Introduction:

In Part I and Part II, we covered several aspects of Inflation/CPI. It’s the single most important financial issue for 2022 so we explored the topic in depth. Cutting to the end, a combination of higher interest rates, comparisons with last year’s high CPI, and falling real estate and auto prices will ensure the CPI falls in 2023. However, given higher mortgage and loan rates, affordability on many items won’t improve even with lower prices. That will also be true for food and services.

Today, we’re going to cover bad government policy, and how Congress, the White House, the Federal Reserve, and other central banks created the problems we’re experiencing today. Just so I don’t have to cover it multiple times in this piece, this is not a partisan issue. Overspending and bad government policies are a problem for both political parties in the US.

Harmful Governmental Policies:

Most of the negative issues we’re seeing in the economy and markets have been caused by poor government and Fed policy. Let’s take a closer look at some of the key decisions that led to inflation, reduced affordability, and expectations for a recession in 2023.

The Underlying Cause of Inflation:

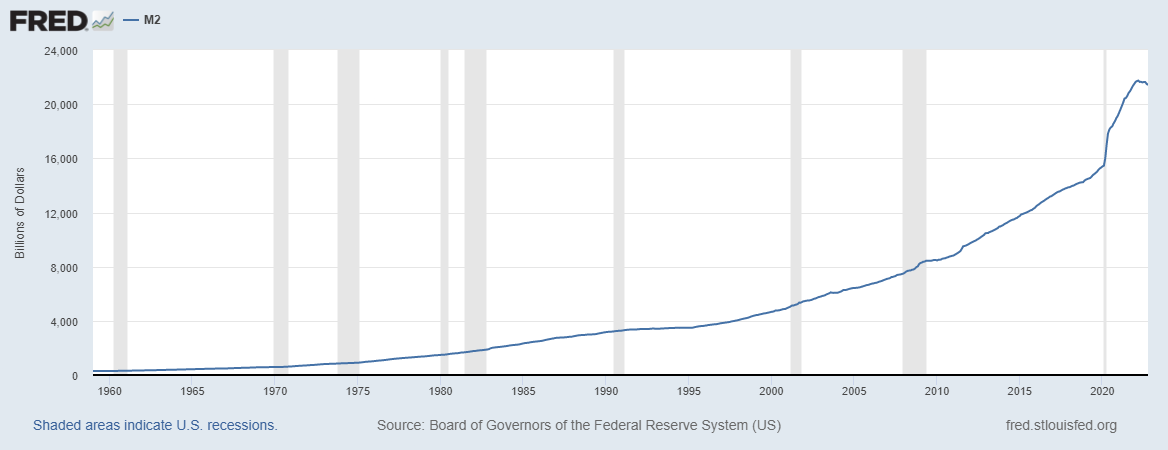

We’ve seen all kinds of tortured explanations for the rise in inflation that started in the fourth quarter of 2021. It’s true that there were supply chain problems and a war in Ukraine but those issues are secondary in understanding the inflation problem. The old expression is that inflation is what happens when too much money is chasing too few goods.

When the US and most of the rest of the world locked down in early 2020, people were prevented from working and producing. At the same time, the government sent stimulus checks worth trillions of dollars to people sitting at home. So, trillions of extra dollars into a market where production had stopped. That’s the exact recipe for inflation. Everything else is just a sideshow (again – as far as inflation is concerned).

Here’s the proof in a graph:

Do this to the money supply and shut down production, you get inflation.

In fairness, people really didn’t understand Covid at first and it was hard to figure out the best/safest course of action. However, the spending orgy continued long after we had made the decision to reopen the economy and get back to having work and social lives.

The best examples of this are the infrastructure bill in which another trillion or so of additional spending sponsored by the White House was advertised as being done to reduce inflation. In response to higher fuel prices, California sent checks to its citizens. And as noted in Part II, the US is subsidizing purchases of vehicles where there’s so much demand, Ford raised prices by more than double the subsidy.

The Takeaway: More cash flooding the system without additional supply creates more inflation. Everything the government is telling you about what’s causing inflation and how their actions will “fix” the problem is incorrect. You can not spend your way out of an inflation problem – especially when it was excess spending that created the problem.

Want to Know Who’s Paying for Your “Stimmies”?:

Most Americans received government checks in 2020 and 2021 and started to spend. At first, spending was on goods and home improvements. The price of such items skyrocketed including lumber and appliances. Well, the price was higher assuming you could get supply. Later, the demand for goods subsided and as of now, we’re seeing services inflation as people go out, travel, and try to make up for lost time by having fun in public.

For everyone reading this who got a government check for a few hundred or a couple of thousand dollars, we have one question: Are your annual expenses up by more or less than the amount of the stimulus payment you received? We’re certain that for most of you, your expenses are up by more than your stimulus checks.

The Takeaway: You are paying for your “stimmies”. Inflation is theft. The government is using inflation to appropriate the value of your savings and income without passing a bill providing for direct taxation (and getting voted out of office).

Energy Markets:

People all over the world are suffering from higher energy prices. While it’s appealing to blame Putin, this White House has made fewer leases available for energy exploration than any administration in decades and has said openly it wants to put the US energy companies out of business. Instead, the White House is negotiating with communist and terrorist countries Venezuela and Iran to get them to produce more. This isn’t good for energy prices, the environment, or US foreign policy interests.

The most recent policy debacle relates to the Russian oil price caps. The actual effect was to re-open European markets to Russian energy. Because Europe is closer, transportation costs are lower and the Russians are actually making MORE money per barrel of oil.

The US and possibly the Saudis are emptying strategic petroleum reserves (SPR). That helped keep gas prices lower for the midterm elections, but in the next few months, when we start to replenish supplies, it’s going to create more demand.

The Takeaway: As with many things, our energy policy doesn’t accomplish what it claims to do. Russian sanctions aren’t hurting Russia in the way planned. Environmental policies shift production to countries with weaker environmental regulations. And the SPR is about to reverse from a source of supply to demand. For more detail see here.

There’s No Price Discovery:

The governmental and central bank manipulation is most apparent in the sovereign debt market. The Bank of Japan has at times, been the sole buyer of Japanese government debt. That country is facing a sovereign debt death spiral. More details on that here and here.

The UK recently had to step in to buy Gilts (Great Britain’s version of 30-year Treasuries) to bail out pension funds which were facing a market death spiral of their own. The US Federal Reserve STILL has almost $9 trillion on its balance sheet which includes trillions of US Treasuries. And the European Central Bank has also been a huge buyer of its own debt.

The Takeaway: These markets are completely manipulated with governmental or quasi-governmental institutions determining the size of the money supply, interest rates, and the shape of the yield curve. Centrally planned economies don’t work and are ALWAYS subject to market forces eventually. The adjustment is and will be painful.

The Anti-Russian Sanctions:

We’re on record as saying the anti-Russian sanctions were well-meaning and poorly-designed. Almost every aspect of the sanctions didn’t result in long-term damage to Russia; but rather, reduced the value of the dollar as the world’s reserve currency. This is a national security issue for the US. We are splitting the economic world into two parts and the BRICS nations are openly considering a commodity-backed competitor to the dollar.

The Takeaway: In the interest of keeping this piece a reasonable length, we recommend reading this and watching this where we explore the issue in great detail.

That’s a Lot of Negative Commentary. What Do We Do?:

It’s true that governmental policy has not only created these problems; but also, is actively making things worse. At DKI, we don’t think it’s helpful to just complain. No matter how bad the policy is, there’s typically a way to make profitable investments from it. Our portfolio is currently designed to outperform in the conditions outlined in this section. Feel free to check out how we’re investing to benefit from bad policy here.

That’s a wrap for Part III. More to come in the next week on what I think happens to Fed policy, earnings, and the market. I may take a day or two to collect my thoughts on how to best present this, but you’ll have it well before year-end.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI , affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.