CPI High, PPI High, Retail Sales High, Fed Threatening Faster Rate Increases

It was a rough week for the “pivot” people as economic data including inflation comes in above expectations. The Fed is threatening faster rate increases. One day, the Fed will pivot to lower rates, but we’re not there yet.

If you don’t follow me on Twitter, you can remedy that here. Now, on to the “Things”.

1) January Consumer Price Index Comes in High:

Tuesday’s Consumer Price Index (CPI) was 6.4% which was above expectations of 6.2%. The monthly increase was .5% which was both above the .4% expected and a sharp increase from the prior month. The December number was also adjusted from the reported -.1% to positive .1%. Most concerning was the services inflation of 7.2%

Graph by DKI Intern, Dylan Kogan

The DKI Takeaway: That huge services number is going to be a problem for Fed Chairman, Powell. The Fed has little control over services pricing and with a tight labor market, it’s going to be even harder. That’s why we keep telling you that Powell is more focused on the employment numbers than the CPI. He wants to increase unemployment to stop a wage price spiral. The pivot will be delayed.

2) What if the Response to Inflation Creates Inflation:

Mark Rossano, CEO of C6 capital and I addressed the NY Alterntative Investment Roundtable two months before the Bank of Japan (BoJ) threw in the towel and raised interest rates. We warned that Japan has entered the beginning stages of a debt death spiral where inflation meant the BoJ needed to raise interest rates. However, doing so would mean taking on higher interest expense that would overwhelm Japan’s budget. The remedy for that would be more currency printing leading to more inflation. This week, Mark and I revisited the situation and updated listeners on recent events.

Thanks to the NY Alternative Investment Roundtable for hosting us twice.

The DKI Takeaway: I’ve discussed this issue with Michael Gayed on a Twitter Space and Mark and I will revisit the topic on Wednesday at 2pm in another Twitter Space. Here’s why it matters to you: The same problems Japan is experiencing now are becoming an issue in the US. We’re heading in the same direction, but haven’t gotten as far yet. We watch Japan as a warning for US fiscal and monetary policy.

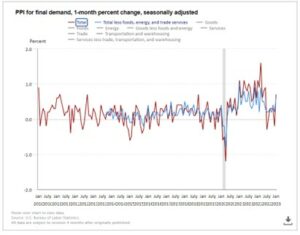

3) New Economic Data is Red Hot:

On Thursday, we got a host of “positive” economic news. Producer prices, which are correctly seen as a leading indicator of inflation, were up .7% monthly which was well above the .4% estimate. Jobless claims fell to 194k which was below the 200k expectation. And a day earlier, the retail sales number was a seasonally adjusted positive 3%. Despite (or perhaps because of) inflation, the consumer is still spending.

Graph from the US Bureau of Labor Statistics

The DKI Takeaway: Despite contraction reported by the Philly Fed Manufacturing Index, the economy continues to perform above expectations. This data is negative for DKI stock pick $COUR, positive for DKI pick $ENVA, and again, means a Fed pivot to lower rates will be delayed.

4) James Bullard Drops the Hammer:

St. Louis Fed President, James Bullard spoke in public on Thursday. Seeing the hot inflation data mentioned above, he said that he wouldn’t rule out a 50bp (half a percent) rate increase at the next meeting. Cleveland Fed President, Mester is also agreeing with that in public. The Federal Reserve has just tapered from .75% increases to a .50% increase, to the most recent .25% increase. Accelerating the pace of interest rate hikes would be a shock to the market.

James Bullard showing you how he feels about small rate hikes (not positive).

The DKI Takeaway: Bullard also said that he had pressed for a 50bp hike at the last meeting. His remarks caused the market to fall during the day. DKI has been saying for approximately 8 months now that the Fed isn’t about to “pivot”. Bullard agrees.

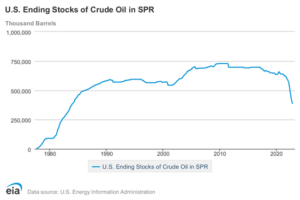

5) White House Still Selling Down the Strategic Petroleum Reserve:

Last fall, in what we believe to be a midterm election ploy, the White House sold off a large amount of the Strategic Petroleum Reserve (SPR). It was effective in helping lower gas prices ahead of an election where Democrats performed better than expected, and the White House got lucky that we didn’t have production or refining capacity taken out by a fall hurricane. (Some poor candidate choices by Republicans helped as well.) We expected to see the SPR replenished following the midterms. Not only has that not happened, the Administration has just announced further sales in excess of Russian production cuts.

We’ve hit levels last seen in 1984

The DKI Takeaway: The SPR is at levels last seen in 1984 when the US had a smaller population and lower energy needs. Eventually, the SPR will shift from being a source of oil to a demand for oil. We continue to maintain a large energy portfolio available to subscribers here.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.