to offer his opinion on an investment product increasingly being marketed to retail investors:

I strongly believe in learning Wall Street jargon. The more you know about how Big Finance works, the more pitfalls you can avoid. Let’s talk about “private credit” which is being aggressively marketed to retail investors. You can invest via funds, ETFs, and you should also be aware that your pension plan may hold some sort of allocation to the sector. Slick marketing promises steady income with buzzwords like “diversification” and “stability.” (DKI note: “stability” can often mean not marked to market.)

Private credit is an investment where non-bank lenders lend money to companies; typically, real estate developers and small to medium sized business. These loans are private deals with multi-year lockups and little liquidity. They pay higher returns because they’re riskier. The market is huge—$1.5 trillion worldwide.

Regulators like ASIC (Australian Securities and Investment Commission) in Australia and US regulators are concerned because of the market’s opacity. Loan valuations are hard to verify, and funds often borrow heavily, hiding risks. ASIC calls it a “Wild West” due to limited oversight, while the Fed warns of systemic risks if defaults spike in a downturn; especially since retail investors, lured by slick marketing, may not grasp the risk of loss and the illiquidity of these private investments.

Illiquidity is a fancy finance way of saying that your cash is tied up in loans for years, unlike stocks that you can sell fast. If you need money sooner, you’re likely to sell at a large discount/loss.

In a recent example in Australia, a private credit lender arranged a loan worth nearly half a billion dollars for a proposed 55-story tower in Sydney in early 2023. It looked like a sure thing with its location over a new rail link and the promise of marquee tenants. Construction has yet to commence. Property values are down due to oversupply and more employees working from home in addition to persistently high interest rates and rising construction costs.

More troubled loans in the private credit industry are coming to light. Big Finance loves to package assets up in all kinds of fancy wrapping. Finance to non-bank lenders often comes from the banks. This is why regulators are concerned. If an economic downturn takes hold, then the assets underlying these investments will all be marked down at the same time. The effects can ripple through financial markets creating chaos. Naturally, the banks ultimately rank first in any wind-up. You, the investor, will lose money before the banks.

Beginners should not be taken in by promises of high returns. Only allocate a small amount of your capital, pick funds with experienced managers, and keep other investments that are easy to sell. Always consider the risks to keep your money safer.

Halo: Proposed Tower Exposing Private Credit’s Trouble and Unfulfilled Promises

DKI Takeaway: Gary here: There’s nothing wrong with investing in private credit if you understand and can handle the risks. But please heed Phil’s warning. These are illiquid private deals where you are likely to be the first to be hurt in a downturn. If you don’t understand the risk, there’s nothing wrong with passing on an investment even if it later turns out to be profitable. At DKI, we not only provide transparency into my personal portfolio; we also provide writeups explaining in detail why I own these positions and what I think the risk is. DKI subscribers are invited to ask me follow-up questions. I’m a big fan of Phil’s work because he’s made it his mission to help educate new investors. He’s outstanding at getting professional investors to explain how they think about the markets in plain language understandable by everyone. Phil will be guest-hosting the video version of the 5 Things this week. Come check it out at DKI’s YouTube channel and please subscribe to Phil’s channel. We both want you to understand investing better.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.