MannKind is acquiring DKI portfolio position scPharmaceuticals ($SCPH) for $5.35/share in cash and a contingent value right worth up to $1.00. It’s the second medical device acquisition from the DKI portfolio in the past two years and the third acquisition premium in four years. Steel prices fall as US suppliers increase capacity. Just a couple of months ago automakers screamed that tariffs would make cars unaffordable. All we can say is “You keep using that word. I do not think it means what you think it means.” Margin use hits new highs with the market at all-time highs. Risk control matters! Nvidia announces another fantastic quarter, but lack of sales to China weigh on the stock a bit. Expectations were high. In our educational section, we discuss the P/E ratio and explain how to use it.

This week, we’ll address the following topics:

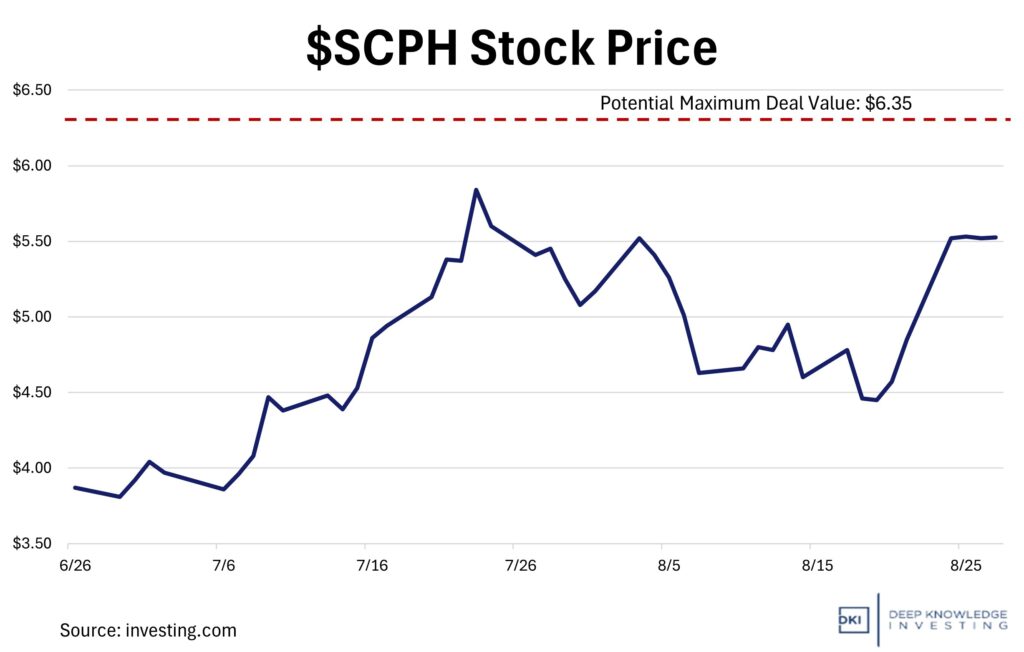

- MannKind $MNKD is acquiring DKI portfolio position scPharmaceuticals $SCPH for up to $6.35/share. DKI subscribers make 40% – 50%+ on our second medical device acquisition in two years.

- Steel prices fall as US suppliers increase capacity. Remember just a couple of months ago when automakers whined that tariffs would make cars unaffordable? We ended up with lower steel prices instead.

- Margin usage hits record highs. That’s probably not due to short positions or hedging.

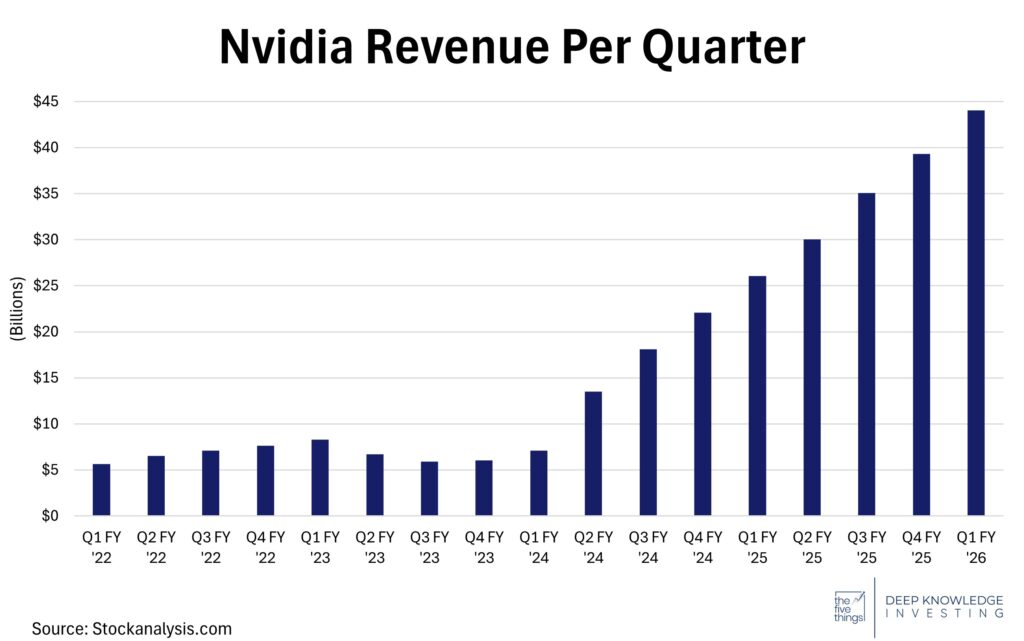

- Nvidia $NVDA announces another incredible quarter. Lack of sales to China keep the stock from rising. The current valuation already reflects a lot of good news.

- In our educational topic, we cover the basics of understanding the P/E ratio.

This week marks the start of college football season and a holiday weekend, yet the DKI interns keep on as always. Credit to Cashen Crowe, Samaksh Jain, and Gideon Rotem for much of what you’re about to read. In our video version, we’ll give Robb Fahrion a break for the long weekend and bring in Mark Rossano as your popular guest host. Let’s dive in:

1) MannKind to Acquire scPharma:

MannKind is acquiring DKI portfolio position scPharmaceuticals ($SCPH) for $5.35/share in cash plus a contingent value right (CVR) worth up to $1.00/share. The full value represents a 31% premium to Friday’s closing price. MannKind has the necessary financing from Blackstone. This is the second DKI healthcare device portfolio company acquired in the past two years and the third portfolio company acquired for a large premium in the past four years. A CVR is used when the buyer and seller disagree on price and the seller agrees to provide “proof”. In this case, CVR holders will receive the full $1.00 if the FDA approves the $SCPH autoinjector on or before September 30th, 2026 and if annual revenue reaches $120MM by the end of 2026.

Big win for DKI subscribers who made 40% – 50%+ on this stock pick.

DKI Takeaway: A potential acquisition was always part of the DKI thesis in this stock. The deal price is low relative to scPharma’s high growth rate so there’s a small chance a larger company like $JNJ, $BSX, or $MDT could make a bid. scPharma’s at-home diuretic is as effective as the current standard of care while providing a safer and more convenient treatment location for congestive heart failure and chronic kidney disease patients. At-home treatment saves programs like Medicare approximately 75% and is being favored by new CMS regulations. Credit goes to Dr. Paul Thompson, a member of the DKI Board of Advisors who initially suggested the idea. The takeover was more than 40% above our initial purchase price and more than 50% over our average purchase price. You can read more about our thoughts on the deal here and here. If this is interesting to you, you’re welcome to subscribe.

2) US Steel Demand Struggles to Keep Up with Supply:

Domestic steel mills are ramping up output and underlying steel demand isn’t growing as fast. Time-sensitive orders are getting filled and steelmakers have found themselves cutting prices to chase sales. Capacity expansion is partly to blame, amplified by electric arc furnaces (also known as mini mills) which can melt scrap into new steel. In 2024, steel imports rose, accounting for roughly a fifth of US steel consumption.

Tariff policy gave US steelmakers an opportunity to raise prices and increase profits. On the demand side, key sectors have been underwhelming and construction demand has been soft for a variety of reasons including interest rates. Residential construction showed signs of acceleration in late 2024, and there’s demand for housing at lower prices. The auto industry is still trying to figure out how much EV demand there is while also increasing prices.

There’s enough capacity here for increased economic growth. Data reported yearly.

DKI Takeaway: A mix of circumstances are reducing demand for US steel consumption. However, increased investment in US manufacturing may end up needing that excess capacity. Demand numbers in US steel production and consumption are reported on a yearly basis, so these figures don’t account for possible significant intra-year change as many companies across the country continue to invest in local manufacturing. It was just a couple of months ago that the automakers were whining that steel tariffs would make car production unaffordable. As DKI predicted, we ended up with increased supply instead. The full book on tariffs has yet to be written, but the predicted economic Armageddon has not arrived.

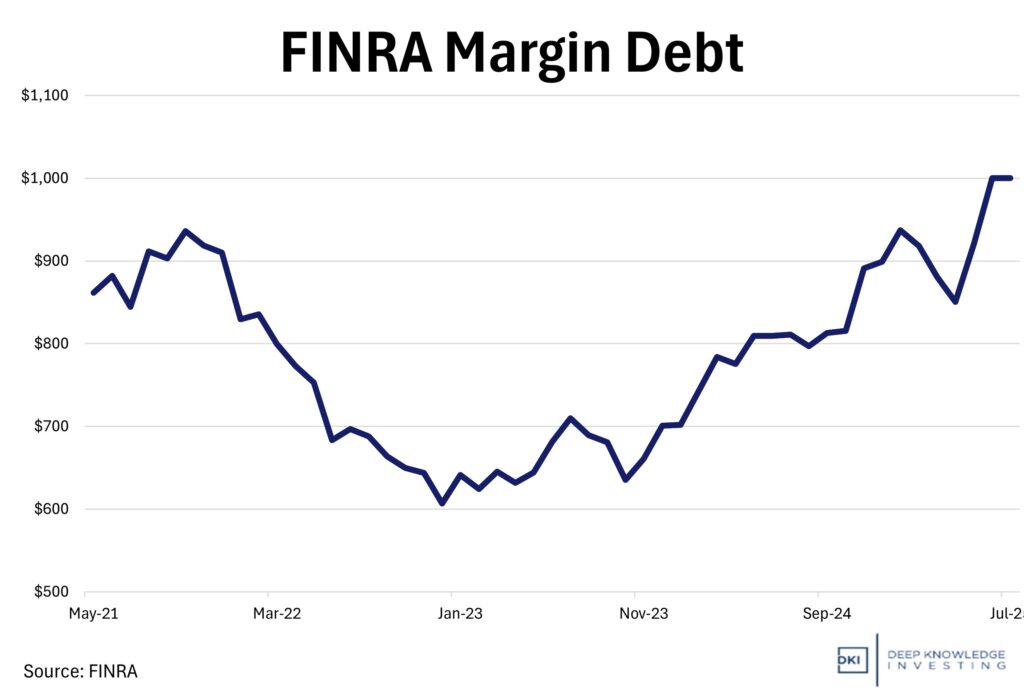

3) Is FINRA Margin Debt Really a Concern?:

Investor leverage has reached a record amount, with the total FINRA margin debt totaling $1.02 trillion, up 26% year-over-year. Many consider an increase in margin debt to reflect a bullish mood as more investors are using leverage to increase their positions. This goes hand in hand with the record amount of capital inflow into the retail investor market covered by DKI previously. Investors are more willing to take on risk regardless of market levels. Additionally, a rising market will generally create some growth in margin debt as margin limits will increase with more buying power from good returns.

Inflation and a rising market have made this manageable for now.

DKI Takeaway: Some are saying rising tech earnings and a continued AI boom make increased margin investing a wise decision. They also point out that inflation, larger balance sheets, and higher equity valuations all make higher margin levels manageable for now. We’d advise caution. Credit spreads are unusually tight and the VIX is low meaning the market is pricing in continued calm. That means valuations imply no concern regarding economic growth, inflation, employment, tariffs, AI profitability, and rising consumer credit losses. I use margin when investing, but also have large hedges in place to insure against market drops and higher inflation. It’s important to remember that margin amplifies returns; both positive and negative and that margin calls always come at the worst possible time.

4) Nvidia Slides Despite Record Revenue:

Nvidia reported a strong fiscal Q2 performance, delivering $46.7 billion in revenue, a 56% increase, and GAAP net income of $26.4 billion, outpacing analyst expectations for both. Adjusted earnings per share of $1.05 was above estimates. Revenue from the Blackwell data center platform grew 17% sequentially, demonstrating adoption of the latest AI chip architecture. The board approved an expanded $60 billion stock buyback authorization.

However, the exuberance was met with tempered investor sentiment. Shares declined by about 3% in after-hours trading due to slightly lower than expected data center revenue and guidance that included no H20 chip sales to China in the next quarter. Geopolitical uncertainty, especially around U.S.–China chip friction, further weighed on sentiment, dampening the otherwise bullish narrative for AI infrastructure spending.

Incredible growth quarter after quarter.

DKI Takeaway: Nvidia’s Q2 results reinforce its dominance in AI compute, but the pullback highlights investor wariness that even high-performing tech giants, despite growing much faster than other mega-cap technology companies, can stumble under lofty expectations and geopolitical concerns. Demand remains resilient, but the stock price assumes continued good news. We saw similar results in AMD’s most recent earnings announcement where despite solid results, high expectations created disappointment. Key drivers to watch are data center and capital expenditure spending trends, access to Chinese markets, and whether Nvidia can deliver on ambitious forecasts for AI infrastructure. Success in these areas could justify its premium valuation and stock buybacks. A small miss may spark renewed volatility. I thought some of the comments on X were interesting as many seemed surprised that the good quarter didn’t lead to further stock price increases. The company is performing admirably. The stock price already reflects that.

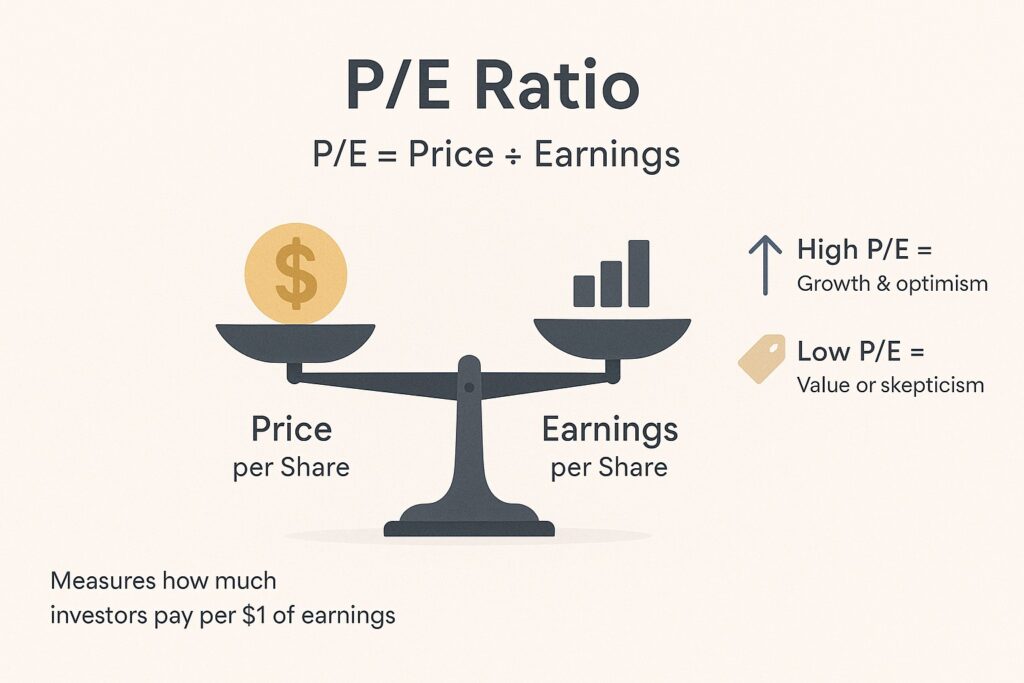

5) Educational Topic: Understanding Price to Earnings:

The price-to-earnings ratio, or P/E ratio, is one of the most widely used metrics in investing, often giving investors a quick gauge of whether a stock may be undervalued or overvalued. The metric is calculated by dividing a company’s share price by its earnings per share (EPS). EPS is the company’s net profit divided by the number of shares. If a stock trades at $36 with an EPS of $3, the P/E would be $12. This means that investors are paying $12 for every dollar of the company’s earnings.

The P/E ratio is a useful indicator in the realm of market expectations and sentiment. A higher P/E generally suggests investors predict the company has a promising future with likely earnings growth and are willing to pay a premium for the stock. A lower P/E might signal skepticism by investors or that the stock is a “bargain” due to structural issues or expected lower growth. Comparing a company’s P/E to its historical P/E range could show investors if it is trading relatively high or low vs past valuations.

This is probably the most important stock market metric for mature companies.

DKI Takeaway: Most investors like to use forward P/E ratios, preferring to value the company based on this year’s earning or next year’s vs looking backwards at the prior year. There are also cases where you want to buy companies trading at a high P/E ratio. In the case of many cyclical companies, you want to buy the stock when earnings have bottomed which would be when the P/E is the highest. Once earnings have recovered, the P/E will fall which can be the signal to sell. This ratio is probably the most important stock market metric for mature companies, but the way you use it will differ from industry to industry.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.