Two quarters ago, terrible results from education company, Chegg (ticker: CHGG) caused a huge drop in Coursera (ticker: COUR) stock. We wrote about the fact that these companies are in two different businesses, and that Chegg is regarded as a “cheating site”. At the time, Chegg complained that fewer people were entering college and those that did were taking easier classes. We noted that online degrees were only 10% of Coursera’s revenue. Coursera is constantly adding new programs and university partnerships so we expect that part of the business to grow.

After the close today, Chegg announced a decent first quarter with revenue growth of 1.5% in line with expectations and adjusted earning above analyst estimates. However, Chegg lowered revenue guidance for the year from the previously announced $830MM – $850MM to a range of $740MM – $770MM. EBITDA guidance was lowered as well. The reason given (again) was students taking fewer classes and that those classes are also easier meaning the students need less help. As of this writing, CHGG stock is trading down 31% in the aftermarket.

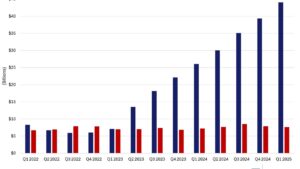

We continue to maintain that Coursera is in a different business than Chegg. Coursera’s degree business grew 11% this quarter after growing 82% the year before and 112% the year before that. Despite facing two years of pandemic comparables and a strong labor market, Coursera is still growing. Overall revenue was up 36% last quarter and gross profit grew 54%. You can read our detailed analysis of Coursera’s strong quarter here.

If COUR stock drops tomorrow on concern about CHGG results, it would be a good time to acquire more shares. In general, we love buying stocks that are down because of unimportant news.