The big news of the week was President Trump announcing tariffs in excess of what the market expected. Equity indexes immediately fell and continued that trend for the following two days. While most of the commentary was negative, I’m not convinced the approved consensus is correct. The short version is in this edition of the 5 Things. For those of you who want the full version, it’s linked here and available on the DKI site. Manufacturing activity was down last month with prices increasing. It’s not a long-term trend yet, but it looks a lot like stagflation. Energy demand is accelerating, but energy prices are declining. If that’s confusing, don’t worry. We’ll explain. Bond yields and mortgage rates are down. DKI told you they’d sacrifice the stock market to bolster bonds. Will this make housing more affordable? Finally, in our educational “Thing”, we help new investors understand different kinds of market orders.

This week, we’ll address the following topics:

- Tariffs – What if everyone is wrong?

- Manufacturing activity is down and manufacturing prices are up. Should we be worried about stagflation?

- Energy demand is increasing yet usage projections and oil prices are both declining. What’s going on here?

- Mortgage rates are down. This wasn’t the intent of the White House, but they did tell us it was coming.

- Educational Topic: Understanding Different Types of Stock Orders:

As always, DKI Intern, Cashen Crowe came through for us. Despite having multiple exams this week, he continued to make his mark on this version of the 5 Things. Following in my footsteps and those of former DKI Intern, Dylan Kogan, Cashen is heading out soon for a multi-country trip. A true adventurer, he’s not afraid to travel on his own. A true DKI’er, he’s capable of working from anywhere in the world. Well done!

Ready for a week of revitalization and disaster (depending on who you’re talking to)? Let’s dive in:

1) Tariffs:

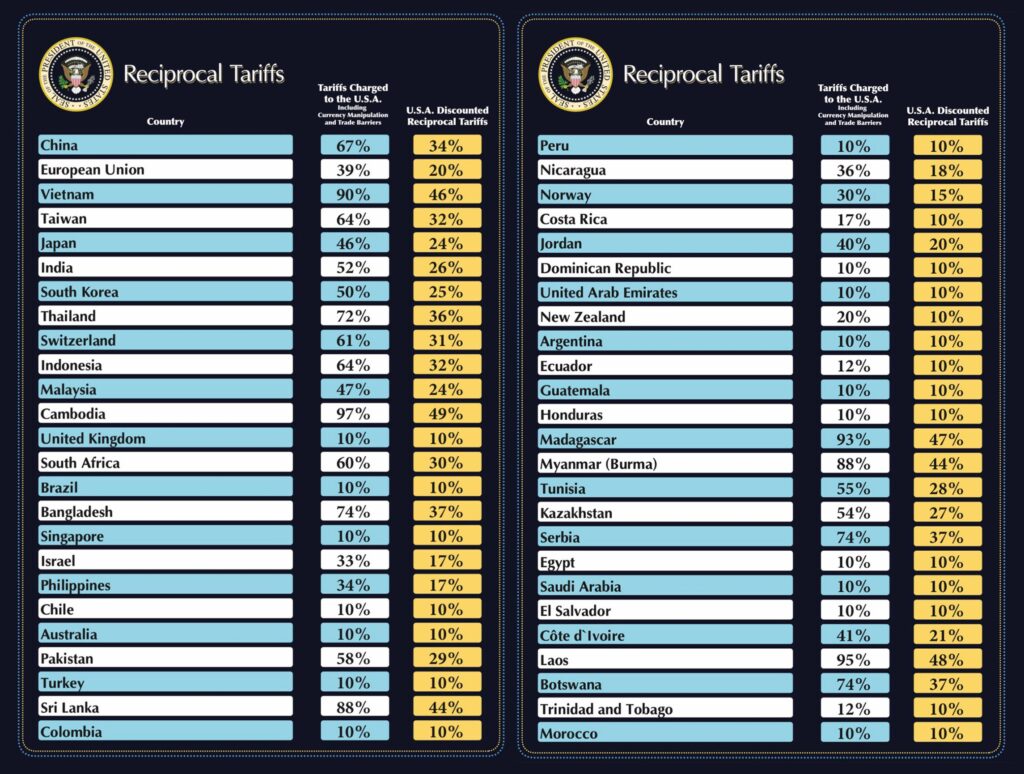

On Wednesday afternoon, President Trump presented his new tariff plan. Tariff rates were above expectations leading to big decreases in equity indexes. As most of us have read dozens of articles on the topic, I’m going to focus on a few specifics where I think the dominant narrative is misleading. I don’t know how all of this ends, but I do know the path we were on ends badly.

While I’m in alignment with the ideals of free trade, what we’re doing right now isn’t working for the country. People are complaining about all the pain we’re about to experience. They’re probably right. The analogy I’d use here is when someone has a heroin addiction, detoxing is incredibly painful, and also necessary to save their life. Continuing to use heroin means today will be more comfortable at the expense of dying from the addiction in the future.

We’ve sold off so much of our manufacturing capability. We’ve sold off our ability to make things. We export dollars and receive goods. In return for cheap goods, we’ve accumulated unpayable debt and other liabilities. We can keep putting people on public assistance and funding that with more inflation-causing debt. But that doesn’t fix the problem.

Change is often painful, and reversing 50 years of a cheap money addiction is going to be very painful. The economy, spending levels, and production we have now are not sustainable. So, we either try to fix it and accept the inevitable pain, or we hand the problem to the next generation. Maybe the tariffs don’t work, but continuing on our current path definitely isn’t working.

Countries like China complaining about US tariffs on their goods could solve this by reducing their tariffs on ours. The word for those who don’t and complain is chutzpah.

DKI Takeaway: In multiple pieces recently, I’ve written that the Trump Administration is willing to see stocks decline if it means lower bond yields. Treasury Secretary, Bessent, needs to refinance $7 trillion in the next 12 months, and unless he can do so at lower rates, we’re going to have an even larger budget problem. On Thursday, the NASDAQ was down 6% while the yield on the 10-year Treasury closed at under 4.1%. As I write this on Friday, the markets are down another 5% – 6% and the 10-year yield is now below 4%. We told you they’ll kill stocks to save bonds (credit to Michael Gayed for that phrasing) and that’s exactly what we’re seeing.

It’s easy to tout the advantages of free trade, but when some of your trading partners use mercantilist policies to grab most of those benefits for themselves, it makes sense to reset expectations. For those of you who want a more detailed analysis and a point of view that’s different from the mainstream press, please check out our full piece (not paywalled) here: Tariffs – What if Everyone is Wrong?

2) Concerns of Stagflation on the Horizon:

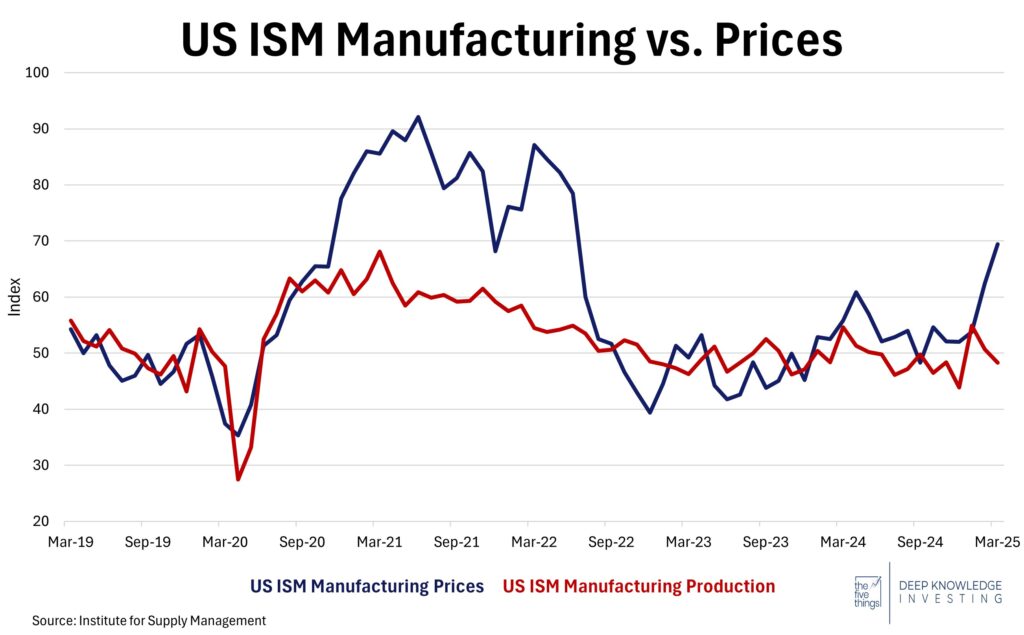

Concerns of stagnant economic growth are ramping up as the Fed can’t get inflation to subside. DKI blames both the Federal Reserve and Congress (especially Congress). Recent purchasing managers’ index numbers have shown a sharp increase in manufacturing prices with a decrease in manufacturing production— an indicator of stagflation.

Stagflation materializing in America would bring not only poor inflation numbers, but higher unemployment and lower overall growth. In the short-term, tariffs are likely to make this worse. Consumer confidence also continues to decline, but as we pointed out last week, their response has been to save and invest more; something we think is wise.

Prices are up (blue) while production is down (red). Not great.

DKI Takeaway: Jumping to the conclusion that we are going to enter a period of stagflation might be a little early. Despite unwanted inflation numbers, we are still working with an incredibly resilient labor market and high trending income and improving savings rates. We also note that DKI has been saying the productive private economy has been in recession for a year; something being masked by governmental overspending. The government has also skewed the employment statistics by being the main source of job growth in recent years. A smaller government sector will be good for the economy even though it will make apparent the weakness that already exists.

3) Demand for Electricity is Ramping Up – Projections are Declining:

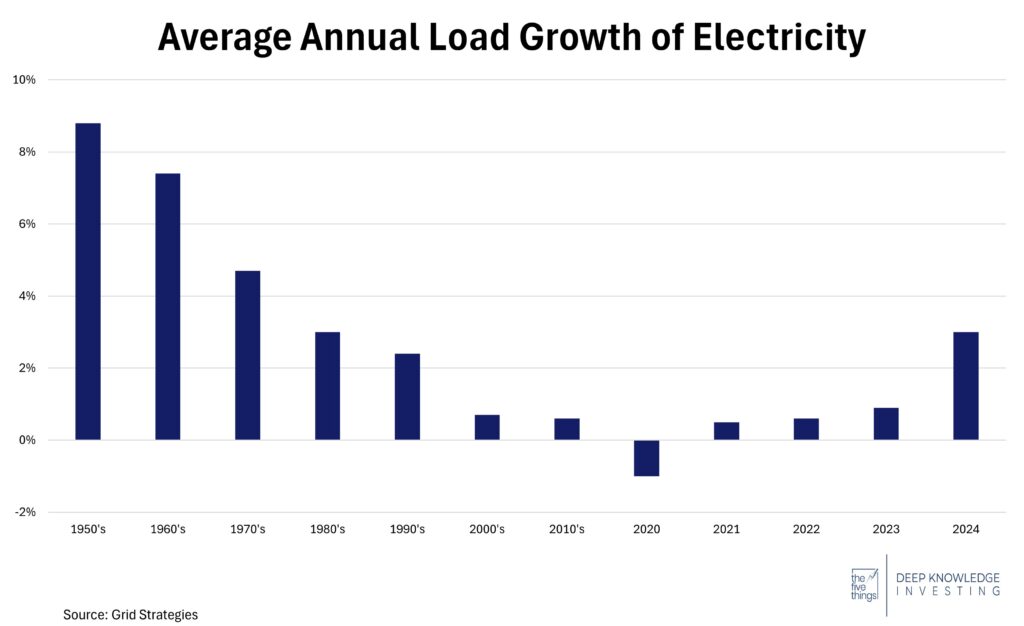

After years of stagnation, power demand is again on the rise. Recent growth rates of electricity usage have begun to reflect the expansion of industries such as semiconductor chip manufacturing, AI data centers, and battery manufacturing. Data centers providing AI and cloud computing are responsible for much of the demand growth in electricity. We last saw this effect in the 1970s when appliances and air conditioning became big demand drivers. This level of demand will continue to require increased investments in electricity generation.

Note that demand loss in 2020 was only 1%. Rate of increase is accelerating.

DKI Takeaway: Demand is increasing, yet oil prices are plummeting. Brent crude has fallen from $81 in January to $64 as I write this. The reason for the discrepancy is people are projecting a worldwide recession as a result of tariffs and energy demand always falls during recessions. If you want to know if we’re reducing our energy positions due to this risk or increasing them due to last week’s stock price decreases, you’re welcome to subscribe.

4) Mortgage Rates Falling Again:

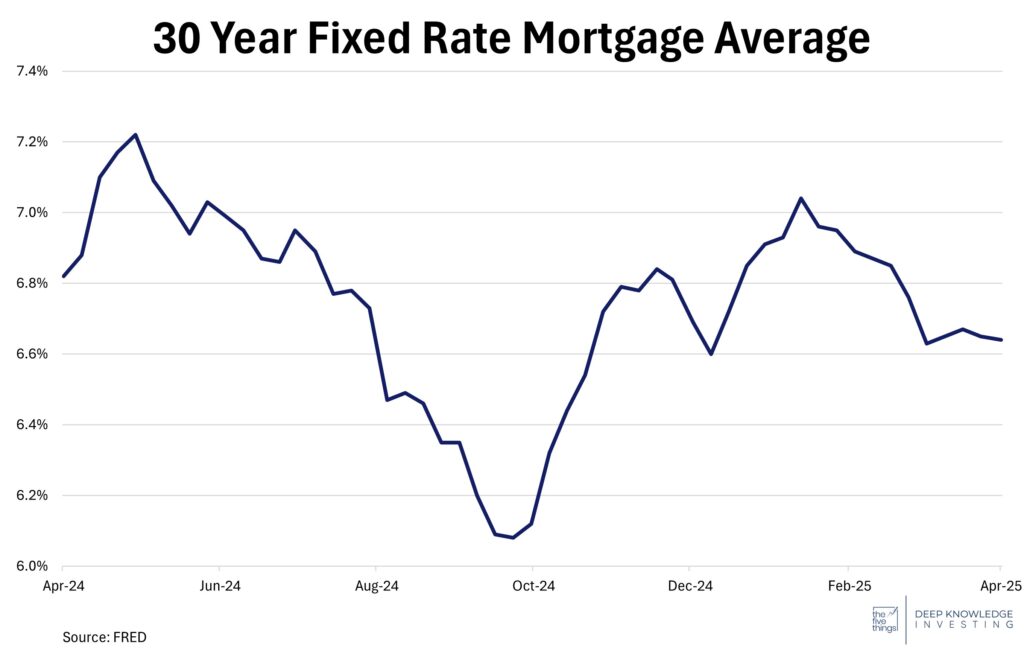

Our chart below shows mortgage rates declining from recent 7%+ highs. When the St. Louis Fed updates its data, the next point is going to show a further decrease in financing costs. Typically, when mortgage rates rise, property prices fall so that people have similar monthly payments. In recent years, higher mortgage rates effectively locked people into their homes as selling meant getting a new higher-rate mortgage. People faced with selling a big house, buying a small house, and having higher monthly payments stayed put. That reduced supply and the resulting increase in home prices and mortgage rates priced many Americans (particularly young Americans) out of the housing market.

The next data point is going to be even lower.

DKI Takeaway: DKI has said many times the plan from the White House was to kill equities to save bonds. In his first term, President Trump used a rising stock market as a report card on his Presidency. This time, as tariff discussions and announcements have caused equity indexes to fall, the President has said he’s not concerned about the stock market. The yield on the 10-year Treasury has fallen from 4.8% in January to 3.9% as I write this. Treasury Secretary Bessent needs lower rates to refinance at least $7 trillion in the next 12 months. DKI’s portfolio was heavily hedged for this outcome.

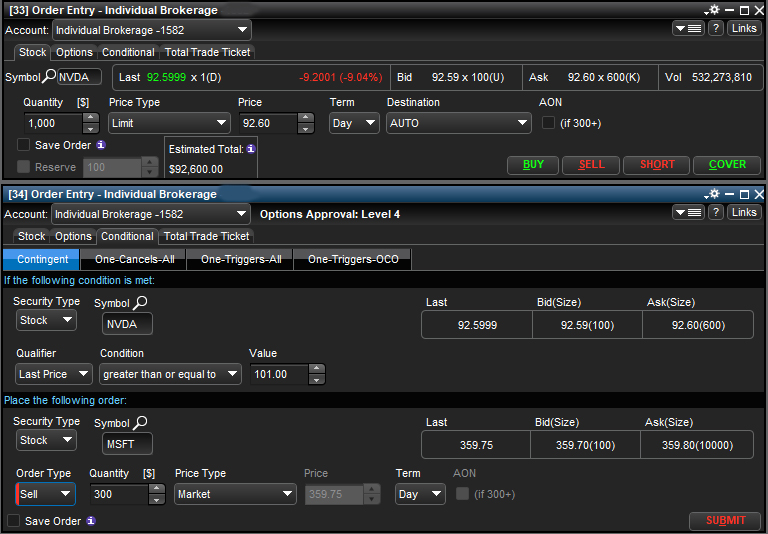

5) Educational Topic: Understanding Different Types of Stock Orders:

When placing a stock order, you have the option to choose how that order is executed. Understanding this is essential in helping investors make smarter, more controlled trades. Let’s go over some of the more common options and discuss how they affect the speed and the price at which the trade is executed. Knowing when to use a specific order type can help you avoid costly mistakes and manage risk effectively.

- A Limit Order will only be executed at a price you specify or better. The order lets you set the maximum price you will accept when buying or the minimum price you will accept when selling. You have control over cost, but not over execution timing.

- A Market Order will be carried out immediately at the best available current price. You have control over execution timing, but not over price. Large market orders can lead to overpaying or selling too cheaply.

- Market on Close (MOC) is an order that is executed as a market order at the end of the trading day. The price will be at or near the closing price.

- All-or-Nothing (AON) – also known as Fill-or-Kill (FOK) is an order that will only be executed if the entire order can be filled immediately. You would typically use this if you’re bidding on multiple exchanges or trying to set up a paired trade.

- Volume Weighted Average Price (VWAP) is an order that seeks to match the average volume-weighted price during the trading day. If you take the total dollar value of the stock traded that day divided by the total number of shares traded, you’d end up with the VWAP. This is a way to match the average market price for a whole day instead of the price at a particular point in time.

- Pairs Trade is a conditional order that executes two separate orders at the same time. It’s particularly useful for risk arbitrage where investors seek to buy one security and sell another at the same time hoping to profit when the spread between them later collapses. Merger arbitrage strategies use these often.

A limit order to buy $NVDA and a conditional order to sell $MSFT if $NVDA rises.

DKI Takeaway: For most trades, you won’t need the more complicated or sophisticated strategies. Most of the time, the best option for basic trading is a limit order. You set a reasonable price where you expect the order to get executed. If you’re in a time-sensitive situation, you can set the limit a bit above the current offer and increase the probability of getting your order filled. For speed, the market order is best, but please understand that comes with a risk. On rare occasions, there have been stories of volume disappearing and orders getting executed at prices far above the offer or far below the bid. While this doesn’t happen often, because it’s possible, I rarely use market orders.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.