The Personal Consumption Expenditures (PCE) Index is the preferred inflation metric for the Federal Reserve. This month’s report came out during Good Friday when the markets are closed. Within hours, the hawks who favor higher rates and the doves who favor lower rates all claimed the report vindicated their view. We’ll elaborate. Shockwave Medical $SWAV gets approached by J&J and DKI subscribers make huge returns. Investor, analyst, and writer, Enrique Abeyta, contributes a guest “Thing” with a technical indicator that’s been predictive 100% of the time. Nvidia $NVDA takes a loss – sort of. Finally, consumer confidence looks ok for now, but future expectations are signaling a recession. If that’s confusing, don’t worry – we’ll explain.

This week, we’ll address the following topics:

- The PCE is still too high, but in-line with expectations. Fed doves and asset gatherers resume begging for rate decreases.

- Shockwave Medical ($SWAV) gets takeover offer. DKI subscribers make 70% in under four months. What happens next?

- Enrique Abeyta explains a predictable technical indicator which only happens once or twice a decade. That’s right – it’s a guest “Thing”.

- Nvidia ($NVDA) suffers its first loss of the year.

- Consumer confidence doesn’t surprise, but does offer a warning.

Ready for anew week of shocking information? Let’s dive in:

1) The PCE is as Expected:

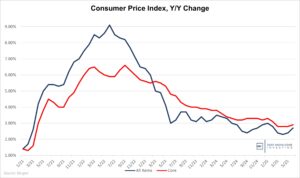

The Personal Consumption Expenditures (PCE) price index is the Fed’s preferred measure of inflation. February’s PCE was up 2.5% for the past year and 0.3% for the month. The yearly number was in line with expectations. The monthly was just below the 0.4% expected. The difference is rounding. The Core PCE, which excludes food and energy was up 2.8% for the year and 0.3% for the month. Both of those were in-line with expectations. Consumer spending, which has been weak in recent months was up 0.8% which was above the 0.5% expected. Part of that increase in spending is due to inflation and part is due to more purchasing. In a shift from recent trends, pricing on goods increased by more than that for services.

Asset gatherers took this month as proof that the Fed should lower rates. Actual results look pretty flat to me.

DKI Takeaway: It’s 11am on Friday as I write this, and I’ve already read multiple articles about how the “lower” PCE means the Fed should lower interest rates in June. The PCE was up by 0.1% and the Core PCE was down by 0.1%; both within a reasonable margin of error. The 0.3% monthly increase annualizes to 3.7%. It’s possible that another few months of CPI and PCE data could influence the Fed to lower rates at the June meeting. However, this same PCE report is being cited by the hawks (people who prefer higher interest rates) as proof they’re right while doves (who favor lower rates) claim it validates their beliefs. Current Fed Chairman, Jerome Powell, offered public comments that will be interpreted by both sides as favorable to their preferred path. My view is we’re seeing sticky inflation, and the Fed should be very careful about lowering interest rates too early. That’s the mistake made by former Fed Chairman, Arthur Burns in the 1970s.

2) Shockwave Medical ($SWAV) Gets Approached Again:

DKI recommended Shockwave Medical $SWAV to subscribers in December at $190. The company makes a best-in-class device that enables placement of a stent in cases where excessive calcification makes using a typical stent difficult or impossible. A key part of our thesis was the high probability the company would be bought by a larger medical device company for > $300. Last week, it was announced that Johnson & Johnson $JNJ has approached Shockwave. The stock now trades at $325, up more than 70% in under four months.

That’s gone well. J&J announcement can be seen in the spike at the right.

DKI Takeaway: DKI Board Member and Cardiologist, Paul Thompson, originally suggested the idea and was vital in explaining the benefits of Shockwave’s technology along with connecting DKI with interventional cardiologists like Dr. Dan Fram. This was a team effort that benefitted DKI subscribers. On the positive side, Boston Scientific $BSX could try to start a bidding war. On the negative side, it’s possible an offer will be rejected and a deal won’t happen. We’d assume if that’s the case, management would have a huge amount of confidence in near-term results.

3) Enrique Abeyta Illustrates a Technical Indicator with a Perfect Record:

DKI invests based on fundamental analysis so we’re pleased to bring in a great investor who uses technical analysis successfully…Investors often dismiss technical analysis as “voodoo”, but certain indicators can be very powerful. One of the most useful is understanding the impact of trend. When we see certain indicators happen in a consistent pattern, they can give us a very good idea about what is most probable to happen in the future. Think of it like playing blackjack, where the cards that have been dealt can tell you about the likelihood of the next cards to be dealt. With the close of the month of March, the S&P 500 has now been up for five months in a row.

Table from Bespoke Investment Group showing the results each time the S&P was up by more than 1% for five straight months.

DKI Takeaway: The table shows it’s not uncommon for the stock market to break the streak. The following month is negative 42% of the time, slightly worse than the 40% of the time a month is negative historically. When you look out six months and one year, the data becomes powerful and predictive. Across the 12 prior occurrences, returns are 50% higher than the average market return. Six months out, the S&P is up 92% of the time. Twelve months out, it’s up 100% of the time. In this case, is past performance an indicator of future performance? Maybe. A lot can happen in the real world that could change the course of the stock market and the economy. Historically, when you see a trend this strong, five months of returns of 1% or better, it points to the power of the underlying positive trend in the overall stock market. It’s one of the reasons HX Research remains constructive for the rest of 2024.

4) Nvidia ($NVDA) Suffers its First Loss of the Year:

Ok – I apologize for the clickbait headline. This wasn’t really a “loss” for Nvidia. Samsung did grab a $750MM order away from $NVDA. Korean company, Naver, wanted to ensure they had more than one source for AI chips and some think Samsung’s Mach-1 chip has advantages over Nvidia’s Chips.

The Mach-1 is Samsung’s first in-house AI accelerator chip.

DKI Takeaway: $NVDA is the market leader in graphics processing units (GPUs) which are ideal for artificial intelligence applications. Samsung is already producing high-end cell phones that have onboard AI capabilities. While Nvidia has a lead in the space, no lead in technology is ever perpetually safe. Competition is coming and some AI companies want to ensure they have multiple suppliers. I have no negative opinion on Nvidia’s products. I just don’t think they’ll have the GPU/AI market to themselves forever.

5) Consumer Confidence vs Expectations:

The Conference Board reported its consumer confidence index for March. At 104.7, it was roughly the same as last month’s 104.8. That part was fine. The expectations index which measures consumers outlook for income, business, and labor conditions was a different story. That measure fell from 76.3 last month to 73.8. Anything below 80 is a possible signal for recession.

No surprises for the index. Expectations are the problem.

DKI Takeaway: I’ve noticed a frantic increase in the number of articles in the mainstream media bemoaning Americans’ lack of enthusiasm and gratitude for our fantastic economy. While inflation is lower now than it was in 2022 and employment seems to be increasing, I can promise you that the people being surveyed understand the economy better than the “experts” in the media and narrative-crafting economists. There has been no increase in full-time employment in recent years. All of the job growth is people taking on more part-time jobs. More people aren’t working. The same number of people are working more. And while the media is focused on disinflation (a decrease in the rate of inflation), real people live off of price levels. I can’t find anyone who believes the fiction that food prices are up only 2% which means more people are struggling to balance their household budget. We’re seeing an increase in consumer credit usage as a result. Rather than tell the American people they’re wrong, it would be better if these experts made more of an effort to understand their concerns.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.