Insight into the Newly Acquired SIVB, Consumer Confidence is Up, Alibaba Splits into Six Units, and PCE Cools (sort of).

This week we witnessed the end of Silicon Valley Bank’s story, but also got new insight into what led it to fail earlier this month thanks to testimony from Fed Governor Michael Barr. There was interesting economic data showing consumers are reducing their spending but remain confident in their finances. Finally, the Chinese e-commerce giant Alibaba announced a massive restructuring. Stories and analysis below.

1) …And Sold! Silicon Valley Bank Has Found a Buyer:

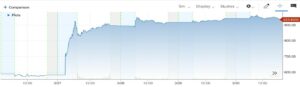

Early last week, First Citizens BancShares announced it will acquire Silicon Valley Bank’s ($SIVB) assets from the FDIC. SIVB was shut down by the FDIC in early March, which has been searching for a buyer for the remaining assets. First Citizens will pay no cash up-front and will instead finance the deal with stock appreciation rights, which derive their value from changes in the price of First Citizen’s stock. The stock appreciation rights can be worth up to $500 million, which is a discount from Silicon Valley’s value prior to its failure. The FDIC agreed to provide a line of credit for the deal and will share some of the losses on commercial loans with regulators. The total expense to the FDIC’s fund, according to a First Citizens presentation, will be approximately $20 billion. The fund does not include taxpayer money and is instead replenished by a fee from member banks.

First Citizen’s stock rose 50% on the news

DKI Takeaway: It is great that $SIVB, which kicked off the banking-sector collapse, has found a buyer, but work remains to be done. Cash is still flowing from regional banks to larger banks and money market funds. Also, other banks are being penalized for Silicon Valley risk taking via the FDIC’s insurance fund. That means we’re all going to pay our “share” of their losses. Please keep this in mind the next time you hear that there was no bailout.

2) S. Consumer Confidence Improves:

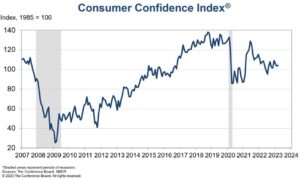

The Conference Board’s Consumer Confidence Index rose slightly to 104.2 in March, reflecting consumer’s increased optimism about the economy’s outlook. Economists had anticipated the index to decline to 101.0. The report also showed that consumers feel better about economic conditions for the next six months. Those surveyed also indicated Americans think that jobs are becoming more scarce and that consumers plan to decrease spending on services. The Fed has been watching services spending closely as labor shortages and wage increases have applied upward pressure on inflation.

DKI Takeaway: Despite the banking turmoil and persistent inflation, consumers remain optimistic about the future of their finances. That’s going to apply pressure on the Fed to not “pivot” to lower rates yet, and is continued good news for DKI stock pick Enova International ($ENVA).

3) Fed Vice Chair for Supervision, Barr, Sheds Light on Handling of Silicon Valley Bancorp:

Last week, Fed Governor Michael Barr spoke before the House and Senate regarding the Fed’s regulation of Silicon Valley Bank ($SIVB) leading up to March 10th, when it was shut down by the FDIC. Barr indicated that the Fed had been in contact with Silicon Valley as early as 2021 over its concerns about SVB’s management of interest-rate and liquidity risk. Near the end of that year, Barr claims the Fed issued six warnings to the bank and issued two more in May 2022. That was followed by a meeting with the bank’s senior management and a downgrade of the bank’s management rating. “The risk model was not at all aligned with reality,” said Barr, which makes a lot of sense considering the firm’s lack of a Chief Risk Officer for an eight-month period. This was followed by a new Chief Risk Officer who was focused on personal matters instead of the duration risk in the bond portfolio. In February, a meeting was held at the Fed to consider the effects of interest-rate hikes on some banks’ financial condition, including SIVB. When deposits began leaving, the Fed believed it could save the bank by replacing deposits with loans from the Fed’s discount window, but by the day of its collapse, the Silicon Valley was already anticipating more cash outflows than it had collateral to cover.

DKI Takeaway: The question remains why the Fed failed to take more action to curb Silicon Valley Bank’s risk management. The Fed is conducting a review of its conduct, led by Fed Gov Barr, which will be released on May 1st and will seek to answer that question. For those who have any sympathy for $SIVB, management was aware the Fed was raising rates, and had been warned the bank was poorly positioned.

4) Alibaba and the Six Units:

Alibaba ($BABA), the Chinese e-commerce firm which owns Alibaba.com, Alipay, and Ant Group, will split its business into six units. Each unit will include its own executives and Board. The move is designed to allow its companies to have greater autonomy over operations and finances. This comes at a time when China’s ruling party is beginning to show greater flexibility regarding the tech sector. Previously, Alibaba’s CEO, Jack Ma, had been the target of fierce crackdowns by the Chinese government on tech firms. In 2020, Ant Group’s IPO was blocked by the CCP following Ma’s statements criticizing China’s regulation of the financial sector. However, the shift was clear after Ant Group was granted government approvals to expand its consumer finance business earlier this year.

DKI Takeaway: Alibaba competes with many U.S. firms globally including Amazon ($AMZN), Paypal ($PYPL), and Uber ($UBER). It will be interesting to see how these companies will respond to the $BABA restructuring. Moreover, given the high risk associated with Chinese investments, does the split make any part of Alibaba’s company more attractive for investors?

5) PCE Index:

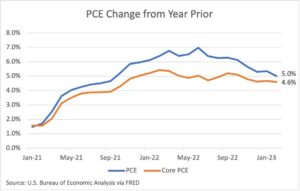

The Personal Consumption Expenditures index, the Fed’s preferred measure of inflation, rose by a smaller amount in February. The gauge showed a 5.0% increase in February (y/y), which was down from a 5.3% increase in January. It also came in slightly lower than economists were expecting. At the same time, the core Personal Consumption Expenditure index, which strips out prices for more volatile items like food and fuel, also cooled to 4.6% from 4.7% in January. This was also below what economists were expecting.

DKI Takeaway: This is positive news for the “pivot” people hoping for lower rates from the Fed. However, the Federal Reserve will still be monitoring labor supply and demand mismatches, wages, consumer spending, and the banking fallout before its next interest rate decision on May 3rd. DKI also notes that the services segment of the PCE was up 5.6% which is the highest reading in nearly 40 years. We guarantee that Chairman Powell is watching that number and that might be enough to delay the pivot.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.