We have a lot of technology-related news this week. Hewlett Packard Enterprise partners with Nvidia to make high-end AI servers and further cement Nvidia’s position as the entrenched market leader. Peter Thiel invests $200MM in Polymarket. These prediction markets/betting platforms not only provide people an opportunity to bet on economic or political events; but also, provide the public with valuable information on how the public views these events. Think of it like a stock chart for unusual events that allows insider trading. Tesla launches a robotaxi pilot. There were some issues, but Elon Musk is great at using problems as an opportunity to improve products. I’ll never give up my personal cars, but understand that robotaxies are coming soon. Washington DC is considering a ban on government use of Chinese and Russian AI. Given that DeepSeek is already transmitting user data to the CCP, this seems wise. (Yes – I’m aware that I just praised government policy as “wise”. It feels strange to me as well.) In our educational topic, we unravel various kinds of share classes we see in stocks.

This week, we’ll address the following topics:

- Hewlett Packard Enterprise teams up with Nvidia to make high-end AI servers. We think it’s a win for both companies.

- Peter Thiel invests $200MM in Polymarket. These prediction markets not only allow betting on events; but also, provide investors with valuable information on public sentiment.

- Tesla launches a robotaxi pilot in Austin, TX. It didn’t go perfectly, but these things never do. Improvements on the way. Don’t bet against Elon.

- Washington DC is considering a law to prevent government use of Chinese AI models. DeepSeek is transmitting data back to the CCP so this precaution makes sense.

- In our educational topic, we discuss how to understand different share classes.

Excellent job this week by interns, Samaksh and Cashen. They’ve also been joining us for the weekly 5 Things video version and adding some youthful expertise to the show. Come check them out at our YouTube channel. I think it’s impressive that a couple of 19-year-old interns can discuss complicated topics on camera. And for those of you who are wondering: I don’t prep them or write a script. They know the material!

Ready for a week of self-driving technology news? Let’s dive in:

1) Hewlett Packard Enterprise Teams up with Nvidia to Power AI Servers:

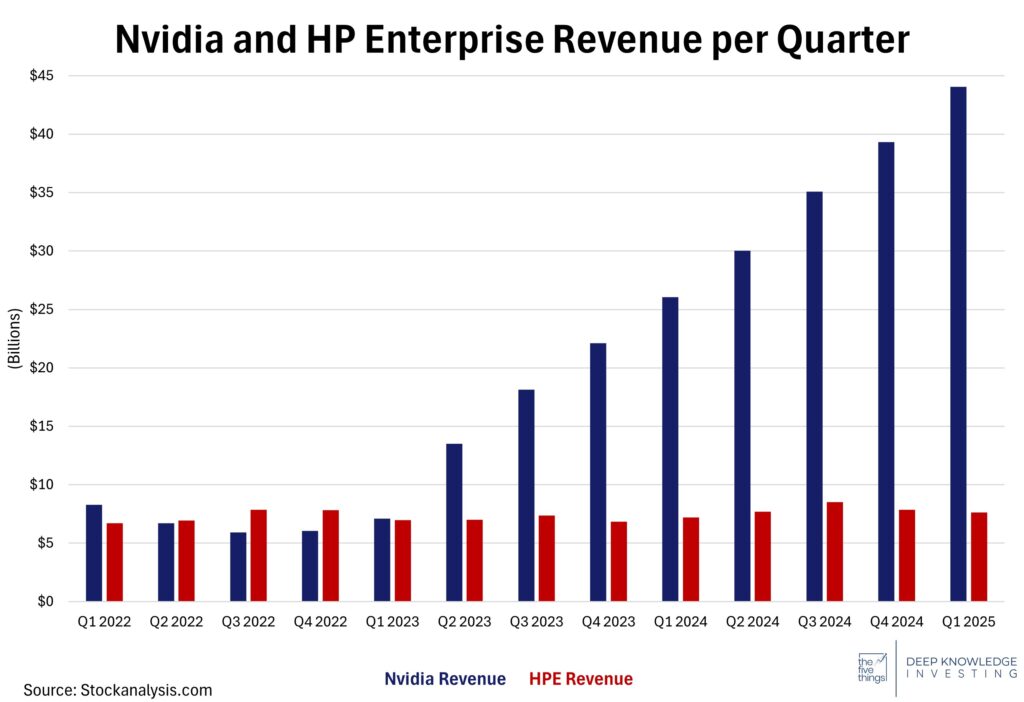

At its Discover event, Hewlett Packard Enterprise ($HPE) announced a new generation of AI servers built around Nvidia’s high-end Blackwell GPUs. Systems include rack-scale configurations like the GB200 NVL72 which are liquid-cooled and designed to handle trillion-parameter AI models. (Yes – GB200 NVL72 will be on the exam 😉) There are also smaller less-expensive versions as well. The “Nvidia AI Computing by HPE” stack integrates Blackwell compute, high-speed networking, and a variety of other high-end features which create turnkey solutions for generative and industrial AI workloads. Targeted at enterprise, sovereign, and cloud service provider customers, the platforms aim to simplify deployment of AI workloads. $HPE reported over $1.1 billion in net AI server orders last quarter and a pipeline totaling $3.2 billion, indicating pent-up demand.

AI usage is only going to increase – personal and enterprise.

DKI Takeaway: HPE’s Blackwell collaboration cements Nvidia’s hold over enterprise AI infrastructure and signals a shift toward pre-integrated, high-density AI systems. Investors must watch for three dynamics due to this partnership. First, HPE’s ability to preserve margin since its premium pricing depends on long-term adoption and service revenue attached to these AI systems. Second, Nvidia’s architecture dominance as their chips are increasingly the standard building block, deepening dependency among OEMs and data centers. Third, the evolution of AI workloads with HPE is betting on large-model training and inference, but future shifts to edge or modular AI could pressure centralized rack sales. Success for HPE hinges on execution. If adoption stays robust, HPE secures stable growth, but slowing AI interest would compress margins.

2) Prediction Markets Go Mainstream:

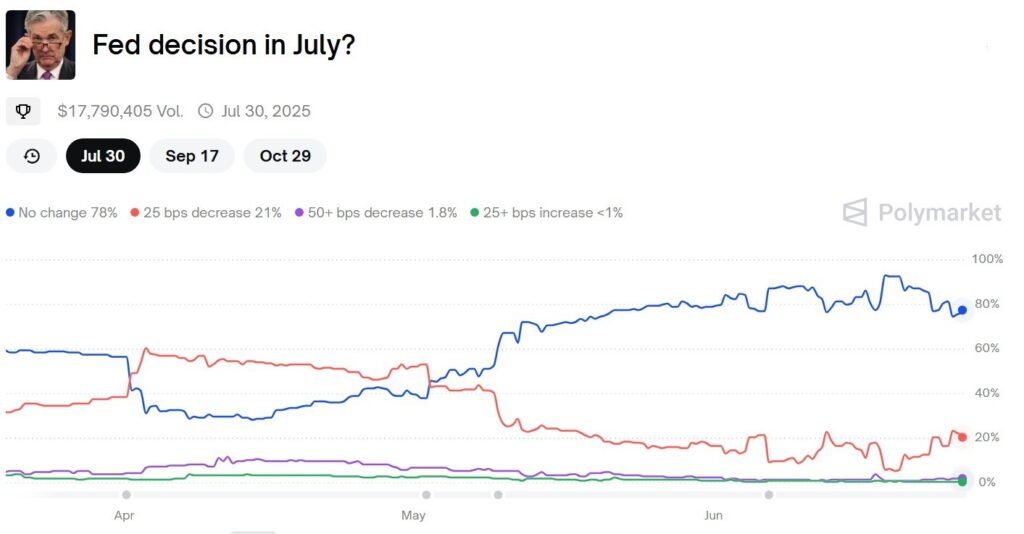

Peter Thiel’s Founders Fund just made a $200MM investment into Polymarket, the growing blockchain-based prediction market. This comes during a surge in public interest into prediction markets. Competitors, Kalshi and PredictIt are also providing markets with “wisdom of the crowd” probabilities. Polymarket’s implied market cap is now $1B which lends credence to the possibility of a new asset class in event and derivative markets. These could create financial instruments that could theoretically be used for hedging portfolio or position risk. Investors could also use market prices on geopolitical events to make informed decisions.

On the political side, election wagering provides an indication of public opinion. Given the horrible accuracy of polling in recent elections, these markets could be used to give voters and politicians a more accurate idea of where their candidate stands. As more people place wagers, the cumulative weight of the number and size of bets provides information that creates the potential to vastly change how society understands the future.

Bond markets vs futures markets vs predictions markets: Which is most accurate?

DKI Takeaway: The softened name of “prediction market” does not make Polymarket and companies alike less of a financial risk. Like the stock market, people are allocating capital against future results with the market makers taking their share. By turning predictions into tradeable assets, these markets allow investors, speculators, and bettors to both earn money from astute analysis and provide the rest of the market with an indication of public sentiment.

3) Tesla Launches Austin Robotaxi Pilot Amid Early Safety Hiccups:

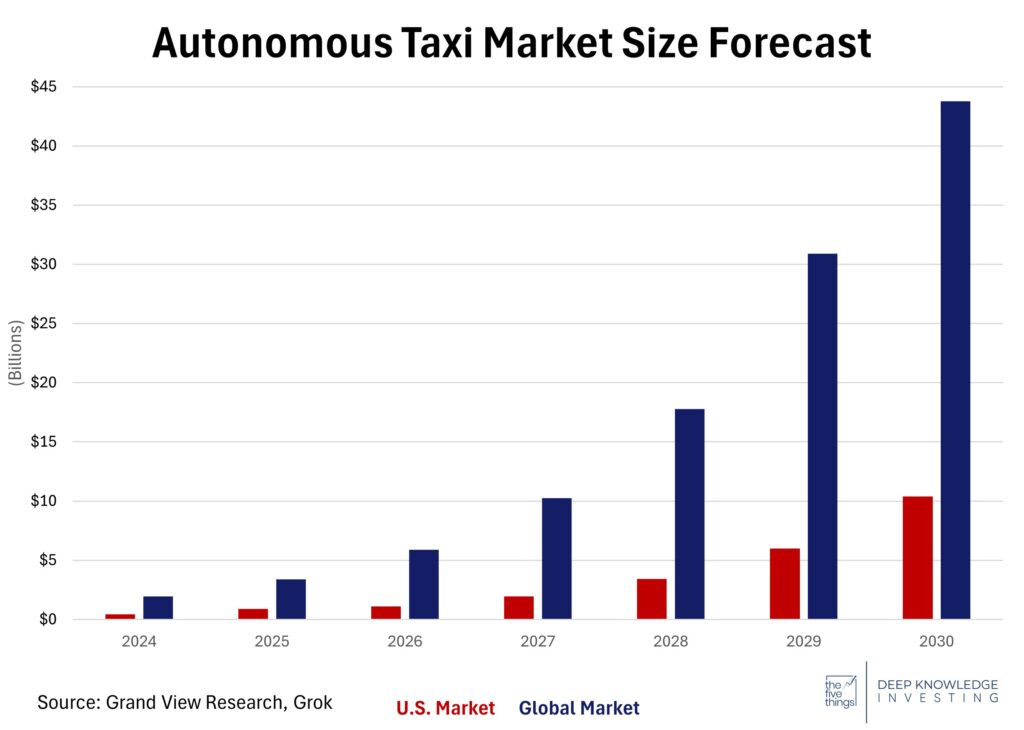

Tesla launched its first robotaxi trial in Austin on June 22, deploying a fleet of 10 – 20 Model Y vehicles equipped with Full Self‑Driving (FSD) software, causing the stock to jump 8% last Monday. The cars operate within a geofenced area, are assigned passengers via a Robotaxi app, and include both a front-seat safety monitor and remote teleoperators for oversight. Regulatory momentum in Texas has eased local oversight, though some senators urged Tesla to pause until stricter safety rules take effect in September. Initial rider videos and city incident reports reveal early mistakes; vehicles straying into wrong lanes, abrupt braking, and occasional speeding. Understandably, these incidents drew scrutiny from NHTSA and safety experts. Meanwhile, Tesla faces direct competition: Waymo already operates a commercial, lidar-enabled robotaxi fleet in Austin, offering fully driverless rides through Uber, and has accumulated over 10 million paid trips in its five cities.

There’s no stopping this trend, but I’m still not giving up my E46 M3.

DKI Takeaway: Tesla’s Austin robotaxi launch is a critical first step; however, early performance issues highlight that execution will define its future more than ambition. While the low-cost, camera-only approach may scale faster and cheaper than lidar rivals, safety glitches and regulatory friction could slow deployment. Waymo’s mature, sensor-rich model remains the benchmark, and Tesla must quickly reduce edge‑case errors to build credibility. The key is monitoring rollout speed, incident frequency, and regulatory responses. If Tesla irons out reliability concerns and streamlines teleoperations effectively, its robotaxi network could materially reshape transportation economics.

4) The Proposed Law Blacklisting Foreign AI Models:

The “No Adversarial AI Act” was just introduced. The intention is to prohibit federal agencies from using AI models developed by foreign adversaries. Any AI that originates from countries like China, Russia, and Iran would be barred from US government use. With the DeepSeek surprise earlier this year making many think the Chinese were capable of threatening large US AI models, concerns have grown about its ability to create rapid economic and military advantages for adversaries. Data security fears arose that already prompted many US companies to prohibit the use of DeepSeek, with the US government following. It’s already been reported that DeepSeek relays user information to the CCP, so these fears are reasonable.

Do you want the CCP to have access to the AI use of our government?

DKI Takeaway: Previously, DKI wrote about how export restrictions on Nvidia’s high-end GPUs could encourage the Chinese to build their own competing technology. Ideally, we’d like to see the Chinese be more dependent on American technology, just as the US is dependent on Chinese rare earth elements and magnets. Last month, we reported on how the Chinese secretly inserted devices into solar panel equipment that would allow the CCP to harm the US grid. DeepSeek is already transmitting user data back to the Chinese government. The US government shouldn’t be participating in this and should encourage the continued leadership of US-based AI instead of relying on foreign models.

5) Educational Topic: Understanding Share Classes:

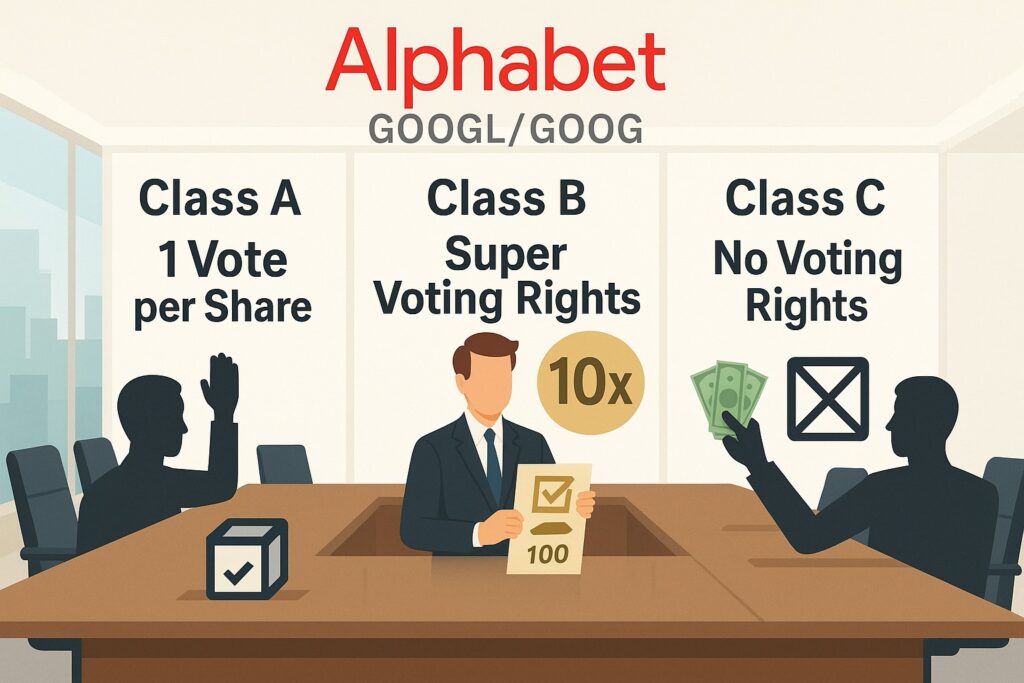

Companies occasionally divide common stock into share classes that offer different voting rights and various privileges. While different common shares typically have the same economic stake in the company, the voting rights they come with can differ.

These shares are usually split into Class A, B, and C, but these are only labels and will differ from company to company. For example, Alphabet’s Class A shares (GOOGL) have 1 vote per share, the Class B shares owned by founders have 10 votes, and the Class C shares (GOOG) have no voting rights. This gives the founders the ability to hold the majority of voting power even with a minority equity stake. These kinds of structures enable management to raise capital from the public without giving up major decision making power. Another reason companies may split shares into different classes is to allow smaller investors to invest in a company with very expensive shares. Berkshire Hathaway did this years ago to enable small investors who couldn’t afford to buy one whole share to invest in the company.

Voting rights can impact the stock price by less than you might expect.

DKI Takeaway: The billionaire media executive John Malone is an excellent example of someone who utilized different share classes to maintain control over multiple companies, even with a minority stake. This gave him the ability to preserve his power in the companies even when raising capital from the public. His example of leveraging multi-class shares show how he was able to make decisions that might not have been possible in a single class share system. Malone always allowed investors a way to profit alongside him; something that investors loved about him as a person and an executive.

Sometimes, shares with greater voting rights trade at a discount to the non-voting shares due to differing liquidity. Investors will often choose the ability to exit an investment quickly over the ability to vote their shares in corporate actions.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.