We lead off with the news that 1Q GDP came in both negative and below expectations. That, combined with a higher-than-expected inflation number, had investors worried about stagflation again. DKI thinks the data is less significant that some others do. President Trump’s tariffs provide the US with a big win and a potential loss (depending on your point of view). IBM commits to investing $150B to produce mainframes and quantum computers in the US. China slows shipping of cheap goods to US ports while the two countries talk about getting together to talk about tariffs, balanced trade, mercantilism, and fentanyl shipments. Super Micro Computer lowers revenue guidance by a lot They claim its just because orders were delayed by a quarter. We’ll see in a few months. In our educational section, we explain portfolio rebalancing and give you the reasons you might want to do it, and why some investors don’t.

This week, we’ll address the following topics:

- 1Q GDP is negative. Want to know why we don’t think it matters?

- IBM commits to spending $150 billion to expand US production of mainframes and quantum computers. Tariffs FTW.

- China cuts exports to the US leaving ports with less business. Tariffs FTL (depending on your point of view).

- Super Micro Computer cuts revenue guidance. It seems like every other week, we have a different forecast for AI infrastructure spending.

- Educational topic: What’s portfolio rebalancing and should you do it?

In a very short time, Cashen Crowe got himself up to speed and has taken over ownership of the 5 Things. DKI has had other interns get to this level, but none that were in their first year of college. Much of what you’re about to read represents his research and efforts. Nice job, Cashen!

1) GDP Meh:

The market traded down Wednesday morning on a worse than expected 1Q GDP estimate. GDP was reported at -0.3% which was below expectations of -0.2%. In addition, the Personal Consumption Expenditures figure came in 0.1% above expectations. While the market had a strong reaction, I don’t think this news is significant.

1) The stagflation story highlighted by lower growth and higher inflation is based on 0.1% deviations from expectations. The US economy is far too large and its economy too complicated to measure with that level of accuracy.

2) While I am often critical of the press, they nailed the big part of today’s GDP miss. Consumers who are worried about higher future prices due to tariffs bought plenty of goods in advance of expected higher prices. Imports subtract from GDP. This was inventory stocking by both retail and consumers and is a huge, but one-time event.

3) One thing that the gold community is focused on, but the press isn’t is massive inflows of physical gold into the US. I read a report last week suggesting that gold imports are so high that the last six months of inflows are equal to about 13% of the amount of gold stored in Fort Knox. Those imports also subtract from GDP, but I don’t know that I’d worry much about the impact on the economy from importing physical gold.

4) DOGE efforts to cut wasteful spending (whether your preferred party likes them or not) subtract from GDP. The US method of calculating GDP is so inaccurate that if the government wastes money, it’s treated the same as actual production.

5) As DKI predicted last summer, Congress will keep overspending. We said that would be the case whether team red or team blue won last November’s election. Team red claims to be the party of fiscal sanity, but their only goal is to slow the continual growth of spending by a small amount. The government is still taking on massive amounts of debt and that’s not going to stop. The reason I keep referring to our finances as a Potemkin economy is because our GDP numbers are determined by Congressional overspending and financed by debt and inflation. The productive private economy has been in recession for a long time and that’s been masked by government transfer payments and higher interest expense. Today’s negative GDP print tells us very little about the health of the private sector.

Pre-tariff stocking and buying is what caused the huge drop at the right.

DKI Takeaway: When I look at the -0.3% GDP number, I don’t think it tells us much about the actual health of the economy. That number was pulled down by a massive surge in inventory stocking, pulled down further by gold imports, and increased by government spending on consumption (not production). While the headlines will provide plenty of fodder for politicians and their friends in the press to attack each other, none of this changes my view on any of DKI’s portfolio companies or the wisdom of hedging out equity exposure.

2) IBM Makes Major US Tech Commitment:

IBM recently announced its plan to invest $150 billion into US manufacturing over the next five years to expand its American mainframe and quantum computing systems. To avoid supply chain shocks, IBM decided to deepen its US manufacturing footprint. The new mainframes to be produced in the US will heavily rely on AI systems. IBM notes that scaling AI isn’t just about software; but also, the underlying hardware which US manufacturing will be able to produce.

Having domestic production capacity insures IBM against geopolitical conflict. Investors reflected their approval of the new announcement. Even with a commitment of this size, the R&D capital expenditures don’t look to be too much of a burden for the company.

Most of the people criticizing tariffs ignore this.

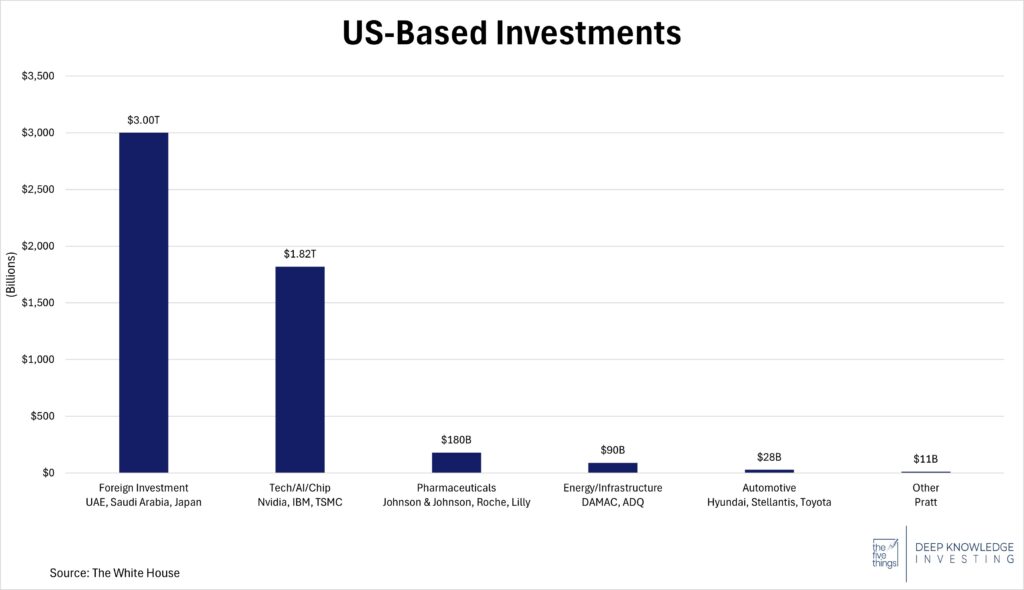

DKI Takeaway: Excluding investments made by foreign countries, the total list of planned US-based investments during President Trump’s second term has reached a total of roughly $2.1 trillion. This is a contrast from the past few decades and is creating a new and necessary level of restructuring in critical technology production. New high level technology production is the best possible outcome from tariff-driven reshoring. Reversing years of industrial capacity migrating to international locations will create thousands more highly skilled jobs and create technology clusters America hasn’t seen in years.

3) China Cuts Back:

Tariffs now have west coast ports bracing for abrupt changes in incoming shipments from China. There is an expected 35% decline at the Port of LA. Some reports have even described the port of Seattle as a “ghost town” due to a decline in shipments. Adding to this, Beijing recently ordered airlines to stop any new Boeing jet orders and even began rejecting delivery of orders already placed. Boeing is a huge exporter, and has adjusted to these market changes by delivering to other waiting customers.

These two developments following the steep tariffs on Chinese goods show China’s reluctance to work towards a trade deal. China’s retaliation isn’t just affecting the US. As the world’s largest exporter, China’s choice to seek new buyers has the ability to change the landscape of trade across the globe. A decoupling between the US and China isn’t the most likely outcome right now but it is something being discussed.

Ships aren’t lining up right now.

DKI Takeaway: With such large numbers of imports in the past few weeks from major retailers stocking up before tariffs, new import levels could drop even more. Experts think some retailers only have two months of regularly-priced inventory left, and future potential shortages and price hikes have American consumers worried. China is saying they will suffer economic hardship to avoid capitulating to the US. They may get the opportunity to prove their sincerity.

4) SMCI Slashes Revenue Guidance: Does it Matter?

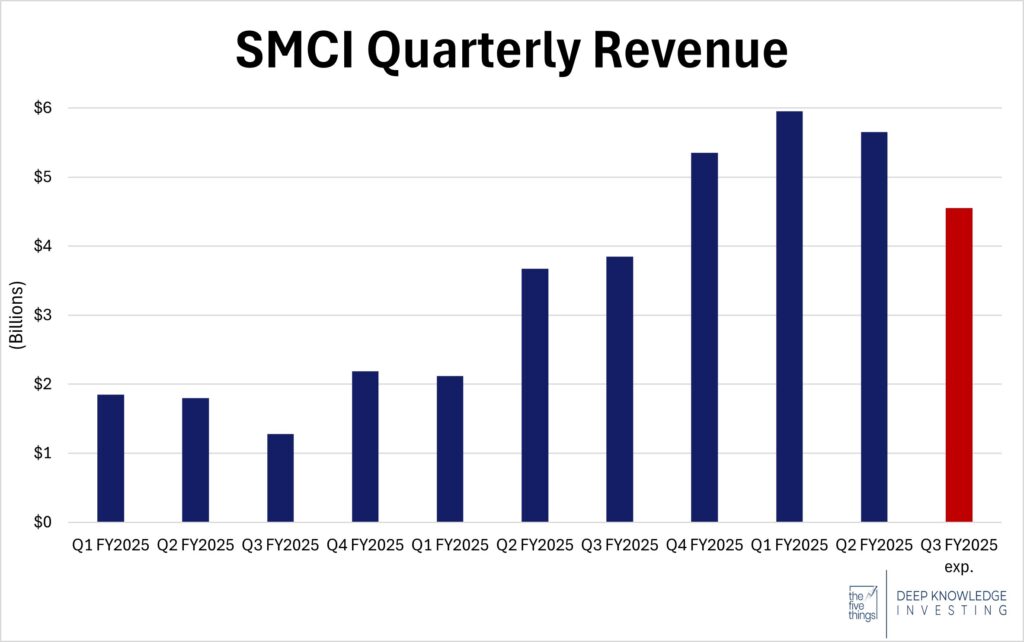

Super Micro Computer, Inc. recently cut its 3rd fiscal quarter revenue guidance, forecasting a 17% decline. $SMCI blamed “delayed customer platform decisions” for pushing sales out to the following quarter and reduced estimates. The news again raises the question over whether big tech companies will reduce data center spending in the coming months. In another three months we’ll see if business is declining, or if orders were just pushed out by a quarter.

A revenue decrease of that magnitude will take down the stock.

DKI Takeaway: As quarter-to-quarter spending in the AI and data center sector remains volatile, stock prices continue to jump in both directions. Often, the entire sector trades as a group. Fluctuations in performance will continue to have outsized impact on the high-multiple AI stocks. AI demand is real, but revenue timing is not immune to affecting company performance, despite superior level infrastructure positioning.

5) Educational Topic: The Importance of Rebalancing Portfolios:

A common mistake some long-term investors make when building a portfolio is believing that it can be left alone indefinitely. However, market movements over time will shift the balance of asset classes changing risk exposure. As investors age, their risk tolerance often decreases which should be reflected in their portfolio. This can be done with a process called rebalancing, where an investor will realign the weightings of assets in a portfolio.

Many investors will choose to make this rebalance on a scheduled basis, maybe yearly, or whenever a threshold for asset class deviation is met.

Growth stocks or alternatives like Bitcoin and gold? Why not both?

DKI Takeaway: Some investors choose to take the target-date fund route, which is a type of mutual fund or ETF designed to automatically rebalance based on a specific target withdrawal year. Further from the target date, the fund will favor stocks with higher growth potential and higher risk, shifting towards investments perceived to be less risky as it moves closer to the target date. Rebalancing doesn’t only have to pertain to target withdrawal dates but can also be done to adjust geographical or industry risk.

Rebalancing forces investors to sell assets that have appreciated in relative value to buy ones that have depreciated against the rest of the portfolio. Many traders will object to this as they prefer to let their “winners run” and to cut losers quickly. DKI doesn’t think there are best practices in this matter, and that your portfolio should reflect both your current risk tolerance as well as the opportunity set for your best investment ideas.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.