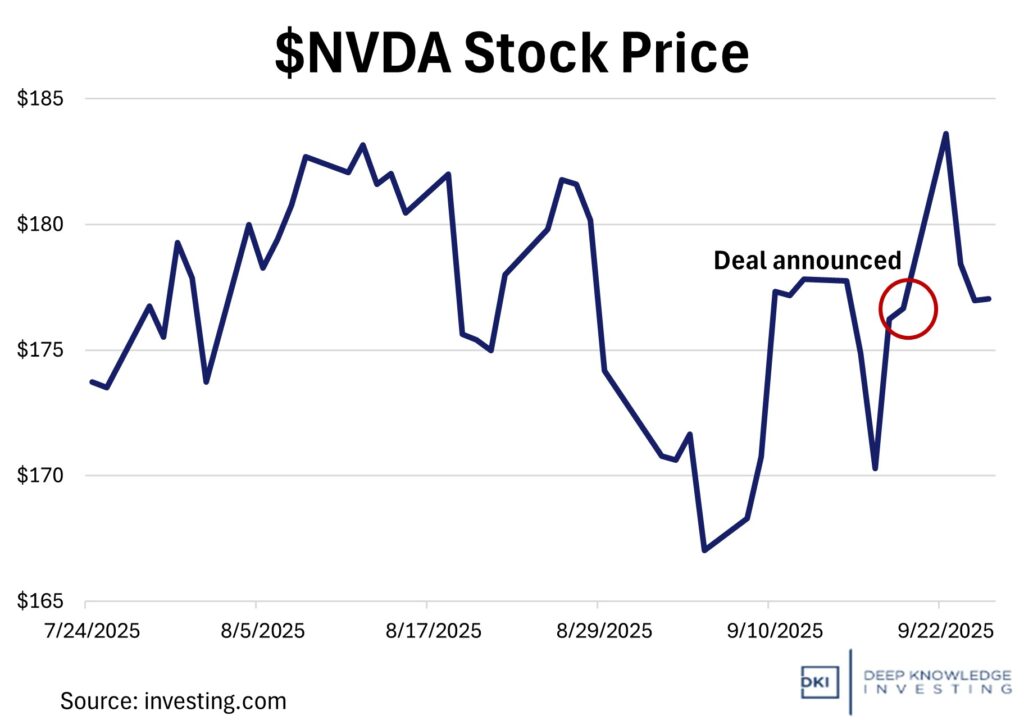

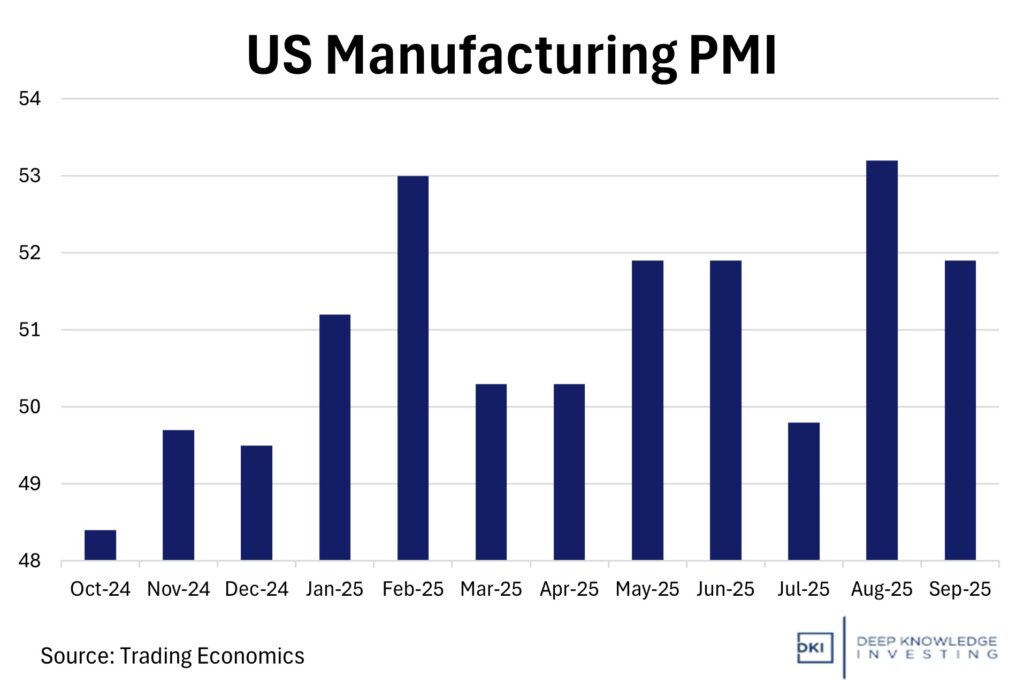

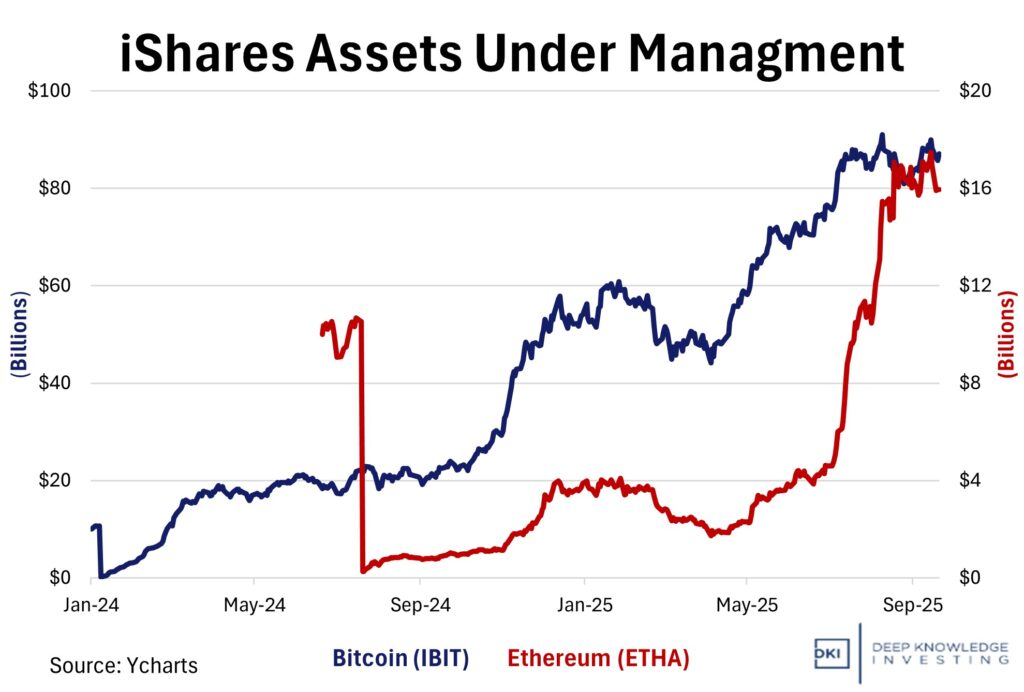

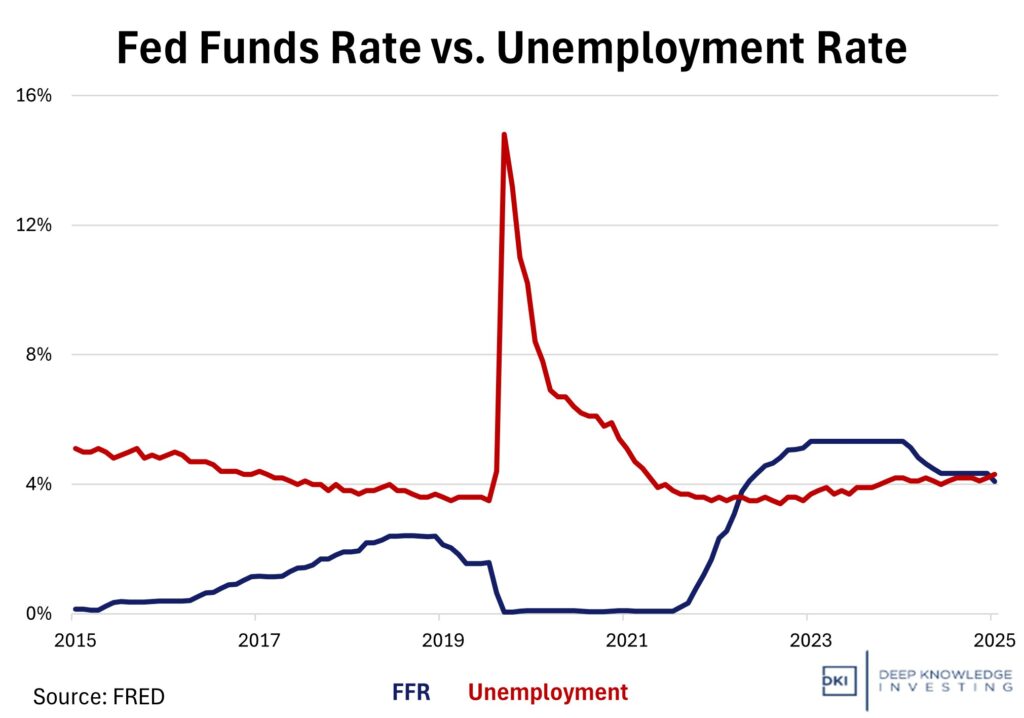

Last week, Enrique Abeyta warned that OpenAI reminds him of Enron from the dot com boom/bust. This week, Nvidia announced a $100B “investment” into OpenAI which will then be used to buy Nvidia chips. This is the exact kind of accounting shenanigans that Enrique warned about. He’ll be guest hosting the video version of The Five Things this week so check us out on YouTube to see what he has to say about it now. Manufacturing growth is still positive but slows slightly. That’s a small change in the rate of change for all the high-school calculus fans in the crowd. When the Bitcoin ETFs were approved, Grayscale decided to keep an above-market fee schedule. Now, the Blackrock Bitcoin ETF is 4x the size of $GBTC and Blackrock is making more than $250MM/year on digital investment ETFs. Fed Chair Powell says there’s risk to the economy no matter what the Fed does. DKI agrees that they don’t know what they’re doing and can’t fix the problem. Read on for our solution – which won’t surprise you. In our educational topic, we explain what working capital is and why it matters.

This week, we’ll address the following topics:

- Nvidia $NVDA partners with OpenAI and buys $100B of chips from itself. This looks like those vendor financing/revenue deals we saw in the dot com bust which is exactly what Enrique Abeyta @enriqueabeyta predicted last week.

- Manufacturing growth continues, but at a slower rate. It’s not time to panic.

- Blackrock is making a quarter of a billion dollars a year in crypto and Bitcoin ETF fees. Grayscale gave up market dominance in exchange for an above-market fee schedule.

- Fed Chair, Jerome Powell, says that no matter what he does, there’s risk to the economy. DKI agrees that the Fed doesn’t know what they’re doing. #EndTheFed.

- In our educational topic, we explain what working capital is and why it matters.

DKI’s interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem continue to do excellent work on the 5 Things every week so please keep them in mind as you read this week’s issue. Robb Fahrion and the team at Flying V is a huge contributor to the video version and distributing the written one. And we welcome Enrique back as an always-popular guest host for the video version this Monday.

Ready for a week of AI overspending? Let’s dive in:

1) Nvidia Partners with OpenAI and Buys $100B of Chips from Itself:

Nvidia $NVDA and OpenAI have signed a letter of intent to deploy at least 10 gigawatts of Nvidia systems to power OpenAI’s next generation AI infrastructure. The goal is to train and run future models on the path to computer superintelligence. To support this massive buildout, Nvidia will, over a period, invest up to $100B in OpenAI.

The first gigawatt deployment is scheduled for the second half of 2026, which will utilize the new Nvidia Vera Rubin architecture. The effort will incorporate millions of GPUs across AI data centers. Jensen Huang emphasized the partnership as a “next leap forward” in compute, while OpenAI CEO Sam Altman added that compute infrastructure is the foundation of the future economy.

Is it really revenue if it’s your own money?

DKI Takeaway: The headlines were impressive, but the details were concerning. $NVDA is “investing” $100B in OpenAI which OpenAI will use to buy Nvidia chips. Nvidia is effectively financing its own demand. As Enrique Abeyta pointed out in last week’s 5 Things, OpenAI expects to burn $125B of cash in the next 4-5 years and just agreed to spend $300B with Oracle $ORCL. To Enrique, big multi-year deals from a company requiring funding looks a lot like Enron from a quarter-century ago. If he’s right, that’s bad for Nvidia and Oracle, and would likely send the stocks of the big AI hyperscalers down as well. This week, Stephen Innes pointed out that 9 of the 10 largest US companies are AI proxies and that the five largest make up 20% of global market cap. My conclusion is the safest move is to hedge your portfolio. For more details including commentary from me Enrique and Stephen, check out this week’s article on the topic, “What if OpenAI is Like Enron and Nvidia is Like Cisco”.

2) Growth Momentum Eases as US PMI Slips:

The Purchasing Managers’ Index (PMI) is a monthly indicator derived from surveys of supply chain managers across multiple industries. Values above 50 indicate expansion compared to the prior month, while values below 50 indicate contraction. The “flash” PMI is a preliminary estimate (using 85% of responses) which just slid slightly to 52.0 from 53.0. Manufacturing activity is still growing; just at a slower rate.

New orders increased a little, and production gains were smaller than in August. Some surveys in the index indicated a buildup of unsold inventories as sales softened. It’s impossible to know, but I wonder how much of that was related to over-ordering due to tariff fears which temporarily unbalanced supply and demand.

US manufacturing growth continues. Over 50 means growth vs the prior month.

DKI Takeaway: When most of President Trump’s tariffs went into effect, the media immediately threatened the imagined risk of empty shelves. That hasn’t happened. While orders and manufacturing grew at a slower rate than the prior month, indications of inventory buildup suggest that supply isn’t deteriorating. This data was produced before the Fed’s rate cut. In a few months, we’ll see if the Fed’s action spurs additional manufacturing growth.

3) BlackRock’s Crypto ETFs Hit Record Assets Under Management:

In under two years, BlackRock’s entry into crypto ETFs has evolved from experiment to income stream. According to data from the Onchain Foundation, BlackRock’s Bitcoin and Ethereum ETFs are generating roughly $260 million in annualized revenue, with $218 million attributed to its Bitcoin products and $42 million from Ethereum vehicles. The success is largely driven by the firm’s iShares Bitcoin Trust (IBIT), where the 0.25% fee has allowed it to outpace some of BlackRock’s core equity funds in fee income despite much lower assets under management. $IBIT now commands a dominant share of U.S. spot Bitcoin ETF flows, placing BlackRock at the center of institutional crypto adoption, demonstrating it is no longer a test run project for large asset managers.

The SEC approved Bitcoin ETFs just a year and a half ago.

DKI Takeaway: What was once an exploratory move into digital assets is now a high-margin business for BlackRock, and it’s sending ripples through the traditional asset management world. BlackRock has proven that regulated crypto and Bitcoin products can be scaled profitably within institutional frameworks. The broader implication: other large asset managers can no longer view crypto ETFs as fringe experiments; but rather, as potential revenue pillars. Success depends on sustaining inflows, defending the high-fee structures, expanding into custody and staking services, and navigating regulatory changes efficiently. The Grayscale Bitcoin Trust $GBTC had the market to themselves for years. They decided to maintain a very high fee schedule, and now has assets under management less than one-quarter that at Blackrock alone.

4) Powell: “No Risk-Free Path” for the US Economy:

Fed Chair, Jerome Powell, recently spoke in Rhode Island and delivered a stark message, saying there is “no risk-free path” for the US economy in the near future. Powell believes that any choice the Fed makes will have a downside in another area. With inflation remaining uncomfortably high and a cooling job market, the Fed put themselves in a challenging situation where lower rates lead to more inflation and higher rates lead to more inflation and a weaker job market. By admitting that no policy choice is without hazard, Powell himself is describing the Fed’s lack of confidence in its chosen path, something DKI has agreed with all along. This creates some credibility issues as the Fed has lost control of the one thing it is supposed to do. Powell knows he is in trouble.

The Fed is cutting into too-high inflation and a stable in-balance job market.

DKI Takeaway: The Fed was far too late to raise the fed funds rate when inflation was an obvious problem in 2021. Better yet, with all the PhD-level economists in the building, why was no one able to figure out that Congress spraying trillions of “free” dollars into the economy would lead to inflation? In September of 2024, they starting a cutting cycle that was far too early if your goal was to get inflation under control, but was well-timed if you wanted to get the incumbent party re-elected. (The Fed has ALWAYS been a political institution.) Now, they’re cutting again with inflation too high and a cooling but balanced labor market. Powell has previously said that he has limited confidence in Fed predictions and now is saying he doesn’t know the right path to take for the US economy. If he can’t be sure of a way to craft fiscal policy without creating additional downside, how can the American people feel comfortable his economic stewardship? DKI’s solution (stop me if you’ve heard this one before): #EndTheFed and let the bond market set interest rates.

5) Educational Topic: Understanding Working Capital

Working capital is the money a company can readily use for its day-to-day operations after paying (short-term) bills. This can be calculated by subtracting a company’s current liabilities from its current assets. It’s a good measure of a company’s short-term liquidity.

Understanding how much financial cushion a company has to cover immediate expenses can make a big difference when considering an investment. If a company has enough working capital, it will continue to be able to pay employees, suppliers, and rent even if it faces a slowdown in sales or an increase in costs. Many companies also have seasonal business cycles, so more working capital means a company can better handle these ups and downs. However, if a company’s working capital is very low (or even negative), it could be an indicator that the business is stretched too thin and struggling to manage expenses.

Ideally, your cash availability is greater than your coming bills.

DKI Takeaway: From an investor perspective, working capital creates a snapshot of a company’s liquidity and overall efficiency. However, this is more of a short-term outlook. Working capital doesn’t consider long-term assets and liabilities, or credit lines and debt capacity. Bigger isn’t always better. An excessively high amount of working capital could suggest that the company is sitting on piles of cash or inventory without putting it to productive use. If a business isn’t reinvesting enough into growth, this could limit long-term return potential.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.