President Trump fires the head of the BLS. We immediately get performative complaining that the integrity of the BLS and the government data collection process is being threatened and politicized. Somehow, the “integrity” crowd ignores the fact that last year, there were two 800k plus revisions and we just had a 258k revision. Firing the head of an agency that can’t report accurate data does not create an integrity crisis. Consistently bad data is the issue and we support efforts to fix that. Apple commits to another $100B in US manufacturing spending. After decades of selling off our manufacturing capacity and relying on harmful and unreliable Chinese products, this is necessary (even if it costs more in the short-term). Hopefully, the whole country is watching to ensure these commitments result in shovels hitting the ground. After threatening employees who own Bitcoin, Jamie Dimon has made a full turnaround. JP Morgan Chase partners with Coinbase to allow funding of cryptocurrencies through JPM bank accounts and Chase credit cards. DKI still thinks the best approach is to own Bitcoin and that stablecoins threaten banking profits. $AMD has a good quarter, but not good enough. $SMCI has a bad quarter. Disappointed investors hammer the stock. In our educational topic, we help you understand the different kinds of stop losses and how to figure out if you should be using them.

This week, we’ll address the following topics:

- President Trump fires the head of the BLS leading to wailing about the integrity of the system. DKI asks why those wailing weren’t concerned about data integrity when for years, the BLS reported “data” so bad it was unusable.

- Apple $AAPL commits to another $100B in US manufacturing for a total of $600B. Decoupling from Chinese spyware and malware is necessary.

- JP Morgan Chase $JPM partners with Coinbase $COIN to allow funding of cryptocurrencies through bank accounts and rewards-bearing credit cards. That’s quite a turn for CEO, Jamie Dimon.

- $AMD delivers strong growth, but the stock was priced for perfection and fell a bit. $SMCI has a declining growth rate and gave guidance suggesting it’s not a one-quarter problem. That stock fell much more.

- In our educational topic, we explain the difference between trailing and fixed stop losses, and help you understand whether you should be using stop losses at all.

Ready for a week of controversial and necessary firings? Let’s dive in:

1) President Trump Fires the Head of the BLS:

President Trump just fired Bureau of Labor Statistics (BLS) Commissioner, Erika McEntarfer, leading Democrats to claim the President was politicizing the BLS, and to wail that the firing is a threat to the integrity and independence of Federal statistics. Do a web search, and you’ll see endless political operatives and “analysts” claiming the President’s action is what threatens the integrity of the entire system. Let’s examine the data before drawing conclusions.

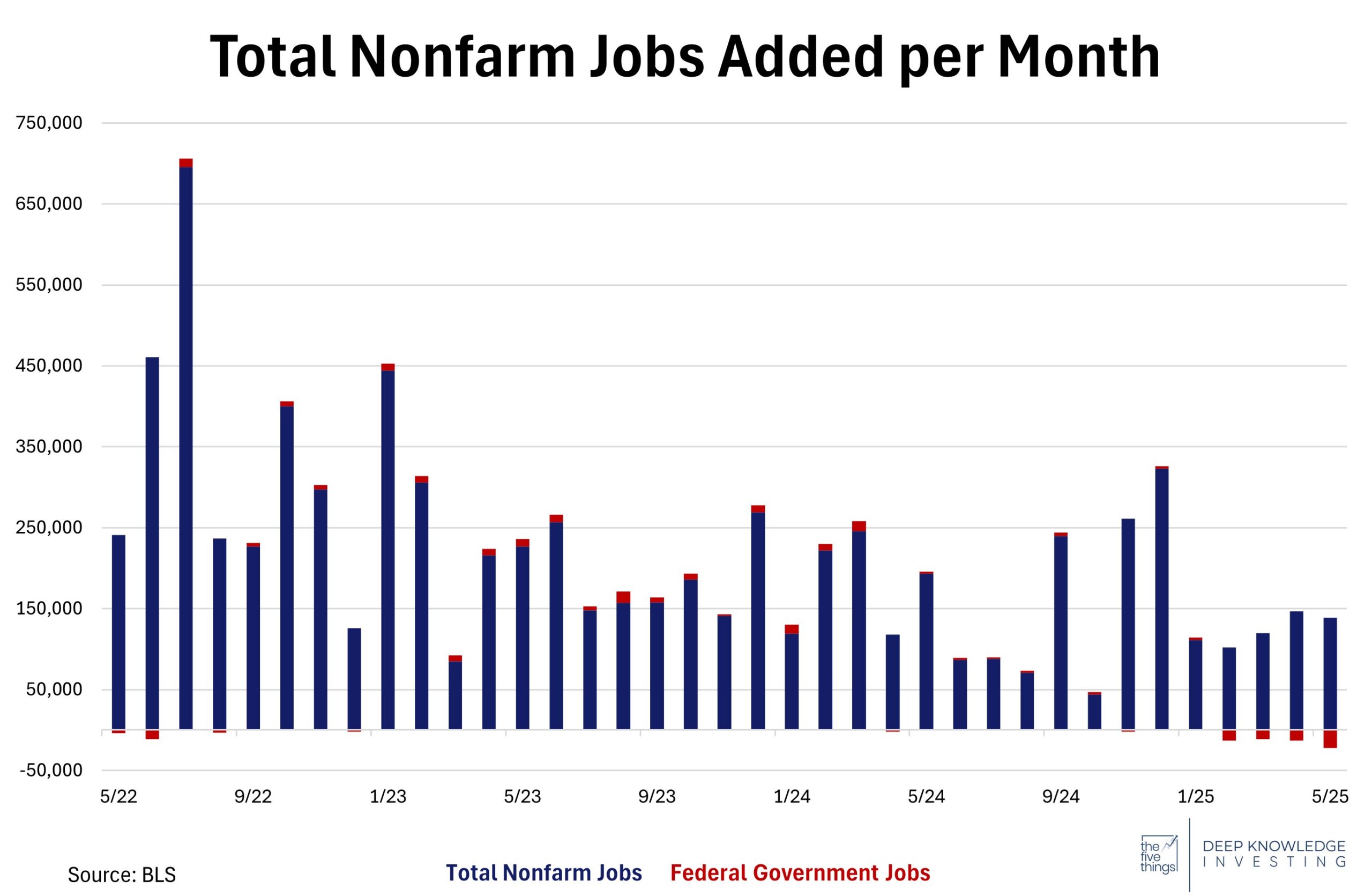

President Trump is focused on last week’s 258k downward revision in recent employment reports. DKI has frequently commented on the inaccuracy of the BLS and I’ve written dozens of pages noting the consistent trend has been for the agency to report positive job results when everyone is paying attention, only to adjust those numbers down by significant amounts in the less-watched later revisions. The trend was so severe, that I stopped tracking the data and stopped using it for analysis. It was useless.

McEntarfer was a Biden appointee who also presided over an 818k downward revision for the year ending in March, 2024. There was also an 832k downward revision across three months in 2023. In fairness, that last revision took place on McEntarfer’s watch, but the initial data was released before she was in charge.

The “data” isn’t even close.

DKI Takeaway: We’ve seen massive downward revisions covering 2023, 2024 and 2025. Is President Trump firing McEntarfer really the event that destroyed the integrity of the BLS, or has the BLS destroyed its integrity by constantly publishing nonsense. I think there are three possibilities for what’s happening.

- Politics: I’ve previously suggested that the inaccurate data presentation might be politically motivated, and President Trump just suggested the same.

- Bad data: James Lavish, who I respect, has made a convincing case that the BLS is getting bad data at the beginning and needs more time to publish accurate results. Michael Shedlock (Mish) is a member of the DKI Board of Advisors and has been tracking BLS data inaccuracies for years. This is not a new problem.

- Incompetence: Maybe the BLS isn’t politically motivated, but is unable to find a way to collect and report accurate data.

In the end, reporting accurate data is the job. If the BLS can’t find a way to do that, then they should expect to be fired. Right now, Democrats are focused on the firing. I think we should be asking why the Biden White House didn’t fire McEntarfer for constantly producing bad data. The integrity of the institution is being threatened by reporting “data” so bad, the revisions far outweigh the beat/miss vs expectations. Firing the person who is responsible for producing the bad data isn’t a threat to the system; assuming the real goal of the BLS is to provide us with accurate data.

2) Apple Ramps Up U.S. Investment with Additional $100B in Manufacturing:

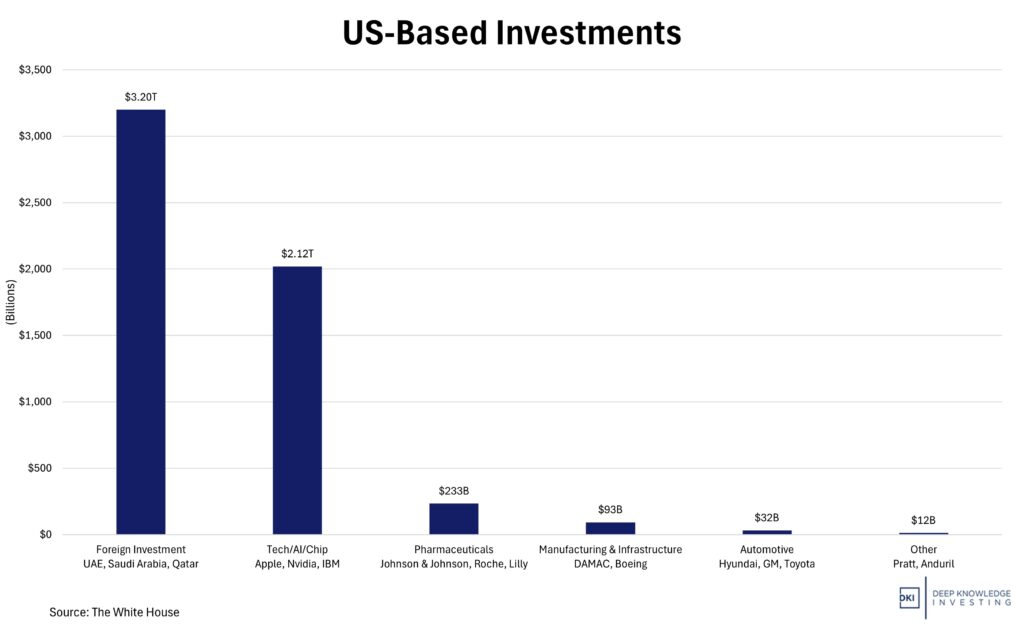

At a White House event on August 6, Apple CEO Tim Cook announced a fresh $100 billion investment in U.S. manufacturing, raising the company’s total U.S. commitment to $600 billion over four years as part of its new American Manufacturing Program (AMP). The AMP will expand Apple’s supplier network across all 50 states, support 450,000 supplier and partner jobs, and directly hire 20,000 employees focused on R&D, silicon engineering, AI, and software development. The initiative includes major partnerships with Corning, Texas Instruments, Applied Materials, Samsung (for chip packaging), GlobalWafers, and others. They aim to produce components for the iPhone and Apple Watch in Kentucky and build domestic chip supply chains. This move helps Apple avoid steep tariffs and is a good beginning to the long process of reversing the catastrophic decades-long trend of selling off our manufacturing capacity. Given China’s proclivity to hide spyware and malware in electronics, should we keep buying from them just for the lower initial price?

This chart gets better every time we update it.

DKI Takeaway: Apple’s bold U.S. investment is not just politically astute; it reflects a deeper economic stratagem. The AMP creates immediate policy insulation, but its true value lies in cementing long-term supply chain sovereignty, technological leadership, and regulatory goodwill. In the short term, higher domestic production costs could pressure margins or spark incremental device price hikes. In the long term, we can revive our high-end manufacturing sector and stop relying on China for products they use against us. (See the spyware and malware in solar panel infrastructure.) If executed with discipline, this program could redefine “Made in America” tech and lower the long-term costs of depending on China. Critics claim Apple is merely making worthless promises and intends to delay real expenditures until there is a future White House more willing to continue outsourcing American industry and jobs. This is a valid concern, and the Trump Administration should be watching Apple and other companies to see that they follow through on their public commitments.

3) JPMorgan Chase Partners with Coinbase to Fund Crypto Wallets:

JPMorgan Chase announced they will be joining forces with Coinbase to integrate cryptocurrencies in Chase’s banking system. Starting this fall, Chase account holders will be able to fund their Coinbase crypto accounts with their credit cards. In 2026, Chase plans to allow their “Ultimate Rewards” points to be redeemed for cryptocurrency in the form of USDC stablecoins. Additionally, Chase customers will be able to link their bank accounts directly to Coinbase crypto wallets in 2026, removing the need for third-party transfer apps.

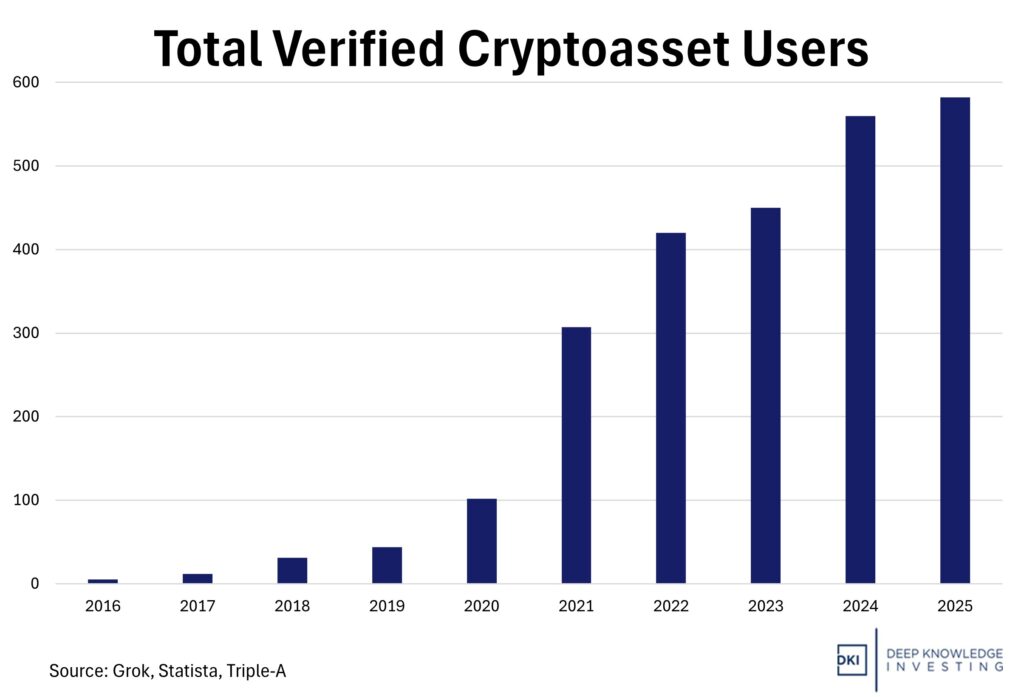

In short, JPMorgan is simplifying cryptocurrency access for banking and credit card services. This highlights a broader market shift as major banks are becoming more tolerant of cryptocurrencies and stablecoins have found a way to profit from a fast-growing financial asset. Growing mainstream acceptance of crypto combined with the long-accepted incentive of credit card reward points mean we are experiencing a shift that could soon connect crypto into everyday transactions.

This isn’t going to stop.

DKI Takeaway: JP Morgan Chase CEO, Jamie Dimon, previously was negative on digital assets. Now, having found a way for his bank to profit from it, we’re seeing major bank acceptance. While not a part of daily life yet, acceptance of cryptocurrencies is growing quickly. This moves cryptocurrencies from an asset that requires specialized knowledge to one that can be held in standard institutional and personal bank accounts. Technologically, linking bank accounts to crypto wallets via secure API (application programming interface) and using stablecoin for points redemption is creating a bridge between digital and traditional currency. DKI notes that we are among the many who draw a distinction between cryptocurrencies and Bitcoin. We own huge positions in Bitcoin and have avoided all cryptocurrencies. We continue to believe that stablecoins have the potential to threaten the profit model of the banks, something we’ve discussed in prior versions of The 5 Things.

4) AMD and SMCI Get Hit by Strong Expectations:

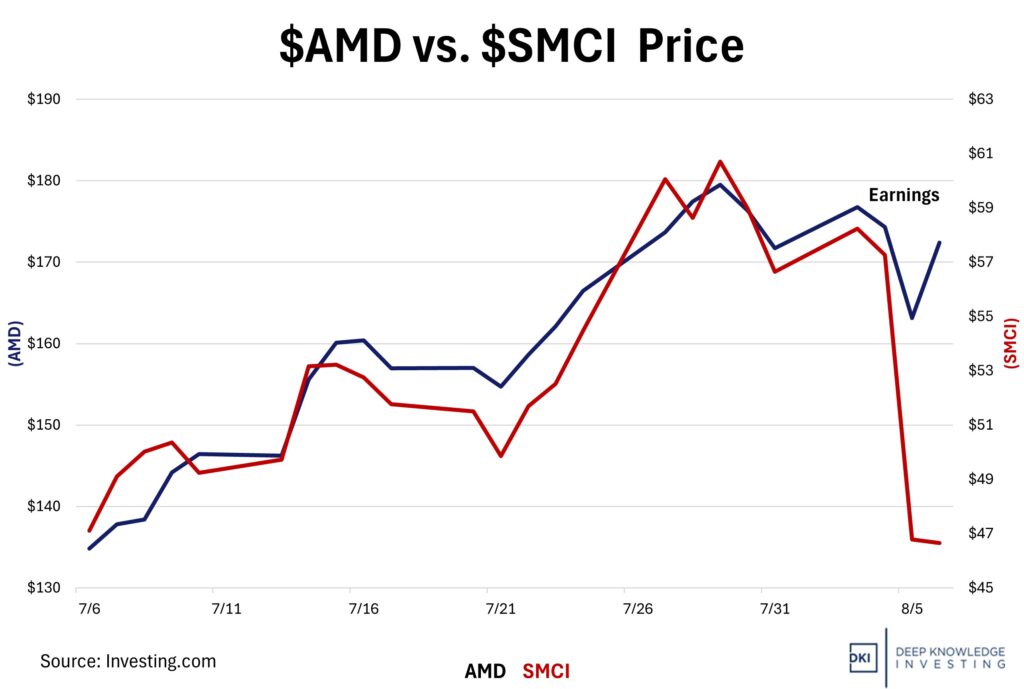

$AMD delivered strong second-quarter results featuring record revenue of $7.7B (up 32% YoY). Earnings per share of $.48 were in line with expectations. The stock still fell by 6% the next day due to extremely high investor expectations and data center growth of “only” 14%. With AMD shares up 80% in the three months prior, the stock was priced for perfection. Still, the small decrease only made a small dent in the recent rally.

Supermicro’s $SMCI decline post-earnings was even more dramatic, with shares dropping nearly 20% in one day. Revenue grew but at a decelerating rate. $SMCI’s produced soaring sales growth during the initial AI infrastructure boom. Recently, the momentum cooled, causing revenue to miss optimistic analyst forecasts. EPS also reflected pressure as the company’s gross margins shrank along with increasing operating expenses. Overall, SMCI had a rough quarter and forward guidance suggests a pause in growth.

A small blip for $AMD. A revaluation for $SMCI.

DKI Takeaway: AMD’s selloff wasn’t driven by a fundamental collapse. With robust demand across AMD’s portfolio, they continue to invest heavily in AI chips, driving growth. AMD’s stock bounced back to near pre-earnings levels the next day and as we noted last week, has just increased pricing on their AI accelerators. In both AMD and SMCI’s case, sky-high expectations made disappointment more likely. The market had already priced in AMD’s gains. Supermicro, worried investors with its declining growth rate and guidance suggesting that’s not a one-quarter issue.

5) Educational Topic: Trailing vs Fixed Stop Losses:

Some investors and traders want to be sure they never take large losses in a given stock, even on a temporary basis. To prevent that, they use stop loss orders. Unlike the stereotypical buy low / sell high mantra, using a stop loss order means the investor will automatically sell a stock if it falls by more than a pre-determined amount.

For example, if an investor buys a $100 stock and is using a 10% stop-loss, they would automatically sell the stock if it declined to $90. That’s an example of a fixed stop loss.

A trailing stop loss adjusts with upward price movement in that same stock. Let’s use the previous example of a $100 stock, but this time, there’s a 10% trailing stop loss. Now, let’s imagine the stock rose to $120. A 10% drawdown from there would be $108. That means the stock in this example would automatically be sold at $108.

Asset protection or guaranteed losses – that depends on your investing strategy.

DKI Takeaway: Portfolio manager and friend of DKI, Enrique Abeyta, frequently says plan the trade and trade the plan. When deciding to use a stop loss, it’s important to know what your risk tolerance is and how that impacts your investment thesis. If you’re a short-term trader, or have a lack of confidence in your thesis, using a stop loss (either fixed or trailing) is an effective way to limit losses. They can also be a way to ensure losses. Some highly leveraged shops would be fine with you buying a stock at $100, selling it at $90 and buying it back at $100.

I almost never use stop losses. Because I’m a long-term investor and usually have a well-researched thesis, I often view price declines as an opportunity. On more than one occasion, we’ve bought more $LVS stock when it declined on news that we considered unimportant or temporary; something we covered in last week’s 5 Things. When the stock recovered, we made higher profits on a larger number of shares. There’s risk to investing this way. For us, the key is to understand if and why we have a differing opinion than the stock market has on a particular investment.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.