The Reserve Currency Issue

DKI started writing about issues regarding the status of the dollar as the world’s reserve currency over a year ago, and it’s been a regular topic of commentary on the blog. This week, we’ll examine some of the key issues surrounding the long-term health of the dollar as well as recent economic weakness. Some of that weakness is real, and some is perceived. There were also earnings reported this week. And by the time you read this, it’s possible that First Republic ($FRC) will be the next bank to have failed, First Republic ($FRC) just became the next bank to enter receivership. DKI told subscribers last week that we weren’t touching the bank stocks. This is why and won’t be the last one.

Some of you will notice that this week’s 5 Things includes 7 Things. That’s either because DKI provides excellent value, or because we can’t count. You decide. Let’s get started:

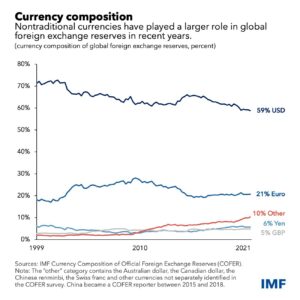

1) The Dollar is Losing Share:

People tend to talk about the dollar’s status as the world’s reserve currency as a binary thing. It doesn’t work that way in reality. Currencies rise and fall in power and influence over the course of years or decades. While a collapse is technically possible, it’s not the most likely outcome. The US has been financing massive budget deficits for decades with dollar-printing. In addition, stress between this White House and the Saudis has broken the petrodollar in favor of China’s yuan. Finally, impounding Russian dollar-denominated reserves informed the world that the US is only a reliable partner if you remain in the good graces of Washington DC, a place that changes leadership every few years.

This graph from the IMF shows the dollar losing share for decades.

DKI Takeaway: We support the effort to contain the Russian military, but take issue with the design of policies that hurt the US more than they hurt Russia. Countries all over the world are remaking trade arrangements to de-dollarize. Even without a threatened BRICS currency to compete with the dollar, more countries are trying to do business in their own currencies. DKI has a detailed post explaining the issue. Non-paywalled article is here.

2) Much of the Money Leaving the Dollar is Going to Gold:

As countries attempt to hold less exposure to an over-printed dollar and demand greater independence, much of the money leaving the dollar is going into gold. Central bank purchases of gold have hit their highest level in over half a century.

We see big spikes just before the US abandoned the gold standard, and more recently as the US started monetizing larger deficits.

DKI Takeaway: The US dominated the post-war Bretton Woods arrangement partly by holding more gold than anyone else. The US then over-printed the dollar leading to other countries exchanging their dollars for gold. This caused President Nixon to close the gold window. Massive Congressional budget deficits combined with Federal Reserve monetizing (more over-printing) that excessive spending are incentivizing other central banks to exchange dollars for gold again.

3) Consumer Confidence is Declining:

The Consumer Confidence Index fell from 104.0 last month to 101.3 indicating growing consumer concern regarding business and employment conditions. The short-term Expectations index fell from 74.0 to 68.1. Anything under 80 indicates people think we’ll have a recession within the next year. This is one area where Main Street and Wall Street agree.

This graph showing a decline in consumer confidence comes from The Conference Board.

DKI Takeaway: DKI has been writing about shifting inconsistent consumer and economic data since last November. While unemployment is still low and consumers are still spending, it looks like small recent changes in the labor market combined with two years (so far) of high inflation are taking their toll on consumer sentiment.

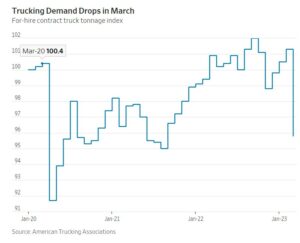

4) It’s Not the Supply Chain:

Many people in government have claimed that recent inflation was the result of Covid-related supply chain disruption. There’s no question that Covid caused supply issues, but DKI has been on record as saying the primary cause of inflation over the last two years has been excessive currency creation (running the digital money printing presses). The response to Covid was to hand out money (creating demand) while preventing people from going to work (limiting supply). Regardless of the prior cause, the supply chain issues are now “resolved” and that’s a bad sign for the economy.

Graph from the Wall Street Journal.

DKI Takeaway: Months ago, DKI noted that demand for goods had fallen off a cliff and that inflation was coming from the services side of things. Services inflation tends to be more sticky and harder to reduce. That decline in trucking demand is a sign of a weaker economy and lower interest in purchasing future goods.

5) GDP Falling – Indicating Stagflation?:

DKI, along with James Davolos of Horizon Kinetics, correctly called the coming stagflation in February of last year, and that’s what happened (regardless of whether the White House wants to admit it or not). On Thursday, we got the first quarter GDP report of an anemic 1.1%. It’s positive, but not great and is declining.

Jack Farley astutely points out declining and below-expectations GDP combined with a high increase in prices. More stagflation on the way?

DKI Takeaway: The situation might not be as bad as it seems. DKI always adjusts government-reported statistics like CPI and GDP for obvious inaccuracies. Mish Shedlock points out that “inventory adjustments subtracted 2.3% from GDP”. This is a temporary change in inventory stocking that can swing short-term GDP from one quarter to another. Adjusting for this, GDP would have been 3.4%, a much healthier number.

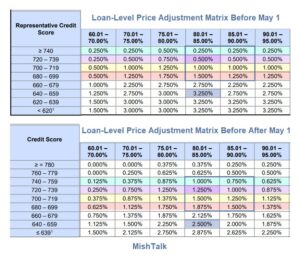

6) Higher Mortgage Rates With Higher Credit Score?:

The US government has just issued new regulations raising fees on homebuyers with high credit scores in order to lower fees for homebuyers with low credit scores. I did a Twitter Space with economist, Mish Shedlock, and attorney, Phil Kessler (also a member of the DKI Board of Advisors) to discuss the implications of the policy as well as the legality. Mish thinks this is terrible policy which will have negative impacts unforeseen by the officials who implemented it. Phil thinks a legal challenge on the issues of equal protection and/or the takings clause has a high probability of success. I agree with both of them.

Great chart by Mish showing the change in pricing based on credit score.

The DKI Takeaway: It might sound good to say we support homeownership in general and that the wealthy can subsidize the less fortunate without hardship. However, people with credit scores in the high 600s/low 700s range are more likely to be responsible than rich. In addition, this policy will affect the incentives and incomes of homebuilders, realtors, and anyone selling to someone with the “wrong” (read responsible) credit score. It’s bad policy that will have a bad outcome.

7) Enova International ($ENVA) Has Great Quarter Which is Misunderstood:

Enova crushed earnings expectations beating its own guidance and announcing adjusted EPS a full $.20 above analyst estimates. Originations were over $1B again with revenue up 25% vs last year. Most importantly, despite this high growth, marketing expense as a percentage of revenue fell and credit quality improved vs the prior quarter.

The DKI Takeaway: The stock fell the next day due to disappointment that the company only guided to a slight increase in earnings from 2Q ’22. The second quarter is typically seasonally weaker than the first quarter, and despite improving revenue and profitability, the stock is trading at 6x earnings. The overall environment for Enova’s business right now is positive, and management announced they have retained outside advisors to try to improve shareholder value. The stock has recovered much of recent losses and is up substantially from where DKI recommended it. If this is of interest to you, reach out at IR@DeepKnowledgeInvesting (took out the .com to reduce spam).

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.