This piece was originally published on June 12th, 2024

Overview:

Today, we got the May Consumer Price Index (CPI) report which showed an overall increase of 3.3% unadjusted in the last year and 0.2% vs last month. That’s slightly below last month’s 3.4% and expectations of 3.4%. The 0.2% monthly increase was below the 0.3% expected. The Core CPI which excludes food and energy was up 3.4% for the last year and up 0.2% from last month. Both of those were 0.1% below expectations. The annual number is still well above the Fed’s 2.0% target although the trend is pointed down a bit from recent months. Let’s go through the details:

Little change in the CPI for the past year. Core CPI coming down.

Just barely above 2% now. Still not “restrictive”.

Food:

Food inflation came in at 2.1%, down 0.1% from last month. Food at home was up 1.0% which was below last month’s 1.1%. I write this every month, but I continue to insist that anyone who believes that grocery prices are up only 1% hasn’t been inside a supermarket in years. Food away from home is now up 4.0% roughly the same as last month. Anyone who’s seen the recent posts about bills of more than $20 for a burger, fries, and soft drink at fast food places won’t believe this number either. I write this every month, but I continue to be skeptical of this part of the CPI, and have been for the past two years. It seems understated to me.

Some people who I respect are saying that food prices really are up a small amount from last year and that consumers are still experiencing sticker shock based on the huge price increases we saw in 2022 and 2023. I acknowledge that may be a possible explanation, but either way, the official numbers show increases of 20% – 30% over just a few years, and many people I talk to are seeing multi-year price increases substantially higher than that. Whether the big move came in 2022, 2023, or is continuing now, both the rate of increase and price levels for food purchases are creating stress in many homes.

The reason I keep reprinting the same language about understated food inflation is because the BLS keeps printing the same nonsense.

Energy:

Energy has been the reason the CPI has come down so much in recent months (disinflation not deflation). That trend was never going to be sustainable especially given the desire of many western governments to limit hydrocarbon production. Energy prices are up 3.7% from last year, but were down 2.0% in May from the prior month. Gasoline was up 2.2% vs last year, but down 3.6% in the month. Fuel oil was up 3.6% for the year and down 0.4% vs April. Energy prices had risen due to the production cuts in Saudia Arabia and Russia, but have been down recently on fears of a worldwide recession.

In previous editions of this report, we’ve highlighted the White House strategy of draining the Strategic Petroleum Reserve (SPR) to get fuel prices down ahead of elections. With a contentious Presidential election on the way and a White House desperate to convince Americans the economy is in good shape, DKI doesn’t expect any meaningful replenishment of the SPR. In fact, there are credible rumors that the Administration is considering selling down the SPR ahead of this fall’s election. That’s a dangerous strategy as it sells off a strategic resource just ahead of the fall hurricane season. We’ll all be hoping for good weather in the gulf this September and October.

DKI hosted a webinar earlier this year with energy expert, Tracy Shuchart @chigrl, to discuss oil and gas, uranium, and geopolitics. For those of you who want to understand this important part of the economy better, please feel free to check out the full video here (not paywalled): https://deepknowledgeinvesting.com/tracy-shuchart-and-gary-brode-on-energy/. Tracy predicted that oil would be range-bound with a relatively wide range, and so far, that prediction has been accurate.

Vehicles:

New vehicle pricing was down 0.8% and used vehicle pricing was down 9.3%. These have been volatile categories. We’d also note that the decrease in used car pricing is off of a huge increase. Still, if you look at the chart below, you can see that after the enormous Covid-related run-up in used car prices, recent decreases have made a meaningful dent in those non-temporary price increases. Pricing is returning towards the “normal” trend. It will be interesting to see the effect of more manufacturers slowing the emphasis on money-losing electric vehicles and returning their focus on profitable internal combustion cars and trucks. The White House is now looking at massive tariff increases on Chinese EV imports. While that’s not a big percentage of the market right now, we’ll be watching to see how the higher prices and reduced competition affects the future domestic market.

We’re seeing increasing reports of used vehicle loans going delinquent. New car pricing is still high enough that $1,000/month auto payments are far too common for stretched consumers. It’s likely that this part of the CPI will continue to decline in upcoming months. We’ve been highlighting the increasing use of buy now, pay later in recent versions of the 5 Things, and believe that officially-reported consumer indebtedness is understated. Many BNPL users are now falling behind on other debts. We expect this trend to increase in the near future.

Still expensive but with meaningful and continued improvement.

Services:

Services prices were up 5.3%. That’s flat vs last month. Again, services prices have been sticky, and this is an area where the Fed is struggling to bring down inflation. This is partly because much of the increase is caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. Wages are up and the jobs reports show increases in employment.

However, all of the new jobs are part-time and almost all job growth is coming from government and health care which is largely funded by government. That’s telling you the public market is throwing money into the economy while private businesses aren’t doing as well. Finally, these figures are constantly revised downwards. We keep seeing positive initial reports while the historical numbers get adjusted by so much that the current month “beat” isn’t enough to show actual growth. Recent employment data has been mixed, but given the inaccuracies and inconsistencies in multiple data sets, and the constant huge revisions, it’s difficult to get a real handle on the labor market. As we’ve said before, there’s been no growth in full-time employment in years. That means the growth in jobs has been people taking on second and third part-time jobs. More people aren’t working. The same people are working more to make ends meet.

Shelter (a fancy word for housing) costs were up 5.4% and represents the largest category of the CPI. Much of today’s CPI increase is due to this category alone. Housing has remained strong as people are reluctant to sell their homes and move when higher mortgage rates mean a new smaller home might have higher monthly payments. This has kept supply off the market and prices high.

Housing prices remain at all-time highs even with mortgage rates up from three years ago.

Analysis:

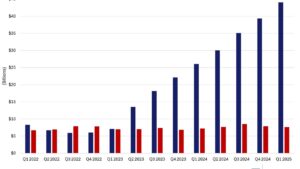

In the fourth quarter of 2023, the market expected six rate cuts for a total of 1.5% with the first cut coming in January or March. DKI disagreed strongly and said we’d get fewer cuts coming much later. In recent weeks, market expectations had been reduced from six cuts to just one or two with the expectation that the first one would come in the fourth quarter. Some Fed Governors have been talking about raising rates again, but we doubt the Fed will want to incur accusations of partisan activity by changing the fed funds rate so close to the November elections.

For those of you who are inclined towards political analysis, we remind you that changes in the fed funds rate act on a lag. That means that a potential September cut won’t be soon enough for the stimulative effect to be felt in the economy before the November election. The White House was hoping for help from the Fed. Instead, they’re going to get that help from a Congress that stimulates the economy through overspending and a Treasury Department that’s monetizing that extra debt. As has been the case for years, we’re all going to be paying for our “stimmies”, government benefits, and other programs through future inflation. Powell knows this even though he’s an experienced enough political operator to avoid saying so in public.

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

Conclusion:

Today’s CPI was below expectations with continued improvement in the Core CPI. I continue to believe that food costs are understated and that we shouldn’t count on continued lower energy prices (which doesn’t affect the Core number). The equity indexes are trading up in the pre-market due to expectations that today’s CPI will encourage the Fed to lower rates sooner. I continue to believe that the Fed will not reduce the fed funds rate at today’s meeting which concludes this afternoon. The market will be looking at the dot plot when the Fed releases its press release and exhibits later today. If the dot plot shows most Fed Governors expect only one rate cut this year, it would be viewed as a hawkish move. Should the dot plot show that most favor two cuts later this year, the market will view that as dovish and could trade up on that announcement. The pre-market increase in the equity indexes is precisely because many expect the dot plot to show a preference for a second rate cut in 2024. As a precaution, I remind you that history has shown the Fed is not accurate in making predictions, and that Powell is likely to say the Fed remains “data driven”.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.