Central banks shatter irony meters as a Fed Governor insists they have unlimited dollars, but it’s Bitcoin that has no value. Not to be outdone, the European Central Bank lowers interest rates and at the same time, warns of coming higher inflation. They’d be better off admitting they’re trapped than saying nonsensical things in public. It won’t matter as no one anywhere has plans to cut spending, the only thing that could address the financial disasters facing Japan, the EU, the UK, and the US. (China’s finances don’t look great either.) In the past month, we’ve seen announcements from Google $GOOG, Amazon $AMZN, and Microsoft $MSFT to buy nuclear energy to power their AI data centers. Do you know how to benefit from this in your portfolio? Backing this demand for new power was Taiwan Semiconductor $TSM which beat earnings estimates due to increased sales of AI chips. A student asks about the value of Bitcoin leading DKI to conclude that a random finance student at the University of Tennessee has more common sense than a Governor at the Federal Reserve. Well done, Vols.

This week, we’ll address the following topics:

- Fed Governor proclaims the Fed has an infinite amount of dollars, but says Bitcoin is worth zero. No idea if he is aware he broke the irony meter.

- Google $GOOG and Amazon $AMZN both invest in more nuclear energy to power AI data centers.

- Taiwan Semiconductor $TSM beats earnings indicating demand for AI chips continues to grow. Great news for Nvidia $NVDA and nuclear power producers.

- The European Central Bank cuts rates and warns of more inflation. We’d send them an irony meter, but it was already broken by the Fed.

- Student question on why Bitcoin has value. University of Tennessee finance students asking good questions.

Intern Andrew is back from a fantastic trip with his grandfather lightening the load on Intern Alex. They’re both smart high-capacity people, and it’s always nice to have the team back at full strength.

Ready for a week of delusional monetary policy and silly comments? Let’s dive in:

1) There’s an Infinite Amount of CASHkari’s Ignorance at the Federal Reserve:

Neel Kashkari once assured us that there’s “an infinite amount of cash at the Federal Reserve.” However, because the printing presses at the Fed work overtime, the U.S. dollar continues its steady decline in purchasing power. It’s no surprise: When you print money like it’s going out of style, it eventually does just that. Last week Kashkari stated, “Bitcoin remains worthless after twelve years”. Yet here we are: Bitcoin has become the 6th largest monetary asset in the world. (Credit to @1basemoney for that.) It turns out that scarcity has value after all. While the dollar inflates into oblivion, Bitcoin’s hard cap of 21 million coins means that, unlike fiat currency, it can’t be debased.

Mr. Kashkari & the Fed could do a better job ensuring the dollar doesn’t become worthless.

DKI Takeaway: Each new dollar dilutes the value of the dollars before it, making savers feel the sting of inflation. But Bitcoin offers an alternative; a decentralized, fixed-supply asset that doesn’t rely on central banks or printing presses. So, while the Fed keeps conjuring cash out of thin air, Bitcoin quietly stands as a hedge against the very system Kashkari is propping up. The only thing that seems “worthless” these days is the idea that endless money printing doesn’t have consequences.

2) Google’s Nuclear Energy Investment Fuels DKI’s Bullish Stance on Uranium:

Google $GOOG has followed in the footsteps of its fellow Magnificent 7 peers, Amazon $AMZN and Microsoft $MSFT, becoming the third big tech firm to make a significant investment directly in nuclear energy. Google plans to purchase power from Kairos, an energy company specializing in small modular reactors (SMRs), which have become particularly appealing due to their lower initial investment costs, location flexibility, and safety profile. The boom in artificial intelligence (AI) is the main driver behind these Mag 7 companies investing billions into data centers to power their AI models. Joining the positive headlines for the week, Amazon is heading up an equity investment in a nuclear company along with Ken Griffin of Citadel.

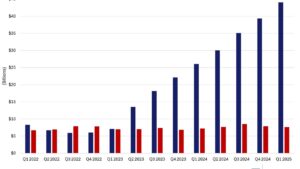

Graph from the World Nuclear Association and Bloomberg. Red is unfulfilled demand.

DKI Takeaway: Nuclear energy projects take a long time to get approved and built. However, this isn’t necessarily a concern for our uranium position. When we look at long-term nuclear power growth trends against the incoming and current supply, it’s clear that supply isn’t growing fast enough to meet the rising demand, as shown in the graph above. For the past 70 years, fear has been the biggest limitation to nuclear energy adoption, but that fear is gradually fading as nuclear power becomes crucial for AI development and non-carbon power generation. With growing demand and lack of supply growth, we expect continued increases in the price of uranium. To learn more about our uranium position, check out our current recommendations or watch our webinar with Enrique Abeyta @enriqueabeyta on $TLN from this past May.

3) TSMC Crushes Earnings:

Taiwan Semiconductor Manufacturing Company $TSM, the world’s largest advanced chip manufacturer, reported revenue of $23.5 billion, up 36% year-over-year and 12.9% from the previous quarter. To finish the year, they expect strong revenue growth, with projections between $26.1 billion and $26.9 billion. On Wednesday, $ASML, a fellow chip manufacturer, reported disappointing earnings and guidance, which shocked the market. However, on Thursday, an earnings beat from TSMC reaffirmed the market’s positive sentiment on AI, driving the entire market up early in the day on expectations of further AI growth.

Strong growth from TSMC for the same reasons fueling Nvidia’s revenue growth

DKI Takeaway: Nvidia’s $NVDA chips are manufactured by TSMC giving the market positive guidance for $NVDA’s next earnings report. Overall, AI-oriented growth companies have the potential for huge returns. The entire sector is seeing large cash inflows and new competitors. In the midst of this competition, we cannot overlook the big players like Google, Amazon, Apple, and Meta, who will not allow startups to undercut their potential market share. Overall, the AI space race is moving fast. Regardless of which companies are the long-term winners, they’re going to need a lot of power generation capacity to keep all those new chips running.

4) ECB’s Rate Cut: Desperation and Confusion Unveiled:

Christine Lagarde, President of the European Central Bank (ECB), has slashed rates by 25 basis points, dropping them to 3.25%. Yet, at the same time, she issued a stark warning: “Inflation is expected to rise in the coming months.” This contradiction raises a critical question: why cut rates when inflation is expected to heat up? The answer is clear: the ECB is drowning in debt. This move isn’t just a reaction to slowing growth; but rather, a desperate signal that the central bank is trapped by the eurozone’s unsustainable debt levels. The ECB’s once powerful tools are losing their bite. It’s now caught between two impossible choices: more inflation, or higher interest expense leading to more inflation. Europe’s debt burden is crushing, and the ECB’s actions are beginning to look wildly incoherent. The euro is being deliberately debased, sacrificed in a futile attempt to mitigate the debt crisis. With the bank’s credibility hanging by a thread, and inflation on the rise, the future of the euro looks increasingly fragile.

Source: CanvaAI

DKI Takeaway: Two conclusions are glaringly obvious: central banks are flailing, trapped by too much debt and incoherent monetary policy; or worse—intentionally debasing the euro to delay the inevitable. For the past two years, DKI has been writing and speaking about the same dilemma facing the Bank of Japan which has barely raised rates and seen the yen continue to fall in purchasing power. We’re facing the same issue here in the US which we’ve explained in our eBook, Couter-Intuitive Inflation: Can Federal Reserve Rate Hikes Cause Inflation. As always, we remind you that even when the news is “bad”, there are opportunities to make money. DKI’s portfolio is well-positioned to benefit from coming high inflation. If you want help with that, reach out here.

5) What are You Buying When You Invest in Bitcoin?:

One of the questions we received this week from a University of Tennessee student was: “What am I buying when I invest in Bitcoin? Is it like the dollar or more like an asset such as gold?” This is an important question, as Bitcoin is often stigmatized as “worthless” with no tangible backing. However, unlike the dollar, Bitcoin has a limited supply, as shown in the graph below. Bitcoin is a new technology. Thousands of years ago, when people first started using gold as a store of value, there was likely hesitation in adopting it, as with all new technologies. If you want to know how lightly regarded gold was, at one point, the price of peppercorn per ounce was higher. The key difference with Bitcoin is that it stores a record on the blockchain. When you purchase Bitcoin, your ownership is recorded in the blockchain’s code, and the record is key to your store of value.

The dollar supply looks like the inverse of this graph.

DKI Takeaway: Bitcoin functions as a store of value like gold due to its limited supply and increasing demand. However, one advantage Bitcoin has over gold is its liquidity and ease of tradability, which make it more accessible than investing in physical gold. One of the most important aspects of owning Bitcoin is self-custody, which gives you complete control over your holdings, as exchange stability can sometimes be an issue. Check out our thread on X to learn more about the self-custody process. In the era of rapidly declining dollar value, assets like gold and Bitcoin are essential hedges against future inflation. We also think it’s interesting to pose this contra-question to people who think Bitcoin has no value: Why are you comfortable with the value of the dollar? It’s backed by “faith and credit”. To own the dollar, you’d have to have faith that the credit of an organization with $36 trillion in debt is secure. You don’t have to be a Bitcoin “maxi” to take a 1% position. Alternatively, you could watch Neel Kashkari and the Fed debase your dollars into oblivion.

Here’s the video version: https://www.youtube.com/watch?v=O1bJXbK5E5I

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.