The Higher for Longer and Jerome’s not Kidding Issue

Jerome Powell tells the “pivot people” higher for longer. We’ve been seeing inconsistent economic data turning more negative. DKI Board Member Mish Shedlock illustrates this point and Michael Gayed warns about the possibility of another round of stagflation. DKI agrees with both of them. Charlie Biello Tweets a graph supporting Dario Perkins’ excellent point from an earlier 5 Things regarding the non-collapse of the housing market. The White House upsets a sensitive Xi, and Jeff Weniger produces a graph explaining in one image how the CPI is designed to be inaccurate. There were so many interesting “Things” this week that we even added a bonus 6th Thing at the end.

We also congratulate new DKI intern, Tristan Navarino. In his first couple of weeks, Tristan made some nice contributions to the 5 Things. While I was at the IMN Real Estate Conference in Newport this week, Tristan selected most of this week’s “Things” complete with supporting graphs and images. In a few weeks, he’s gone from a guy who did a couple of graphs to a meaningful contributor producing high-quality work. Well done!

And now, on to the Things:

1) Jerome Powell Tells Congress “Higher for Longer”:

Federal Reserve Chairman, Jerome Powell, spoke to Congress this week and reiterated the same thing he’s said for the past year; that he’s committed to getting inflation down to 2%, that we’re nowhere near that now, and that the Fed plans to raise rates again this year without lowering them in 2023.

The “pivot people” are hoping for a reprieve, but Powell’s thumb has turned down.

DKI Takeaway: The Fed has been wrong about a lot, but with the CPI at double the target, Core CPI stuck above 5%, real interest rates just barely positive, and a Fed balance sheet approaching $9T, the Fed is correct that it’s too early to pivot. DKI has been telling you for a year that we’re not close to the pivot. Powell may have finally convinced the market that he’s serious about higher for longer.

2) More Detail on the Housing Non-Crash:

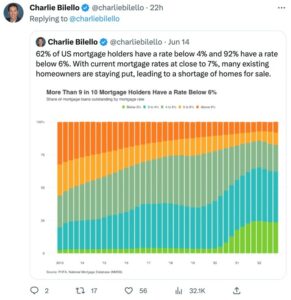

I was at the IMN Real Estate Opportunity Forum in Newport last week, and there was a lot of discussion regarding the weakness in commercial real estate and the surprising strength in residential sales. Charlie Bilello has a great chart showing that over 90% of mortgage holders would need to refinance at meaningfully higher rates if they sold their home and moved.

Chart and commentary from Charlie Bilello. Data source is FHFA.

DKI Takeaway: A couple of weeks ago, we highlighted this same point from Dario Perkins. While higher mortgage rates have made homes less affordable, anyone with a mortgage more than one year old is “trapped” by a mortgage rate that is below current levels. It would be uneconomical for many of these people to move even to a smaller cheaper home and that’s kept supply off the market.

3) US – China Relations Not Improving:

US Secretary of State, Anthony Blinken, met with Chinese President Xi Jinping in an effort to improve deteriorating relations between the two largest economies in the world. As is typical for the Chinese leader, Xi blamed tensions between the two countries on the United States and gave a list of his expectations for US actions required to improve the situation. Not so much on China’s responsibility in the matter. The White House responded by calling Xi a dictator.

Blinken and Xi. Photo from Reuters.

DKI Takeaway: Leaving aside whether it was wise or helpful to call Xi a dictator, we credit Joe Biden for speaking plainly and correctly. Xi heads up a one-party totalitarian State. He may not like the label, but it’s accurate. At DKI, we’re more concerned about access to pharmaceuticals, chips made at Taiwan Semiconductor, and components for US weapons systems. Relying on China for crucial items is foolish. The US needs domestic supply of these goods. As a free-trade advocate, it feels strange to write that, but the US shouldn’t have to count on China for anything this important.

4) Could we See Stagflation Twice in Two Years?:

DKI and inflation-focused investor James Davolos correctly predicted last year’s stagflation back in February of 2022. As both of us expected, the US had a recession characterized by two quarters of negative GDP growth combined with high inflation. Conditions-based investor, Michael Gayed, just warned about the possibility of two rounds of stagflation in two years.

Gayed making a clear call on this one.

DKI Takeaway: DKI has been highlighting inconsistent economic data for over half a year now. We’re starting to see a slowdown in economic activity combined with high services inflation. It wouldn’t take much for the US to tip into recession again while inflation is still high. While stagflation is rare, we could see it twice in two years. Do you know what you’d do with your investment portfolio in this scenario? DKI has a list of specific investments designed to outperform in that environment that we make available to subscribers. What if you had a better plan than “just wait for things to get better”.

5) New PMI Data is Not Encouraging:

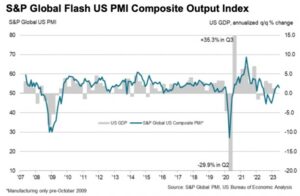

Preliminary “Flash” data came out on Friday showing weakness in the Purchasing Managers’ Index. As DKI Board of Advisors Member, Mish Shedlock points out, we have a 3 month low in the Composite Output index, a 2 month low in Business Activity, a 5 month low in Manufacturing Output, and a 6 moth low in US Manufacturing.

Not awful but not great either.

DKI Takeaway: We’re starting to see a pattern characterized by slowing manufacturing and consistent high consumer spending. We’d expect that over time, lower consumer spending will follow a weaker economy rather than the opposite. This is the kind of data that would make Michael Gayed correct in the previous “Thing to Know”.

6) One Way the CPI Misstates Inflation:

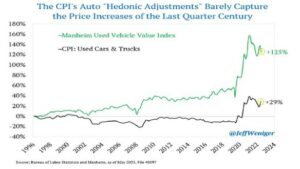

DKI spent much of last year explaining why and how the CPI was misstated, often by as much as 100% in 2022. Credit to Jeff Weniger for a great explanation of one way the CPI is designed to be misleading. When the auto manufacturers add a bunch of expensive new features that many drivers may not want, the CPI makes a “hedonic adjustment”. That’s a fancy way of saying that even though auto prices are up a lot, the US Bureau of Labor Statistics can show a much lower rate of inflation.

Jeff Weniger analysis and original post here.

DKI Takeaway: The huge price increase you’ll pay if you want to buy a car is seen in the Manheim Index in green above. The government “adjusts” for all the new features and manages to tell the rest of us that prices are only up 29% over the past 27 years. This is why your household budget will often bear no resemblance to the most recent 4% CPI figure.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.