President Trump and his team are energetically remaking both the Federal government and our trade relationships. The pace of change has been incredible, and depending on your political preferences, you’re either thrilled or appalled. As always, we’ll try to bring you a clear view on policy and leave the politics to others. As I write this, President Trump is commenting on reciprocal trade agreements. It turns out that some of the biggest critics of his trade policies have the most restricted access to their own markets. Trump then threatened the BRICS coalition not to try to replace the US dollar as the world’s reserve currency. DKI notes that this threat is likely to be counterproductive AND that it confirms our long-held concern that more than half the world wants to reduce exposure to the dollar. Remember two weeks ago when DeepSeek’s announcement meant that no one needed to buy Nvidia $NVDA GPUs or build more energy infrastructure? The US AI hyperscalers announced massive increases in AI-related capital expenditures. They’re putting a lot of capital behind the idea that there are no shortcuts in AI, a point DKI made in a recent version of the 5 Things. President Trump also wants to start a sovereign wealth fund. Before you cheer, please remember that this proposed fund will be used to influence public and private companies, and will one day be run by representatives of the political party you dislike. Finally, we address China’s economic difficulties. Malinvestment has led to overcapacity and deflation.

This week, we’ll address the following topics:

- The free and fair-trade dilemma. Is the complaining about potential US trade barriers coming from BRICS countries reasonable?

- Potential BRICS competitor to the Dollar. People keep telling me it won’t happen, but President Trump is still trying to head off the possibility.

- Tech spending growth on AI infrastructure. Silicon Valley is indicating they don’t believe DeepSeek’s claims and are putting hundreds of billions of dollars behind that opinion.

- The U.S. sovereign wealth fund. We have mixed feelings unless we can get Nancy Pelosi to manage it1. Then, we’re all in!

- China’s worsening deflation. Too much manufacturing and too much mal-investment.

This week’s 5 Things again represents fantastic work by DKI Intern, Josh Reaves. He selected topics, researched well, wrote clearly, and produced graphs. His 5 Things YouTube thumbnails are already legendary. DKI wants to welcome fellow Haslam College of Business (University of Tennessee) student, Finley Roland. Finley joins us as a digital marketing intern. Her intensity, capability, and drive had her fly through the interview process with everyone consulted uniformly recommending bringing her onboard. Just days in, she’s already making meaningful improvements to the previously-neglected Instagram page. Great job, Finley!

Ready for a week of international trade and currency news? (Too clickbaity?) Let’s dive in:

1) The Free and Fair-Trade Dilemma:

In 2024, the United States recorded its largest goods trade deficit of $1.2 trillion, with much of the imbalance stemming from BRICS nations (Brazil, Russia, India, China, and South Africa).

To reduce this trade deficit, President Trump has proposed tariffs of up to 100% on all goods from BRICS countries if they pursue a common currency that would compete with the U.S. dollar. The trade deficit with China alone was $295 billion, highlighting the disadvantage American manufacturers face against Chinese competitors. BRICS nations have employed various measures to maintain their dominance in export markets. The People’s Bank of China has manipulated its currency (Renminbi/Yuan), keeping their currency weak at 7.3 per U.S. dollar. This makes exports cheaper and more competitive than U.S. goods. India also maintains high tariffs on luxury cars and other premium products, limiting the U.S.’s ability to export to their growing market.

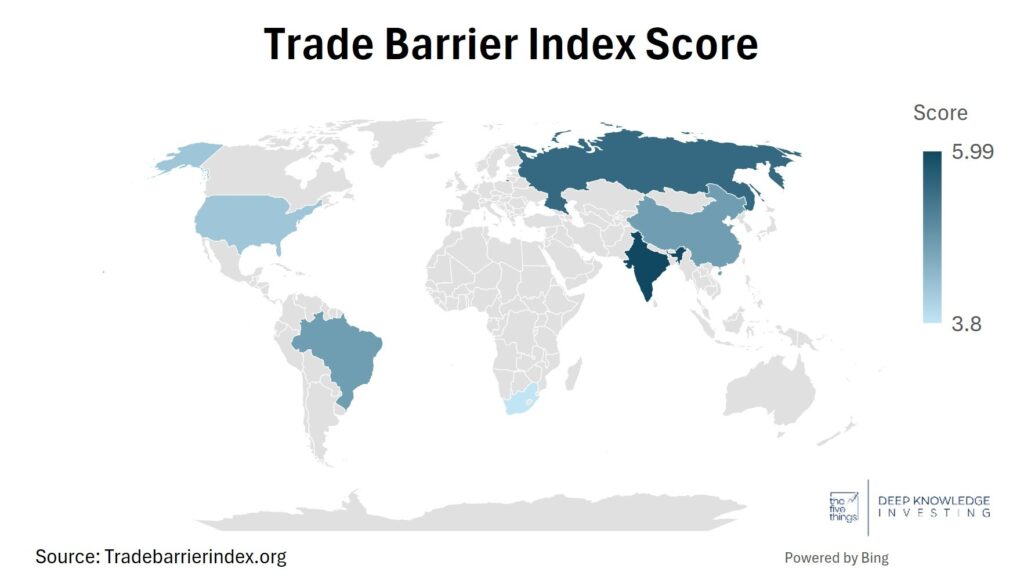

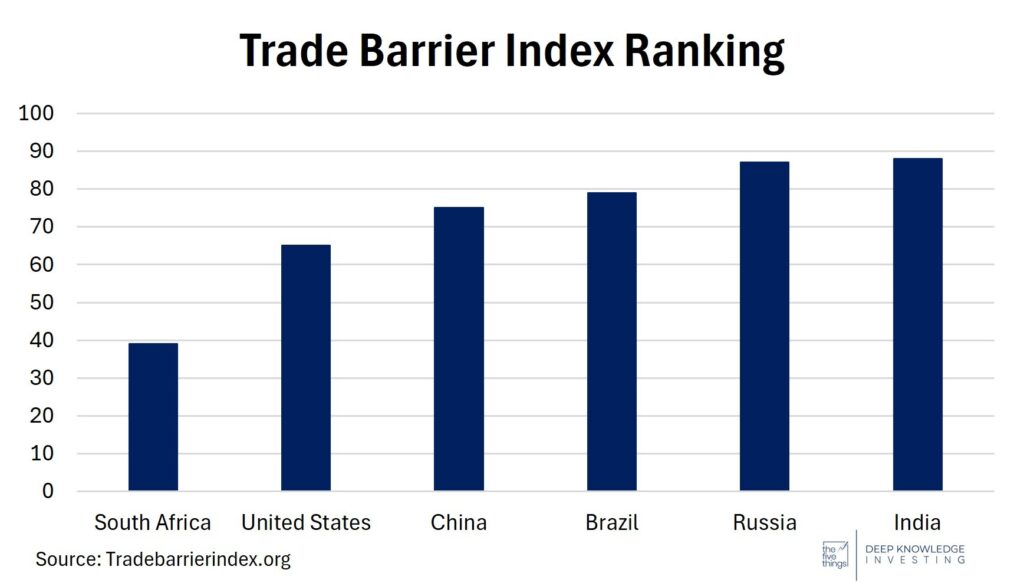

The US is no angel in this category, but many of the countries complaining are less open to our products than we are to theirs. Data from tradebarrierindex.org.

Higher is worse. Russia and India at #87 and #88 out of 88 countries listed.

DKI Takeaway: While this strategy risks potentially pushing prices higher in the U.S., President Trump is aiming for more reciprocal trade agreements in an effort to restart US manufacturing and restore balance to our economic relationships. He’s aiming for a zero-goods trade deficit which may be optimistic. By enforcing reciprocal trade policies, he’s hoping domestic production will become more competitive and self-sufficient.

While many of President Trump’s tariffs have been politically oriented, these policies are aimed at supporting US manufacturing. While they tend to be unpopular in finance circles and at discount retailers which like cheap goods from overseas, for workers who are desperate for high-paying manufacturing jobs, they hope to restart entire local economies. What do you think? Is it in the interests of the US to reduce the ever-increasing goods trade deficit?

2) Potential BRICS Competitor to the Dollar:

For the past couple of years, the BRICS nations (Brazil, Russia, India, China, and South Africa) have been discussing the idea of creating a new currency to compete with the dominant U.S. Dollar and attempt to replace it as the world’s reserve currency.

This idea continues to gain traction as the U.S. Dollar is increasingly being used as a political and international relations weapon. The U.S. has utilized dollar-related sanctions to compel compliance and punish economies abroad. DKI has written and spoken at length about how the anti-Russian sanctions were ineffective in removing Russia from Ukraine. Even worse, those sanctions made clear that access to dollar reserves and the dollar system relied on remaining in compliance with the wishes of Washington DC, a place that changes leadership and policies every few years.

BRICS is seeking an alternative to reduce exposure to the dollar by contemplating transacting in a completely different currency. This is motivating President Trump to threaten to impose 100% tariffs on BRICS nations if they move away from the dollar.

Can the dollar stay on top, or will it be de-throned by BRICS or Bitcoin?

DKI Takeaway: For the past two years, I’ve been having polite discussions and debates with economists and market strategists who insist that BRICS has no path to creating a reserve currency that could succeed let alone challenge the dollar. My response has been that the dollar has been losing share for years, and that when more than half the world’s population is looking to exit the dollar, it’s going to lead to a future demand problem whether the solution is a BRICS currency or something else. President Trump’s serious threats to impose 100% tariffs indicates he agrees with DKI that dozens of countries exiting the dollar system is a problem for the US.

While Trump is attempting to take an aggressive stance on the issue to prevent BRICS from developing a new currency, his actions may inadvertently encourage it. Much like the Streisand effect, where attempts to prevent something lead to the opposite effect, President Trump’s 100% tariffs could encourage BRICS to expedite their de-dollarization efforts. The more the US treats the dollar as a weapon to compel compliance, the greater the incentive for other countries to reduce their reliance on it.

3) Tech Spending Growth on AI Infrastructure:

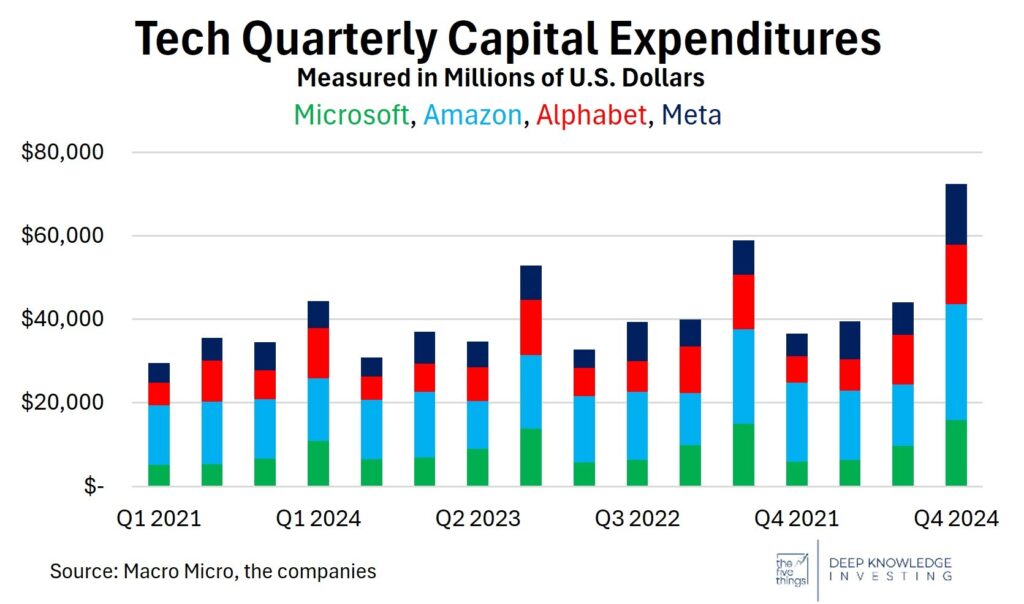

In recent years, the “Magnificent Seven” (Apple $AAPL, Microsoft $MSFT, Alphabet $GOOGL, Amazon $AMZN, Nvidia $NVDA, Meta $META, and Tesla $TSLA) have significantly increased their capital expenditures (capex). These expenditures have primarily been driven by investments in AI and cloud computing. Leading this charge are Microsoft, Google, Meta, and Amazon, which are projecting over $215 billion in capital expenditures for 2025, a 45% increase from the previous year’s spending.

Alphabet (Google) has announced a significant capex increase this year, rising from $52.5 billion to $75 billion, as it strives to stay competitive in the AI race against Microsoft and Meta, both of which continue to invest heavily in AI. Meta and Nvidia are also ramping up their AI-related investments. Meta plans to spend over $60 billion in 2025, while Nvidia is injecting more capital into AI semiconductor production to meet surging demand.

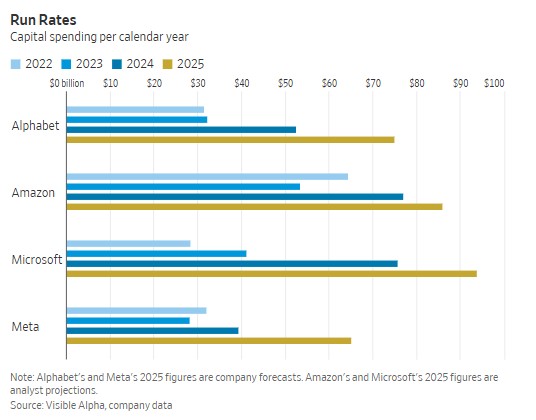

Excellent graph from WSJ shows hyperscalers intend to increase AI spending.

Historical growth leading to projected future growth.

DKI Takeaway: This commitment by U.S. tech giants to AI and cloud computing underscores their determination to maintain leadership in the evolving AI landscape. These expenditures highlight how crucial these sectors are as potential long-term revenue drivers (assuming they can figure out a business model), requiring substantial upfront investment to scale operations. This willingness to sacrifice short-term profits for higher capex signals just how vital AI is to these companies and the broader economy. More significantly, increasing already huge spending levels by additional tens of billions of dollars indicates that Silicon Valley doesn’t currently see DeepSeek’s claimed $6MM of computing cost on top of $50MM of hardware as either credible or a path to long-term success. Don’t sell your power generation stocks yet. The DKI portfolio has substantial energy investments including a large amount of capital dedicated to the idea that nuclear power will be the carbon-free reliable energy source of the future (again).

4) The U.S. Sovereign Wealth Fund:

On February 3rd, President Trump signed an executive order calling for the creation of a Sovereign Wealth Fund. The order directs the Secretary of the Treasury and the Secretary of Commerce to develop a plan for the fund’s funding mechanisms, investment strategies, structure, and governance.

Sovereign wealth funds in Europe and the Middle East, as well as state-managed funds in the U.S. like Alaska’s, are successful examples of funds that create long-term wealth from natural resources. This new fund is expected to leverage over $5.7 trillion in federal assets on its balance sheet. With President Trump’s push for expanded drilling for oil, these reserves could also be monetized by the fund. President Trump has also expressed interest in using the fund to acquire TikTok, either in whole or in part. Potentially, it could own stocks, private equity, or digital assets like Bitcoin.

The biggest investing opportunity lies in the two secretaries appointed to oversee the fund’s creation. Secretary of the Treasury Scott Bessent and Secretary of Commerce Howard Lutnick are both known for their public bullish sentiment toward gold and cryptocurrency. Given their prominent support for these assets, it is reasonable to expect that a portion of this new fund will be dedicated to gold and/or cryptocurrency.

DKI has concerns about a US sovereign-wealth fund, but some countries make it work.

DKI Takeaway: DKI has mixed thoughts about this. We acknowledge that some sovereign wealth funds have been successful in other countries. Further, we’d prefer to see the US government investing rather than spending. Our reservations relate to the fact that our government isn’t great at managing its money, and the idea of a national hedge fund is concerning. For those of you on the left side of the aisle, you should expect to see a lot of carbon-based energy investments. How do you feel about that? For those of you cheering President Trump and Secretary Bessent, how long do you think it will be before a future White House decides to use the fund to pressure companies into DEI commitments and start investing in uneconomic assets considered socially desirable? We also point out that the Federal government and all 50 States have massive pension funds which already serve a similar purpose. It’s not the worst idea we’ve ever heard, but the potential for misuse is big league. What would it take to get us fully onboard? Appoint Nancy Pelosi as fund manager and head trader, and we’ll all be able to retire worry-free.

5) China’s Worsening Deflation:

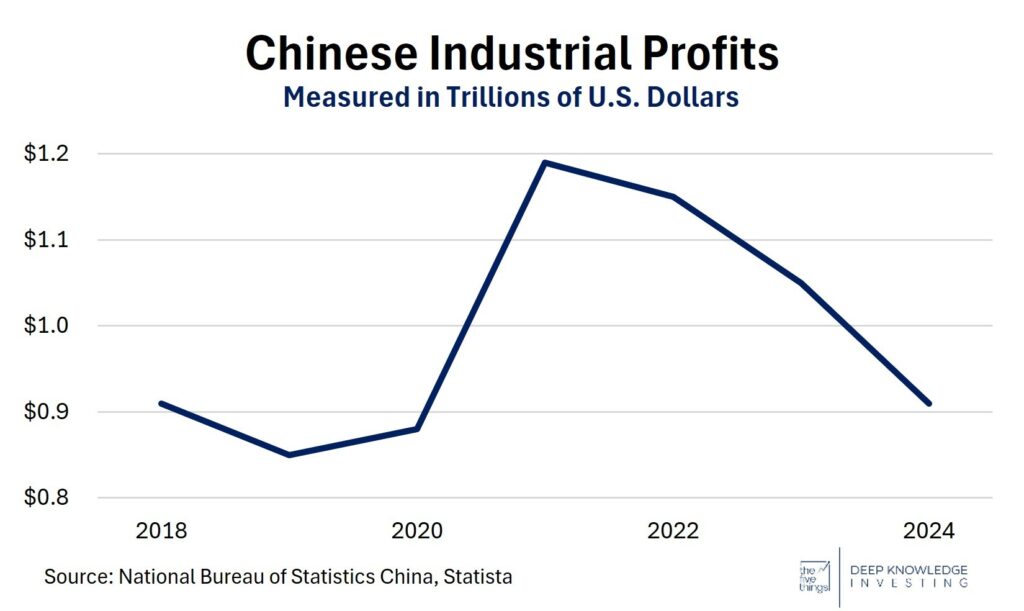

China’s deflationary crisis has been underway for six consecutive quarters with signs of problems beginning in 2022. The crisis continues to deepen, prompting the CCP to inject stimulus to reverse the trend.

This crisis reached a new milestone last year, with Chinese industrial profits falling 3.3% in 2024, following a 2.3% decline in 2023. This marks the third consecutive year of profit declines, reflecting persistent deflation. A 54.6% drop in metal smelting and rolling, a 45.1% decline in minerals, and a 22.2% decrease in coal make the trend clear. In contrast, necessities like heat production, oil and gas, and textiles saw reasonable increases, highlighting a shift in demand away from discretionary goods. Profits for state-owned firms suffered the most, falling 8% in late 2024 compared to a 1% decline for private firms.

China has its economic strengths, but it’s not going great right now.

DKI Takeaway: While China’s problems with the overvaluation, overleverage, and overbuilding of real estate are well-known, overcapacity in industries like automobiles, solar energy, and steel has created an intensely competitive market, driving continuous price cuts. Major manufacturers like Xinte Energy project over $500 million in losses due to market saturation. This downward pressure fuels a self-reinforcing deflationary cycle, exacerbated by high debt levels and consumer expectations of further price drops. China’s worsening deflation will send ripples through equity and commodity markets that are reliant on Chinese growth.

1For those of you who don’t track such things, it is legal for members of Congress to trade on inside information. Nancy Pelosi is legendary for making incredibly timely and profitable trades. Members of both parties do this, but no one better than Pelosi. While legal, DKI believes it’s unseemly to make money trading in this way and would like to see the law changed.↩

Here’s the video version https://www.youtube.com/watch?v=2LygN30w050&t=1784s

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.