The Federal government shut down this week. Democrat and Republican donors cheered. Politicians threatened the end of the world in front of microphones. The market shrugged. DKI has spent years expressing concern about the lack of pharmaceutical production capacity in the US combined with our large prescription drug use. President Trump uses tariff threats to get more manufacturing capacity at home. Electronic Arts is being acquired in the largest LBO in history. Will this lead to a reduction in abusive microtransactions and loot boxes/gambling designed to hook kids? We hope so. Politicians have complained for years about US citizens paying high prices for pharmaceuticals when other countries get huge discounts. This effectively put the responsibility of funding drug development on the US and let other countries be free riders. TrumpRx is trying to fix this issue. It’s easy to make fun of the name, but this seems like a good idea to me, and one that both Ds & Rs have talked about supporting for years. Ever wonder what a bid-ask spread is and how it affects the cost of investing? We’ll cover that in our educational topic.

This week, we’ll address the following topics:

- The Federal government closes for a while. Both Democrats and Republicans are receiving support from their base for the continuing disagreement. DKI agrees!

- President Trump decides to tariff pharmaceutical companies not building manufacturing capacity in the US. DKI has been concerned for years about our inability to produce pharmaceuticals. Why was no one else worried?

- Electronic Arts $EA is being acquired in the largest LBO in history. We’re hoping removing the requirement to report earnings every three months leads to better games.

- TrumpRx attempts to lower drug costs for some Americans. We hope it’s effective.

- In our educational topic, we explain the bid-ask spread and how it affects your investing cost.

Ready for a week of a government shutdown that didn’t end the world? Let’s dive in:

1) The US Government Shuts Down for the First Time in Nearly 7 Years:

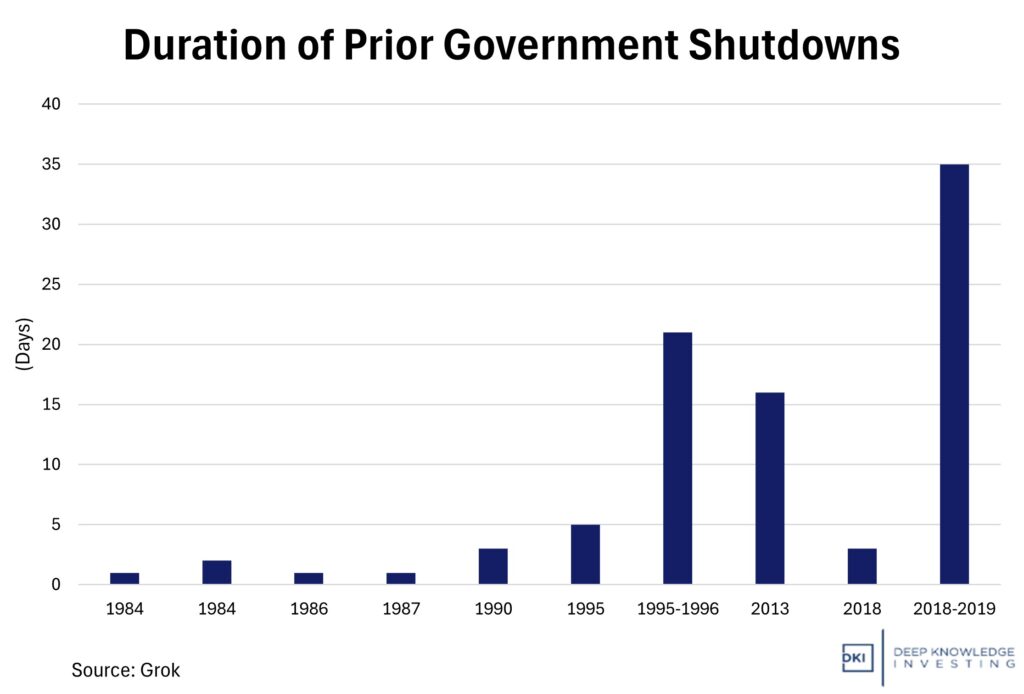

At 12:01 a.m. ET on October 1, the federal government entered shutdown mode after Congress failed to pass appropriations legislation by the deadline. Republicans and Democrats each attempted stopgap funding measures, but disagreed on maintaining “temporary” Covid subsidies for government-run healthcare insurance (Obamacare) and healthcare spending for people in the country illegally. The shutdown immediately furloughed 900k federal employees and delayed payments to another 700k. Essential services, like Medicare, Social Security, air traffic control, and national defense, continue under statutory authority, but numerous agencies, including the NIH, CDC, and various social programs, are now partially or fully suspended. The Trump administration froze $26 billion in funding for some States and warned of broader firings if the impasse continues. Fiat economists wailed that the shutdown will harm GDP growth, but DKI points out (again) that wasteful government spending adds to GDP while often destroying value. The stock market shrugged and spent the following couple of days flat to up slightly.

We lived through all of these. We’ll live through this one.

DKI Takeaway: Both Democrats and Republicans are supportive of the shutdown. Democratic donors were encouraging their representatives to take a stand and not give in to President Trump. Republicans don’t want to finance an additional $1.5 trillion for an extension of these “temporary” funding measures and payments to people in the country illegally. Neither side has upset their base with the impasse. DKI supports the shutdown as well for two reasons. First, we think it’s valuable for most of the country to have a regular reminder that we can operate our lives without constant government supervision. Second, President Trump now has the leeway to reduce the federal workforce, something DOGE wanted to do more of when Elon Musk was there. Do we really need a federal workforce larger than the population of ten States? The bad news: I can promise you that the government will continue to spend more every year, take on more debt, and debase the dollar.

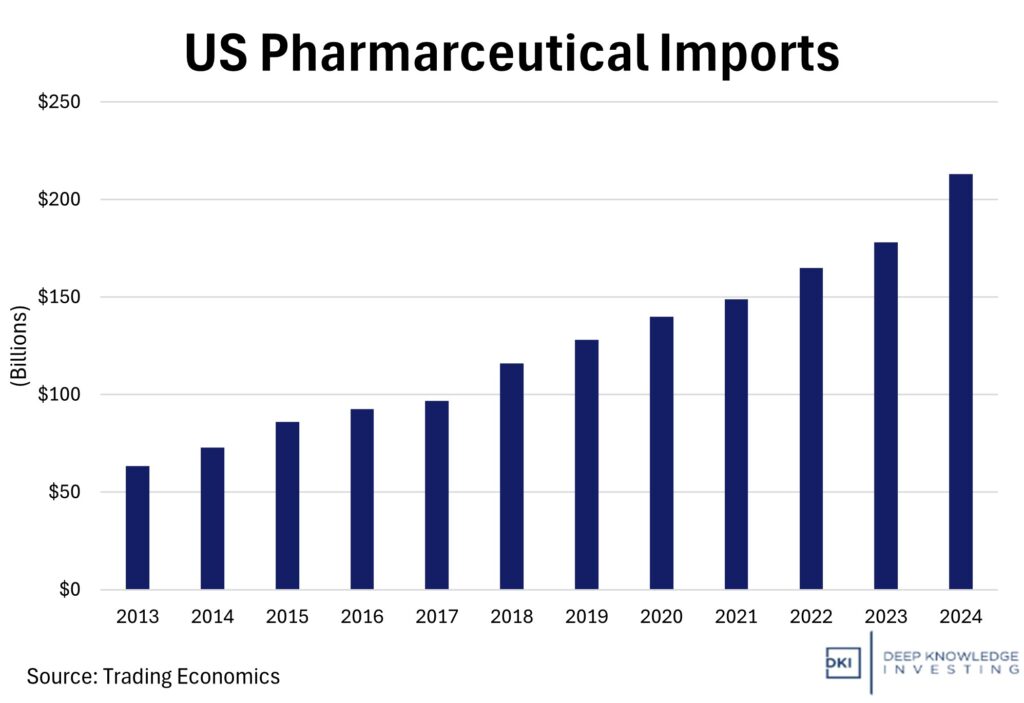

2) Tariffs on Imported Pharmaceuticals Now in Effect:

This week, President Trump announced a 100% tariff on all branded or patented drug imports from companies not building US plants, which went into effect on October 1st. With Big Pharma feeling the pressure, several giants have responded with price cuts and direct-to-consumer discounts (covered more extensively in Thing #4). There have been some valid concerns that tariff pressures could cause an R&D problem: will big companies be forced to reduce funding for innovation?

Less self-reliance and higher drug prices in one chart.

DKI Takeaway: With 100% tariffs now in place, companies are rapidly announcing US manufacturing plans. We are moving towards a more US-centered supply chain when it comes to pharmaceuticals. DKI approves. The US used to manufacture most of our drugs in Puerto Rico where the drug companies had favorable tax treatment. Then, some politicians in Washington decided to eliminate the tax advantage and production primarily moved to China. The CCP now has massive leverage over the US. We just saw the White House bend to China on high-end GPUs when China cut off access to rare earth elements. What do you think happens if China cuts off our prescription drug supply. President Trump just provided a huge incentive for companies to manufacture in the US and these companies appear to be responding. We support reshoring – doubly so in crucial industries like drug production.

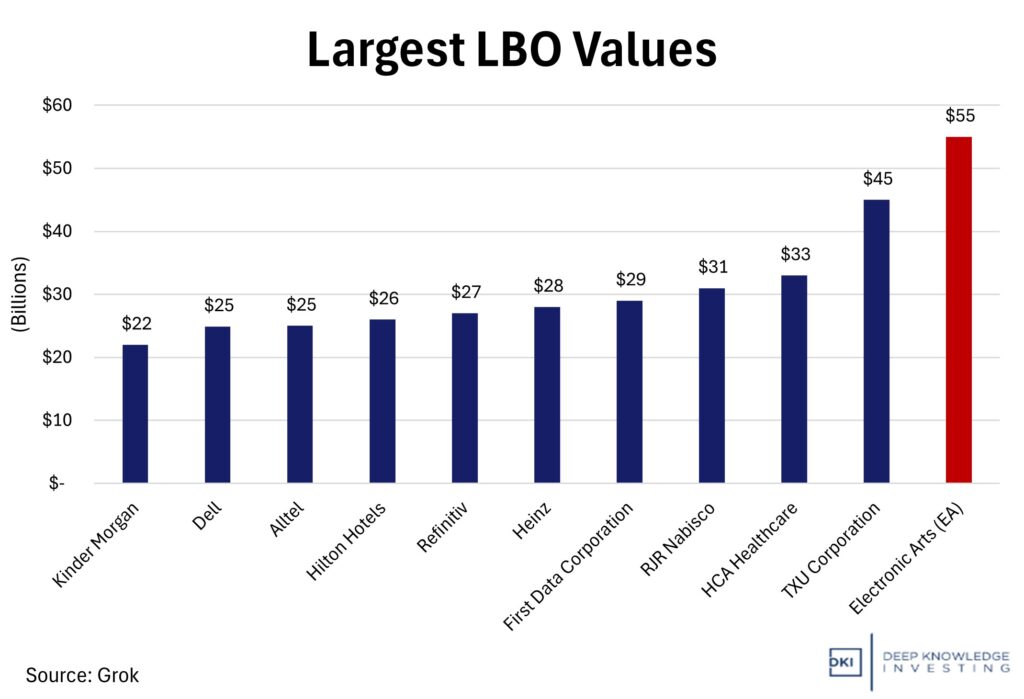

3) Electronic Arts Being Taken Private in Largest LBO Ever:

Saudi Arabia’s Public Investment Fund, Silver Lake, and Jared Kushner have partnered in a $55B acquisition of Electronic Arts ($EA). Electronic Arts is one of Silicon Valley’s gaming giants, known for sports games like Madden and FC (formerly FIFA) and Battlefield. The company has struggled in recent years as some games have disappointed players. Stockholders will receive $210 per share in cash, following approval of the agreement. The transaction size surpasses the $45B buyout of TXU in 2007.

Incredible to me that the 1989 takeover of RJR Nabisco is still on this list!

DKI Takeaway: The videogame business has become more challenging. New games can cost hundreds of millions of dollars to develop and not all will recover those costs. The studios are incentivized to play it safe and keep making updates to popular IP. The public companies use unpopular microtransactions to make quarterly earnings estimates. We’ll see if going private amplifies these trends, or if relieving the necessity of reporting earnings every three months will allow EA’s developers to focus on the long-term and to make better games. Given the tendency of some microtransactions to resemble gambling, we’re hoping to see the industry develop better long-term relationships with its younger players.

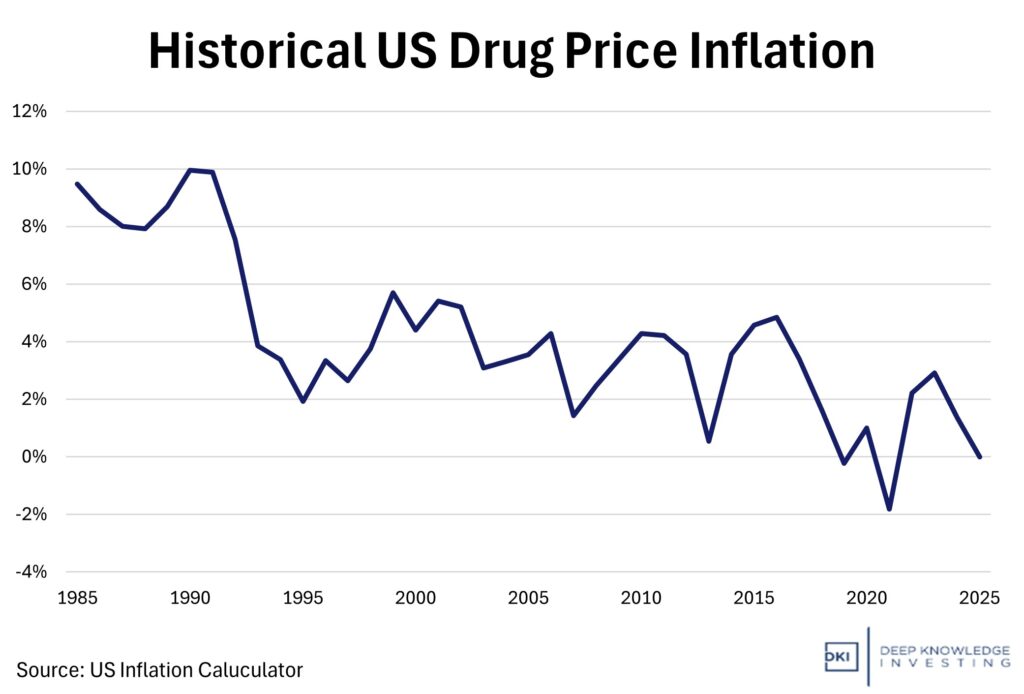

4) President Trump Cuts the Middleman with TrumpRx:

The Trump Administration just unveiled TrumpRx, a direct-to-consumer government website selling pharmaceutical drugs at a discounted price. Set to launch in early 2026, the website will let Americans buy prescription medicines directly from drugmakers, bypassing middlemen like pharmacy benefit managers (who are often responsible for much of the drugs’ price markup). The US government will not be selling the drugs itself but instead operating the system that will link patients to drug manufacturers’ online pharmacies.

This discounted cash-pay program comes just as President Trump’s 100% tariff on internationally produced drugs goes into place. Pfizer took advantage of this deal and secured 3 years of tariff protection in exchange for being a major participant in the drug program. Eli Lilly and Bristol Myers Squibb may enroll into this program at a later time.

Given the way drug prices are listed, there’s no way to know if this is accurate.

DKI Takeaway: The key part of TrumpRx was a most favored nation policy pushing the drug companies to sell to Americans at the discounted prices they offer in other countries. For decades, Americans have shouldered a disproportionate share of the R&D costs and profits of the drug companies while foreign residents enjoyed deep discounts. With Democrats reasonably angry about the high drug prices Americans pay and Republicans reasonably angry about some of the unfavorable hidden research related to certain vaccines, we’d expect both sides to support this effort. My views on this matter have evolved over time so tune into the video version this week to see what guest host, Howard Freedland, and I have to say about it.

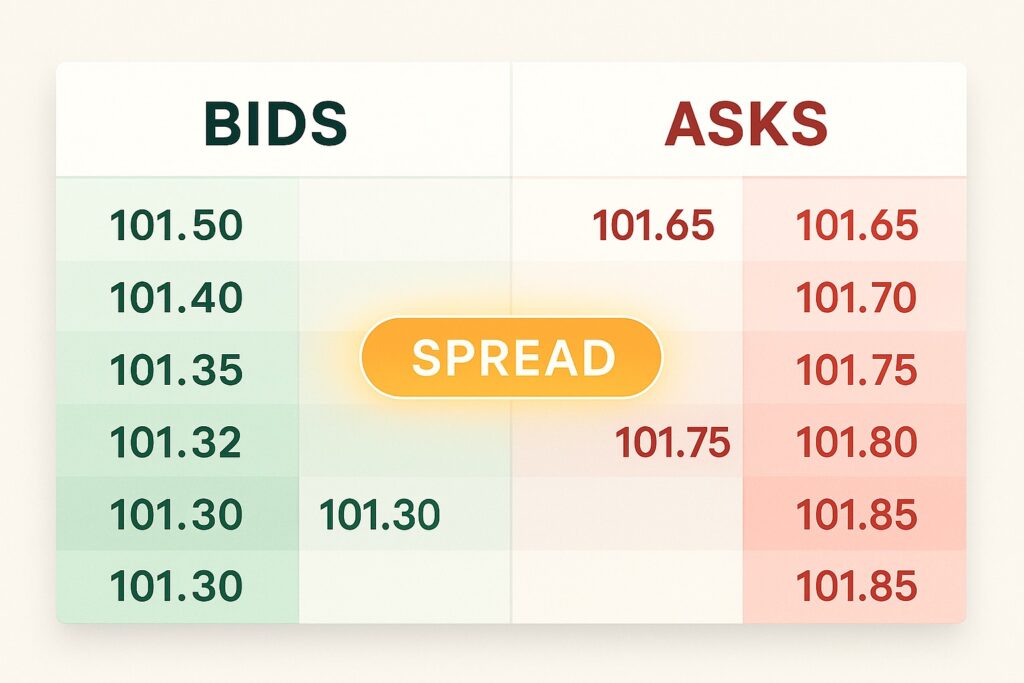

5) Educational Topic: Breaking Down a Bid-Ask Spread

Stock prices are quoted with a bid-ask spread. The “bid” is the highest price someone is willing to pay. The “ask” is the lowest price at which someone is willing to sell shares. When there is overlap, a trade takes place. This is no different that if you were to try to sell your house. You might want to receive a high price while multiple potential buyers may bid different lower prices. A deal happens when you agree on the price. In the stock market, traders often provide liquidity and market makers (who have largely been replaced by computers) try to keep the market in balance. In exchange for taking the risk of owning more shares than they want or selling shares they might not yet own, the market makers will capture the “spread”. That’s the difference between the bid and the ask.

More liquid stocks tend to trade at a small spread and less liquid stocks tend to trade at larger spreads. Most brokerage firms now advertise no-fee trading. That’s partially true. While they may no longer take a per-share fee, they will either capture the spread or get paid by a big firm like Citadel to do so. If you’re a long-term investor, the spread tends to be small and unimportant. However, if you’re day trading, it’s helpful to think of the bid-ask spread as the “fee” for trading.

In this example, you’d pay $.15 to buy and sell at the same time.

DKI Takeaway: The cost of bid-ask spreads often sneaks up on investors. Especially with stocks with wide spreads, it can be easy to pay a large amount in dealer fees. It is important to treat this as a cost. Always checking the spread before trading can help investors keep a better track of their finances. DKI’s usual approach is to invest over a multi-year time-frame where getting the investment thesis right can turn into gains greater than 100% making the bid-ask spread irrelevant.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.