Lots of tariff-related non-news this week. The CPI was up by 0.1% which was far from the disaster predicted by fiat economists. Energy has been a tailwind and may become a headwind. Shelter may become a tailwind. Either way, prices of goods are not rising as feared. The press report on the jobs report is technically correct and highly inaccurate. Were they misreading or misleading? You decide. Gold overtakes another the euro as the world’s second largest reserve asset. DKI subscribers own gold as do I. Still in Lisbon, I only own enough euros to buy sparkling water. (When in Rome…) Either way, it’s a win for holders of the yellow rock and another loss for fiat. Micron Technologies announces $200B of new production capacity in the US and will start to make some of the world’s best memory chips here. One week after crying about potentially higher steel prices, GM announces $4B of new domestic production capacity. Will the fiat economists complaining about tariffs acknowledge that some of this is a positive for the US, American workers, and national security? Finally, one of our YouTube viewers asks about the difference between inflation, disinflation, and deflation. Great question. We’re on it!

This week, we’ll address the following topics:

- The CPI rises, but less than expected. The tariff Armageddon has yet to arrive.

- The press misleads on the jobs report. It’s higher quality than many think.

- Gold passes the euro as the world’s second largest reserve asset. Fiat takes the “L”.

- Micron Technologies and GM announce billions of dollars of new production capacity. We expect fiat economists to ignore this when complaining about tariffs.

- A great viewer question on the difference between deflation and disinflation is this week’s education topic. If the terms confuse you, we have you covered.

DKI Interns, Cashen Crowe and Samaksh Jain show up in force this week. I’ve been working with them on their writing. Just two weeks later, there is noticeable improvement. Their two favorite things to say are: “I have a question.” and “Sure, I can do that”. They’re smart, hardworking, and bring a positive attitude every day. Please celebrate their work by reading on.

Ready for another week of no tariff disasters? Let’s dive in:

1) CPI Rises but Less Than Fiat Economists Warned:

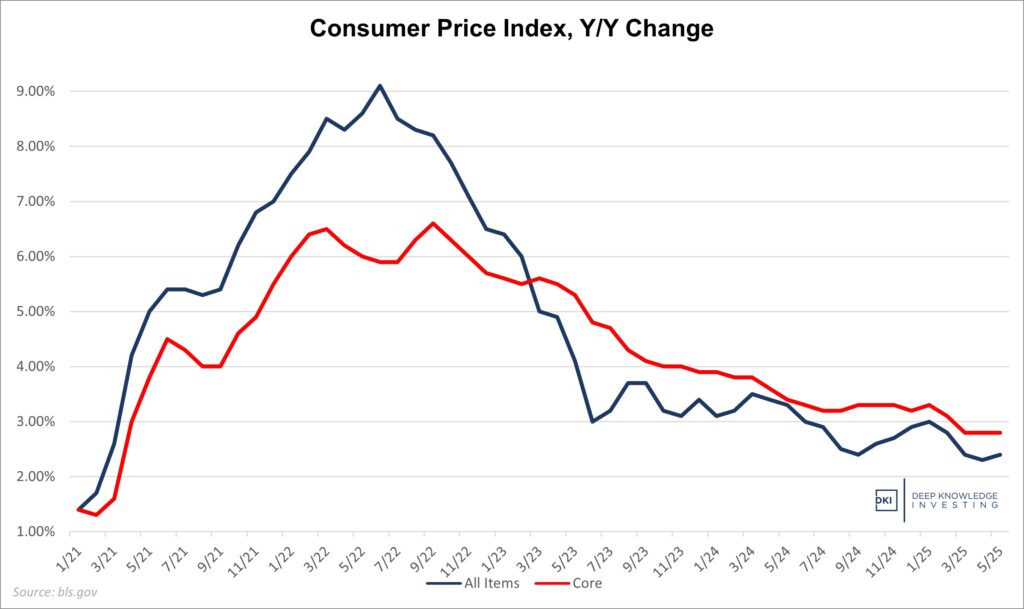

Last week, we got the May Consumer Price Index (CPI) report which showed an overall increase of 2.4% for the last year and up 0.1% for the month. The annual number is up 0.1% from April and in line with expectations. The monthly is down 0.1% and below expectations. The Core CPI which excludes food and energy was up 2.8% vs last year and up 0.1% for the month. That’s consistent with the prior month and 0.1% below expectations. Energy has been a tailwind. That may reverse. Shelter, a fancy word for housing, has been a headwind. That may also reverse.

The all-items was up 0.1%. That’s not the tariff disaster expected by fiat economists.

DKI Takeaway: This month, we had a 0.1% increase in the all-items CPI and no change in the Core CPI. While price changes can take time to move through a complicated supply chain, the tariff-related carnage fiat economists have been carrying on about has not appeared – at least yet. It could happen in the future, but as of now, there is little evidence of the massive price increases that many feared.

I agree with current consensus that the Fed will keep rates unchanged at the next meeting. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected higher future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise. Full DKI analysis available here.

2) The Press Misreads the Jobs Report:

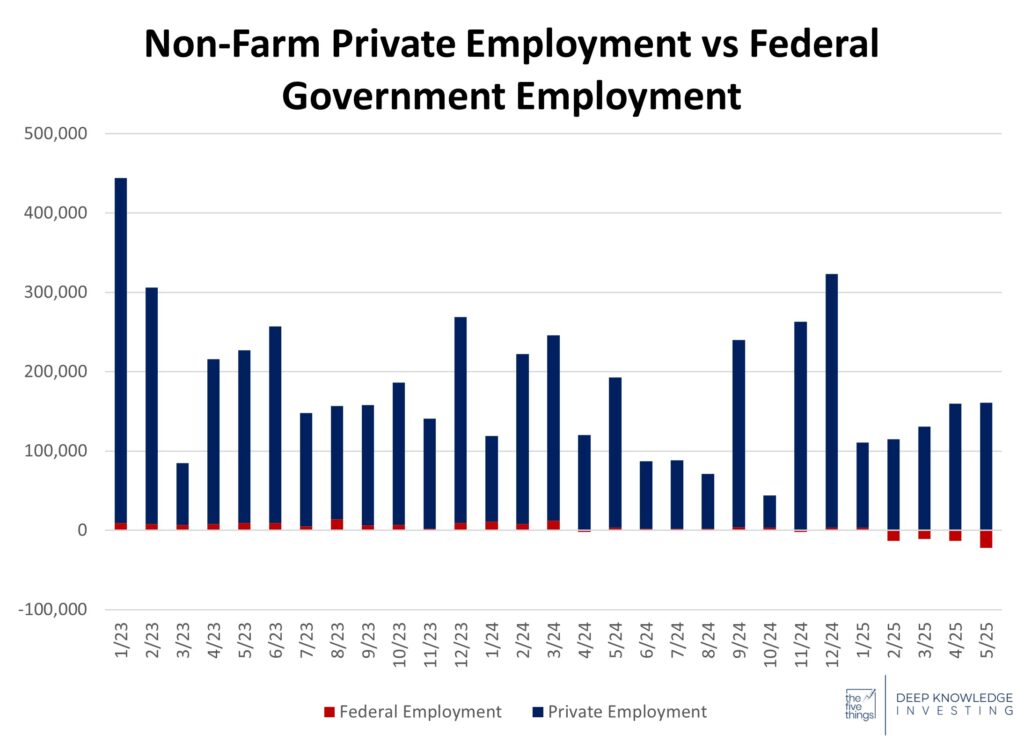

Last week, the Bureau of Labor Statistics (BLS) released the May jobs report. NBC derisively reported that the “U.S. added 139,000 jobs in May as the labor market steadily cools”. They correctly noted that new jobs exceeded estimates for 120,000, but that this was a decline from the prior month’s 147,000. Mark Twain wrote about the misleading nature of statistics. DKI agrees that NBC is using the right numbers, so why are we skeptical about the reporting?

By cutting government jobs, the Trump Administration is helping the economy and hurting their own economic reporting.

DKI Takeaway: The prior White House increased government employment in a manner that made the employment statistics look artificially positive. DKI likes to delineate between jobs in the productive private sector and the ones in government which are a tax on citizens. Last month, government employment was down by 22,000 jobs meaning the private sector added 161,000 jobs. The market generally views beating estimates by a few thousand jobs as significant. In this case, the Trump Administration is reducing wasteful government jobs which helps the economy, but hurts their reporting. Last month, the private sector beat the 120,000 estimate by more than 40,000 jobs. That’s significant.

3) Gold Passes the Euro as World’s Second Largest Reserve Asset:

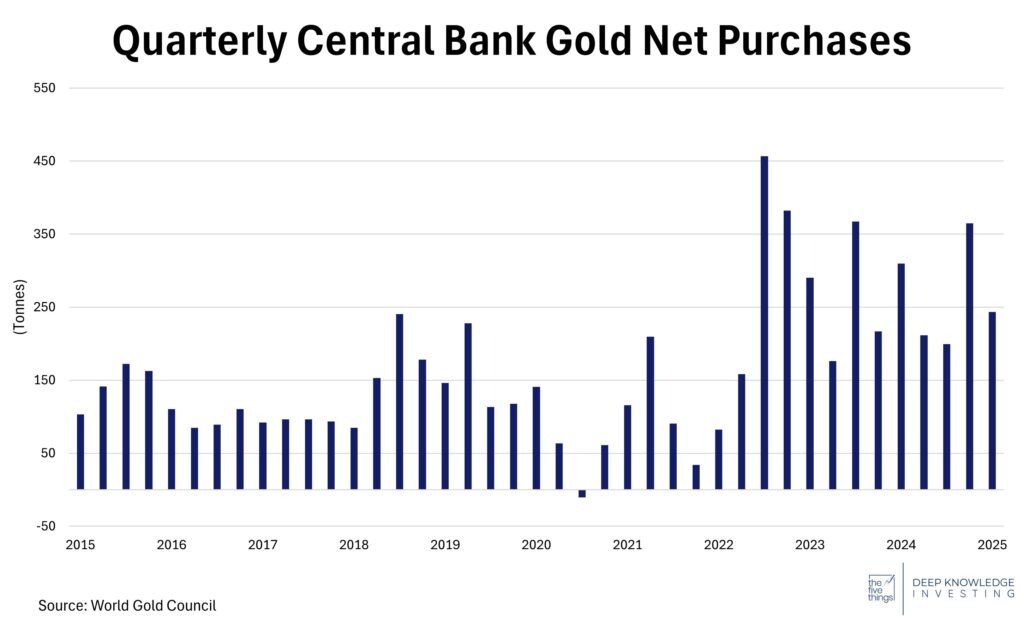

Gold overtook the euro to become the second-largest reserve asset held by central banks, accounting for roughly 20% of foreign reserves versus the euro’s 16% according to the European Central Bank’s 2024 data. Driven by geopolitical concerns and a ~30% rally in bullion prices (in excess of $3,400/oz), central bank demand reached record levels. Purchases exceeded 1,000 tons for the third consecutive year. Emerging-market economies like Poland, Turkey, India, and China were among the largest buyers, seeking “portal assets” that preserve value across monetary regimes. While gold now approaches the reserve levels of the Bretton Woods era in tonnage, it remains price-volatile and less liquid than currency reserves, factors central banks must weigh against its geopolitical insulation and the inevitable decline in fiat purchasing power.

Gold is an asset that isn’t someone else’s liability. Worldwide reliance on fiat is fading.

DKI Takeaway: Gold’s climb past the euro marks more than a redistributive shift. It reflects deepening concern over the future value of constantly debased fiat currencies, and the resilience of the international financial system. Central banks are signaling that asset diversification now includes geopolitically safe-haven hedges alongside traditional currency holdings. This trend isn’t a flash in the pan; rather, it’s a systemic recalibration. (DKI has been warning for years that the BRICS drive towards de-dollarization is something we take seriously.) Gold is regaining its status as a strategic reserve asset, with price momentum and reserve-driven demand potentially reinforcing each other.

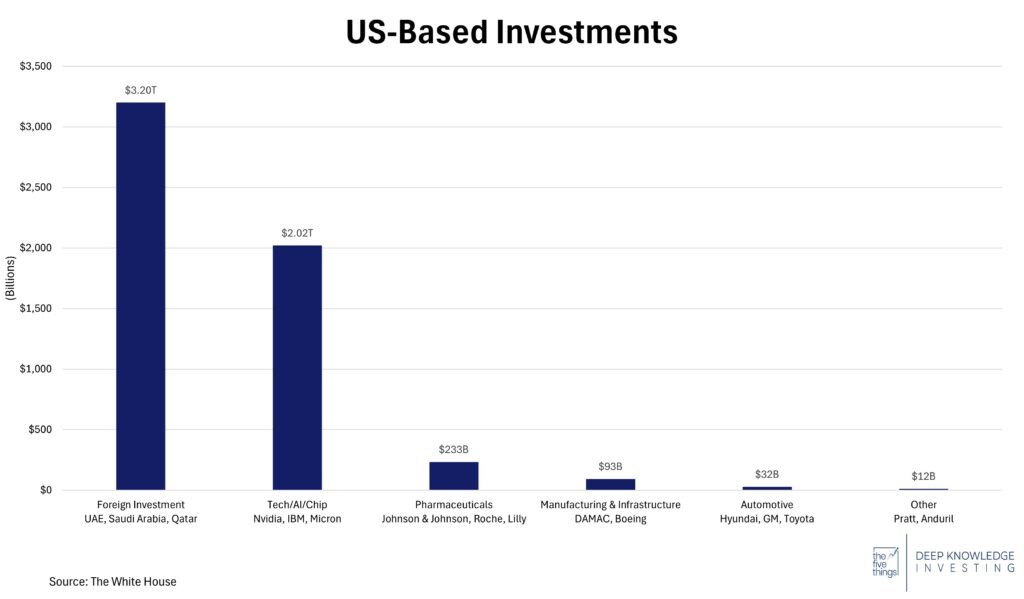

4) Micron and GM Buy-in on US Manufacturing:

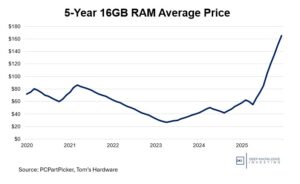

The US-based memory chip maker, Micron Technologies ($MU), announced a planned investment of $200 billion into American manufacturing and R&D, expanding plans to build fabrication plants in Idaho and New York. This investment is aimed at meeting the surging demand for Micron’s DRAM chips and raising US output to 40% of DRAM production. With much of the expansion being AI-driven, the company’s efforts to increase domestic production will return market-leading chip production to the US.

General Motors ($GM) also announced a $4 billion investment into US manufacturing, upgrading three US vehicle plants to boost output of both electric and gas vehicles. By moving around model production locations and keeping the Detroit factory dedicated solely to electric vehicles, GM plans to avoid tariffs and take advantage of tax credits for domestically assembled EVs. This is a positive development just one week after the company complained about tariff increases potentially affecting steel prices.

It’s going to take years to reverse decades of outsourcing, but this is a great start.

DKI Takeaway: In addition to $6.4B secured from the CHIPs Act, Micron’s investment will help reshore key manufacturing to avoid future tariffs and to avoid geopolitical-based supply line disruptions. With GM, the investment reflects strong demand, but refocusing one of the plants on entirely electric vehicles causes potential hesitation due to less-than-expected demand for EVs. However, the plan to hedge this bet with additional investments in internal combustion engines is a relief to many investors. With both companies looking to take advantage of tax and government incentives, the investments continue to support the rise of a new manufacturing cycle.

DKI has tried to show both sides of the complicated tariff issue. These increases in domestic production capacity and the new jobs that will follow is something the fiat economists complaining about tariffs should consider. What if increases in domestic capacity offset the decreased demand for foreign goods? What if more Americans working in technology and quality manufacturing jobs decreases employment and welfare use? Honest evaluations require dynamic analysis.

5) Educational Topic: Understanding the Major Market Indices:

Some common economic terms that describe changes in the price of goods and services are inflation, disinflation, and deflation. Understanding each helps investors, businesses, and consumers anticipate how the value of money and assets may change.

Inflation is a continued increase in the overall price of goods and services, meaning the same item will cost more than it did at a previous point in time. While inflation can be caused by reduced supply of goods and services, the real definition is an expansion of the money supply leading to reduced purchasing power of your currency. While inflation can benefit some, like debtors and the people who have first access to new capital, it is a horrible hidden tax that reduces the living standards of most people.

Disinflation is a change in the rate of change, or a second derivative. For those of you who didn’t love your high school calculus, it’s just a fancy way of saying less inflation. For example, an inflation rate of 9% going to 3% is disinflation. Prices are still rising, but at a slower rate.

Deflation is a decrease in the price level, or negative inflation. Fiat economists try to sell the populace on inflation by scaring people into believing that inflation is necessary for economic growth. This is not correct. I imagine that no one reading this would be upset if they went to the grocery store and found that prices were lower. Technology is characterized by constant deflation; providing better products each year while the prices of last year’s models fall. Yet, sales of consumer electronics increase constantly. Put us on team deflation and remind the Federal Reserve that its mandate is “stable prices”. That’s a 0% inflation rate.

Bad, better, best.

DKI Takeaway: When inflation rises faster than salaries, people experience reduced purchasing power. They may have more dollars, but can purchase fewer goods and services making them effectively poorer. The most common measure of inflation is the CPI, which DKI reports on every month. The CPI looks at a “basket” of goods that the average American uses and compares prices over time to gauge inflation. We remind readers that stable prices encourage savings and investment that grow the economy, and that inflation encourages YOLO consumption and debt which lead to long-term poverty. Say it with us: #EndTheFed.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.