The Real Estate Issue

Commercial real estate is collapsing while home prices have remained relatively stable. Want to know how and why? We have you covered. Plus, there’s more Chinese data threatening a global slowdown and US consumers continue to spend even though it means running up more credit card debt. What do higher credit card balances mean in an inflationary environment? Is it time to panic yet? Let’s examine:

1) Commercial Real Estate is in Trouble:

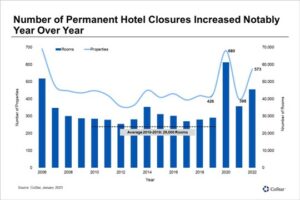

Two big announcements in San Francisco this week. A REIT (Real Estate Investment Trust) decided to stop making payments on a $725MM loan which covered 2,900 hotel rooms including the 1,921 room Hilton San Francisco Union Square, the city’s largest hotel. The property appraised for more than double that amount in 2016. Check out DKI Board member, Mish Shedlock on the topic. At about the same time, an office tower in San Francisco sold for 70% off of the original listing price and 60% off of the 2005 purchase price.

Property foreclosures ticking up. Graph from Attomdata.

As of now, we expect to see higher numbers in 2023. Graph from CoStar.

DKI Takeaway: This is the problem with the Fed keeping (manipulating) interest rates at around zero for a decade and a half. Desperate for yield, “investors” shift to more speculative opportunities and blow up huge bubbles in asset prices. Many are blaming the Fed’s rate hikes over the last year and a half for the problems, but it was the low/zero rates that created the issue. Reasonable interest rates are the solution. Failed loans are yet another reason we’re not touching the banks right now.

2) Another Reason the Housing Market Hasn’t Collapsed:

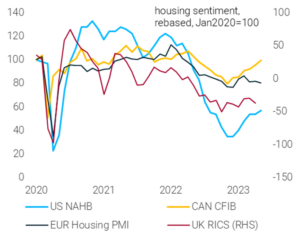

There has been much reasonable speculation that one reason housing prices haven’t collapsed yet is because people are “trapped” by their current low mortgage rates. This makes sense as people are unlikely to sell their home with a low-rate mortgage and buy a smaller cheaper home with a higher mortgage rate. No one wants to trade down to a smaller house with monthly payments that are the same or higher.

Graph from Dario Perkins

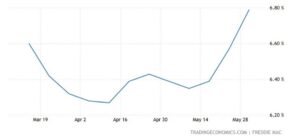

New homebuyers are betting on a change in the slope of this 30-year mortgage rate graph from Tradingeconomics.

DKI Takeaway: Dario Perkins provides an excellent alternative hypothesis. Home buyers are paying up now, and assuming that the Federal Reserve will cut interest rates soon. They believe they’ll be able to refinance into a cheaper mortgage next year. If they’re right, they’ll “overpay” for a year and then lock in a lower payment in a year. DKI understands the reasoning, but thinks they might be disappointed with where rates are then. Prematurely predicting Fed pivots has been a common error for many and the national pastime for FinTwit (financial Twitter) participants.

3) The SEC Goes After the Crypto Exchanges:

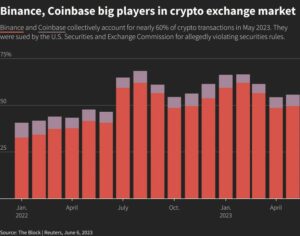

The SEC filed lawsuits against Binance and Coinbase accusing them of trading unregistered securities. Barron’s had the ridiculous line of the day writing that crypto “may have some practical use in the world. But mostly in places where traditional finance has failed, such as El Salvador”.

The big exchanges handle a lot of volume. That affects crypto, but not the long-term outlook for Bitcoin. Graph from Reuters.

DKI Takeaway: DKI recommended Bitcoin at around half of its current price in dollars and has understood that there is a difference between Bitcoin (sound money) and sh*tcoins which enrich insiders and act as casino gambling for “investors”. The Barron’s line is ironic given that the US just decided to take the debt ceiling from $31T to $35T in the next two years and has another $200T of unfunded off-balance sheet liabilities. Let’s get our own dollar house in order before poking at El Salvador.

4) China’s Exports Fall – A Lot:

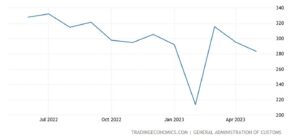

In May, Chinese exports were down 7.5% after growing 8.5% in April. Chinese imports were also down 4.5% in the month. These are huge numbers and stoked fear of a slowing global economy.

This trend in Chinese exports is not encouraging. Graph from Tradingeconomics.

DKI Takeaway: This is the second week in a row we’re highlighting economic weakness in China. The country’s mercantilist policies mean they are the world’s top exporter of goods and indicate worldwide weakening demand. This could cause reduced demand for oil, something OPEC anticipated with its recently announced 2MM barrel per day production cut.

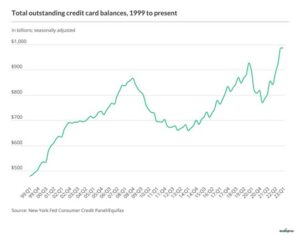

5) Credit Card Balances Are Rising:

DKI has previously highlighted the fact that Americans have largely blown through their Covid stimulus payments and lockdown savings. In addition, families are feeling the bite from inflation-fueled higher prices. However, spending hasn’t slowed and that means a return to credit cards to make ends meet.

The balance is higher on a dollar basis, but due to inflation, it’s not as large a lift as it appears. Graph from Lendingtree.

DKI Takeaway: Inflation means the larger balance doesn’t represent as large a debt as it appears from a historical perspective. The increased spending combined with low unemployment is the ideal environment for DKI stock pick Enova International ($ENVA). Full report and updates available to subscribers.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.