This post originally appeared on April 12, 2023.

DKI has written constantly about inflation since November of 2021 when we warned that it was going to be a bigger and more persistent problem than most people thought. We also provided practical specific ideas for how to protect your portfolio. By January of 2022, we were saying clearly that the Federal Reserve’s insistence that inflation was “transitory” was unsupported.

There’s an article on CNBC today that accurately explains the discrepancy. The relevant excerpt:

Officials initially dismissed inflation as transitory, expecting it to fall as pandemic-related factors dissipated, but were forced to play catch-up as price increases proved more durable.

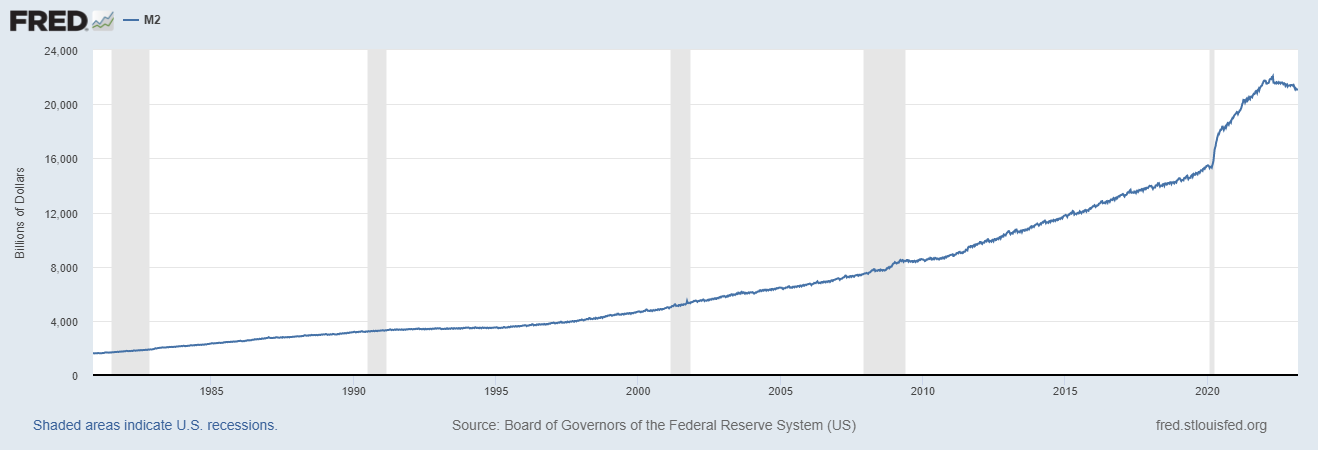

The Fed was incorrectly looking at temporary supply chain issues related to Covid as the cause of inflation. DKI was focused on the expansion of the money-supply. “Inflation” used to be defined as an increase in the supply of money. It’s easy to see in a chart from the St. Louis Fed:

It wasn’t Covid-related supply chain issues that caused inflation. It was Covid-related stimulus spending that kicked off the inflation mess we’ve experienced during the past two years.

Today’s announcement of the decline in the CPI to a still-high 5.0% has many convinced inflation is about to disappear. There’s no question that Federal Reserve rate hikes are bringing inflation down and that the accounting for housing prices have gone from understating the CPI to overstating it.

The issue that concerns us is the primary reason for the giant expansion of the money supply is government overspending. The US is still running a multi-trillion-dollar yearly deficit which is probably in the $5T – $8T range counting off-balance sheet spending (Medicare, social security, and other promises of future benefits). Neither party in Washington has shown an inclination to cut spending. That means that while the CPI will come down this year, it’s the decline in inflation that’s “transitory”. Long-term, the US (and most of the “developed” world) has two choices: cut spending, or face a future recurrence of inflation. What the Fed is doing right now is working. For there to be permanent change requires a different approach from Congress. We’re not going to get that.

The DKI portfolio has a lot of capital committed to ideas that will outperform in an inflationary environment. It’s available to subscribers here.

I’m reachable at IR@DeepKnowledgeInvesting.com with any comments or questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.