The “Pause” Issue

New CPI is lower, unless you count Core CPI which is sticky. Fed “pauses”, but raises rate target for the year and pours cold water on the “pivot” soon crowd. The $ATVI / $MSFT deal faces further hurdles. And the yield curve continues to indicate a coming recession. We also congratulate DKI Intern, Tristan Navarino, for contributing ideas and graphs for this version of the 5 Things. Well done! It was a big news week so let’s get started.

1) May CPI is 4.0% – Is that good?:

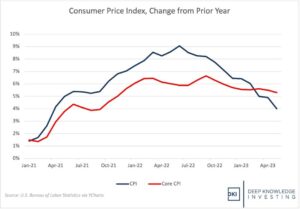

The May CPI report showed an inflation reading of 4.0%. That’s down from last month and last year, but still double the Fed’s target rate. The primary reason for the reduction is a huge decrease in energy prices over the last year. Shelter (housing) prices are still up 8% despite higher mortgage rates. And health care services is still benefitting from a one-time huge adjustment that will end in September.

The Fed is having trouble moving that red line.

For those of you who find this confusing, we have a handy guide.

DKI Takeaway: Not only does inflation remain high despite huge reductions in energy prices off of last year’s highs, the bigger issue for the Federal Reserve is the sticky core number. This version of the CPI excludes food and energy prices. Higher demand for services and higher wages are keeping this category from moving much despite Fed rate hikes.

2) The Fed “Pause” is Here – Sort of:

The Fed concluded its June meeting and decided not to raise rates for the first time in over a year. However, the release was much more hawkish and reiterated the intention to get inflation down to the 2% target. The “dot plot” which shows each Fed Governor’s expectations for future levels of the fed funds rate indicates plans for two more rate hikes this year.

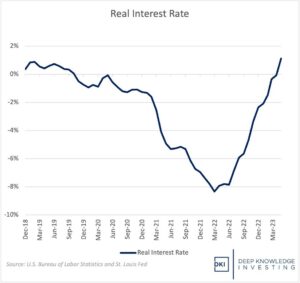

Real rates are just over 1%. This is not nearly as draconian as many think.

While the market is celebrating, the right side of this chart shows the loss of purchasing power for the average American wage-earner. Credit to ZeroHedge for the graph.

DKI Takeaway: Asset gathers disguised as investment managers and bank investors have been complaining that the Fed broke the economy with its quick rate hikes. We assert that a decade and a half of near-zero rates are what broke the economy and returning to more normal rates is just indicating who’s alive, who’s dead, and who’s mostly dead. Real interest rates (the fed funds rate less inflation) is just barely over 1%. That’s would still be considered stimulus in a rational world.

3) Quantitative Tightening is Disappointing:

The Federal Reserve has been talking about quantitative tightening for over a year. After running up a $9 trillion dollar balance sheet including trillions of mortgage-backed securities they’re not allowed to own, the Fed decided to start to reduce the balance sheet in order to try to take some stimulus out of the economy. Let’s see how they’re doing:

Graph from the Federal Reserve.

DKI Takeaway: One reason for this year’s stock market strength has been continued liquidity provided to the market. Whether it’s real interest rates that have been negative for most of the year, a still-high Fed balance sheet, or continued governmental overspending, the economy still has lots of liquidity being provided by central planners. That tiny blip up near the end of the chart was the bank depositor bailout.

4) FTC Asks Federal Court to Stop $ATVI/$MSFT Deal:

The Federal Trade Commission is trying to get an injunction from a federal court to prevent Microsoft from completing its acquisition of Activision. There had been reports that the companies were going to try to close the deal despite regulators in both the US and the UK attempting to stop it on antitrust grounds.

Is this deal really an antitrust problem?

DKI Takeaway: DKI can’t find a real antitrust reason to stop this vertical merger. Microsoft doesn’t and won’t have a monopoly on high quality games. Sony has its own amazing Santa Monica Studio and Nintendo produces the best games on its own platform. Plenty of game designers want to independently put content on multiple platforms. However, as much as we prefer a light touch by regulators, we think the progressives in government have a valid point here. Big tech firms have been buying their competitors preventing the formation of the next generation of technology firms. It might be best for companies like Microsoft and Facebook (Meta) to have to fight it out with smaller competitors.

5) Yield Curve Inversion is Worst in Four Decades:

The market correctly watches the spread between the two year and ten year Treasury bonds as an indicator of coming recessions. The idea is that when the market has high short-term rates and lower long-term rates, it’s because investors are anticipating an economic downturn followed by the Federal Reserve lowering interest rates.

This is the most inverted the 2 year/10 year spread has been in over 40 years.

DKI Takeaway: DKI has been highlighting inconsistent economic data since last November and has been pointing out incorrect market expectations on interest rates for almost two years. However, this indicator has proven to be reliable and is the most negative we’ve seen since the high inflation and double-dip recessions of the late ‘70s / early ‘80s. The Fed is probably raising rates into a recession. We started this version of the 5 Things by pointing out that the Fed has been far too dovish and now we’re saying they’re risking a recession. The situation is complicated and this is why it’s unwise to have rates around zero for a decade and a half.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.