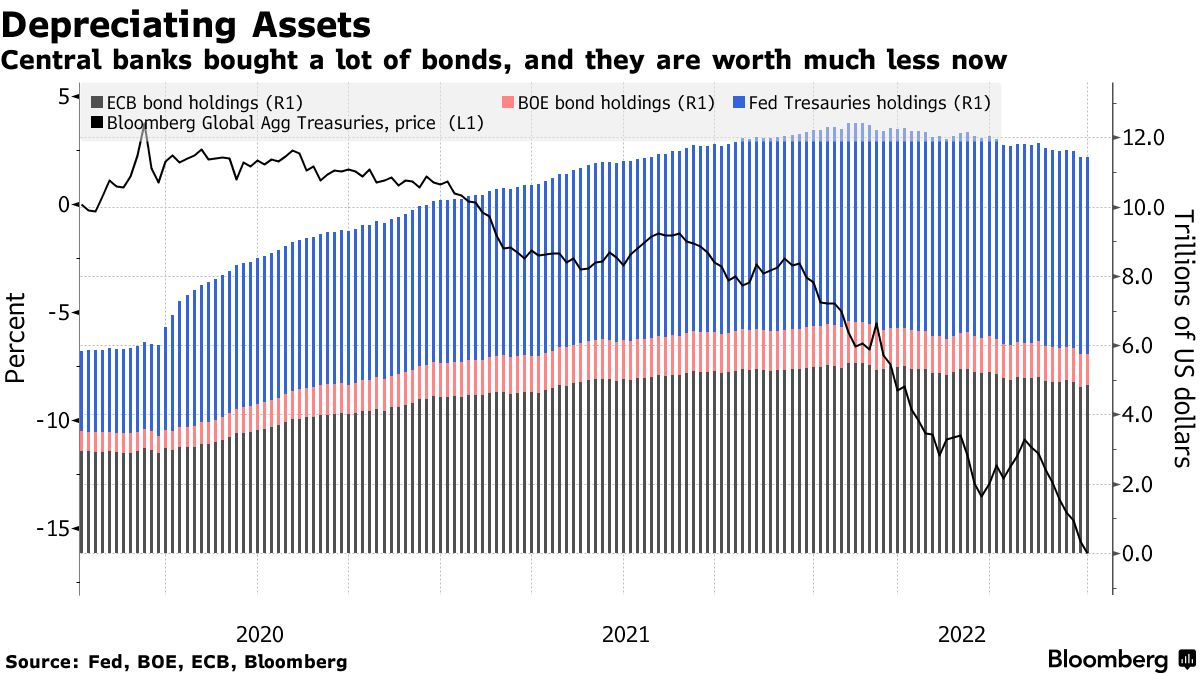

Two months ago, we noted that the Federal Reserve held about $9 trillion of assets that are primarily treasury bonds and mortgage backed securities (that the Fed is not allowed to hold). We wrote that these assets decline in value when interest rates rise, and that if the Fed accelerated the pace of quantitative tightening, it was going to see massive losses.

Bloomberg just realized the same thing. The chart below shows losses from the peak on treasuries of around 20%. The multi-trillion mortgage backed securities portfolio has to be at an even larger discount to that right now.

So here’s an interesting question: If the Fed recognized $2 trillion of losses on a mark-to-market basis, and doesn’t sell those assets, would it still count as quantitative tightening?

paper losses to reflect value if sold off. Hold to maturity and recoup the principal

Yes – we’ve written on that pointing out that right now, the Fed is in run-off mode and in that situation, they won’t have realized losses. But they may not be able to stay in run-off mode forever and if they have to sell something, there will be huge losses (multiple trillions). Given $31T of US on-balance sheet debt, the Fed may have more rope on QT than on higher rates as they want to avoid a death spiral (see today’s premium post on Japan and death spirals). Interesting as well that the regulators can require member banks to mark the balance sheet to market, but they’ve avoided doing the same. Thanks for the great comment!