The big news of the week was the Fed doing exactly what we all expected they’d do; cut the fed funds rate into inflation 50% above the made-up 2% target. Did anyone else catch Chairman Powell accidentally agreeing with President Trump? Gemni has its IPO and the Nasdaq invests. Did anyone expect the crypto markets to have this level of legitimacy? Nvidia buys $5B of Intel. The markets loved the deal for Intel, but let’s explore what’s in it for Nvidia that the press is missing. In a guest thing, Enrique Abeyta says Oracle may never see $300 billion from OpenAI. That’s controversial enough, but you might want to know why he thinks OpenAI is like Enron. The US and China make a deal to sell most of TikTok’s American assets to America owners. Let’s think through why the parents and politicians had valid concerns. In out educational topic, we address why gold and US Treasuries tend to trade together. Longtime DKI readers know which one I prefer.

This week, we’ll address the following topics:

- The Fed cut, but you already knew that. Chairman Powell makes the case that new Governor Miran can’t be a political actor. Did anyone catch the Chairman agreeing with President Trump’s criticism? Read on – we explain!

- Gemni $GEMI has a successful IPO. Nasdaq takes a $50MM position and announces some shared platform resources. Did anyone expect this from the crypto markets a year ago?

- Nvidia $NVDA takes a $5B stake in Intel $INTC and plans to develop chips together. The deal is a huge plus for Intel and may have some hidden benefits for Nvidia.

- Enrique Abeyta thinks OpenAI may not have the $300 billion dollars to complete the promised Oracle $ORCL contract. He thinks the company may be an Enron-level fraud.

- The US and China have a deal to sell 80% of TikTok’s US assets to American investors. There are reasons US politicians and parents were concerned.

- In our educational topic, we explain why gold and Treasuries are so closely correlated. Want to guess which one we prefer?

1) Federal Reserve – As Expected:

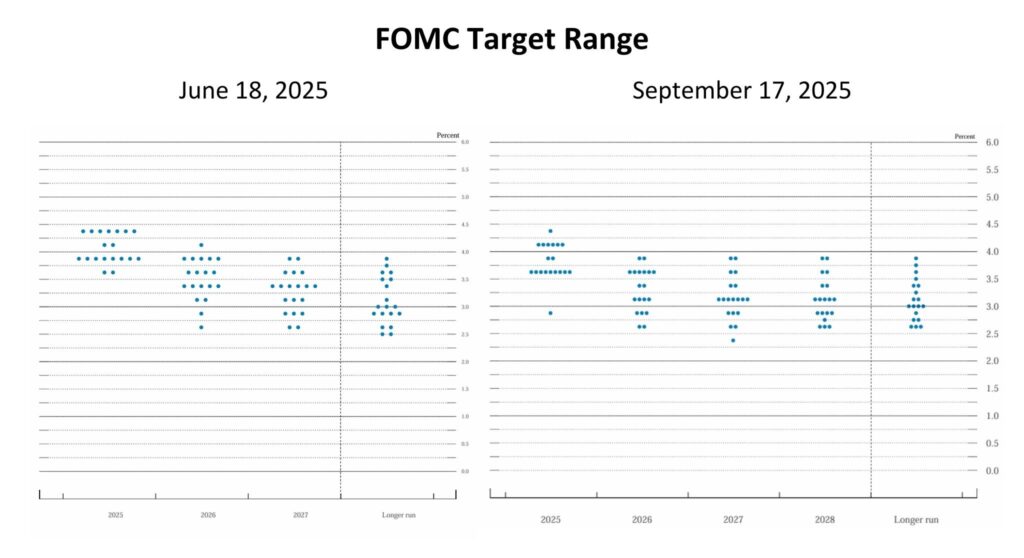

The Federal Reserve concluded its September meeting on Wednesday and surprised no one by lowering the fed funds rate by 25bp (.25%). All Fed Governors but one agreed on the 25bp cut including Lisa Cook, who President Trump is trying to remove for mortgage fraud. The press release cited downside risk to employment as the reason for the cut. That’s reasonable given the data (to the extent the data is accurate). The dot plot was 25bp more dovish than before. That means the Fed expects to cut an additional 50bp (.50%) this year for a total of 75bp of cuts. The June dot plot indicated they expected to cut by a total of 50bp this year. I’m going to point out that the CPI is about 50% above the made-up target and has been above target since 2021, and the labor market isn’t out of balance yet. The DKI portfolio is positioned for higher long-term inflation.

Almost everyone who wanted zero cuts has capitulated.

DKI Takeaway: The new addition to the Fed, Miran, was the one dissent. He wanted a 50bp cut. The dot plot had one huge outlier. It was almost certainly Miran who wants to see an additional five cuts this year, instead of the two favored by most Fed Governors. I just wrote a detailed macro piece explaining how the Fed has always been political. The press clearly hasn’t read it as they spent much of Powell’s press conference asking about the “politization of the Fed and the BLS”. I thought Powell had a great response. He pointed out that the committee has 19 members and 12 of them vote. The only way a political actor could possibly change policy was by being very persuasive. Miran can’t tell the other Governors to obey President Trump’s wishes. He can only try to persuade them that lower rates are the best course of action. I continue to disagree with President Trump and Governor Miran on this. There was one other thing in the press conference that caught my attention. Chairman Powell cited recent downward jobs revisions as one reason the Fed decided to end the “pause” and lower the fed funds rate. I think he accidentally admitted that bad data from the BLS kept the Fed from lowering rates sooner. This is EXACTLY the accusation President Trump has made; claiming Powell is late to cut and that the BLS data hurt him politically. Again, I think all parties in this drama, the President, the Chairman, the new Governor, and the former head of the BLS all share blame for bad policy.

2) Why the Nasdaq is Betting on Gemini Space Station:

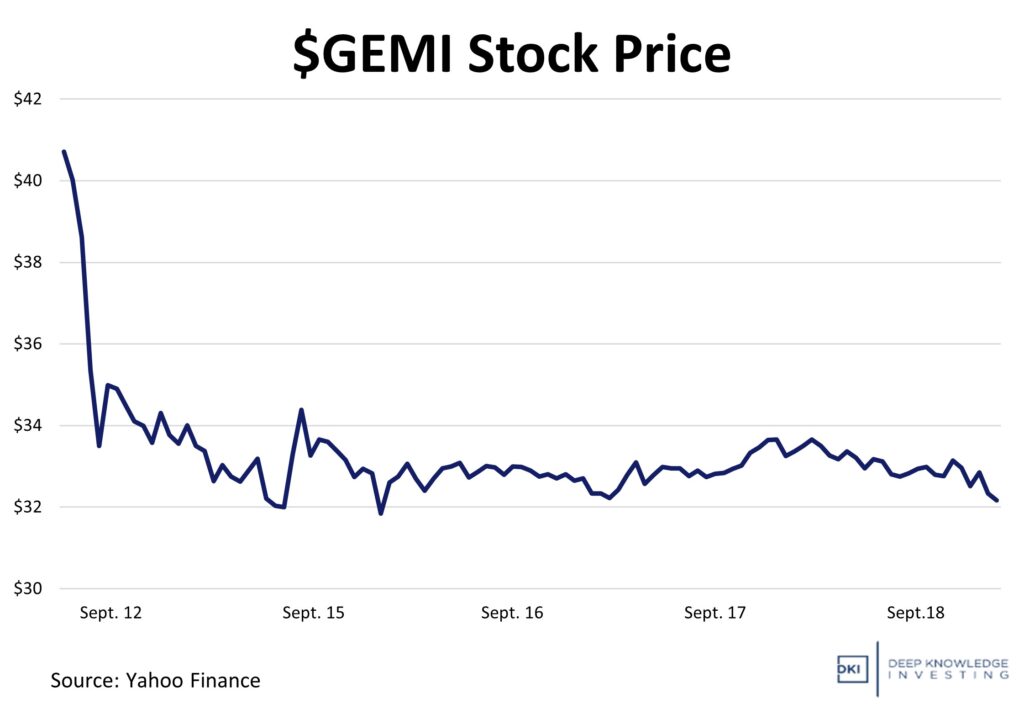

Gemini Space Station $GEMI, the crypto exchange founded by Cameron and Tyler Winklevoss, raised $425MM in an IPO on September 11, pricing shares at $28 and valuing the company at about $3.5B, depending on metrics. The $28 IPO price was well above the initial expected range of $17-$19. As part of the deal, Nasdaq itself made a $50 million private placement investment into $GEMI and entered into a broader partnership with the exchange which will give Nasdaq’s institutional clients access to Gemini’s custody and staking services. It will also provide use of Nasdaq’s Calypso platform for managing collateral. The deal was oversubscribed, but Gemini enters the public markets with losses of $282.5MM in 1H 2025, an increase vs -$41.4MM a year earlier. Revenue declined slightly in its exchange business vs last year.

Down after the offering but still above the raised IPO price.

DKI Takeaway: The deal and the recent Circle IPO signals continued faith in crypto assets among investors. A more favorable regulatory climate after the passing of the GENIUS Act is a positive contributor as well. Nasdaq’s deep dive into Gemini is more than just a high-profile IPO. It reflects a belief that crypto exchanges, stablecoins, and tokenization are core assets for the next generation of financial infrastructure. The partnership gives Gemini credibility and access, but it starts from a base of heavy losses and stiff competition, especially from Coinbase, Kraken, and other exchanges with far greater volume and liquidity. For investors, the key questions are whether Gemini can scale revenue while reducing burn, whether institutional clients actually embrace custody/staking through this platform, and whether Nasdaq can enforce its leverage in this emerging vertical. If all that works, Gemini could prove to be a bridge between traditional finance and on-chain finance; if not, it risks being a case study in overvaluation and misplaced momentum. DKI notes that beyond Bitcoin and Ethereum, most cryptocurrencies have no value. We continue to believe that stablecoins are a threat to the profitability of the big banks.

3) Nvidia Backs Intel with $5B Partnership:

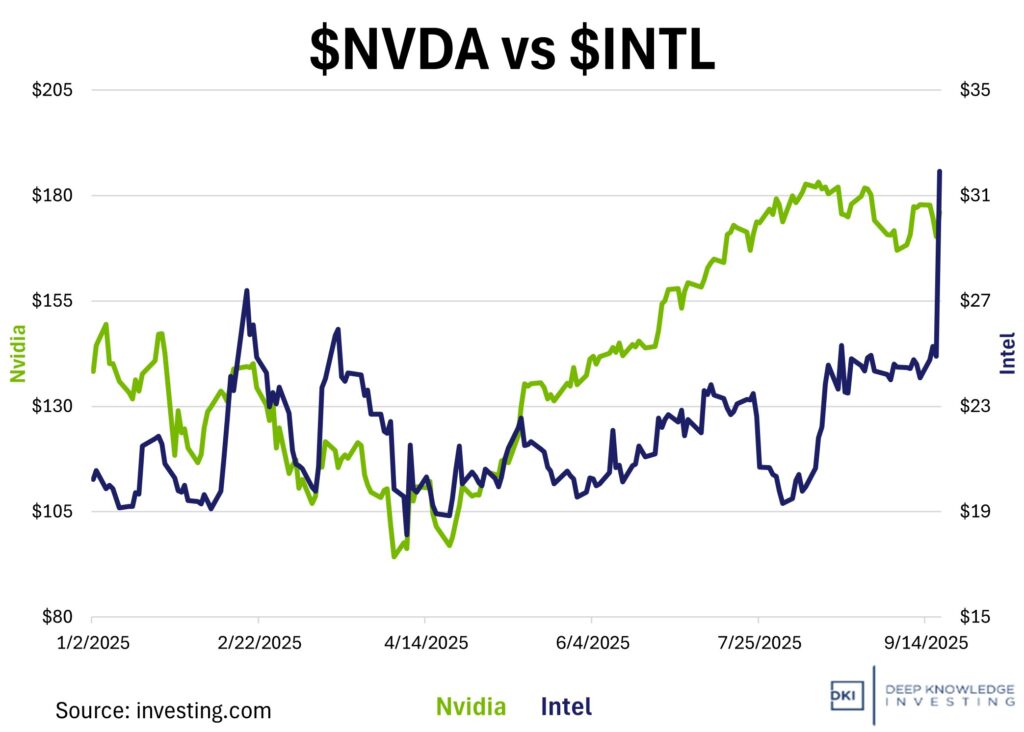

Rivals in the semiconductor industry, Nvidia $NVSA just announced it will invest $5B in Intel $INTC, becoming one of its largest shareholders (about 4%). The two companies unveiled a partnership in which they will co-develop new generations of advanced AI chips for data centers and computers. This alliance will combine Nvidia’s power in the AI chip field and Intel’s CPU expertise. On the day of the news, Nvidia shares saw a modest uptick while Intel shares rose over 25%.

Nvidia will purchase $5B worth of Intel common stock at $23.28 per share, and create a joint development in new chip products for personal computing and AI infrastructure. Intel will create new CPUs and chip integration systems. Nvidia CEO, Jensen Huang, noted that Intel’s Foundry business will not yet start making Nvidia’s own GPU chips. For Nvidia, the deal secures a partner to provide cutting edge CPUs specifically tailored for Nvidia’s AI pipeline and opens up the PC market that has been largely dominated by Intel’s x86 CPUs. For Intel, the deal is a strategic shift that will lean into the AI boom. Over the past decade, Intel has been losing market share to companies like Nvidia and AMD. Intel now has a lifeline and a new track to get involved in the AI-centered chip business.

This shows how much $INTC shareholders wanted support for the foundry business.

DKI Takeaway: For the broader semiconductor industry, this new alliance will cause some shakeups. TSMC is the world’s premier chip manufacturer and produces Nvidia’s flagship GPUs. Nvidia is investing in Intel to ensure a second supplier meaning some of the lower-end production going to TSMC may now go to Intel. From Nvidia’s point of view, the deal also reduces future risk from a Chinese invasion of Taiwan. There are positive optics as well. President Trump just had the US take a 10% stake in Intel and both parties want to see more US tech manufacturing. Nvidia is asking the White House to allow it to sell the Blackwell chips directly to China. We’re now seeing corporations trading favors like politicians from different parties do.

4) Enrique Abeyta’s OpenAI Comparison:

Printed with permission of Enrique Abeyta. This post first appeared at hxresearch. This week, the tech world witnessed a truly eye-popping headline. OpenAI has reportedly committed to spending $300 billion over the next five years on Oracle’s computing infrastructure. The deal, which centers around OpenAI’s so-called Project Stargate, instantly lit a fire under Oracle’s stock. In just one day, Oracle’s shares surged more than 40%, which was a shocking move for a company of that size. To provide perspective, $ORCL added $250 billion in market cap that day. That’s the equivalent of Morgan Stanley’s entire market capitalization!

Here’s the catch: OpenAI is still not profitable. In fact, it is projected to burn thorough more than $115 billion in cash by 2029 at a rate of almost $25 billion per annum. That number, while jaw-dropping, is starting to look small next to the commitments it’s making now. According to multiple reports, OpenAI has committed $19 billion to Oracle just for Project Stargate. It’s also rumored to be the mystery buyer behind $10 billion in recent custom AI chip orders from Broadcom. Altogether, OpenAI is acting like a company with near-limitless financial firepower. Yet, it’s unclear where that firepower is actually coming from.

Everyone is excited about AI, but what if Enrique is right?

DKI Takeaway: Even if OpenAI wanted to pay Oracle $300 billion, how would it do that? It’s not sitting on a mountain of free cash flow. The company depends on venture capital, partnerships, and potentially government grants to keep the lights on. It could suddenly find itself unable to meet all of these promises. That would pressure companies like Oracle, which have built their own projections around those contracts. Enrique compared OpenAI’s behavior to Enron’s. This infamous energy company used big contracts and fake projections to hide that it was losing money and racking up debt. Just before Enron collapsed in 2001, the company was still pushing massive-sounding but misleading deals, like a 20-year video-on-demand partnership with Blockbuster than never took off, or a global trading platform that artificially inflated volumes in the gas market. Enrique believes we may be seeing the same playbook today, only this time dressed in AI.

5) TikTok Deal Creates Control for the US:

In a deal reached in Madrid, the United States and China have agreed to resolve the controversy surrounding TikTok. Reports indicate that TikTok’s U.S. assets will be acquired by a new company consisting of American investors Oracle, Silver Lake, and Andreessen Horowitz. The investors will share approximately 80% ownership. Meanwhile, ByteDance retains a minority stake of approximately 20%. The new company will be headed by an American committee, with a spot reserved for a U.S. government appointee.

To allow for further negotiation, President Trump has extended the divestment deadline to December, following several previous extensions. As a result of this agreement, TikTok will remain open in the U.S., pending finalization and approval from Washington and Beijing. Although the deal meets Congress’ requirements for reduced Chinese control and increased data oversight, it is not yet complete. Specific details, such as TikTok’s algorithm, security measures, and ByteDance’s role, still need to be finalized before the agreement can take effect.

After long talks and many threats, TikTok’s US assets will be owned by Americans.

DKI Takeaway: This new deal is less about saving social media and more about redefining the way the US can preserve tech superiority. By giving US investors majority control (while still licensing ByteDance’s algorithm), the deal creates a structure that satisfied political and security demands without completely voiding Chinese involvement. TikTok is essential a proxy for a bigger battle over data and influence, so keeping it in US control satisfies both parties. Using negotiation, President Trump has shown that ownership is just as much about national security as it is ownership. I’d add one additional detail. While not a TikTok user, I’ve read stories about how China uses the platform to influence US elections, create political conflict, and influence American young people in a way they don’t with their own Chinese subjects. US politicians and parents are right to be concerned.

6) Educational Topic: Why Gold & Treasuries Rally at the Same Time:

Gold and US Treasury bonds are both viewed as premier “safe haven” assets with the ability to attract demand during situations of economic or market stress. During these periods, investors tend to turn towards options that are perceived as safer. Thus, both gold and US Treasuries tend to rally at the same time. Buying Treasuries pushes up the price leading to lower yields. When Treasury yields fall, the interest premium they have over gold shrinks. This makes gold relatively more attractive.

Take for example the March 2020 Covid shock, where Treasury yields plummeted as investors bet on Fed rate cuts. Gold rose at the same time. Similarly, 10-year Treasury yields dropped 40bp and gold’s performance was boosted during March 2023’s mini crisis following Silicon Valley’s bank collapse. Both recent events are testaments to the correlation between treasuries and gold, especially during economic upheaval, banking panic, geopolitical conflict, and other periods of financial stress

Both gold and Treasuries rise at the same time, but DKI prefers gold.

DKI Takeaway: Gold is often talked about as an inflation hedge, especially in DKI’s portfolio. It has historically preserved purchasing power in times of high inflation. We’ll point out that the reason for high inflation is endless overspending leading to currency creation out of Washington DC. We think the long-term return on Treasuries will be negative as the low yield doesn’t compensate investors for the loss of purchasing power. People call these instruments risk-free because the government can always print more dollars to pay its debts. That’s true, but what will you be able to buy with your fiat dollars when that bond matures in 10, 20, or 30 years? The supply of gold only increases 1% – 2% per year. And the increase in the supply of Bitcoin is now lower than gold. Hard money wins every time.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.