Overview:

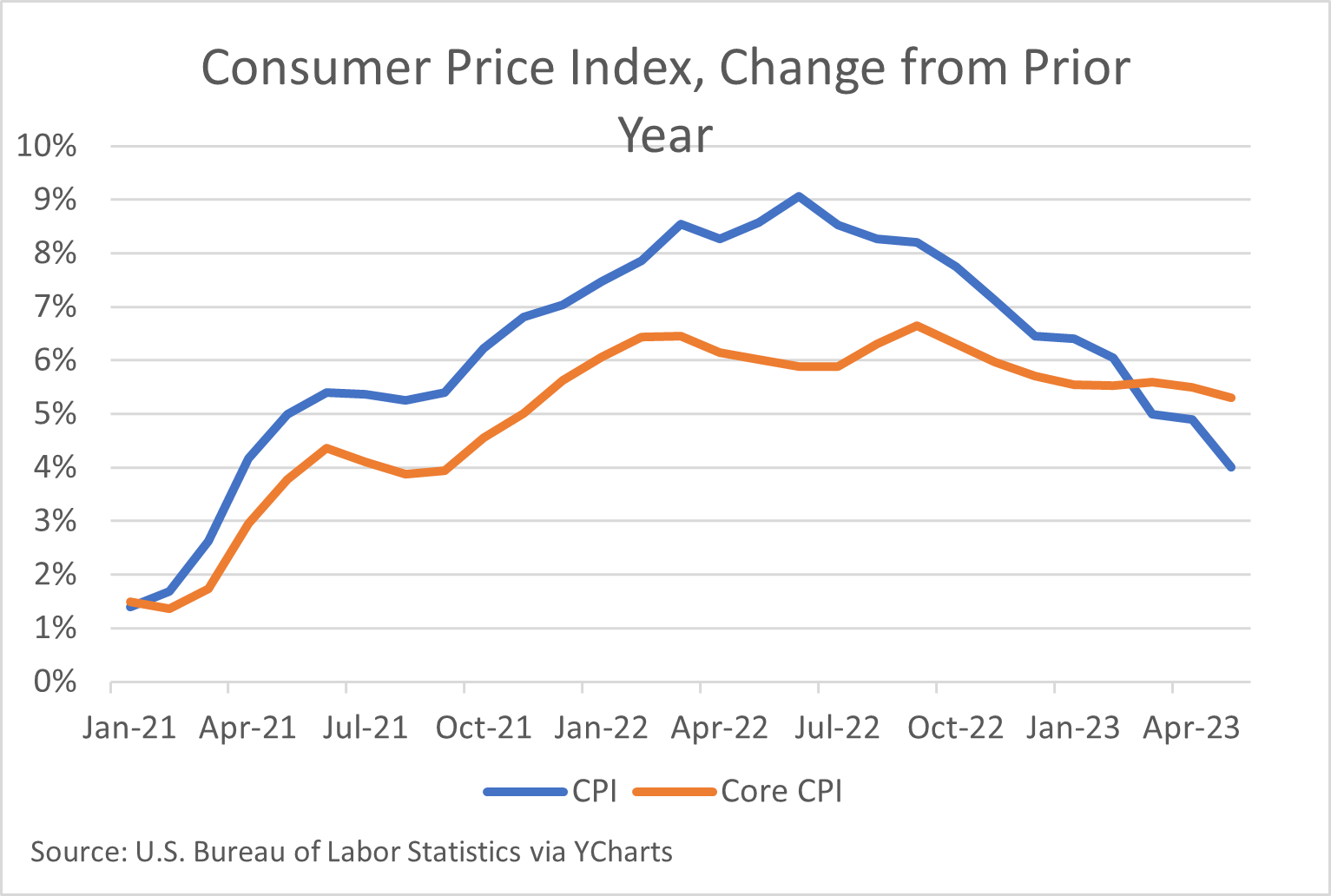

Today, we got the May Consumer Price Index (CPI) report. It showed an overall increase of 4.0% in the last year and .1% vs last month. The core CPI which excludes food and energy was up 5.3% for the last year and up .4% from last month. The market is encouraged by the decrease in the rate of inflation despite it being at or more than double the Fed’s target rate for two years. The Fed will be concerned with the core number. It’s having trouble getting that down due to sticky services inflation and a robust labor market. Let’s go through the details:

The line for Core is looking very flat.

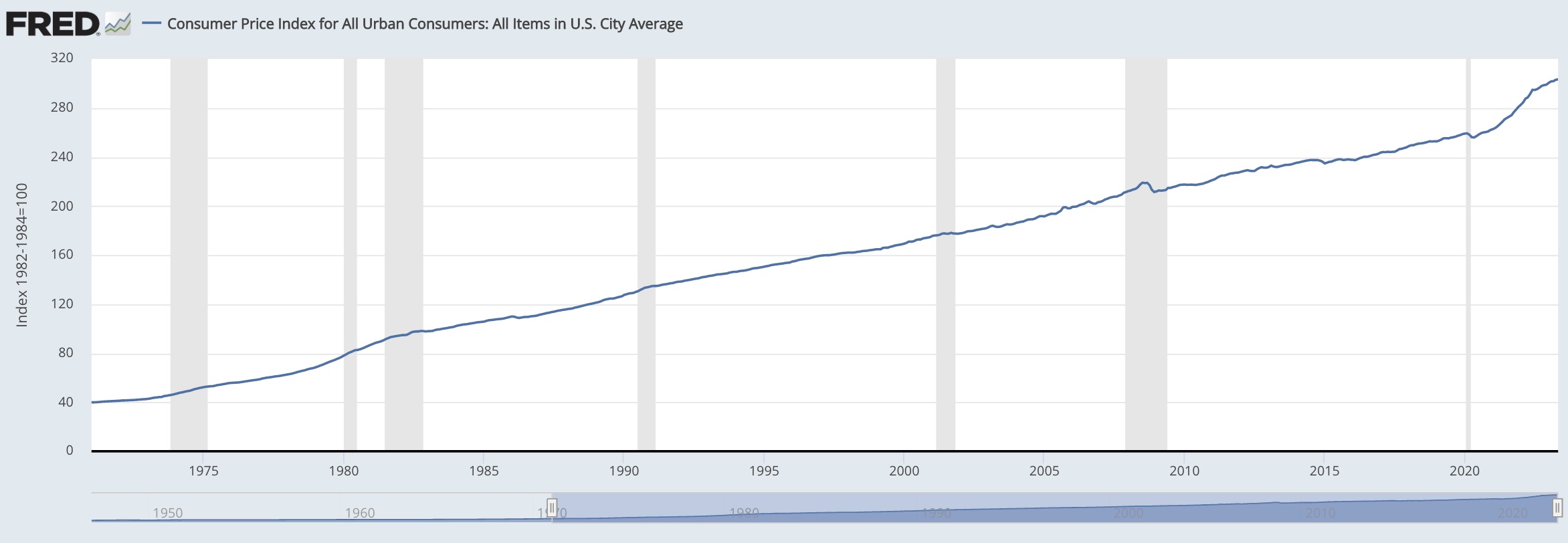

While the market is celebrating, the right side of this chart shows the loss of purchasing power for the average American wage-earner. Credit to ZeroHedge for the graph.

Food:

Food pricing was up 6.7% over the last 12 months. Food at home was up 5.8% and food away from home was up 8.3%. DKI has been skeptical of too-low prices for food in the index for the past year. We believe these numbers are more accurate. Despite war and floods, food commodity prices have fallen. Food away from home includes higher labor cost which is keeping services inflation higher.

Energy:

This is the primary reason for the reduction in the rate of inflation this month. Overall, energy pricing was down 11.7% with gasoline down 19.7% and fuel oil down 37.0%. Part of this is we’re lapping last year’s insane spike in energy prices. Further, we had an unusually warm winter in Europe helping them avoid a likely disaster. Energy prices are also down on expectations for a coming recession amplified by the White House’s continued draining of the strategic petroleum reserve. It was a risky but effective midterm election ploy, and it appears they’re planning on going into the fall hurricane season with low reserves and fingers crossed.

Vehicles:

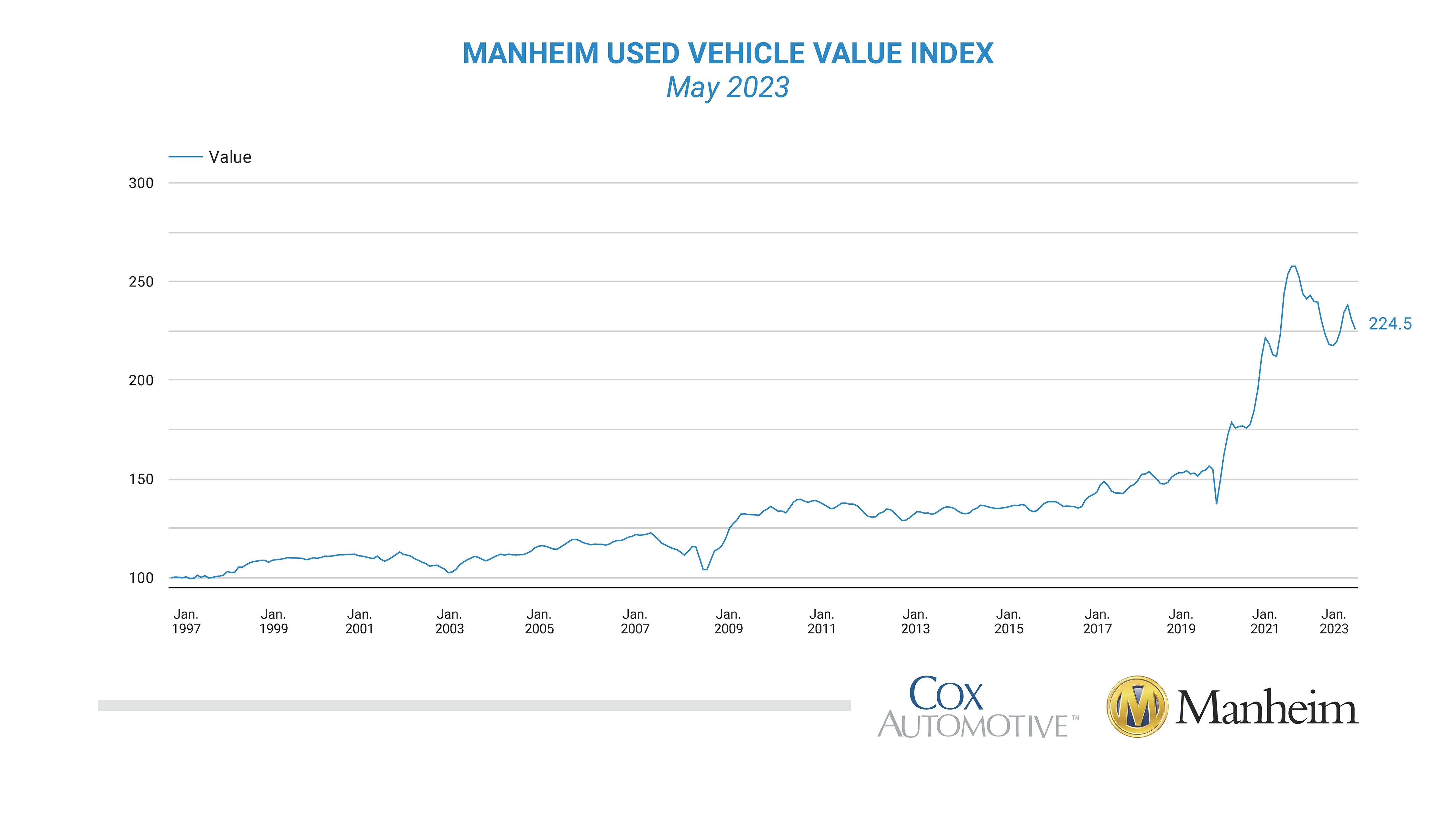

New vehicle pricing was up 4.7% and used vehicle pricing was down 4.2%. These have been volatile categories. We’d also note that the decrease in used car pricing is off of a huge increase. See the chart below and let us know if you think these prices are much of an improvement:

That drop at the end is better, but cars aren’t cheap.

Services:

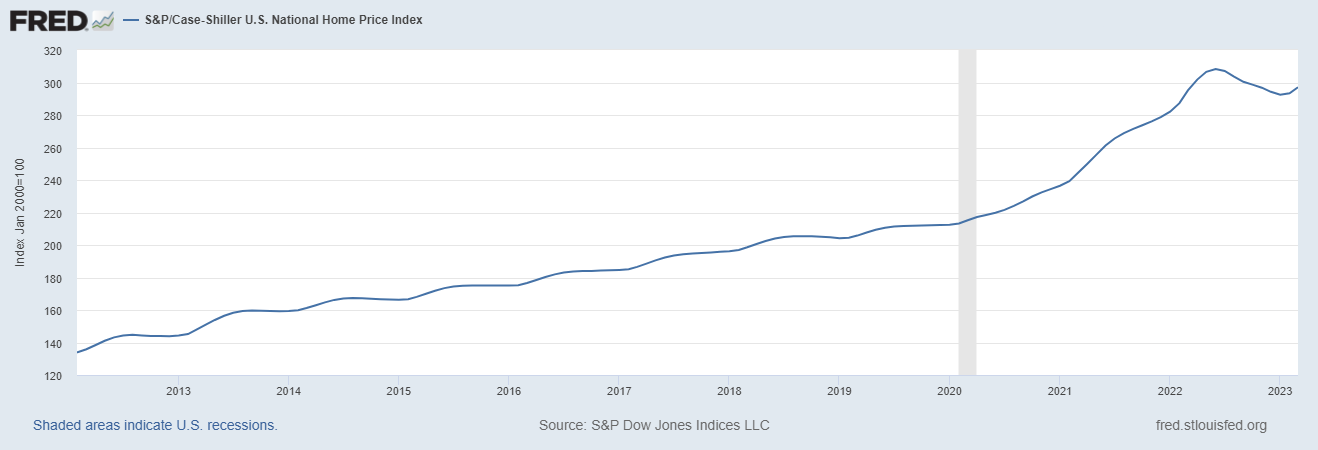

Services prices were up 6.6%, but that’s misleading. This includes a negative .1% for medical care services. Are your medical expenses lower than a year ago? Of course not. There is a massive 12-month negative adjustment that will run through September. We should expect this category to turn from negative to positive (higher prices) in a few months. Shelter prices were up 8.0%. As we keep pointing out, housing prices ran up a huge amount during the first two years of the pandemic. The price increases have slowed, but this is really an issue for people who buy a new home or need a new lease for a place that they rent. The Case Shiller Index is probably more accurate than the CPI Shelter component and you can see that price increases have moderated, but are still at elevated levels.

Not everyone renting a new place is thrilled with the “moderation”.

Analysis:

The market is excited by disinflation. That’s a reduction in the rate of change of the CPI. It means that while prices are still increasing, they’re doing so at a slower rate. That’s great for Wall Street analysts and those who fondly remember their high school calculus. If you’re working and trying to make ends meet, it looks like this:

Is anyone else excited by all the disinflation at the end of this chart? We aren’t either. Graph from St. Louis Fed prepared by DKI Intern Tristan Navarino.

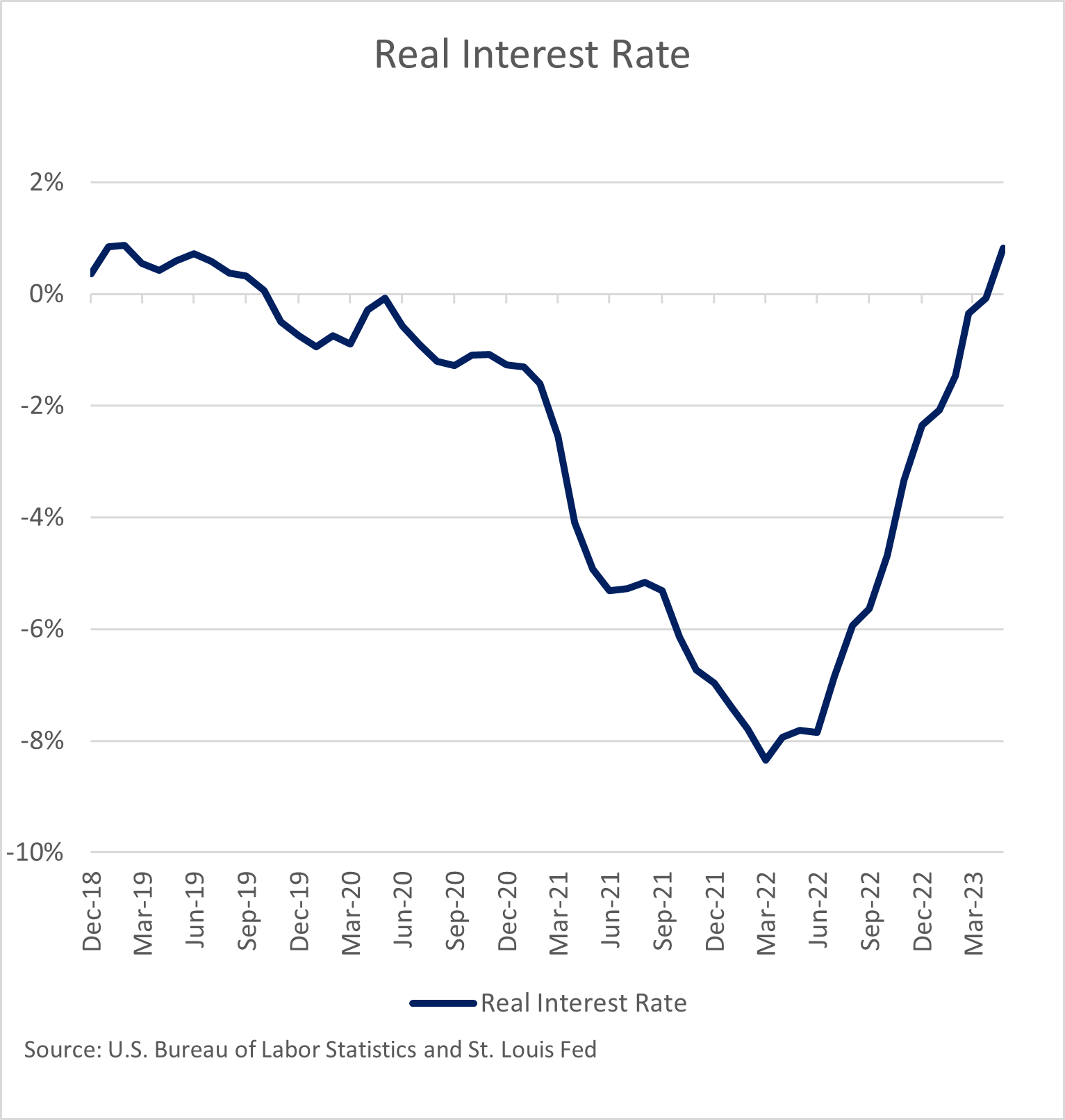

There are many people on FinTwit (financial Twitter) complaining that the draconian and terrible interest rate increases by the Federal Reserve have ruined the economy and their asset gathering businesses. DKI has accused the Fed of being far too slow in raising rates, something Chairman Jerome Powell has acknowledged. If you take a look at real rates (Fed Funds rate less inflation), we get a different story regarding how aggressive the Fed has been:

The real interest rate just went positive for the first time in years and currently sits just below 1%. Are we certain the Fed has ruined the economy with these rate hikes?

Conclusion:

The inflation rate has come down, but core and services remain sticky. It’s unrealistic to expect that food, energy, and healthcare will continue to decline indefinitely. We also point out that even as the Fed raises rates to try to get inflation under control, Congress and the White House continue to overspend which will necessitate further currency creation causing more inflation. We have a fiat debasement perpetual motion machine on display. Our predictions: The Fed will “pause” and not raise rates tomorrow. We get 1-2 more 25bp rate hikes this year. The “pivot” to lower rates will not come this year disappointing market expectations and FinTwit.

GB@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.