This post originally appeared on February 24, 2023

Introduction:

This is Part II of a multi-part piece. Part I is available here.

There is a lot of talk on FinTwit (financial Twitter) that the Federal Reserve has access to more data than we do. The implication is that because they have all of this information, we should trust them to know what they’re doing, and to have better insight into the economy than we have. We concede that the Fed has access to massive amounts of data. Either the data the Fed has is inaccurate, or the people who work there have no idea what they’re doing.

This is Part II on our series on Bifurcated Inflation. In Part I we explained why the consumer price index (CPI), the standard measure of inflation, is inaccurate. Some of that is unavoidable because every household experiences inflation differently and no one measure can capture that over time. Some of that inaccuracy is intentional as government officials change the calculation methodology to make inflation seem lower than it is.

In Part II we’re going to discuss the Federal Reserve, and how and why they’ve been so consistently wrong on the one thing that’s core to their job.

The Federal Reserve Should Not Exist:

Someone on a Twitter Space I recently hosted asked what would happen if there were no central banks. He wanted to know what else would help control inflation. We’ve been told for so long that the Federal Reserve is responsible for keeping inflation at a reasonable and low 2% rate that people think the Fed is the solution to the business cycle and inflation.

The opposite is true. The United States had great economic growth and low inflation when its paper money was backed by actual gold. The establishment of the Federal Reserve enabled the government to monetize huge budget deficits, and fund those with massive currency creation that is no longer backed by gold. The resultant increase in the money supply is the cause of the inflation you’re experiencing today.

The Federal Reserve has created trillions of dollars out of thin air in the last few years. That money is backed by “faith and credit” as well as the military. It’s not backed by gold or any commodities. Even the seemingly reasonable 2% inflation target will destroy 55% of the purchasing power of your money over a typical 40-year working career. That’s theft, and it is the existence of the Fed that enables the government to steal from you. They don’t take money out of your banking account; but rather, by making the money in your account worth less.

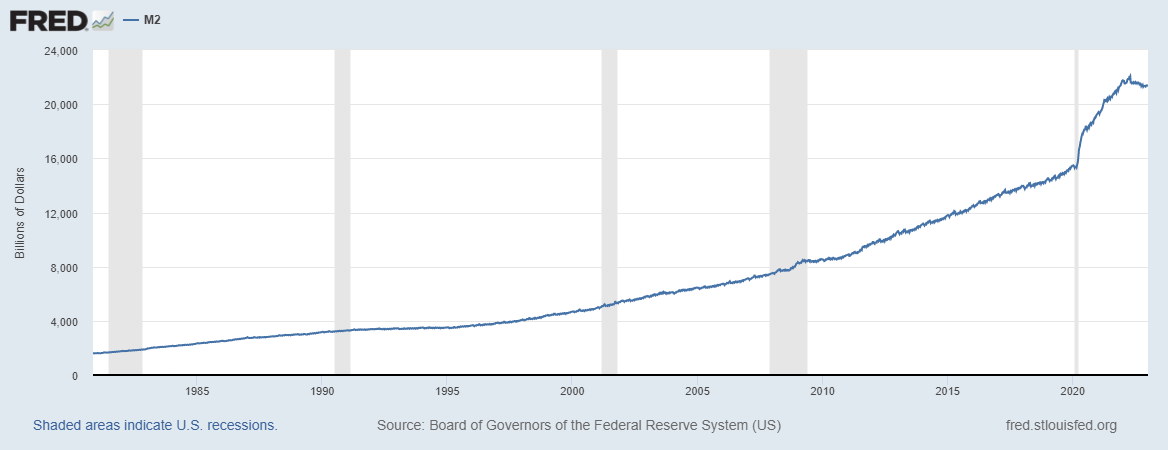

If you want to know the real cause of the huge inflation we’ve experienced over the last couple of years, just look at this chart which shows the increase in the money supply:

Going from $15 trillion to $22 trillion will affect prices.

The Federal Reserve Has No Idea What It’s Doing:

It’s our assertion that the Fed shouldn’t exist, that the currency shouldn’t be debased (see above graph), that Congress shouldn’t have the option to run multi-trillion dollar deficits every year, and that the correct and moral rate of inflation is zero. For the purposes of this article, let’s assume that the Fed should exist and that 2% inflation is a fine and proper goal. Even in that instance, it’s clear the people running the institution have no idea what they’re doing.

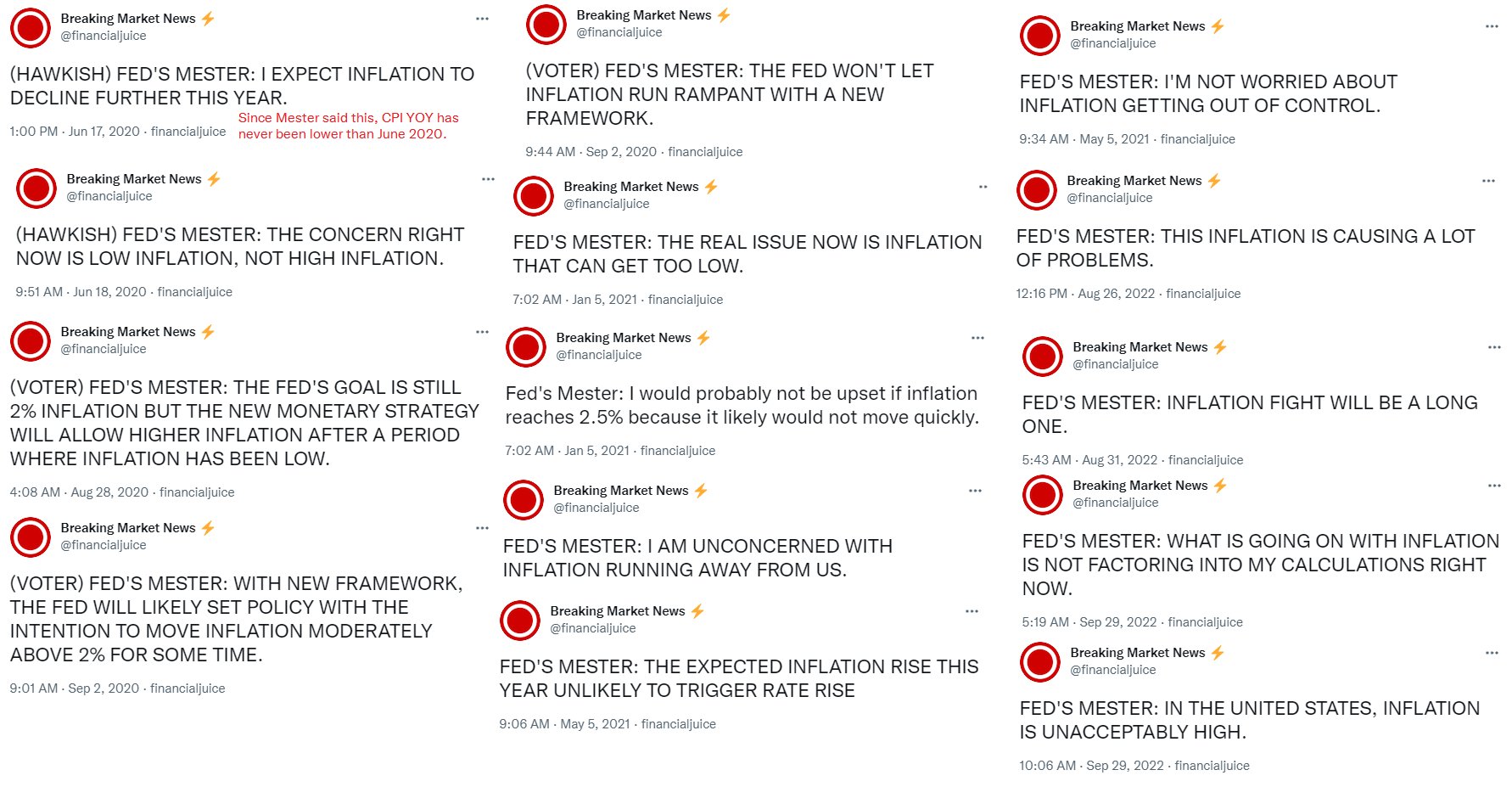

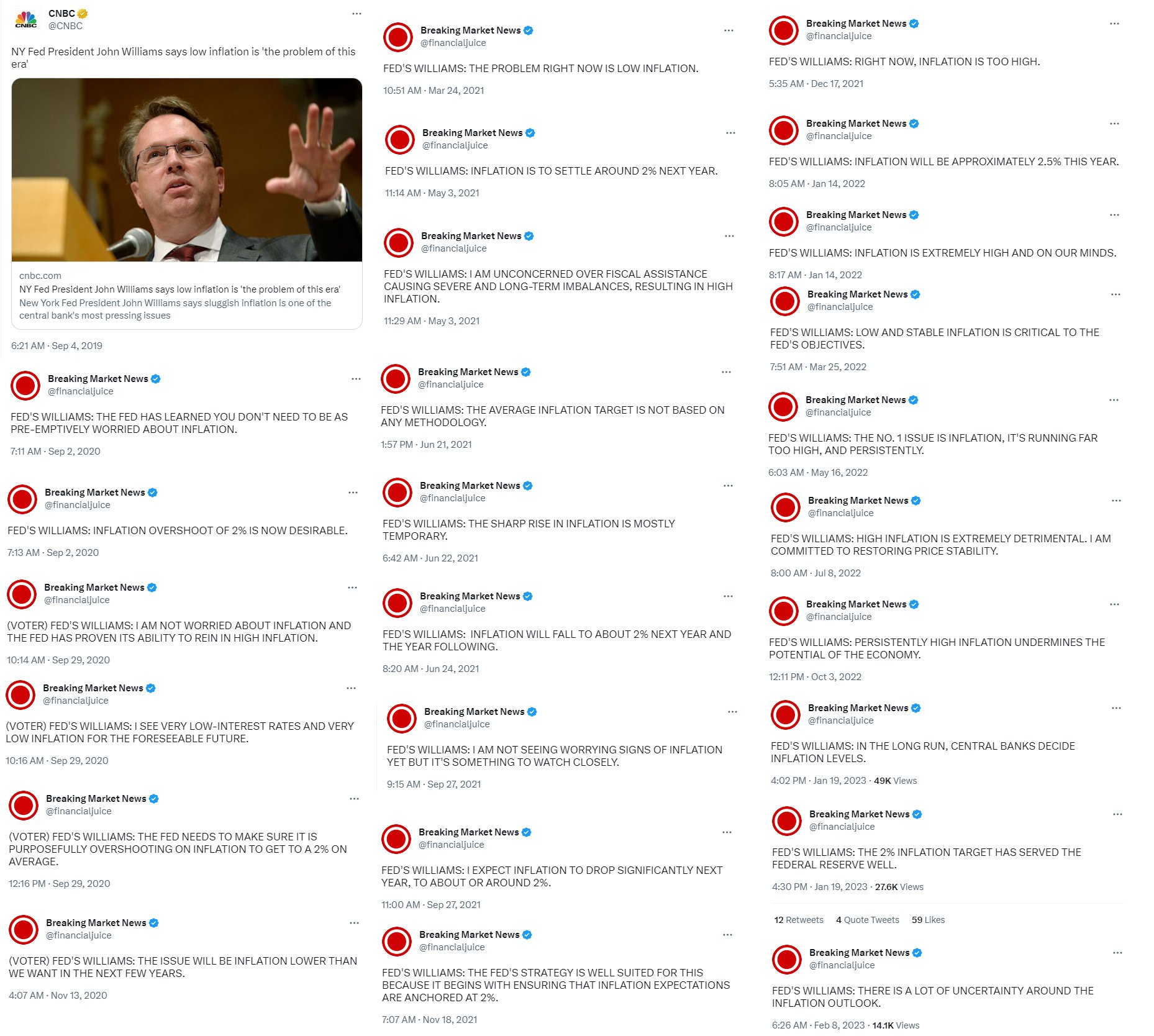

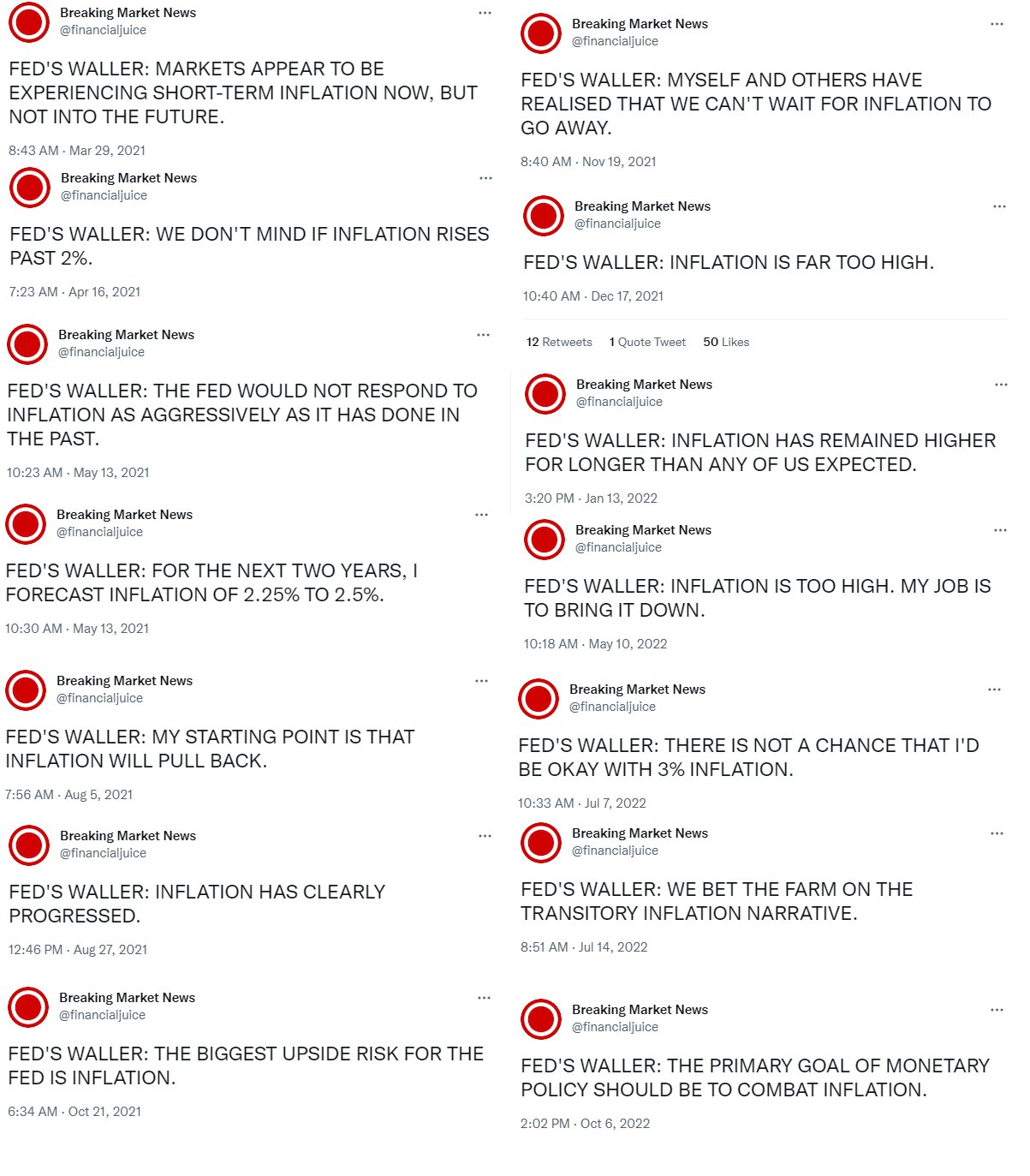

Fortunately, I have some help in making this point. Rudy Havenstein is one of my favorite follows on Twitter. The pseudonymous account is named after Rudolph von Havenstein who was the President of the Reichsbank when Germany suffered hyperinflation. Rudy (on Twitter) has cataloged the comments of many Federal Reserve Governors over the past few years. I’m only including 4, but if you check out Rudy’s Twitter account, you’ll see others. As you read these, please note the dates the comments were made.

Cleveland Fed President, Loretta Mester:

Atlanta Fed President, Raphael Bostic:

New York Fed President, John Williams:

Federal Reserve Governor, Christopher Waller:

For those of you who think that Rudy and I are cherry picking examples, I’ll point out several things:

- Because Federal Reserve Governors and Presidents love to talk in front of cameras, there are plenty of examples of this flawed thinking. I just chose four to save space.

- Even Federal Reserve Chairman, Jerome Powell, has admitted that he was far to slow to start raising interest rates and did so too cautiously at first.

- Almost every Federal Reserve vote on changes in interest rates is unanimous. No one took a stand for a better policy course. They all agreed to the path taken in recent years.

- The US just experienced the worst inflation it has seen in 40 years. The Fed got it very wrong with a lot on the line. They failed when it mattered most.

It’s Hard, But Not That Hard:

Forecasting an economy as large and varied as that of the United States is a difficult job. Given the consistently failed history of economic central planning, that’s why we prefer the “invisible hand” of the market to set the interest rate which is really the price of risk and time.

With that said, the way DKI was able to figure out inflation was a persistent (not transitory) problem months before the Federal Reserve did and half a year before the big Wall Street firms did was due to the M2 graph above. The US had a massive increase in the money supply at the same time that lockdowns were limiting production and supply.

We can only conclude that either the Fed has bad data, or that given good data, they don’t know what to do with it. The even scarier scenario is that with national debt of $31 trillion and close to $250 trillion of total liabilities, the US has debt and obligations that cannot be paid. The only way out of the problem is to cut entitlements which is politically impossible, or to let inflation eat away at the value of our future liabilities. We can not read the minds of the voting members of the Federal Reserve, but merely present as a possibility that they are acting with a different purpose and understand that high inflation is one way out of a problem.

The Reasons Sell-Side Research is Hopelessly Behind:

We were going to add a section on how and why the big Wall Street firms get these issues wrong as well, but we have covered that point recently.

Last year, we published a piece explaining why the sell-side was so slow in reacting to these huge events. Many of these firms have meaningful government contacts, or want to move to government positions. There is a constant pressure not to paint a negative picture as the politicians in charge don’t want to look bad and don’t want the market selling off during their tenure.

Our key point here is that even if the sell-side firms and big-name economists have the right answer, there’s a huge amount of pressure not to stray too far from the crowd and not to express an alternative point of view. We have no idea if these people are capable of interpreting the data correctly or not, but we do know it’s not in their interest to see the truth, understand it, or help you make money from it.

I’ve had conversations with firms who were interested in DKI research who told me they didn’t want their clients to see my negative view of the market last year. They were worried that clients would reduce assets held at their firm. They should have been worried about the performance of those client assets.

This is why despite last year being a historically bad for combined stock and bond performance which was caused by inflation-related interest rate hikes, none of the big firms were able to predict this. Even worse, it took some of them 8 months to even acknowledge that there was something wrong.

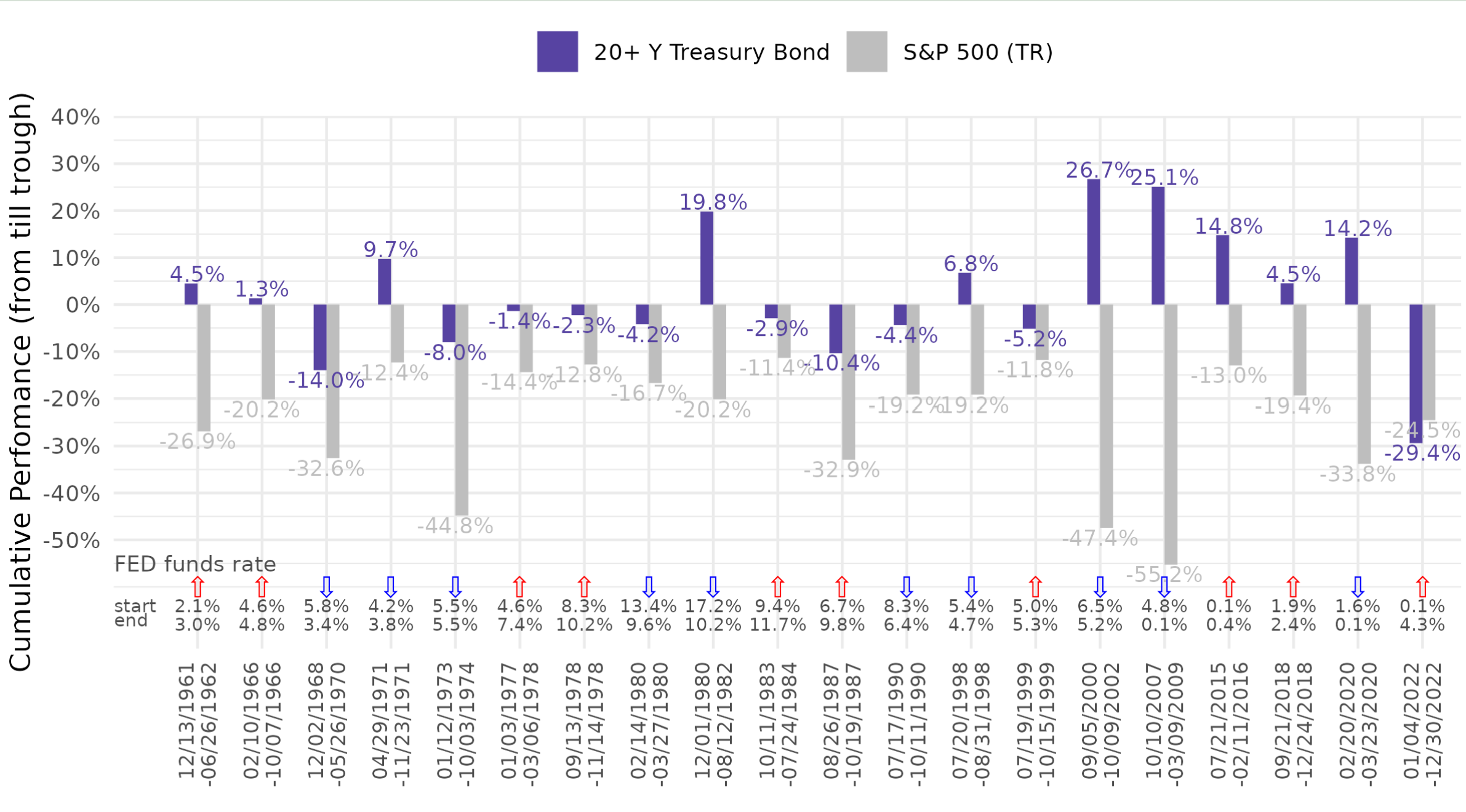

The below graph comes from Michael Gayed of Tidal Financial Group. Check out his fascinating Twitter account here. The purple lines are the return for 20-year Treasuries and the grey lines are the return for the S&P 500. Note that last year was remarkable for having a large drawdown for both. The fact that the big Wall Street firms didn’t react to this, and help clients protect their portfolios tells you they either can’t do the analysis, or it’s to their advantage to avoid telling their clients to reduce exposure. (We emphasize that signal-based funds like some of those at Tidal did not have the option to change their strategy as doing so would have violated their prospectus. Not every fund has the flexibility to make changes in real-time and should not do so.)

Conclusion:

We’ve shown you the issues with how the CPI is calculated and with the way prominent economists analyze it. Part III, will contain DKI’s view of what we think happens to the CPI from here.

We’ll have more on this in the coming weeks, but in the meantime, if you have questions about this subject or report, I’m reachable at IR@DeepKnowledgeInvesting.com.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.