This is an excerpt from the DKI July letter:

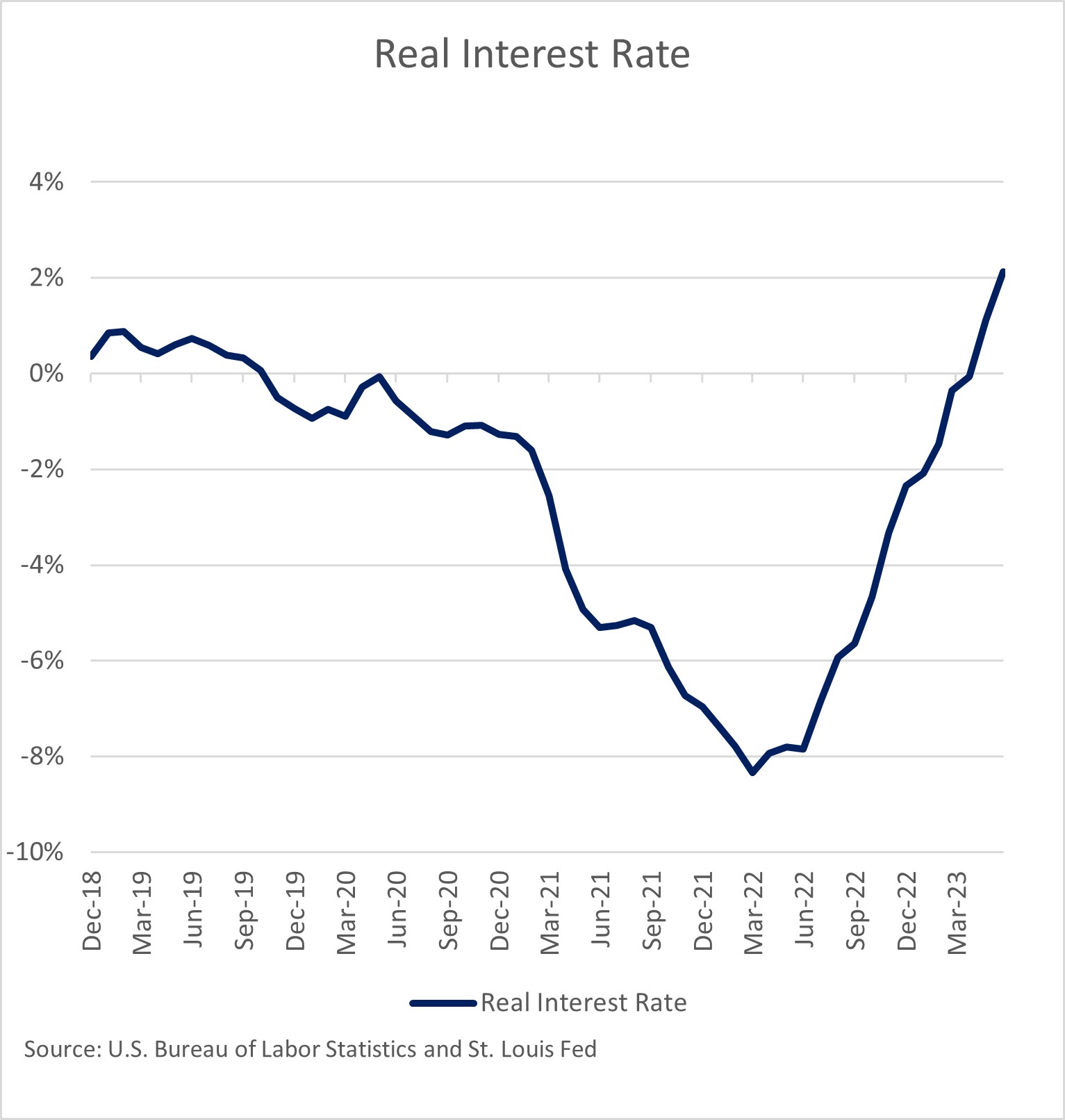

Over a year ago, the “pivot people” started calling for the Fed to pivot to lower rates. At the time and for the past year, DKI has said that we were nowhere near a pivot and that we expect the Fed to continue raising. Shortly afterwards, Fed Chairman, Jerome Powell, started telling people that rates would be “higher for longer”. Despite that, people continue to call for lower interest rates. There are many ways to address this, but the best is this chart:

Real interest rates (the fed funds rate less the rate of inflation) has finally gone back above zero. Most savers are still falling behind inflation and the ones with the highest interest rates are still returning about 1% after inflation.

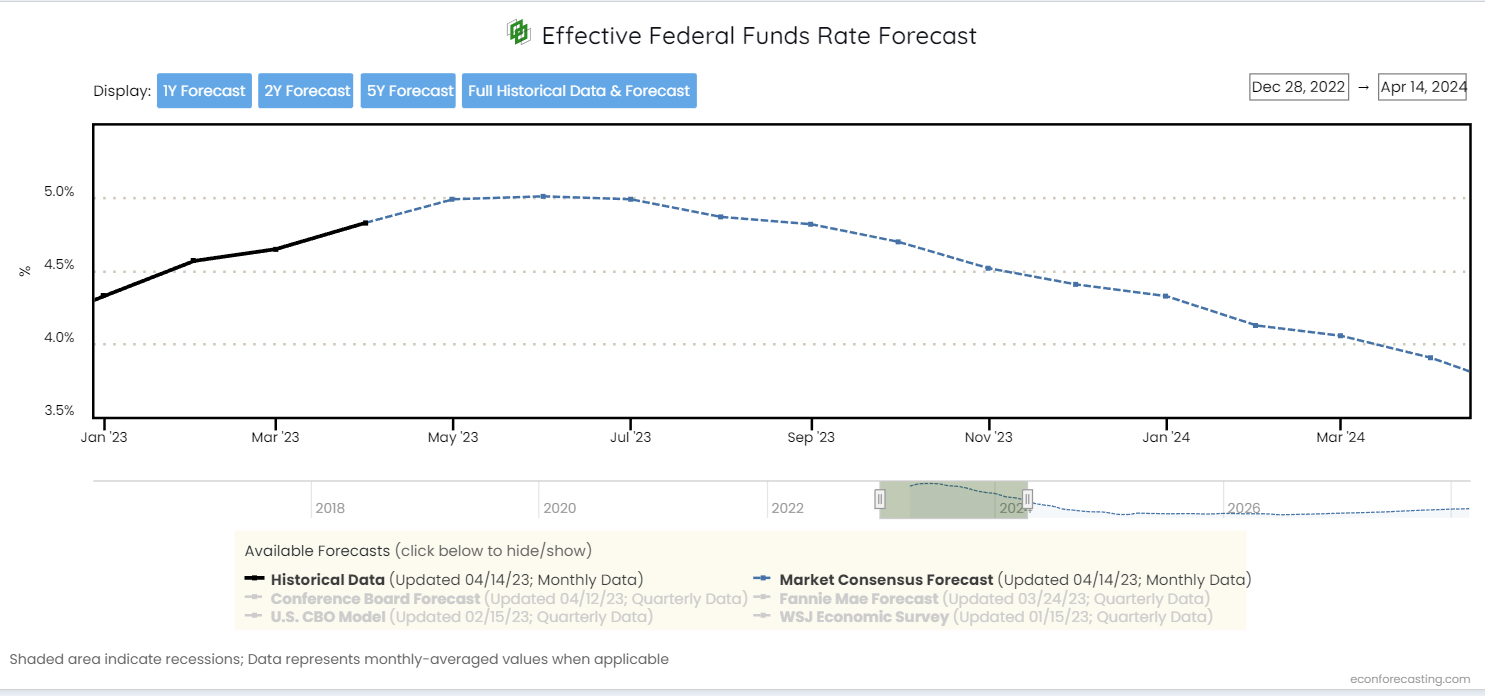

What’s been interesting to us has been the way the market has started to match DKI’s expectations, but without a corresponding move in the equity markets. Let’s look at this chart of expectations for the fed funds rate:

I grabbed this chart from Econforecasting in April. At the time, it showed expectations for over 1.5% (150bp) of Federal Reserve easing over the next year. DKI said that wasn’t going to happen. Here’s the new version:

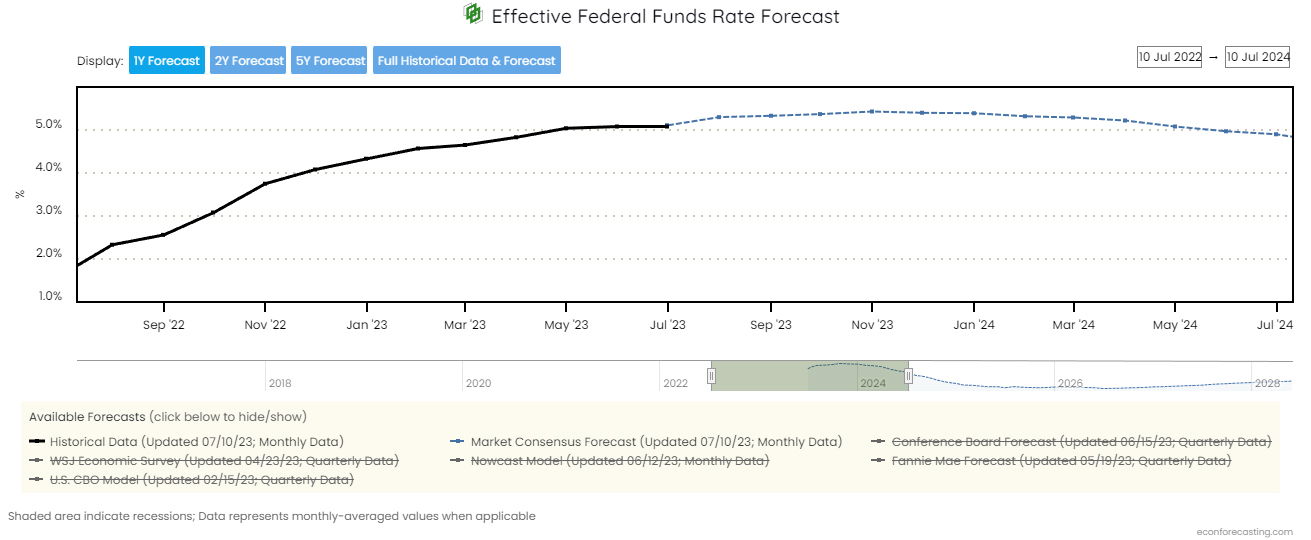

Notice how much more flat that line has gotten and how there’s no expectation of rate cuts in the next year. The market expects the fed funds rate to increase and then to come back to current levels in the next year. This is a more reasonable approach, but it brings up an interesting question. If part of the market is starting to believe Powell’s higher for longer speech, then why are the equity markets continuing to rise?

There are also reasons to believe that inflation hasn’t bottomed. While the market was encouraged by the much lower 3% June CPI, we’ve now passed the highest CPI readings from last year meaning that comparisons going forward will be more challenging. In addition, there’s a huge adjustment to health insurance inflation that’s making the CPI look lower than the inflation Americans are actually experiencing. That adjustment ends in September and will likely go from a tailwind to a headwind. Finally, the main reason June inflation was much lower was a decrease in energy costs from the highs of a year ago. It’s unlikely we’ll see continued decreases of this magnitude going forward. We wouldn’t be surprised to see the CPI tick up later this year. Much of that prediction will depend on future housing prices which have held up much better than most people (including us) expected given the increase in mortgage rates.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.