This is an excerpt from the DKI July letter:

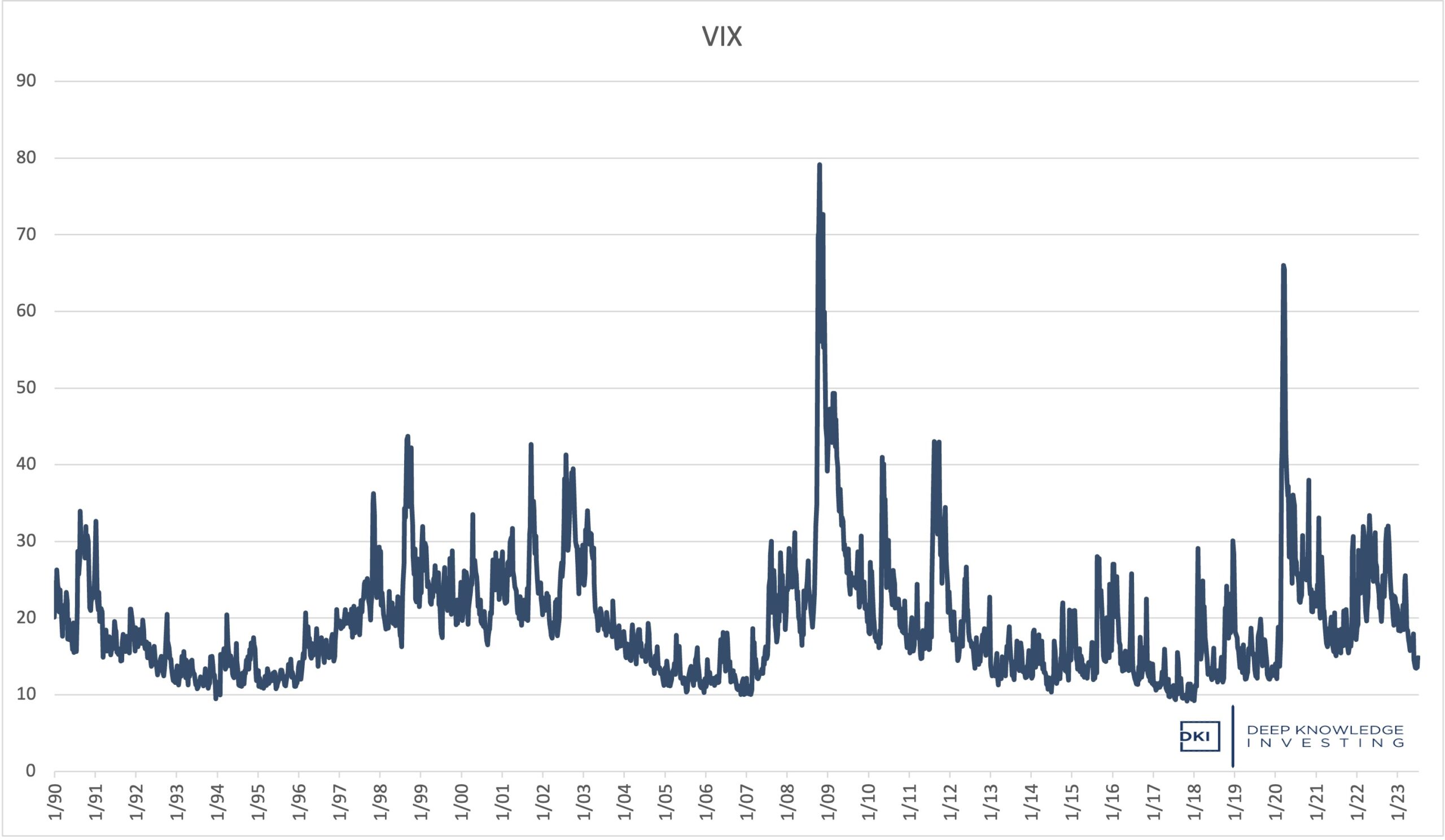

The VIX is an index that measures market expectations for volatility in the S&P 500 over the next 30 days. The index tends to have a skew in it because investors are much more concerned about downwards volatility than upwards volatility. As a result, we’ll typically see the VIX rise when the stock market falls and fall when the market rises. This is why it’s often referred to as the “fear gauge”.

As I write this, the VIX has fallen below 14. That’s a low reading by historical standards. There was a period during the last decade when the VIX traded around or below 10. Let’s examine what’s happening now:

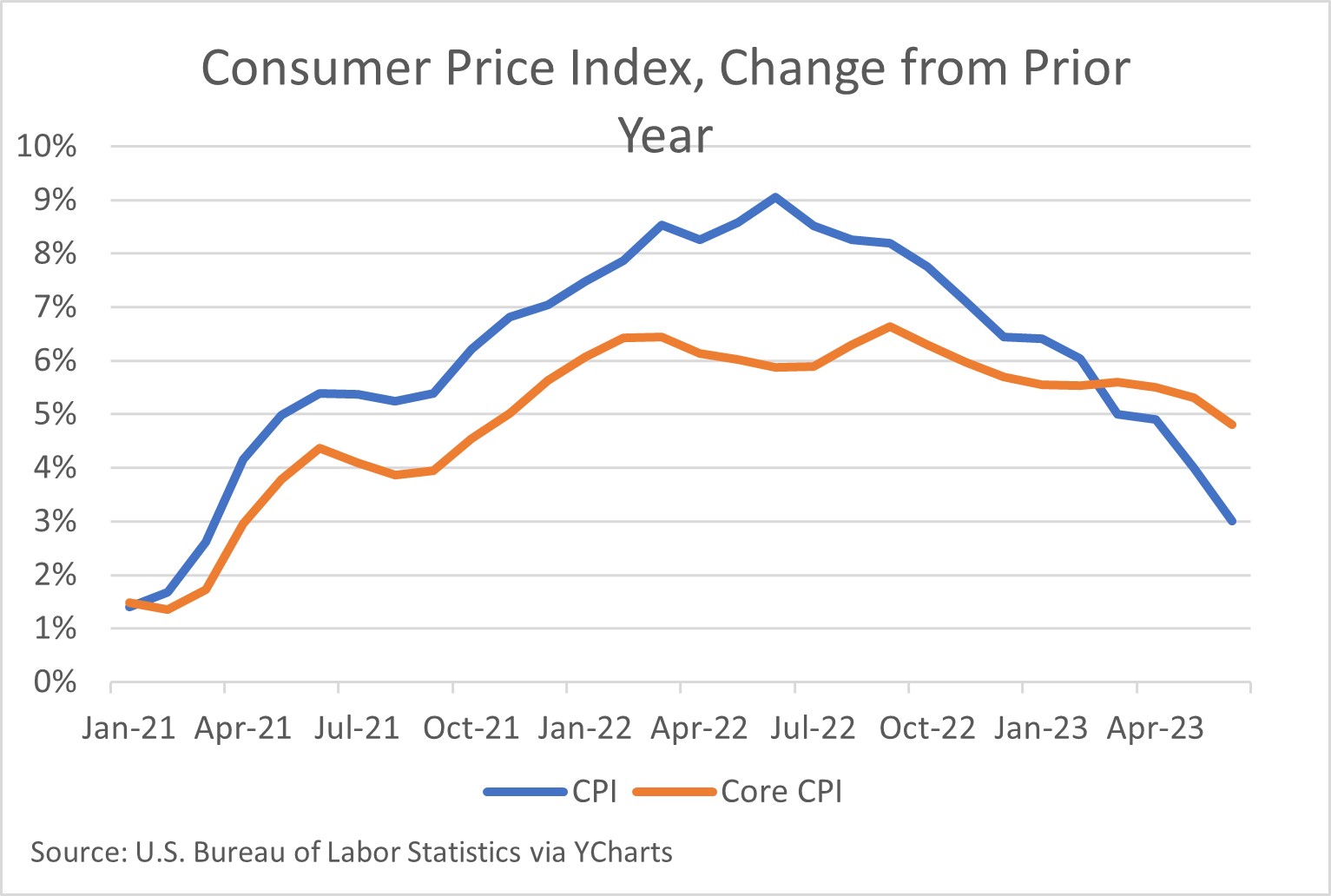

Inflation is coming down but is still well above the Fed’s 2% target. Core inflation is just below 5% and services inflation is above 6%. The Fed believes they have more work to do and I’m in agreement with the market consensus that they’re going to keep raising rates.

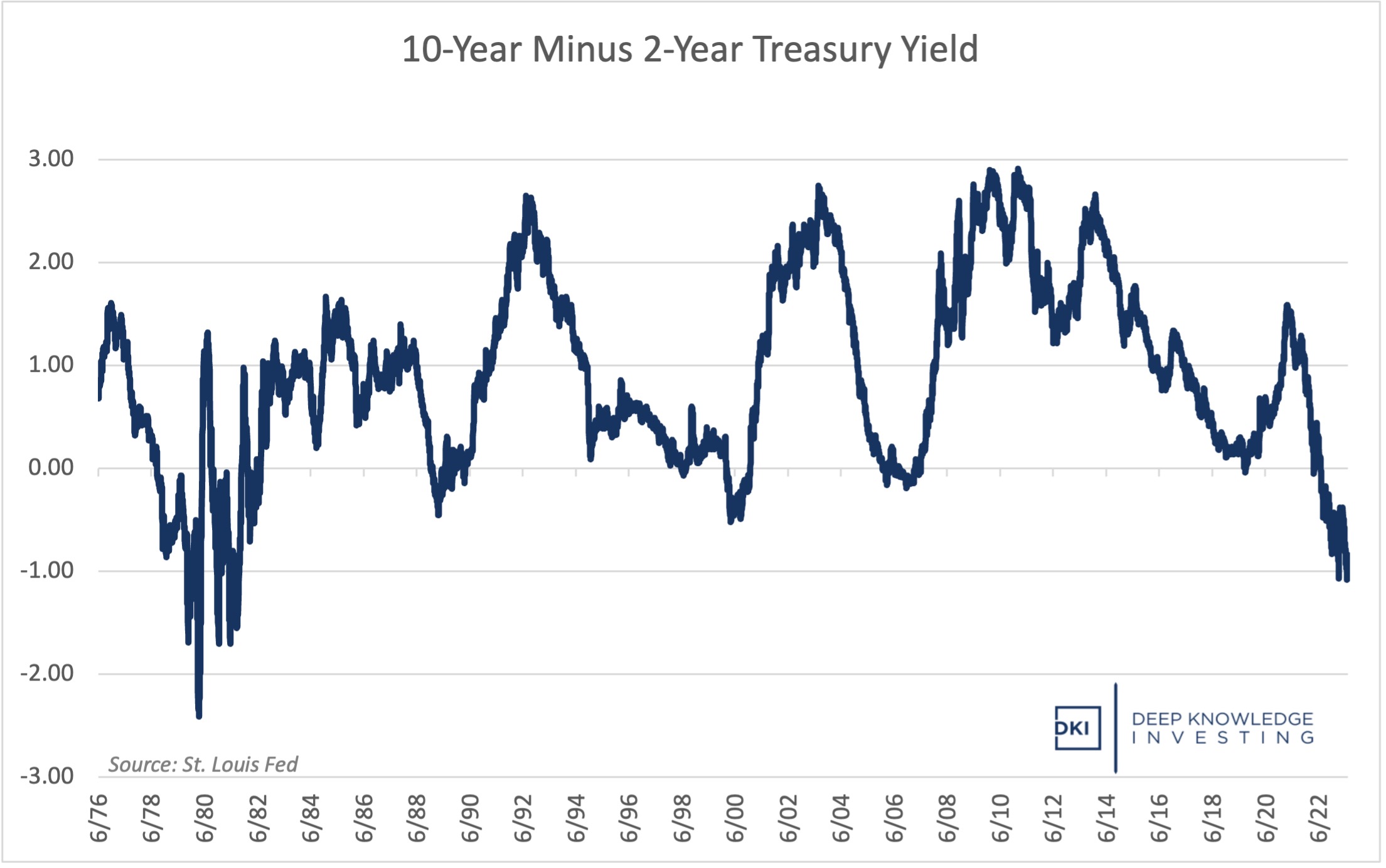

Recession is a real fear. While the economy and corporate earnings have held up better than many including DKI expected, the yield curve remains negative which has been an accurate predictor of recessions.

Japan is facing a potential sovereign debt default. The world’s third largest economy has entered Ponzi scheme territory. In order to pay the interest on the debt, they’ll need to print more yen. It’s a negative when countries like Greece or Argentina default. A default from a major economy would move markets. More on Japan later in this letter.

Ukraine is still at war with Russia. After more than a year of fighting, Russia is unable to fully occupy the country and Ukraine is unable to fully repel the invasion. The US and some European countries are providing Ukraine with money and weapons. Several countries are still trying to admit Ukraine to NATO which would then obligate all treaty countries including the US to enter a hot war with Russia. Even the most dedicated Ukraine supporters should be concerned about the possibility of uncontrollable consequences of war with one of the world’s great nuclear powers.

China is speaking more openly and aggressively about retaking Taiwan. While most Taiwanese prefer to remain an independent democracy, it is unlikely that there is any argument to be made that would persuade the CCP (Chinese Communist Party) that Taiwan will not eventually be brought under Chinese control. The US has implied it would support Taiwan in the event of a Chinese invasion, and a Joe Biden live-microphone gaffe indicated the US has committed to defending Taiwan. The latter is not accurate. Taiwan is the largest supplier of the world’s best computer chips and the US gets most of its pharmaceuticals from China. Until the US re-shores those supply lines and a few others as well, any open conflict with China would have significant unintended consequences.

Market breadth is historically low. Despite large first half gains by the S&P 500 this year, almost all index gains came from 7 mega cap tech firms. The other 493 companies in the index have barely moved in aggregate this year. Low and falling breadth has historically tended to be a sign of an unhealthy market.

Valuations are unusually high. Despite low breadth, the forward price to earnings multiple on the S&P 500 has gone above 20x. That’s something we’d expect to see with the current low VIX, but is at a level where there’s risk. Typically, when valuations get this high, there’s reason to believe we’ll have low risk and high returns in the near future. The length of this list argues that future conditions may not be as positive as many hope.

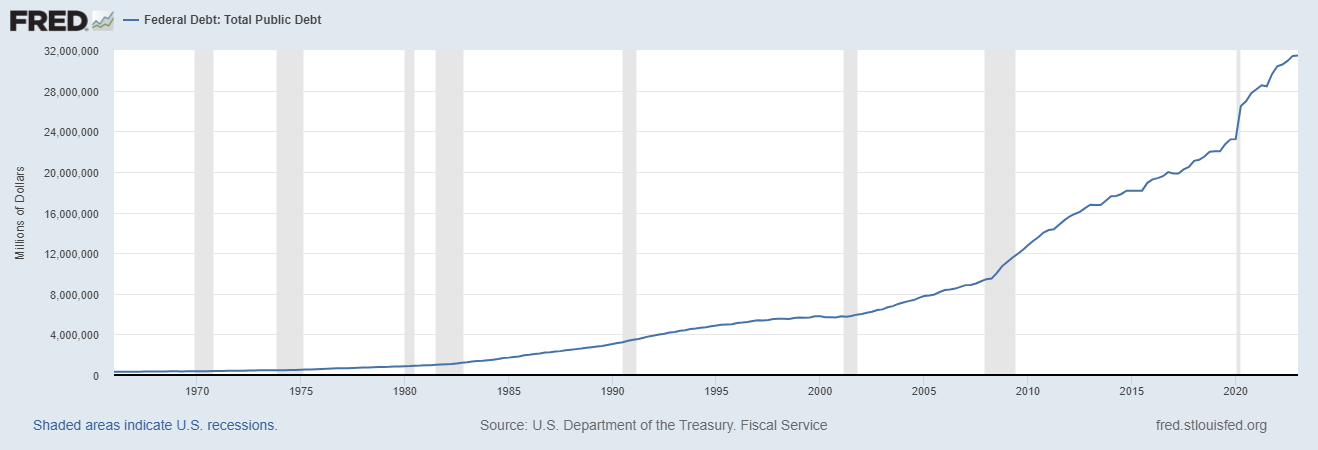

Budget deficits remain huge. Despite months of public arguing between Congressional Republicans and the White House, both sides agreed to a spending plan that would increase the on-balance sheet debt of the US by $4 trillion over the next two years. That’s a huge number and will be financed by more currency printing. As we’ve seen over the last couple of years, this level of currency creation leads to more inflation.

This will be $35 trillion at the next Presidential inauguration – and ignores $200 trillion of off-balance sheet liabilities.

This year’s run up in the market indexes means most investors are ignoring the above list of potential issues. It’s highly unlikely that everything listed above becomes a problem for the market. However, if only one or two of these issues start gaining attention, it would make a VIX reading of under 14 look very low. As noted above, if the market gets more nervous or fearful, the VIX will rise and the S&P 500 will fall.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.