The Federal Reserve completed its June meeting, and kept the fed funds rate unchanged. Your bullet points ahead of Chairman Powell’s 2:30PM press conference.

- The fed funds rate remains unchanged at 5.25% – 5.50%. Earlier this year, most market participants expected the Fed to cut by either the January meeting or the March one. DKI said that wasn’t going to happen. Market expectations shifted, and today’s “pause” was not a surprise.

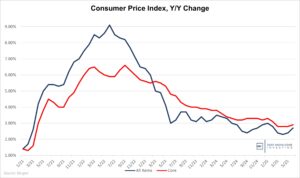

- The press release was more clear than usual. It notes sold expansion of economic activity, a strong employment market, and “modest” progress towards the 2% inflation target. They again reiterated that the goal remains 2%. (Some have expected the Fed to increase the inflation target.) There was commentary on employment vs inflation moving into better balance offset by the observation that “the Committee remains highly attentive to inflation risks”.

- “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” That’s clear language which is more hawkish than the market hoped for and is consistent with DKI expectations.

- The Fed said it expects to continue reducing the size of the balance sheet (quantitative tightening).

- The dot plot: This was tightened and raised. At the April meeting, 2 Governors thought the fed funds rate would remain unchanged at year-end, 2 thought there’s be one 25bp rate cut, 5 were at 2 cuts, 9 were at 3 cuts, and 1 was at 4 cuts (1.00%). The new dot plot shows 4 Governors expecting no change by year-end, 7 at 1 cut, and 8 at 2 cuts. This means that the median went from 6 cuts at the beginning of the year to 3 cuts in April down to one 25bp cut at this meeting. That’s a huge change and consistent with DKI’s “higher for longer” expectation. The market was hoping the dot plot would show a consensus for two cuts today, but the dot plot was more hawkish than that.

- I’ll be on Powell’s press conference which starts shortly and will post any additional information should he say something newsworthy. I expect the press conference will primarily consist of reporters finding a dozen new ways of asking when Powell will lower the fed funds rate followed by him stating the Fed will remain data-driven while trying not to look annoyed.

- DKI continues to believe that inflation is elevated, understated, and a problem that won’t be solved soon. We maintain positions in inflation hedges and beneficiaries like Bitcoin, gold, and energy. Subscribers are encouraged to check out the Current Recommendations page for specific tickers.

GB@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.