This is an excerpt from the DKI July letter:

Last month, we wrote this:

DKI has been highlighting inconsistent economic data since last November. However, recent news has put that trend on steroids. The ISM Manufacturing Index and the Purchasing Managers’ Index are both showing contraction/recessionary indicators. Demand for goods is weak.

Lumber pricing is down, but housing prices haven’t crashed yet despite higher financing costs. However, services inflation and employment data are indicating huge demand. There are more than 10MM unfilled jobs in the US. The unemployment rate is still well below 4%. Wage growth continues although at a pace that falls short of inflation. These are all issues we’ve been exploring most weeks in our 5 Things to Know in Investing piece and add additional detail in posts for paid subscribers. While the investing environment is complicated, there are some stocks that we think will benefit from existing conditions.

July provided more of the same confusion. Manufacturing indexes tended to be weak. The consumer continued to spend. Services spending and inflation remained high, but now there are indications of increasing demand for goods. Finally, the employment situation remains strong.

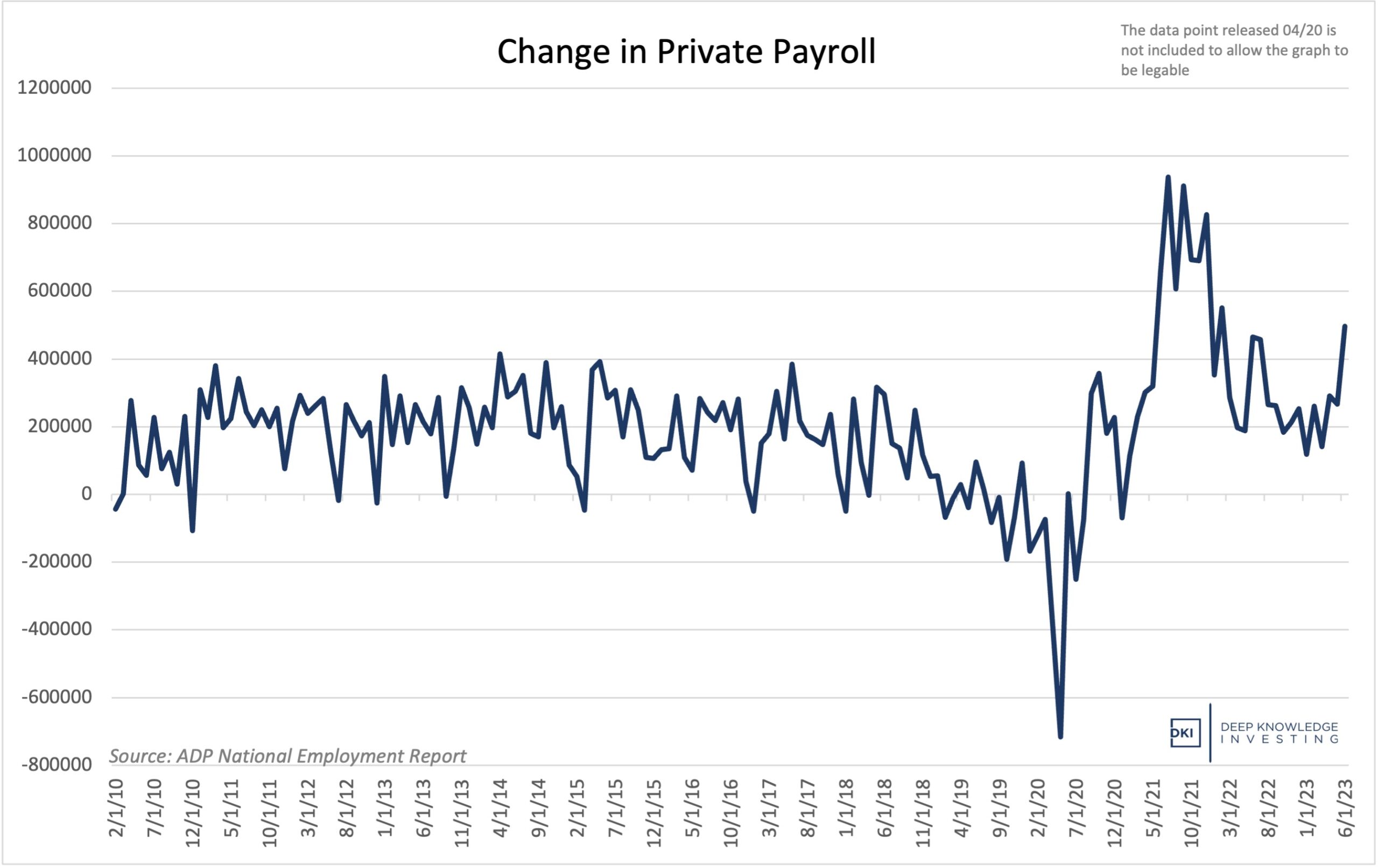

Look at the graph below:

The most recent reading was an increase of just under half a million jobs which was about double the estimate. Some of that is people getting second or third part-time jobs, but either way, the country is definitely back to work.

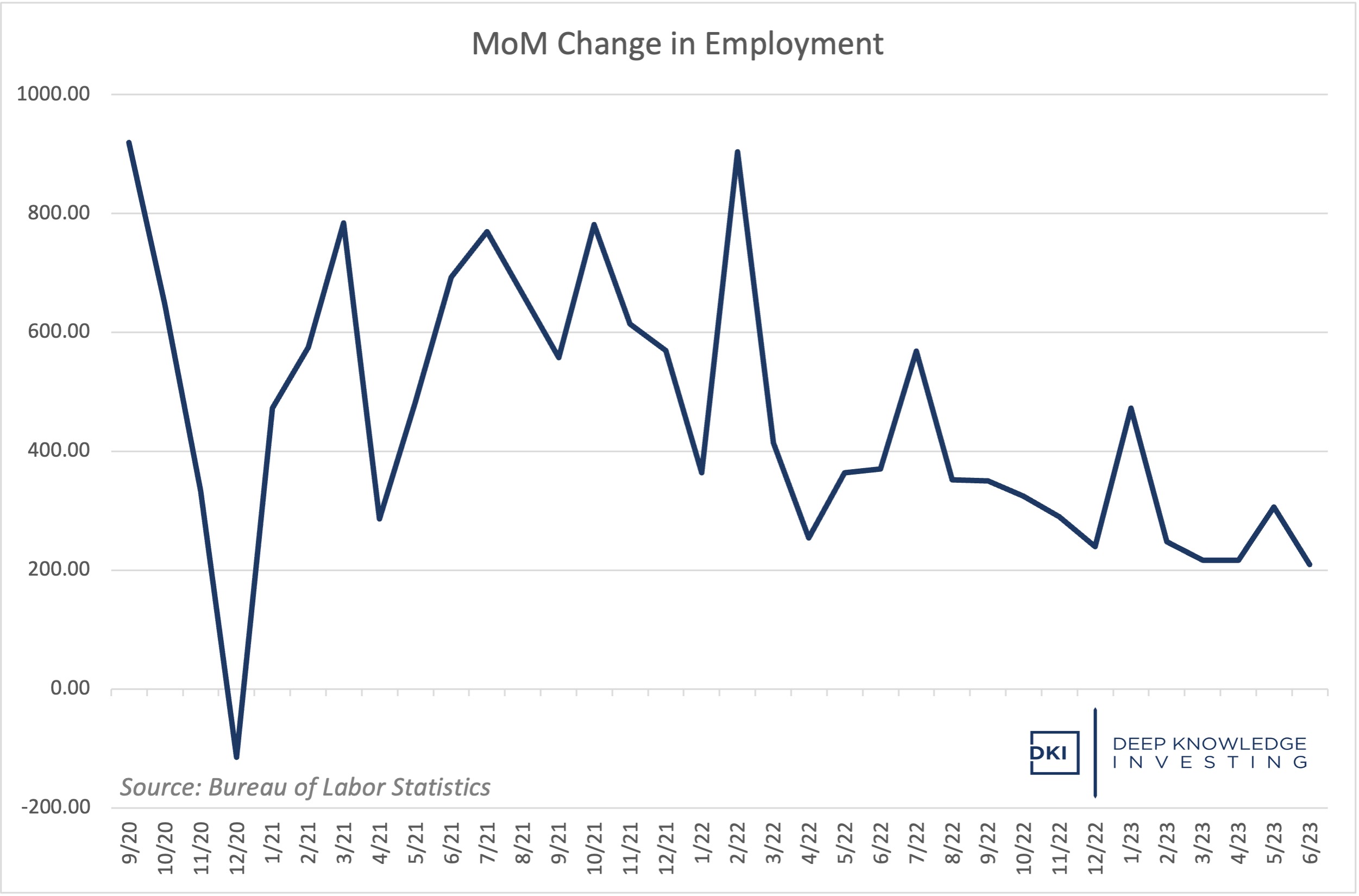

The second graph also shows a strong labor market with an increase of over 200k jobs. The unemployment rate has fallen back down to 3.6%. Even though this second data set indicated job growth was below expectations, there is enough economic strength here to ensure the Federal Reserve follows through on its plan to raise rates again soon.

Right now, the data everyone is seeing indicates we haven’t hit the expected recession yet. If Powell can manage a soft landing here, it would be a remarkable achievement. We still think the Federal Reserve should be disbanded and that the market can and should set the price of interest. Despite those feelings, it would still be a great outcome so while we remain team #EndTheFed, we’re still cheering for Powell to get it right.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.