The Disinflation Issue

Lots of disinflation news this week. Disinflation means a reduction in the rate of inflation. Prices are still going up, but at a slower rate. The data doesn’t paint a perfect picture, and we’ll elaborate in the “Things” below. We also have some new information on the year’s best antitrust case, and DKI enters the debate about the proposed BRICS currency. For those of you who want more disinflation news, check out this post from Mish Shedlock on the drop in both import and export prices.

Also, in last week’s “5 Things” we argued that Beyonce did not cause inflation. In a hilarious comment on LinkedIn, someone responded that Taylor Swift was causing inflation. We put the question to you: Which celebrity or public figure is most responsible for the higher cost of everything? We have a Twitter poll on the subject and at the time of this writing, Jerome Powell had a slim lead over Taylor Swift and Janet Yellen. There does seem to be a clear consensus that Beyonce is not responsible for inflation. For those of you who voted for Taylor Swift, did you do it because you like her or dislike her? Let us know in the comments.

1) CPI Now at 3%:

The June CPI report was mostly positive for the disinflation crowd. The official Consumer Price Index fell to 3.0%. That’s still above the Fed’s 2% target, but a big decline. The Core number which excludes food and energy is more stubborn; hovering around the 5% range which is still high.

Big decline in the CPI, but the orange Core line is still pretty flat.

DKI Takeaway: Good news, but with a few caveats. The CPI was aided by comparisons with much higher energy prices and the highest CPI readings a year ago. Those comparisons will become less favorable in coming months. In addition, there is a huge downward adjustment to health insurance prices that ends in September. Higher shelter prices made up most of the increase in prices, and we expect that to come down so it should be a mix of positive and negative going forward with inflation ticking up a bit this month.

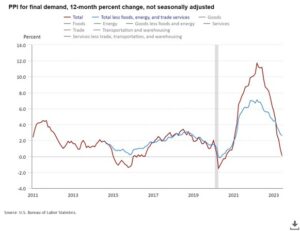

2) The PPI is Obliterated:

The Producer Price Index often leads the CPI and this week’s report blew away expectations. The PPI for June was just above zero, and even the more stubborn core number is coming down.

Unlike the CPI, this chart is not ambiguous in any way.

DKI Takeaway: CPI down with Core CPI stubborn. PPI and Core PPI down big. Import and export prices down big. There are caveats, but the direction is clear. Despite the improvement, we still expect the Federal Reserve to raise rates .25% at the next meeting. Powell is likely to say the Fed will be “data driven” and will consider an additional increase, but the market expectation for the probability of that second increase will fall. DKI still thinks we won’t get the pivot to lower rates soon, but we could see a real pause in a couple of months.

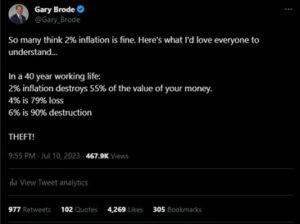

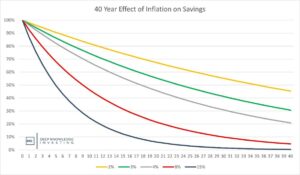

3) Even Small Inflation is a Big Deal:

Last week, we had a tweet on inflation go viral with almost half a million views, 1,100 retweets, over 4,000 likes, and 300 bookmarks.

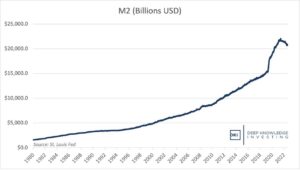

The Federal Reserve, the Treasury Department, and the US Congress are stealth-stealing from you.

You might not notice 2% – 3% this year, but over time, it’s massive theft.

DKI Takeaway: The mandate of the Federal Reserve is “stable prices”. They get away with a 2% target because people don’t notice small changes. However, those changes add up over time. Many will tell you that inflation is necessary for economic growth. This is untrue. Stable prices encourage savings and investment which leads to economic growth. Inflation encourages excessive debt and immediate consumption which brings disaster.

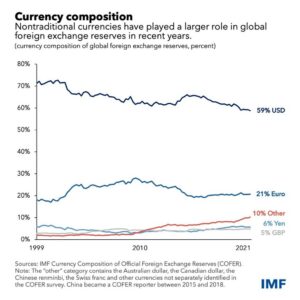

4) BRICS Currency vs the Dollar:

The BRICS coalition (Brazil, Russia, India, China, and South Africa) is growing quickly and now includes countries making up more than half the population of the planet. They are talking about creating a commodity-backed competitor to the dollar as the world’s reserve currency. Critics have dismissed the effort noting the difficulty of organizing a multi-country currency and pointing out that China and Russia are not trustworthy. Those are excellent points. However…

According to the IMF, the dollar has fallen to 55% of reserves since this chart.

Other countries aren’t thrilled with dollar debasement.

DKI Takeaway: The critics have some good points, but don’t dismiss the idea so quickly. A commodity-backed currency would be much more hard (difficult to add to supply) than a dollar backed by “faith and credit”. In addition, the Saudis have broken the petrodollar and are now selling oil in other currencies. Argentina and Brazil are buying imports in Yuan. Most of the world is looking for an alternative. We cover this topic in detail in the DKI July letter (out this week).

5) FTC Effort to Stop the $ATVI/$MSFT Deal is Denied:

The Federal Trade Commission challenged the proposed acquisition of Activision by Microsoft on anti-trust grounds. This week, a District Court denied the FTC’s injunction request. Microsoft is going to have to hurry in order to close the deal before the drop-dead date in the merger agreement. Missing the deadline would likely mean having to renegotiate with Activision for a higher purchase price.

Probably the last time we use this image as the FTC is about to exit.

DKI Takeaway: We think the judge made the right decision. This is a vertical merger and Microsoft doesn’t have anything close to monopoly power in the video game content business. Plus, they agreed to keep Activision’s best games available on competing platforms. Despite widespread criticism of the FTC, the commission had a valid point. A few mega-cap tech companies are buying everything that could possibly compete with them. This is a situation where the progressives in government made a principled argument.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.