Lots of supply chain and trade war news this week. China renews and strengthens restrictions on export of rare earth elements and magnets. They’ve spent decades securing the upper hand in these crucial components leaving the west no choice but to invest in our own mining and refining capacity. Silver joins fellow precious metal gold by hitting its first all-time high in more than a decade. Some say metals are gaining value. DKI suggests that the dollar (and other fiat) is losing purchasing power. Jamie Dimon and JP Morgan start investing in companies that would increase US independence and reduce the influence of the CCP. DKI applauds and hopes the effort is successful. I talk to family office people (including several on the DKI Board of Advisors) on a regular basis and demand for private deals is growing. Goldman Sachs responds by agreeing to buy Industry Ventures. In our educational segment, we discuss the VIX, otherwise known as the fear gauge.

This week, we’ll address the following topics:

- China restricts access to rare earth elements and magnets. We can develop our own capacity, or cede our industrial capacity and international policymaking to the CCP.

- Silver hits an all-time high. More people are waking up to the loss of purchasing power of their national fiat currencies and want to hold something that’s harder to debase. Industrial use is rising as well.

- Jamie Dimon and JP Morgan get onboard with the White House and decide to start investing in companies in strategic sectors that aim to increase US independence.

- Goldman Sachs is acquiring Industry Ventures. The wealth management division has continued demand for private deals.

- Ever wonder what the VIX or “fear gauge” is? In our educational segment, we explain.

This week, I get to applaud our young interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem. In their best week ever, they produced an exceptional version of The Five Things. My edits below were minimal. The credit is theirs. A further hat tip to Samaksh who worked with me on DKI’s latest portfolio idea. He deserved and received prominent credit for his efforts. Finally, I want to thank longtime DKI subscriber, David, who helped me understand how he reads and uses this publication. It’s important to me to understand what our community values.

Ready for a week of further supply chain issues? Let’s dive in:

1) China’s New Sweeping Rare Earth Export Restrictions:

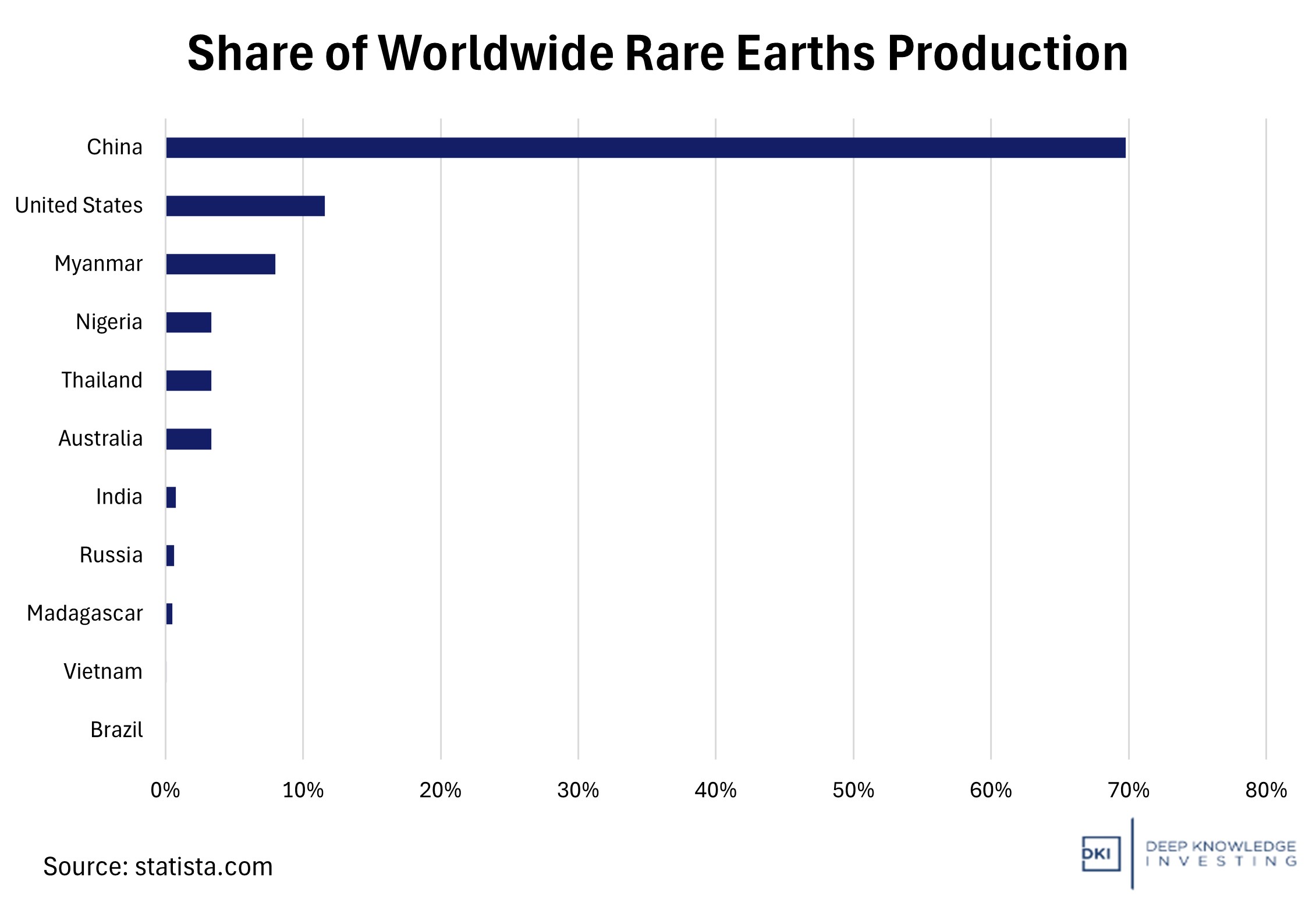

China just announced sweeping new export controls on rare earth elements and related technologies, adding holmium, erbium, thulium, europium, and ytterbium (and possibly mithril and adamantium) to its export control list, on top of 7 existing ones. Out of China’s 17 rare earth elements, 12 are on an export control list. In order for any foreign company to obtain these metals or semiconductor materials in larger than trace amounts (>0.1%), they must gain Chinese export approval. Many of these metals are necessary for EVs, wind turbines, consumer electronics, and defense systems like F-35 fighter jets and advanced submarines. They also appear in technologies we use every day, like LED displays and lithium-ion batteries. Certain rare earths are also fundamental to semiconductors, meaning global supply could be affected in the chip industry. In a modern world that is so reliant on these metals, this creates a wakeup call, highlighting the dangerous reliance that much of the world has on China’s supply of rare earths.

China now controls the world’s supply chains for technology and defense.

DKI Takeaway: China’s share of rare earth production is already at a staggering majority (~70%), and Chinese firms produce over 90% of rare earth magnets that are crucial to tech and defense systems. Beyond just defense, countries like the US are subject to restrictions on metals that are necessary for our manufacturing and energy industries. While the US is already investing heavily in domestic rare earth mining and refining, immediate measures consist of ramping up rare earth stockpiling and recycling. Policymakers are also trying to create joint networks of rare earth mining with countries like Canada and Australia (and possibly Greenland). The west has two options; ramp up production quickly or cede control of our supply chains to China. The second option leads to ceding our international policymaking to the CCP.

2) Silver Price Surges to an All-Time High:

Silver prices just reached an all-time high at nearly $54 an ounce, breaking peaks seen in 2011 and 1980 near $49.80. Why has the metal gained nearly 78% of its value just this year? This comes down mainly to a blend of supply pressures, booming demand, and safe haven investing. Silver supply hasn’t kept up with demand and major hubs for silver trading have seen stockpile sizes dwindle, causing silver lending rates to spike and create a “short squeeze” in the price. A real-life short squeeze was caused by scarcity of deliverable silver.

In addition, silver is both a precious metal and an industrial commodity (unlike gold). About two-thirds of silver demand now comes from industrial uses; mostly electronics and photography. The renewable energy sector has also driven demand as solar power consumed almost 200 million ounces of silver in 2024 alone (nearly 20% of global demand). As DKI often writes, precious metals are considered a safe haven in times of economic uncertainty. With inflation making fiat debasement clear to more families, silver has become more attractive as a store of value this year.

DKI has owned silver since 2020.

DKI Takeaway: It is a fair assumption that silver’s drive is partly due to investors seeking shelter in the markets, but soaring manufacturing is a big contributor. While this increase in price will cause prices to rise in the industrial sector that uses silver most, higher prices also reflect growth in robust sectors like tech and solar energy. At DKI we recommend that investors think about inflation as the loss of purchasing power of the dollar (or other government-sponsored fiat currencies). While not everyone has $4k+ to buy an ounce of gold, more families and investors are seeing the relative value of silver.

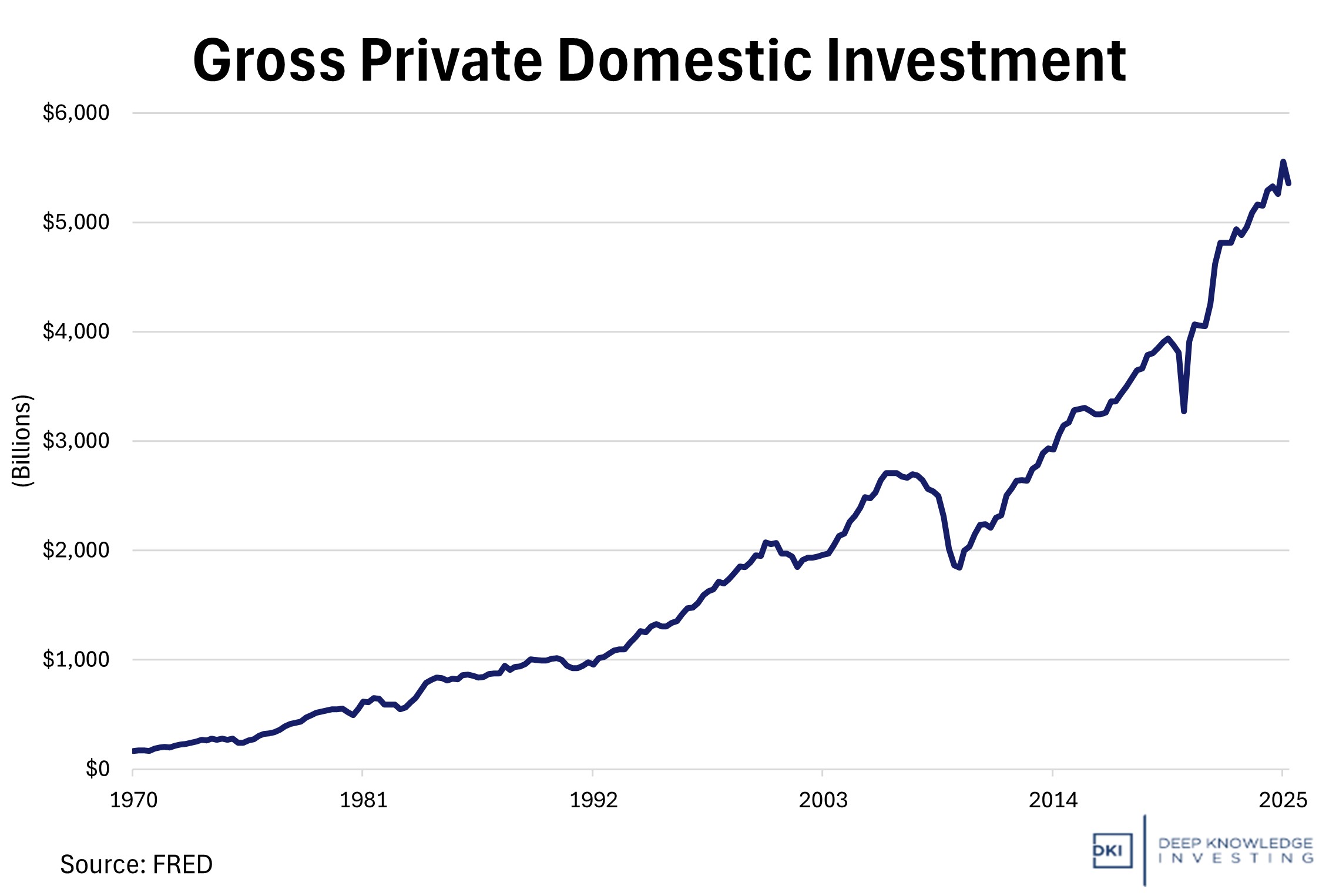

3) J.P. Morgan Unveils $10B Investment Plan to Bolster US Strategic Industries:

J.P. Morgan announced a new $10 billion investment initiative aimed at strengthening U.S. economic resilience by channeling private capital into industries tied to national security via direct equity and venture capital investments. The program, part of a broader $1.5 trillion, 10-year effort, will target critical sectors such as advanced manufacturing, clean energy, defense technology, and AI infrastructure. CEO, Jamie Dimon, framed the move as a direct response to American overreliance on foreign sources for critical minerals, components, and technology, along with the need for private investment to complement government initiatives. The bank will deploy its own balance sheet alongside advisory capabilities, forming a council of public- and private-sector leaders to guide investments. Strategically, the move positions J.P. Morgan as both financier and policy partner, seeking to align capital markets with Washington’s push for industrial self-sufficiency.

Strong trend which JP Morgan intends to continue.

DKI Takeaway: J.P. Morgan’s plan underscores how Wall Street is converging with national strategy, but it also draws attention to the fine line between patriotism and pragmatism. By directly investing in sectors traditionally shaped by government subsidies and regulation, the firm risks becoming entangled in political and policy volatility. Still, DKI believes the upside is clear: If executed with commercial discipline, these bets could generate durable returns while reinforcing American economic and security independence. The bigger story is how this marks a structural shift in capital allocation, where major financial institutions are not just intermediaries, but active architects of national resilience. Investors should watch whether this becomes a blueprint for profit with policy purpose, or a cautionary tale of Wall Street overreach in Washington’s playbook.

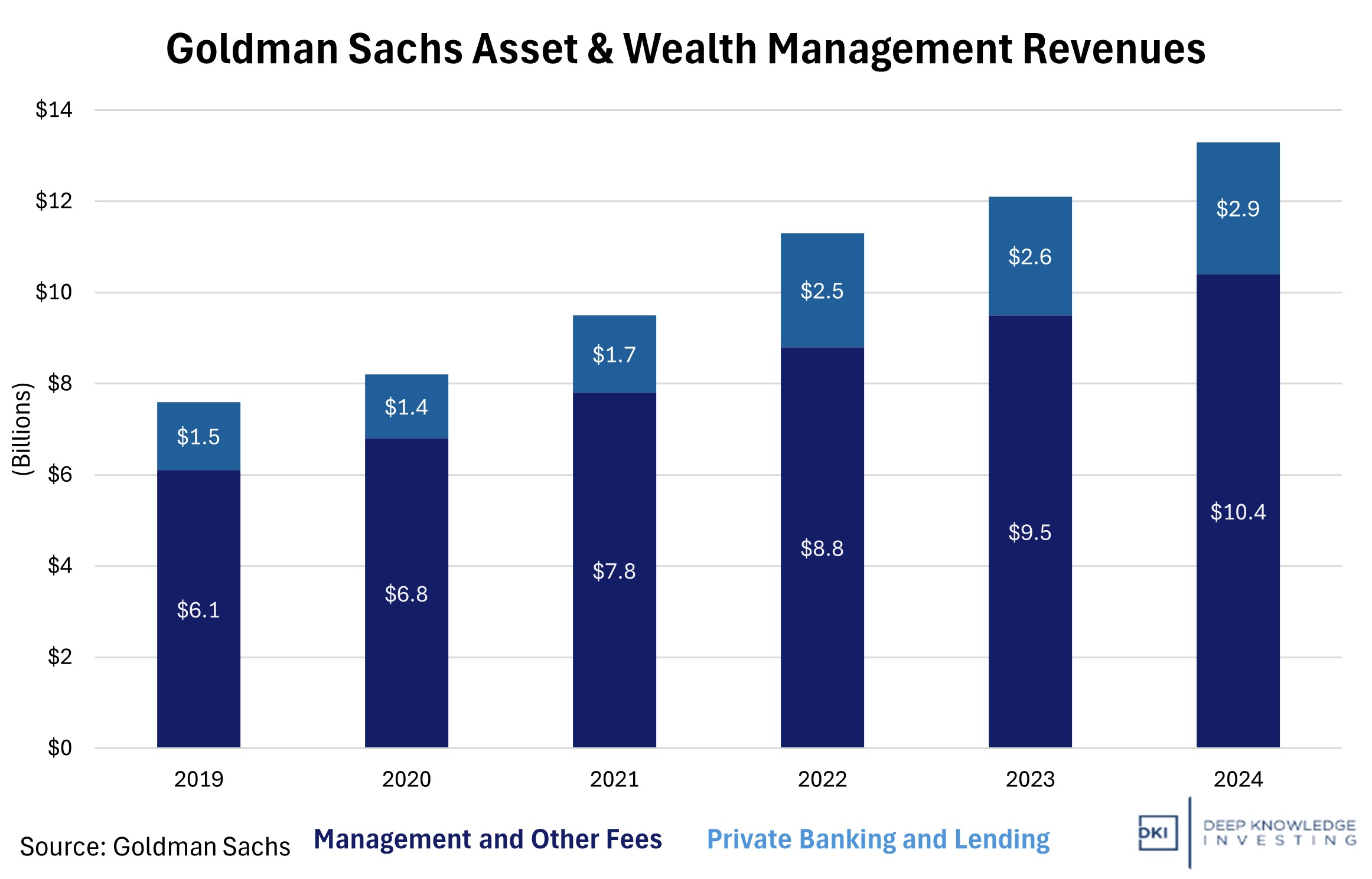

4) Goldman Sachs Pushes Further into Private Markets:

Goldman Sachs ($GS) has agreed to acquire Industry Ventures, a venture capital firm with over $8B in assets under management. Industry Ventures has a large venture capital portfolio, spanning from seed stage to late-stage growth stage including Uber, DoorDash, Roblox, and many more companies. Goldman Sachs will pay $665M at closing, plus an additional $300M based on Industry Ventures’ performance through 2030. “Industry Ventures pioneered venture secondary investing and early-stage hybrid funds, areas that are rapidly expanding as companies stay private longer and investors seek new forms of liquidity,” said David Solomon, CEO of Goldman Sachs. The deal is expected to close in early 2026.

Soon to be added – more VC and private investments.

DKI Takeaway: Goldman Sachs’ acquisition of Industry Ventures is another major addition to Goldman Sachs’ growing portfolio. The agreement allows Goldman to gain deeper involvement in venture capital and alternative assets. A weaker IPO market and more interest in private deals from high-net-worth investors is driving Goldman’s acquisition for the wealth management business. The deal suggests Goldman may start exploring more long-term private investments as it seeks growth beyond traditional banking revenue.

5) Educational Topic: Understanding the VIX Index:

The VIX Index (CBOE Volatility Index) is a real-time measure of the stock market’s expected volatility over the next 30 days which is derived from S&P 500 option prices. Many call it the “fear gauge” as it generally reflects the level of investor uncertainty or risk expectation. The VIX is calculated by a formula which aggregates the implied volatility from the premiums of a broad range of S&P 500 call and put options to derive a 30-day volatility expectation. Higher option prices translate into a higher VIX value which indicates greater expected swings in the S&P 500.

This index is widely considered as a good indicator for market sentiment and risk. A high VIX (above 30) suggests significant volatility expectations, whereas a low VIX (below 20) suggests a more stable market. One thing investors should note is that the index usually moves opposite to the market: when stock prices drop, protective options rise in price, causing the VIX to spike.

Investors worry more about downside volatility than upside.

DKI Takeaway: If a rising VIX serves as an early warning of market stress, then portfolio managers can turn to more cautious investments or stress test their current ones. Simple examples like this show how the index can be used by average investors. While investors can’t actually invest in the VIX, there are VIX-linked instruments that can be used as a hedge against volatility when it spikes. This can offset losses during a stock market decline, since these positions tend to gain value when the VIX rises. While volatility measures price changes, market participants worry more about downward volatility than upward vol. That’s why owning the VIX, or a VIX-linked instrument can be a hedge against stock positions. Just note that due to decay from options, you need to get the timing right. If you own a VIX-linked instrument and the VIX doesn’t change, you’ll lose money over time.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.