Overview:

After months of teasing, last week, the Federal Reserve announced an increase in the Fed Funds rate of 25 basis points (.25 percent) from the current zero (approximately). While this was the smallest possible increase, the Fed indicated it was expecting to raise rates another six times this year and potentially, another 3-4 raises next year. We note that when we started writing about inflation and interest rates in November, many of the large investment banks and market “experts” thought that there would be no rate hikes until late 2022 or sometime in 2023.

This Isn’t Enough:

We understand that the Fed is concerned about crashing an economy that they may see as delicate due to the Ukraine / Russia war. The problem is they’ve waited far too long to act, and at this point, huge inflation numbers are affecting the lifestyles and security of many Americans (as well as millions of people in other countries as well). The most recent inflation number of 7.9% is a 40-year high. More importantly, as we pointed out in January, the only reason inflation is that “low” is because of changes in methodology made since the stagflation debacle of the late 70s/early 80s. Based on the old methodology, the real inflation number being experienced by the typical American family is in the mid-teens.

That means that the official real interest rate is negative 7.6 percent (7.9 percent less .25 percent Fed Funds rate). However, using a more honest calculation of inflation means that the “real” real rate of interest is around negative 15%. Either of those numbers would be an all-time low. A .25 percent move in interest rates isn’t even close to enough to fix the issue.

Source: RD ₿TC

What it Looks Like if We’re Wrong:

Last month, we looked at what it would look like if we’re wrong about inflation and interest rates. Some issues like the probability that the price of used cars won’t keep increasing at 40 percent are reasonable. Others, such as the hope that supply lines will clear are less probable due to conflict with Russia reducing international trade, and China’s continued Covid lockdowns closing ports. However, we think the strongest argument being made that things will settle to a more familiar version of “normal” later this year is the recursive character of economic inputs.

That’s simply a fancy way of saying that for many things the cure for high prices is high prices. While no one likes high oil and energy prices, at some level, people drive less, and keep their homes at lower temperatures. The same higher prices incentivize oil producers to drill more wells. Higher home prices and higher mortgage rates are already causing a slowdown in the rate of real estate transactions. If enough of these factors coincide, the Fed could get the soft landing they’re hoping to get and might not have to raise rates as much as we think.

Inflation is About to Get Worse:

Despite our above acknowledgement that there are some who disagree with us who have smart reasonable points, food prices are about to go up substantially. Ukraine is a huge exporter of grains, and due to the war there, it’s likely that much of the spring crop won’t be planted. Russia is a huge exporter of fertilizer, and they’re no longer exporting to the US. Without fertilizer, crop yields will fall. This will lead to increases in the price of grains and meat as livestock eats a lot of corn.

We also recommend this piece by Lyn Alden where she describes how in recent decades, we’ve had a worldwide push for efficiency at the expense of resiliency. We exported production to low-wage locations and depended on complicated just-in-time logistics to reduce capital invested in inventory. That worked as long as the world was peacefully cooperating.

The downside is we’re now seeing what can happen when a port in China closes for a while, or what happens to automotive production when a semiconductor plant closes for a few weeks. Billions of dollars of high-end manufacturing facilities are currently closed or operating at reduced efficiency due to an inability to get parts.

Looking ahead, China has made it clear it intends to take control of Taiwan at some point. That would put Taiwan Semiconductor under Chinese control. Right now, the US has exercised influence over China and Russia by denying those countries access to some of our more advanced technology. What happens if China has access to the most advanced chip-making technology on the planet and decides to cut us off from that? Globalists have succeeded in creating a more efficient more interdependent world, but right now, we’re glad to see Intel and Taiwan Semiconductor looking at building chip fabrication plants in the US, even if it means a higher cost of labor causing those chips to be more expensive. Resilience is worth something.

Finally, we’ve known about our dependence on Chinese pharmaceuticals and anti-biotics for years. American politicians have been celebrating the impact of sanctions on the Russian economy, but haven’t been as quick to acknowledge the fact that we’re also living with those sanctions. They’re certainly not claiming responsibility for the subsequent higher prices combined with commodity shortages. Conflict with China could lead to a similar problem with a much larger trading partner (and the supplier of our medications). We’re going to need to be more self-sufficient, and that means less-efficient. Higher prices are coming, and a 25-basis point hike in interest rates isn’t going to stop it.

Kicking the Can is Another Way We End Up Wrong:

All of the above is why we’ve carried both inflation and market hedges for the past few months. They’ve both been profitable (although less so on the market hedge for the last week). Our view is that we’ve reached the tipping point where too-low interest rates and too much money printing has led to higher-than-stated inflation and lower-than-stated GDP. By targeting as much as 11 rate hikes over 7 quarters, the Fed is acknowledging it is seeing things the way we are (finally).

Unfortunately, this Federal Reserve has a nose for politics, and has expanded its traditional dual role of price stability and high employment to also include protecting the stock market. This means that if future rate hikes cause the market to fall, the Fed could simply announce it planned to halt rate increases and restart quantitative easing (money printing). The market would rise sharply on that news as long as the bond market would allow it.

The Bond Market and Silly Projections:

The US is running unsustainable deficits and the debt is so high that Chairman Powell can’t raise rates in the way Chairman Volker did 40 years ago. We owe so much money that at some level higher interest rates can’t be financed, and we’d need to cut all spending. Blocking Russia from the SWIFT system was a well-meaning act, but Russia will simply access the Chinese funds transfer system. Grabbing Russian reserves was also a well-meaning attempt to deny Putin the funds to make war, but it also means that anyone other than our closest allies may doubt the value of the dollar as a reserve currency should they fall into the disfavor of Washington DC (which changes hands every 4-8 years). At some point, Powell can decide to lower rates, but if the bond market won’t buy dollars at that lower yield, we’ll be stuck. The game can go on until others decide not to play.

Some will argue that the US has much more capacity to issue debt and that the current $9 trillion Fed balance sheet isn’t a problem. We’d point out that the Saudis openly talking about taking Chinese Yuan in exchange for oil, rather than dollars is a sign that the dollar’s status as the world’s reserve currency is being challenged.

Months ago, when the Fed kept referring to inflation as “transitory”, we wrote that “there (is) no way they could know that was the case”. Shortly afterwards, the Fed bent to reality, and stopped using that word. Last week, at the meeting where Chairman Powell acknowledged the Fed was now considering 11 rate hikes for this year and next, he said, “The chance of recession is not particularly elevated. All signs are that this is a strong economy.”

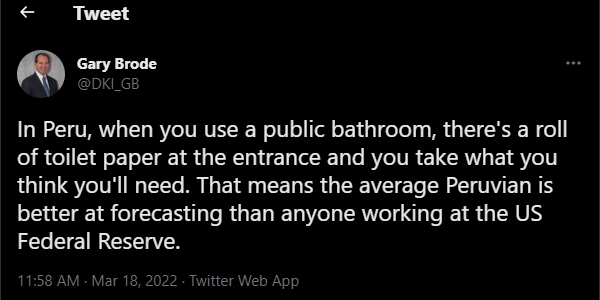

The same Federal Reserve that ignored a historic rise in inflation while keeping rates too low and printing trillions of dollars is now projecting that we won’t have a recession. These are the same people who two months ago were calling inflation “transitory”. Our view of the Fed’s ability to project anything is here:

Our advice to the Fed is when events are going to make your projections look silly, stop saying things.

Conclusion:

Food inflation is coming in addition to the current energy and commodity inflation. Supply lines are being fouled by war, Covid-related shut-downs, port closures, and general lack of parts. Remember, that it only takes one missing part to prevent a car, computer, or other complicated item from being completed. Even if the Fed raises 7 times this year, it will still leave the Fed Funds rate around/below 2%. With official inflation running this high, real rates would still be negative. Finally, we’ve made the case in the past that GDP is overstated. Due to the length of this piece, we’ll come back to that issue in a future article.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI , affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.