The Higher for Longer Part II Declared Jerome “The Hammer” Powell Issue

Fed Chairman, Jerome Powell, continues to hammer home his “higher for longer” mantra regarding rates. The pivot will come eventually, but no time soon. The economy is showing surprising strength, and while there is still some ambiguity to the data, the nightmare economic scenario is definitely not present yet. Employment and spending are still strong which will make it easier for the Fed to continue to raise rates. DKI thinks the Fed’s stance is less restrictive than others do so feel free to read multiple perspectives and let us know what you think. Are we right about the Fed, or have they over-tightened and need to lower now? Plus, we have some technically legal bank malfeasance and two bonus points this week…

1) Jerome Powell Goes to Europe and Reiterates “Higher for Longer”:

Federal Reserve Chairman, Jerome “The Hammer” Powell went to Portugal for a European Central Bank conference. While there, he emphasized the resilience of the US economy, and signaled again that he expected the Fed would raise rates twice more this year. He also reiterated his commitment to get inflation back down to 2%. The one surprise was Powell saying he didn’t expect to hit the target until 2025.

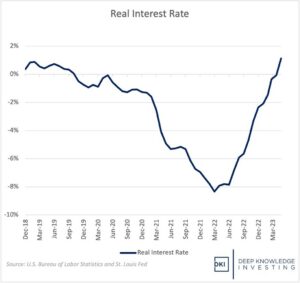

This doesn’t look restrictive to us.

DKI Takeaway: DKI has spent the last year saying the “pivot people” who expected the Fed to have already started reducing rates would be disappointed, and Powell is clear in his “higher for longer” mantra. We’re re-running the chart above to show that real rates (the fed funds rate less inflation) are just barely above 1%. The Fed still is not in restrictive territory yet. It just feels that way because the market has become accustomed to zero nominal rates and negative real rates.

2) GDP Revised Up?!:

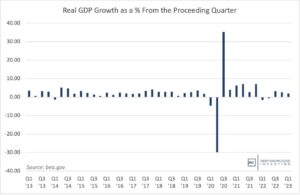

First quarter gross domestic product was revised up from 1.3% to 2.0%. The higher and positive growth for the economy will make it easier for the Fed to continue to raise rates. Fed Chair, Powell, has said the Fed will be “data driven” and an economy that refuses to fall into recession combined with low unemployment and high inflation means more rate hikes are on the way.

We acknowledge the big picture is better than we previously feared.

DKI Takeaway: This is a surprising revision. DKI has often commented on the tendency for government statistics to be very positive in their closely-followed initial reporting and then revised later to less positive levels when fewer people are watching. Seeing GDP revised upwards by .7% is unusual. We also note that all government statistics are faked in one way or another. If the government prints money and spends it paying people to do pointless “work”, that activity adds to GDP growth even if no value is created.

3) Applications for Unemployment Benefits Fall:

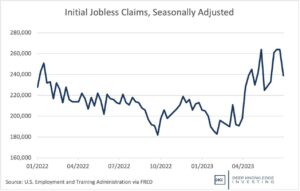

This statistic is reported weekly, so there tends to be some noise in the numbers, but applications for unemployment benefits fell by 26k to 239k. That’s a 10% drop. The number of people receiving unemployment benefits were down by 19k to 1.74MM.

Lots of volatility and a reversal of recent increases in unemployment claims.

DKI Takeaway: Powell and the Fed are more focused on employment and services inflation than on the CPI. It’s going to be tough for the Fed to get services inflation down and to contain a wage/price spiral when the employment situation is this strong. The conclusion here: higher for longer.

4) Home Sales Up AND Down – We Explain:

Mish Shedlock, a member of the DKI Board of Advisors, points out that new home prices are coming down at a record rate (although from very high levels). Builders have moved from offering some favorable closing and mortgage buydown terms to just cutting prices.

A 19% decline in 6 months is significant.

Surprise – lower prices lead to more sales.

DKI Takeaway: Real estate transaction volume has been down due to a struggle between sellers who wanted last year’s prices and buyers who want last year’s mortgage rates. We think the market will clear at lower prices. Unsurprisingly, as builders cut prices, volume and sales are up. That’s a positive for the housing industry.

5) Even Goods Orders Are Up Now:

Zerohedge reports that US durable goods orders are up 1.7% from last month. That’s materially better than the estimates for a 1.0% decrease. The year over year increase is 7.3%.

The graph is skewed by huge Covid-related moves, but 7.3% is big.

DKI Takeaway: Since late last year, we’ve been seeing lower demand for goods and higher demand for services. People bought a lot of electronics and things for their homes during the long lockdowns. Now that social life has returned to normal, Americans are more interested in going out to concerts, events, and returning to travel. We’ll be watching to see if this renewed demand for durable goods continues. If it does, and we would expect an increase in goods inflation, the result will be a more hawkish Fed leading to higher for…well, by now you know the rest.

6) PCE Still High, but Better Than Expected:

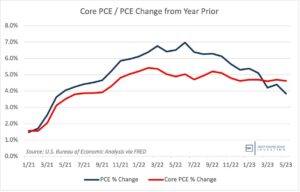

Friday’s personal consumption expenditures index was up .1% to 3.8%. The core number which excludes food and energy was up by 4.6% which was below the 4.7% estimate. This “better” inflation number led the market to rising at the end of the week.

The market is telling you things got a lot better. The core number looks sticky to us.

DKI Takeaway: There’s no question that improving economic data without an increase in inflation is a positive combination. However, as of this writing, the market is up a lot on reduced inflation, and the Fed is having trouble getting that core PCE number down.

7) The Big Banks “Pass” the Stress Test:

Twenty-three big US banks were stress tested by the Federal Reserve to determine if they could survive a global recession, or unemployment rising to 10%. All of them passed, and banking stock indexes rose in response.

So, no more of these bank failures – right?

DKI Takeaway: While it’s a positive that according to the Fed, these institutions would suffer losses of “only” half a trillion dollars in an adverse environment, we’re not celebrating. The banks may have enough capital to satisfy regulators, but the 2008 crisis was caused by long-tail derivative risk that even the desk heads at the big banks didn’t understand. The bank failures earlier this year were caused by duration risk. Whatever the next crisis is, it will be due to something on the banks’ balance sheets that isn’t being tested or thought about by execs or regulators. The correct solution is to stop bailing out failing banks who take too much risk. Let those banks fail and watch deposits and capital flow to banks that are more cautious. If you don’t want to see your tax dollars bailing out more failing banks, then this is how we get there.

Finally, the big banks announced increases to dividends and stock buybacks a day after passing. DKI is generally in favor of returning capital to shareholders. However, our view changes when excessive risk-taking is backed by government guarantees; even implicit ones. This asymmetrical risk/reward encourages unwise risk-taking and is backed by taxpayers.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.