We’ve featured the work of Laks Ganapathi previously. She’s smart, interesting, and subversive. You enter a conversation with her expecting one outcome, and ten minutes later, realize she’s taken a completely different approach to the subject and has detailed reasons for her unexpected conclusion.

I was about to write a piece on the connection between inflation, hyperinflation, over-expansion of the money supply, and overspending by governments. Then, Laks’ piece “Idiots and Inflation” found my inbox, and I realized the article was already written.

It’s worth pointing out that the recent “Inflation Reduction Act” amounts to hundreds of billions of dollars of additional debt-financed spending. You can not cure inflation by printing money and giving it to citizens to “lower” their cost of living. Prices adjust as fast as the government hands out the money.

We just saw the government decide to subsidize the purchase of electric vehicles by $7,500. It took exactly one day for the auto makers to raise their prices by around $7k – $8k. Last week’s news included debt “forgiveness” for people with college debt. Regardless of your political views on how much university degrees “should” cost, one huge problem with the way the program was structured is it makes no reciprocal demands on the universities to not burden students with debt that can’t be paid with the income from jobs available to graduates with a particular degree. The government just waived off between $10k – $20k of debt for students. Anyone want to guess how long it will take for universities to raise tuition by a similar amount?

For a great description of why these programs not only don’t work; but also, create bigger problems for the entire society, please check out Laks’ piece below. We reprint with her permission and note that the original version of this article is available here: https://contrarianunicus.substack.com/p/idiots-and-inflation?utm_source=email.

Idiots and Inflation

A fool and his money are soon popular

As Milton Friedman said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Our favorite is “Print it, and the zeros will come.” – A reliable source

The Zim Dollar

Zimbabwe kept printing money so they could pay their debts. But, ole “Bob” and his cronies wanted more and more, so they printed more and more. By golly, they did a magnificent job. You can now find these notes for sale on e-Bay – I have a stack from my visit to Zimbabwe.

They printed so much money that the Zimbabweans reverted to barter or the use of the U.S. dollar. As a result, annual inflation hit a record 489 billion percent in September 20081, and shoppers carried garbage bags full of bank notes to buy groceries. That’s a lot of zeros.

Now

As of July 2022, with inflation soaring in Zimbabwe and the country’s currency in free fall as people abandon it for the U.S. dollar, the government of President Emmerson Mnangagwa is fighting back with a novel strategy: gold coins. Zimbabwe is selling one-ounce, 22-carat gold coins bearing an image of Victoria Falls, its world-famous natural wonder. While gold is traditionally the ideal hedge against inflation and general economic uncertainty, no country has previously tried to tackle a weakening currency by selling gold coins. And with gold trading at $1,710 per troy ounce late last week, institutional investors may be the coins’ principal buyers.

The Brazilian Letra do Tesouro Nacional (LTN)

LTN bonds issued in the 1970s were short, stop-gap measures, issued much like currency, but were issued to function as a “year-or-less IOU.” Inflation was rampant, and issuing an IOU that could be paid with steeply inflated cruzeiros later was easy. Unfortunately, Brazil could not print enough money, so they printed LTNs with tons of zeros.

Cruzeiros were the currency of Brazil from 1942 to 1986 and again between 1990 and 1993(two distinct currencies). In 1986 a new currency was introduced called the Cruzado. After a few years, a new currency, the Cruzado Novo, or New Cruzado, was introduced, only to be replaced in 1990 by the reintroduction of the Cruzeiro. In another attempt to control inflation in 1993, the government devalued the currency by taking off three zeros from the Cruzeiro and naming the new currency the Cruzeiro Real. The Cruzeiro was devalued several more times, and through the many devaluations, we at Aegis Journal calculate the actual face value of the bond in the current currency of the realm, Brazilian Reals, to be .000000436 R. In U.S. or E.U. – it is even less of a fraction of a cent.

Now

As inflation decelerated in Brazil, a debate ensued on whether the worst passed and whether the central bank could reduce the Selicbenchmark rate.

The official inflation index contracted 0.69% in July, compared to an increase of 0.67% in June, according to the latest figures by the statistics bureau IBGE. Twelve-month inflation in July was 10.07%, and 11.89% in June.

The drop came behind a 4.51% fall in transport prices, as fuel prices dropped 14.2%.

Turkish Lira

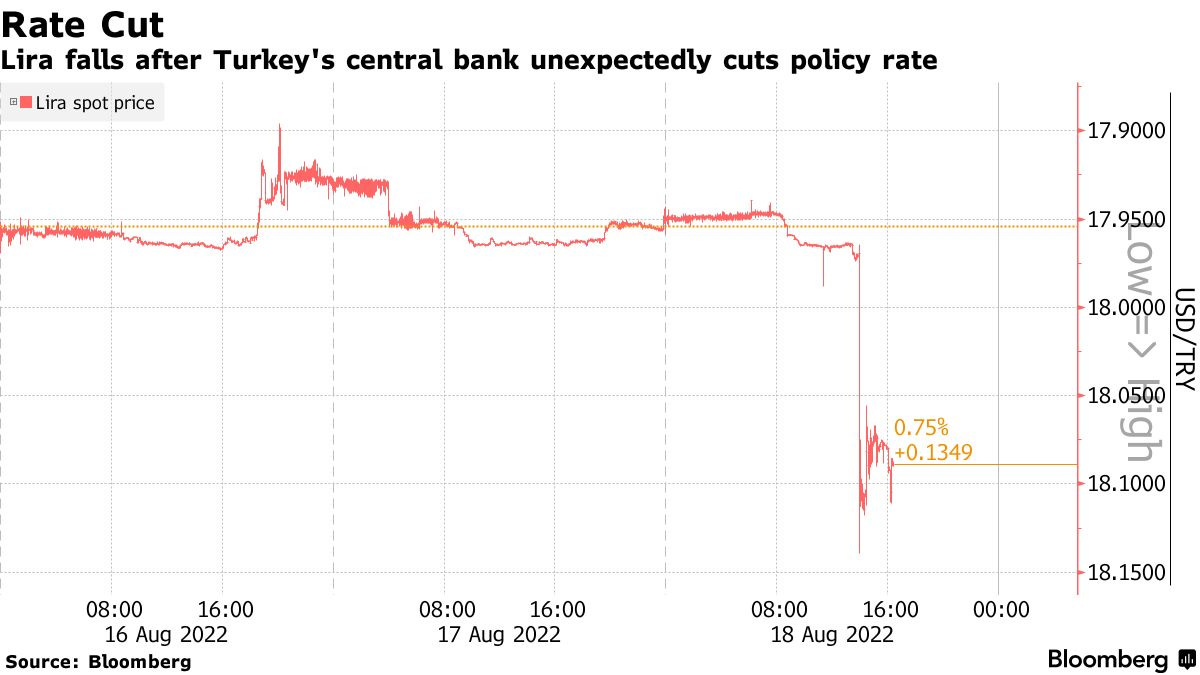

In June 2008, the Turkish Lira was about $.80; it is now $.05. Turkey has taken an approach of easy money and low-interest rates. Beginning in 2009, the government started a massive deficit spending campaign to spur the economy. The county has kept floating debt issues financing the projects for 13 years. Their fiscal balance as a percent of GDP is one of the worst of all OECD countries. The reckless path of borrowing, spending and printing has resulted in rapid inflation. As of August 2022, it was over 80% inflation per month! That means about every 40-day, prices double. So what did Turkey do? What could you possibly do to make it worse? That’s right, lower interest rates.

Now

Turkey’s Lira slid toward an all-time low on Friday as traders continued selling the currency after the previous day’s surprise central bank interest rate cut in the face of near 80% inflation.

Emre Akcakmak, senior consultant to East Capital, based in Dubai: One can assume that the number one priority is economic growth as opposed to price stability. This is typically what happens when electionomics take center stage. Efforts are spent to go from point A to point B (i.e., election time), but caution is required as stretching the system too much might eventually break things.2

Argentina’s Peso

In 2010 the exchange rate was about $0.24 per Peso. It is now $.0073. Argentina is the poster child of how not to run an economy. It is the drunken miscreant of international and domestic finance. Every time Argentina runs out of money, it borrows more. The sober lenders have sown off Argentina forever. But mummy IMF keeps lending more and more money. The IMF just inked its 22 bailouts of Argentina, inching toward the 23rd. Argentinians have endured repeated cycles of hyperinflation followed by attempts at stabilization. Protests meet every attempt at stabilization because the bad mommy told Argentina, “Honey, you have to trim your sails, no more overspending. You need to live within a budget. Bad mommy IMF – austerity is tyranny! Reasoning with Argentina is a bit like talking to an extremely drunk person; they are very happy and make as much sense as a brain-damaged toddler. Argentina is again suffering high inflation at over 90% per month and a recession.

The Root Of Inflation

An inflationary economy begins with the acceleration of money creation to accommodate the government’s budgetary needs and wants. Governments can increase the money supply by printing and spending more money, lowering interest rates, or lowering bank reserve requirements. Conversely, to curb inflation, governments have to reign in their spending, raise interest rates, and increase bank reserve requirements.

You cannot drink yourself sober or spend your way out of inflation. Yet, U.S. policymakers and legislators are trying.