Strong Economic Data Disappoints the “Pivot People”

This week is the “Fed Edition” of the 5 Things. All the economic data that came out this week made a Fed pivot to lower interest rates less likely and further in the future.

We also congratulate DKI Intern, Dylan Kogan, who did the heavy lifting on this edition while I was speaking at the Investment Management Symposium at the College of Charleston. Very nice work, Dylan!

1) Fed Minutes Say What They Told Us a Month Ago:

On Wednesday, the Federal Reserve released the minutes from its last meeting. While they did acknowledge the slowing rate of inflation, the Fed indicated it’s looking for reduced inflation across a broader range of prices. We interpret that to mean they’re focused on the red-hot services sector which was above 7% last month and is being affected by higher wages. The plan is to increase unemployment to reduce wage pressures.

The DKI Takeaway: As DKI has been saying, the Fed “pivot” isn’t here yet. We should expect rates to be higher for longer including multiple additional increases. The DKI portfolio is well-positioned for this environment. You can find that here.

2) Homes – Lower Prices, Higher Mortgage Rates, Unaffordable Monthly Payments:

U.S. existing home sales weakened for the 12th consecutive month in January, although at a reduced pace. According to the National Association of Realtors, the number of units sold fell to 4.0 million, a 36.9% decrease from last year. Consensus estimates had been for an sales of 4.1 million homes. The leading cause of falling home sales are the Fed’s rate hikes, which have made monthly mortgage payments more expensive. Last week, the average rate on a 30-year fixed mortgage rose to 6.88% according to Mortgage News Daily.

DKI Takeaway: Many realtors believe home sales are bottoming out. We think that as mortgage rates continue to increase, affordability will also suffer. Right now, housing prices would need to fall another 30% – 40% or so just to get buyers back to 2021 monthly payment levels.

3) Manufacturing and Services Stabilize:

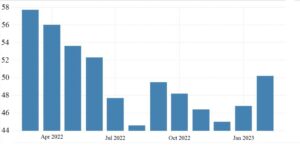

S&P Global’s Composite Purchasing Managers’ Index (PMI), which measures business trends across manufacturing and services sectors showed a stabilization of business activity in the United States after declining for the previous seven months. The composite rose to 50.5 from 46.8 in January. This beat market expectations of 47.5 (readings above 50 mean expansion). The uptick is largely due to the services sector, which saw significant expansion related to unseasonably warm weather. Meanwhile, manufacturing contracted, although at a reduced rate compared to previous month.

Composite PMI Data from S&P Global, Chart from Trading Economics

The DKI Takeaway: Although the PMI report appears strong, as wages continue to rise in a tight labor market, business expansion—particularly services which comprise a significant portion of the economy—may not be sustainable.

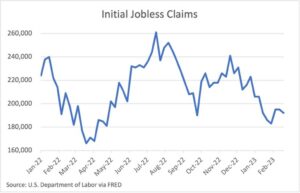

4) Initial Jobless Claims Delay “Pivot”:

Unemployment numbers from last week again point towards a tight labor market. Initial claims dropped to 192,000 from 195,000 for the week ended February 18th according to the U.S. Department of Labor. Economists expected 197,000 new filings. Since the start of the year, initial claims have remained below pre-pandemic averages.

DKI Takeaway: Despite the Fed’s contractionary policies and widespread layoffs, the demand for labor in the U.S. remains strong. That’s keeping services inflation high and will delay a Federal Reserve “pivot”. Powell is going to keep raising rates until unemployment rises.

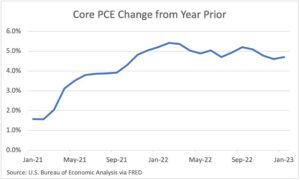

5) Consumer Spending Shows the Fed Isn’t Done Yet:

The Fed’s go-to gauge of inflation, the Core Personal Consumer Expenditure (Core PCE), rose 0.6% in January over the previous month and 4.7% over the previous year. This was higher than the 0.5% economists anticipated for the month of January. During the same month, spending rose 1.8% and personal income rose 0.6%, which as we mentioned in an earlier point poses an obstacle for those hoping for a Federal Reserve “pivot” to lower interest rates.

DKI Takeaway: The Fed is still not even close to claiming victory yet. We should expect Jerome Powell is serious about rates being higher for longer.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.