Leading off the week was the Federal Reserve which took no action and surprised no one. DKI thinks this was the right move. Of greater concern, had they lowered the fed funds rate, we think the yield on the 10-year would have increased. The Fed remains trapped and irrelevant. US oil inventories are down at the same time prices are low. This seems counter-intuitive. We explain. China cuts interest rates. They’re desperately trying to stimulate the economy while claiming they don’t care if they get a trade deal with the US. Alternatively, they could cut to zero and start building more ghost towns. The Trump Administration loosens restrictions on AI-related exports reversing the policy of the prior White House. That’s one way to start to reduce the trade deficit. In our educational topic, we help you understand the difference between short-term and long-term capital gains. While we do address some of the tax implications, DKI does not provide tax advice and suggests you consult a professional who is familiar with your specific situation.

This week, we’ll address the following topics:

- Fed meeting occurs. Nothing happens. No one is surprised.

- Oil inventories fall. Prices down as well. Should that be happening?

- China cuts interest rates. They’re desperate for stimulus while pretending they don’t care about a tariff deal with the US.

- The current White House scraps export restrictions on AI technology reversing the policy of the prior White House.

- Educational Topic: We help you understand the difference between short-term and long-term capital gains.

DKI Intern, Cashen Crowe, demonstrates his typical character and excellent work ethic by doing the heavy lifting for this edition of the 5 Things while preparing for final exams. That’s impressive!

Ready for a week of changing policies and more AI exports? Let’s dive in:

1) Fed Meeting Contains No Surprises:

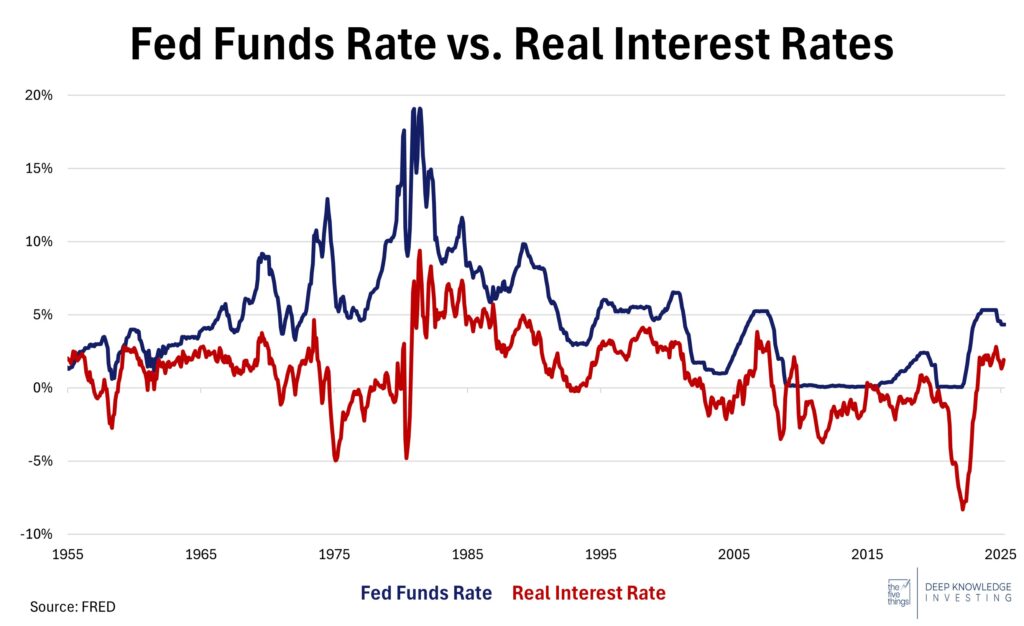

The Federal Reserve Open Market Committee met, took no action, and surprised no one. The Fed emphasized increasing economic uncertainty; analysis I consider reasonable. Chairman Powell remains painted in a corner where a reduction in the fed funds rate is likely to lead to more inflation which is still not under control. Raising rates would both cool the important labor market and strengthen the dollar. If you’re trying to inflate away massive debts and reduce your trade deficit, then a stronger dollar creates a headwind. While DKI is not nearly as apoplectic about potential tariffs as many are, Powell’s point that they could create a one-time increase in price levels is a reasonable concern. Under the circumstances, taking no action is the sensible course.

The real interest rate (fed funds less the CPI) remains under 2%. That’s NOT restrictive.

DKI Takeaway: While he has toned down his acerbic rhetoric about the Fed Chair, President Trump still wants Chairman Powell to lower the fed funds rate. The President believes doing so will help the economy. President Trump’s criticism of Powell’s poor performance is valid. Powell’s Fed has been slow to react to changing conditions and intentionally tried to create more inflation. However, replacing Powell or trying to pressure him to lower the fed funds rate will be ineffective. The fed funds rate refers to the overnight rate. The bond market sets the yield on all longer-dated securities. If the Fed cuts, the bond market will factor in higher expected future inflation raising the yield on the 10-year and mortgage rates. That would be a problem for homebuyers and for Treasury Secretary Bessent, who needs to refinance trillions of dollars of Treasuries this year.

2) WTI Drops as Inventories Fall: A Market Disconnect?

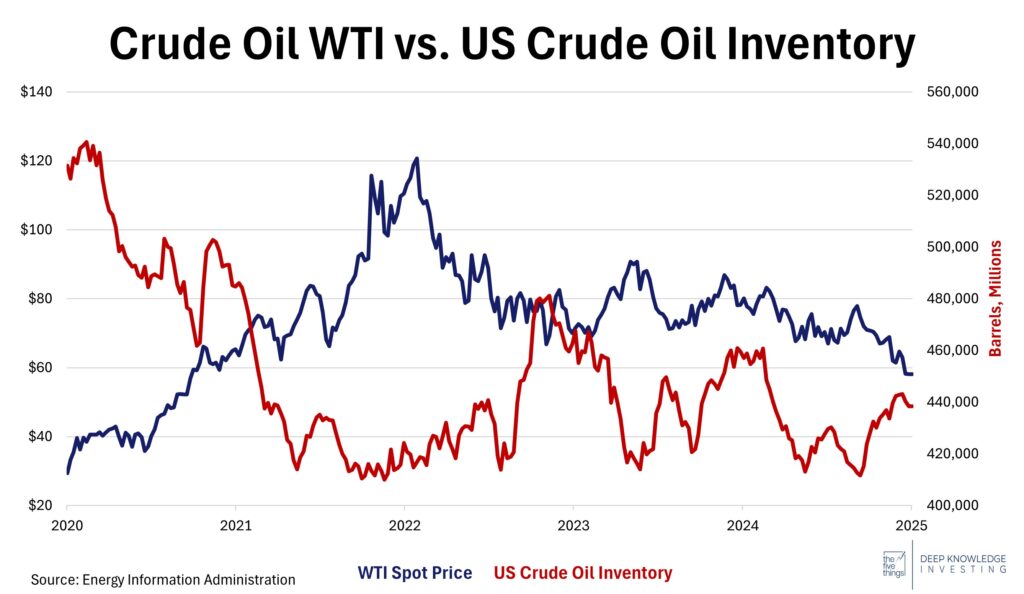

WTI futures have faced some recent pressure even with recent decreases in crude stockpiles. Normally, falling inventories would tighten supply and cause prices to rise, but with weak demand projections dominating the global outlook, the opposite is taking place. OPEC recently increased production to maintain market share while economic data from both the US and China point to slowing demand. President Trump is currently negotiating new trade deals and one place he has capacity to increase US exports is in energy. If the US exports more, we might see domestic inventories remain low.

Correlation is 59% which is meaningful but not determinative. Recent correlation has been negative.

DKI Takeaway: This disconnect between supply and price could be pointing to institutional players reducing exposure as many look towards the uncertain future for trade deals between the US and China. That will impact global growth projections, ultimately having a large effect on expected oil demand. This is one of those uncommon moments when growth concerns have reduced both the forward demand curve (pricing) and the willingness to hold current inventory.

3) China’s Surprise Rate Cuts:

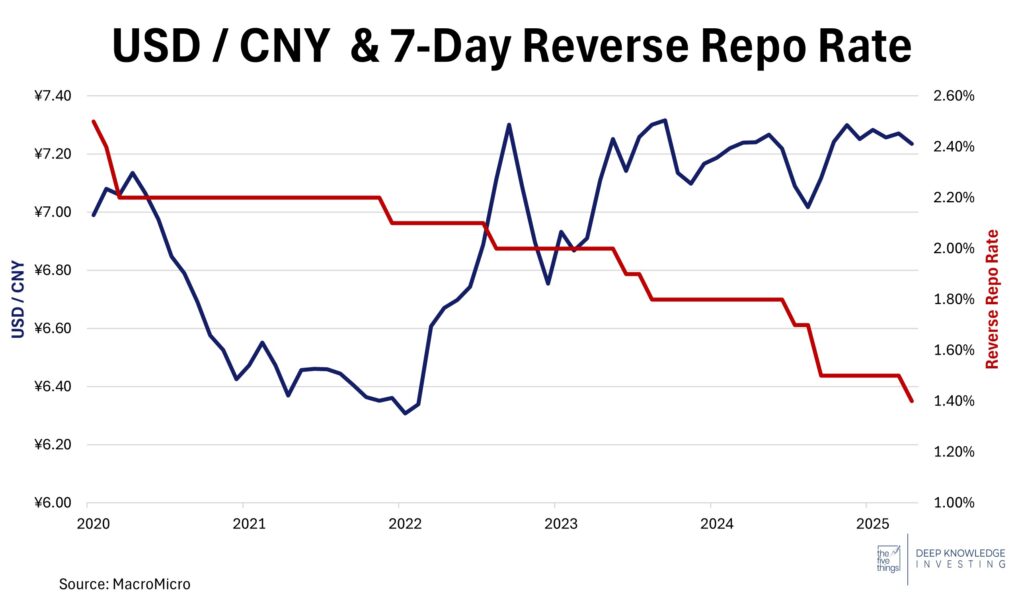

China enacted surprise rate cuts this week, cutting the 7 Day Repo rate from 1.50% to 1.40%. Other relevant benchmark rates were also cut. After the US placed steep tariffs on Chinese goods, trade activity reacted sharply. Orders spiked ahead of tariff implementation and have now stalled. China is trying to soften the economic blow leading to last week’s rate cuts. This could results in a weaking of the yuan, something China has done many times in the past to support its mercantilist policies.

Lower Chinese rates mean a weaker yuan. Chines reverse repo rate data from MacroMicro.

DKI Takeaway: China may be pursuing a multi-part strategy here. With the US Federal Reserve keeping the fed funds rate well above Chinese rates, the weakening yuan protects Chinese exports by making them cheaper in response to reduced demand. Some see this as a continuation of China’s mercantilist policies. Others see it as an admission of weakness as the government throws all possible stimulus at the problem. Many believe this move is performative in advance of coming trade talks. We remind observers that China regularly violates the IP protection of US companies operating there and have threatened to do more of the same in the future. There were also reports in this week’s Epoch Times that China intentionally flooded the US with fentanyl to try to addict and kill Americans. They should apologize for this wrong action.

4) The White House Scraps AI Export Curbs:

The prior White House implemented an AI technology export-control rule aimed at reducing US adversaries’ access to highly sophisticated computing power. The “Framework for Artificial Intelligence Diffusion” put countries into three different tiers which determined their ability to purchase AI technology. This week, the White House rolled back the plan, criticizing it for being too “complex” and “bureaucratic,” and for limiting American innovation.

The Trump Administration is looking to create a new, simpler plan to govern trade with licensing agreements and trade pacts rather than a tiered country system. This regulatory rollback applies to both AI technology and software meaning several US companies are now facing fewer export restrictions (despite some restrictions on China previously mentioned in The 5 Things). The diffusion rule was mostly rushed, creating too much of a burden on US tech companies, and some country tiers appeared to be arbitrary.

What do you think? Should the US export more high-end AI technology?

DKI Takeaway: Among trade tensions with countries like China, this plan reversal, which could give China greater access to US tech, seems counterintuitive, but it gives the US the upper hand in some ways. With the US able to focus on bilateral deals, they can bargain harder and reward cooperation. Additionally, relieving US pressure on China’s AI sector could motivate them to reduce their own chip development efforts, ultimately keeping the US in the lead. The US is trying to support its technology and manufacturing sectors just as other countries do.

5) Educational Topic: The Difference Between Short-Term and Long-Term Capital Gains:

When an investment is sold, any profits made are considered capital gains. The two types of capital gains are short-term and long-term, and they are differentiated by how long the asset is held before being sold. With the IRS’s one-year rule, anything held for less than a year is considered short-term. Long-term means you held the investment for over one year. Understanding the difference between the two is critical for investors as they are taxed very differently.

Short-term capital gains are taxed as ordinary income at regular tax rates ranging from 10% – 37% plus your applicable State income taxes. Short-term capital gains are considered a part of your regular income. Long-term capital gains, are taxed at either 0%, 15%, or 20%, with most investors paying 15% (those with salaries between about $47,000 and $519,000).

Holding period matters for tax implications.

DKI Takeaway: With this policy, the IRS is ultimately able to shape market liquidity by encouraging long-term investments. Investors respond to incentives and often delay selling profitable positions in order to reduce their tax bill. Investors can time these exits based on when they know they might have a lower income and avoid taxes altogether. In addition, long-term capital losses must be used to reduce long-term gains before applying the remaining balance to any short-term gains. There are limitations on how quickly any unused losses can be recognized in future periods. DKI does not provide tax advice and this section is only intended to be an introduction to these ideas. We recommend consulting a tax professional for clear advice regarding your specific situation.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.