Judge Amit Mehta, an Obama appointee, determined Google was abusing an illegal monopoly. The law says he’s supposed to end the monopoly and eliminate the profits from it. Instead, he left it in place and Google is still sending Apple tens of billions of dollars a year. Revolution Wind had its wind power project stopped shortly before completion. This upset green energy activists who were fine with the government stopping the Keystone Pipeline a few years ago. The lesson is to not to be in a business subject to the ever-changing whims of Washington DC. Last decade Kraft and Heinz merged in order to take advantage of operational synergies. A decade later, operating margins are lower and the combined company is now going to split back into its two parts. Warren Buffet is displeased, but the investment bankers are happy to be getting paid a second time. Paul Singer at Elliott Management is heading in the other direction. He invested $4B in Pepsi, which has been a multi-year underperformer. Elliott may advocate for divestitures. In our educational topic, we explain the difference between market capitalization and enterprise value and help you understand which one to use and when.

This week, we’ll address the following topics:

- Judge Mehta concludes Google $GOOG has monopoly power. Then, he leaves it in place.

- Revolution Wind project stopped. Green energy advocates are upset. Keystone Pipeline workers watch with amusement.

- Kraft Heinz $KHC to split into two companies undoing a merger from last decade. Warren Buffet is not pleased.

- Elliott Management takes a $4B stake in Pepsi $PEP. They’re looking at divestitures as well, possibly some food assets.

- In our educational section, we discuss the difference between market cap (equity value) and enterprise value (aggregate value). We’ll help you understand which one to use.

We’ve all heard stories about the internships which involve “shadowing” someone and going to lots of dinners with different departments. Despite their young age, the DKI interns produce incredible work each week. Much of the writing, research, and image generation you’re about to read is a result of the work of Cashen Crowe (University of Tennessee), Samaksh Jain (Rutgers), and Gideon Rotem (Dartmouth). They’ve worked through holidays, travel, and accidents. Great work, guys!

In the video version, Mark Rossano of C6 Capital filled in as guest host last week. We’ll have Robb Fahrion of Flying V back in his usual seat this week. Robb contributes his personal time to ensure the video version of the 5 Things is always improving. If you’re looking for a digital marketing firm, the team at Flying V has been dedicated to DKI from the beginning. I want to express my appreciation to Cashen, Samaksh, Gideon, Robb and the team at Flying V (Alex, Jonalyn, Nazim the Dream, Anton, and Kashif the Chief of technology).

1) Google Avoids Forced Chrome Breakup in Antitrust Ruling:

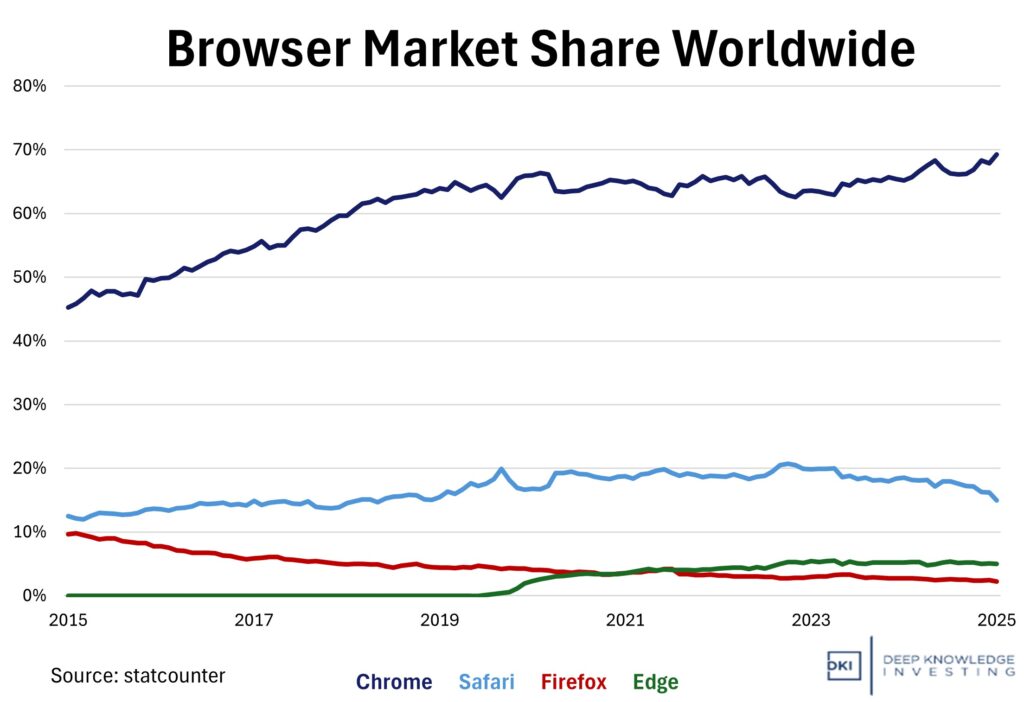

In a high-profile decision, U.S. District Judge Amit Mehta, who was appointed to his position by President Obama, declined to force Google to divest its Chrome browser or halt payments to Apple to maintain its default search engine status, despite affirming Google’s monopoly in search services. The ruling imposes minor behavioral remedies: Google must cease exclusive distribution agreements and share certain search index data with qualified competitors, including emerging AI-backed search platforms such as Perplexity, OpenAI, and DuckDuckGo. Alphabet’s stock surged over 8% following the announcement, while Apple also gained nearly 3%, buoyed by continued revenue from its default search partnership with Google. The court’s decision reflects the recognition that generative AI is reshaping competitive dynamics and that structural remedies may be both excessive and unnecessary at this stage. Antitrust experts point out that once Jude Mehta identifies abuse by a monopoly, he is required by law to end the monopoly and stop excess profitability.

Google-owned Chrome is one way Google embeds its search.

DKI Takeaway: The ruling is a huge win for Google. Even though it makes a determination of monopoly status, the company avoids a potentially disruptive breakup and retains its most powerful distribution lever: default placement on Apple devices. Antitrust experts point out that Judge Mehta made a correct determination, but didn’t follow through with a meaningful remedy to Google’s monopoly. The mandated data-sharing introduces potential competition but may prove superficial against Google’s accumulated dominance. For investors, the takeaway is clear: Google’s entrenched infrastructure, combined with its AI push via Gemini, remains intact and may now face selective, well-capitalized competitors buoyed by data access. Watch how rivals capitalize on new search index data, how Apple negotiates its default deal moving forward, and whether behavioral remedies are sufficient to spur genuine competition. The long-term battleground is shifting to AI innovation, not browser divestiture, and Google enters it with both continuity and momentum.

2) Offshore Wind Faces Trouble with Revolution Wind Suspension:

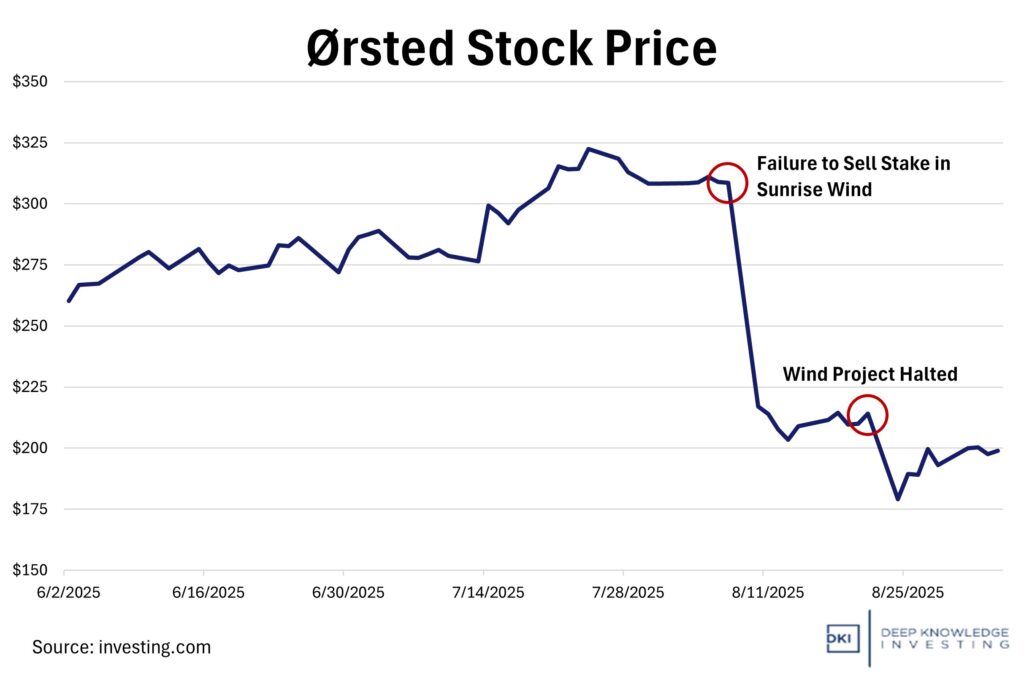

At roughly 80% completion, the Bureau of Ocean Energy Management (BOEM) issued a halt directive on Revolution Wind, citing radar interference concerns with the project. Ørsted, the project’s developer, complied and paused installation of the offshore wind farm. The 704 MW project was expected to deliver electricity to 350,000 homes. The move to suspend affirms President Trump’s continued opposition to unreliable sources of power like wind and support of energy independence through oil and gas. Many of the wind farms are largely built by European developers, also reinforcing President Trump’s skepticism of foreign influence in US infrastructure.

While offshore wind farms do have clear benefits, they cost more than onshore wind and solar. And with developers already dealing with rising costs, a new problem is on the horizon: policy. Political risk plays an important role in projects like these as they are heavily reliant on government subsidies.

This is the risk of a subsidy-based business plan.

DKI Takeaway: This scenario demonstrates an example of a company with a business model that is too heavily reliant on government subsidies and not actual customer demand. Political decisions can be made very quickly and vastly change the scope of a company’s future. When wind projects depend on government subsidies, financial performance can decline due to a decision out of Washington DC. Projects like Revolution Wind were halted in the same way the prior administration stopped construction on various pipelines. The US needs more electrical generation and the political will to build more carbon-based ones doesn’t exist. DKI remains highly bullish on nuclear.

3) Kraft Heinz to Spin Off into Two Focused Businesses:

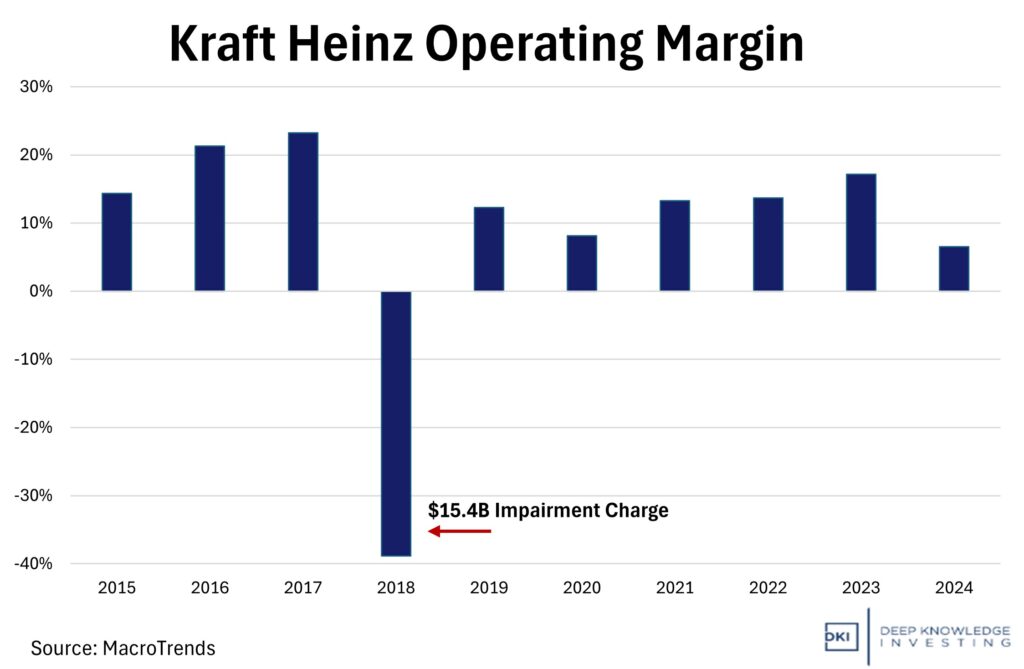

Kraft Heinz has announced a tax-free spin-off, splitting itself into two publicly traded companies by late 2026. The spread-based business is Global Taste Elevation Co., with $15.4 billion in 2024 sales (including brands like Heinz ketchup, Kraft Mac & Cheese, and Philadelphia) and $4 billion in adjusted EBITDA. The food business is North American Grocery Co., with $10.4 billion in sales (featuring Oscar Mayer, Lunchables, and Kraft Singles) and $2.3 billion in EBITDA. The move is a strategic pivot aimed at reducing complexity and enabling each entity to focus on its specific market dynamics; global condiments and staple grocery products.

Investor reception has been tepid. The stock fell roughly 7% after the announcement, reflecting skepticism over the strategic rationale. CEO Miguel Patricio emphasized the need for sharper capital allocation and operational efficiency, but critics, including Warren Buffett, warn that the split alone may not fix structural issues rooted in decades of underinvestment and shifting consumer trends. Buffet is among the investors pointing out that efficiency leading to improved margins was the reason for the initial merger. The company also estimates about $300 million in separation costs, prompting further debate over the net value creation of this restructuring.

The original merger didn’t lead to long-term margin improvement.

DKI Takeaway: Kraft Heinz’s breakup denotes an overdue corporate reset; however, it’s only part of the remedy. This spinoff could enhance operational clarity and attract a more focused investor base, especially by separating premium global brands from lower-margin grocery products. Value will depend on execution. The newly formed entities must overcome high leverage (net debt/EBITDA of roughly 7x), invest meaningfully in innovation, and resist margin erosion from private-label competitors. The potential upside is clear; a streamlined, high-growth “taste” business and a cash-generating grocery core, but the path is narrow. For investors, the takeaway is cautious optimism: assess whether both firms uphold financial discipline, invest strategically, and deliver differentiated market performance. They worry whether this restructuring remains a cosmetic fix on a legacy of underwhelming fundamentals. The investment bankers made money on the merger and now will get another set of fees for the spinoff.

4) Elliot Investment Management’s $4B Stake in Pepsi:

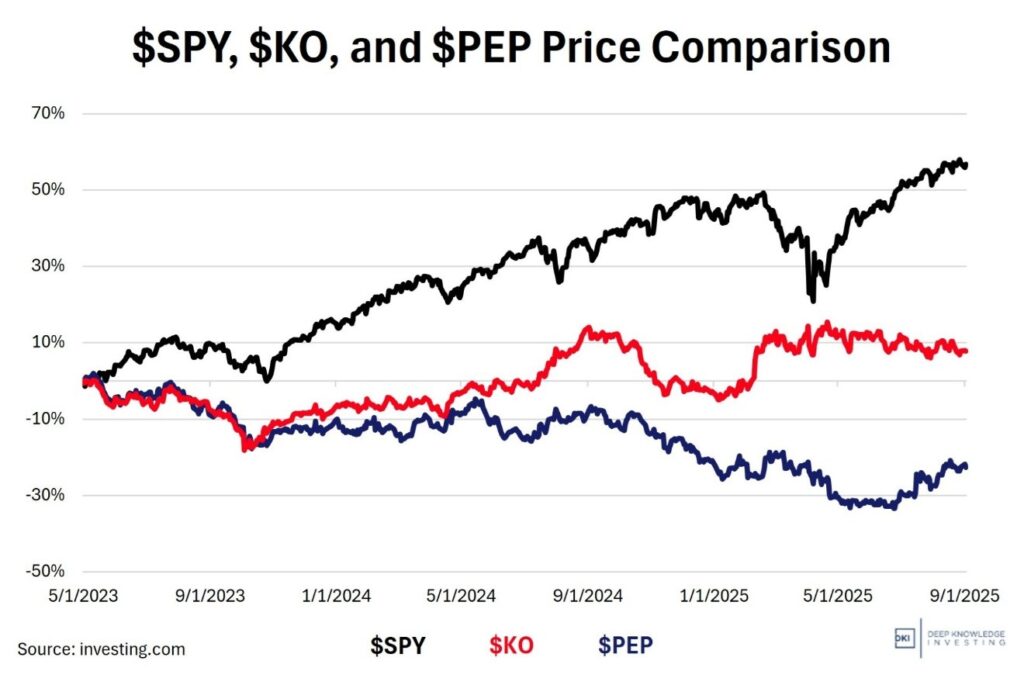

Last Tuesday, Elliott Investment Management announced a $4B stake in PepsiCo ($PEP), making the activist fund one of the company’s largest shareholders. The investment firm now owns almost 2% of $PEP’s shares. Elliott highlighted that Pepsi’s beverage division (which includes Pepsi, Gatorade, and Mountain Dew) has lost market share for more than a decade and has consistently underperformed competitors (such as Coca Cola and Dr. Pepper). They argued that the company’s overall performance has suffered, with Pepsi’s market value down more than a 25% since the May high. The investment firm is also reviewing options for Pepsi’s snack unit. Following this investment, Pepsi shares rose 2.8%. Elliott has outlined a plan to refranchise bottling operations (mirroring Coca Cola’s successful model in 2017) and streamline the product portfolio by cutting underperforming food and beverage lines.

Food and beverage trailing the S&P 500. Pepsi losing significant shareholder value.

DKI Takeaway: The $4B stake isn’t about fixing sales; but rather, understanding that food and beverage companies aren’t able to simply coast on brand power. Where brand loyalty is less consistent and health-conscious choices are growing, the food and beverage market is less susceptible to brand power. If Pepsi is forced to streamline products and adopt successful competitor strategies, it will prove that even established companies like Pepsi are subject to market forces. DKI is not qualified or licensed to provide medical device, but we feel confident in suggesting that drinking less water full of high fructose corn syrup is a good idea. We still wish Elliott Management success in improving the company.

5) Educational Topic: Market Cap vs. Enterprise Value:

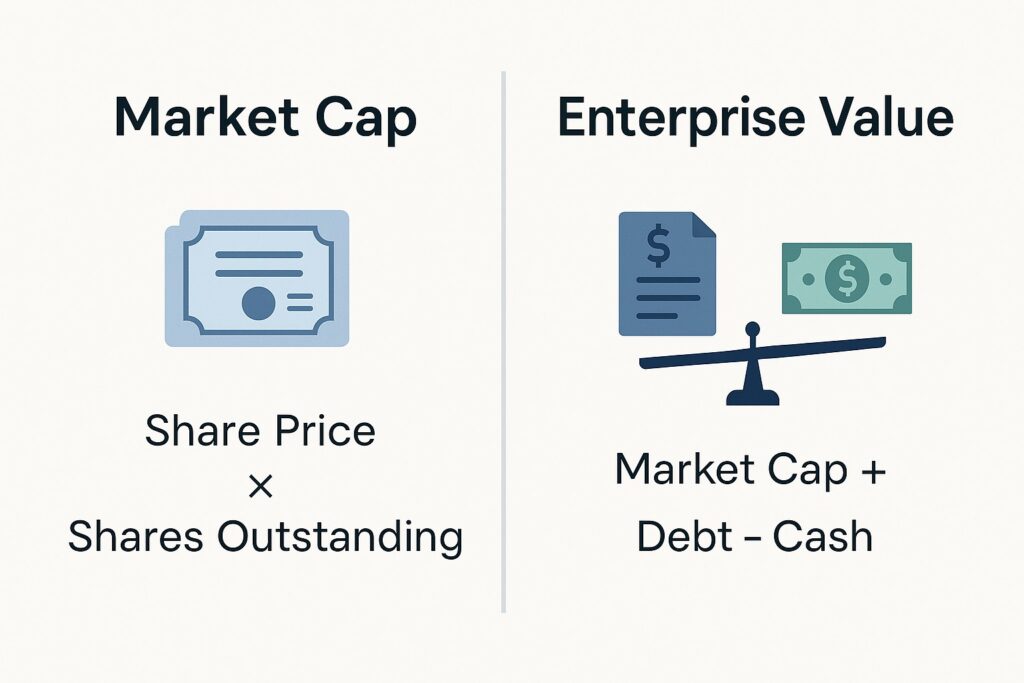

Terms like market capitalization (market cap) and enterprise value are often used when discussing a company’s valuation. Both metrics are important. Market cap is the value of all of a company’s stock. Enterprise value (or aggregate value) is the value of the entire business (its stock plus debt, minus any cash).

Market cap is calculated by multiplying the share price by the fully-diluted number of shares outstanding. Market capitalization is also called equity value. A company’s market cap tells you the size of the business assigned by the stock market which is then often used as a comparison to other companies. Many portfolio managers group companies into categories like small-cap, mid-cap, or large-cap and will often assign different risk and growth profiles to each.

Enterprise value or aggregate value is the total value of a business if you were going to acquire it. Enterprise value is calculated by adding market cap and total debt and then subtracting cash and cash equivalents. This metric considers the amount of debt and cash a company has. If you wanted to buy the entire company, you would have to purchase all the stock, assume the company’s debt, and keep cash holdings. This gives a more realistic picture of a firm’s total value by accounting for what it owes and what it has.

It’s really this simple.

DKI Takeaway: It is important to understand the difference between the two when evaluating a company. Debt changes the picture, and if a company carries a lot of debt, its enterprise value will be a lot higher than its market cap. On the other hand, if a company is sitting on large amounts of cash, its enterprise value will be much lower than its market cap. If you only look at market cap- you might miss these factors. Professional investors use both of these metrics to determine what we’re paying for different factors. For example, to figure out what multiple of revenue, EBIT, or EBITDA you’re paying, you’d use enterprise/aggregate value. To figure out what multiple of earnings you’re paying, because that’s an after-interest calculation, you’d use market cap.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.